Introduction

Intrinsic value is a measure of what an asset is worth, and it is obtained by means of an objective calculation (to a certain extent), such as a DCF, where the cashflows of a company are discounted to the present in order to estimate the company’s true value. Ultimately, this leaves Bitcoin’s value controversial and debatable: this asset class does not produce any cashflows and the debate on whether or not Bitcoin is a store of value is still open. On the other hand, Bitcoins are traded on the stock market and have a market price. So while in corporate finance we usually talk about valuation models, in the case of Bitcoin we preferred to focus on its price because it is the only one which can be computed in an objective way and whose existence cannot be questioned. Consequently, in this article we will analyze Bitcoin’s pricing models, explaining the cryptocurrency’s basics in advance.

Premise

In order to understand Bitcoin’s pricing models, it is important to understand what is Bitcoin mining. Bitcoin mining comprises of solving complex computational math problems and is performed by high-powered computers as the complexity of these problems makes them unsolvable by hand. Whenever an equation is solved on the Bitcoin network, new Bitcoins are produced. In addition to that, miners make the Bitcoin payment network trustworthy throughout the mining operation that secures and verifies all transaction information.

A crucial matter in case of cryptocurrencies is the security. Bitcoin transactions are essentially made through clumping a multiple of Bitcoins together in “blocks” and adding them to a public record called the “blockchain.” Then, the nodes, computers connected in Bitcoin’s network, maintain records of those blocks, enabling them to be verified in the future. Speaking in detail, when a new block of transactions is added to the blockchain by bitcoin miners, it becomes part of their job to make sure that those transactions are accurate. In fact, bitcoin miners assure that bitcoins are not being duplicated.

According to the data from August 2020, there are more than 300,000 purchases and sales of Bitcoin occurring in a single day, therefore, to reward the miners for verifying each of those transactions, they are awarded Bitcoins whenever they add a new block of transactions to the blockchain. The amount of new Bitcoins that is released with each block being mined is called the “block reward” and is halved every 210,000 blocks. In fact, in 2009 it was 50, in 2013 it was 25, 12.5 in 2018 and finally in May of 2020 it was halved to 6.25. In order for the miners to actually earn the “block reward” from their work they have to verify one megabyte worth of transactions and they have to add a block of transactions to the blockchain, which is called “proof of work”. This latter action requires miners to guess a 64-digit hexadecimal number, the “hash”, which is lower or equal than the target hash, and only the first miner to arrive to the solution will be rewarded. Essentially mining has to do with how fast your computer can produce hashes, and this is reason why sometimes it is done via mining pools which are groups of miners working together to increase their chances of finding a block compared to when doing so at the individual level. In case of mining pools, the work performed by each pool member is being recorded and the reward is shared according to the proportion of work performed after suitable verification.

This system is estimated to continue until around 2140, when the total number of bitcoins in circulation will likely reach a limit of 21 million and after which miners will be rewarded with fees for processing transactions that network users will pay. This will ultimately incentivize further mining. What is more, the competition for these fees is expected to cause them to remain low after halvings are finished.

Bitcoin Pricing Models

As Bitcoin is now a worldwide financial phenomenon, it is important to understand how we can price it. Several different pricing models have been created in order to assess the hypothetical price of the coin and the three most popular methods are the Stock to Flow Model, the Energy Value Equivalence and the Cost of Production Model.

Stock to Flow Model

The Stock to Flow model measures the abundance of a particular scarce resource, in this case Bitcoin. The Stock to Flow ratio is obtained by dividing the amount of a resource held in reserves by the amount produced annually. It essentially gauges the amount of new supply that enters the market annually in proportion to the total supply. The higher the ratio, the less new supply enters the market. As a result, an asset with a higher Stock to Flow ratio should, in theory, retain its value better over the long-term.

While this method is useful for measuring the abundance of a given resource, it relies on the assumption that scarcity, as measured by the model, drives value. Therefore, the model fails if Bitcoin does not have any other valuable qualities other than supply scarcity. The model may not even be able to account for Bitcoin’s high volatility, low liquidity, as well as other external factors, such as economic Black Swan events.

Energy Value Equivalence

The Energy Value model instead attempts to value Bitcoin based on the cost of the energy needed to mine it. It is a much more practical approach than the previous method. It has been proved that there is a significant correlation between Bitcoin’s price and its mining expenditure. In particular, Bitcoin’s production cost is primarily driven by the level of electrical energy input and energy efficiency of mining hardware, with many other factors assumed constant. According to the model, Bitcoin’s price is therefore a function of energy input.

One of the drawbacks of the Energy Value equivalence model lies in the fact that it does not consider capital expenditure (CapEx) as part of the process to arrive at the cost of mining Bitcoin. CapEx would imply the cost of purchasing a mining rig, setting up farm infrastructure, regulatory/legal expenses, etc. Also, the operating expenditure (OpEx) would include labor expense and pooling fees in addition to power expense, which the model ignores altogether.

Cost of Production Model

This model solves the issues of the previous ones by computing both the CapEx and OpEx involved in mining Bitcoins in order to get to the full costs of production.

Mining employs computational effort which requires electrical consumption for operation. The cost of electricity per kWh, the efficiency of mining as measured by watts per unit of mining effort, the market price of Bitcoin, and the difficulty of mining are all variables to take into account when making the decision to mine.

Bitcoin production resembles a competitive market and as such miners will keep mining until their marginal costs of earning 1 BTC (CapEx + OpEx) equal their marginal benefits, which is BTC’s price. Break-even points are modeled for market price, energy cost, efficiency, and difficulty to produce. As a result, the cost of production price should represent a theoretical value around which market prices tend to fluctuate. In the following part of the article, we will try to estimate both CapEx and OpEx for Bitcoin mining and then we will sum them up to obtain an estimate of this theoretical value.

Capital Expenditures

CapEx includes all the costs incurred to buy the necessary hardware to build a cryptomining rig, which is essentially a customized PC. It has all the common elements of a PC: CPU, motherboard, RAM, and storage. Where things deviate from the norm is when it comes to the graphics cards or GPUs (Graphics Processing Units), which does all the hard work. In the field of cryptomining, GPUs have been replaced first by FPGAs (Field Programmable Gate Arrays) in mid-2011 and then by ASICs (Application-Specific Integrated Circuits) in 2013. This greatly improved efficiency but also had a huge influence on mining costs.

Currently, the Antminer S19 Pro produced by Bitmain is the most efficient ASIC on the market, both in terms of higher hashrate and lower energy consumption. It has the following specs:

- Hashrate: 110 Th/s

- Efficiency: 0.029 J/Gh

- Power consumption: 3,250 W

- Bitmain’s retail price: $2,500

However, if one were to buy the Antminer S19 Pro, not only it is scheduled for shipment in August 2021, but it is also completely sold out on Bitmain’s official website. It is still possible to find this product on third party retailers and reseller e-commerce websites, including Amazon or Alibaba, for an average price between $8,000 and $9,000, which corresponds to around 3/4x the original retail price of $2,500, inevitably lifting up the costs of mining Bitcoin. If we assume that the market for Bitcoin hardware is efficient, it is the current actual market price of the Antminer S19 Pro the efficient one, and this price will be sustained until more efficient hardware will be launched on the market. As a result, we assumed a CapEx between $8,000 and $9,000 in our model.

Operating Costs

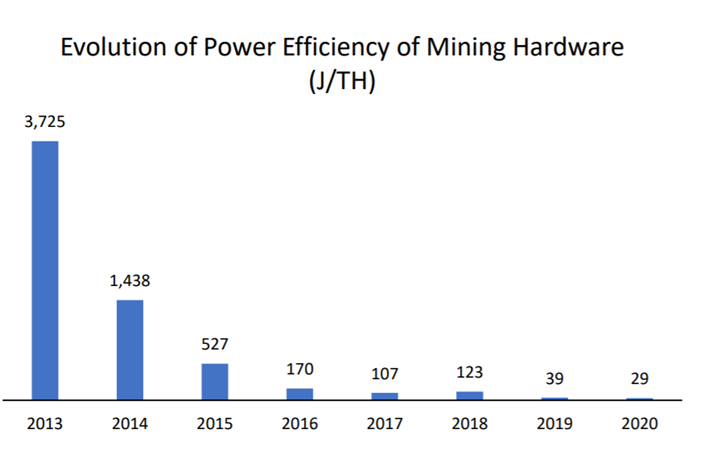

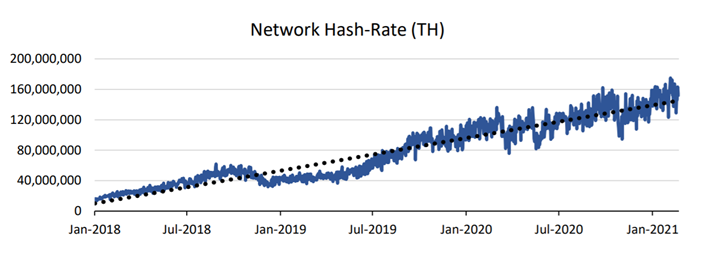

The structure of operating costs for Bitcoin mining is relatively simple and primarily consists of the cost of electricity required to power mining equipment. The level of potential operating expenses directly depends on the level of power consumption efficiency that can be measured as the ratio between hardware hash-rate and power consumption (usually measured as J/TH, Joules per Tera Hash Calculation, the lower is the ratio, the higher is the efficiency of hardware). With the growing proliferation of cryptocurrency mining, power efficiency has improved drastically in order to optimise the cost base of the process. However, despite the continuous improvement of power efficiency of the hardware, the cost of cryptocurrency production (especially Bitcoin) continues to grow on a daily basis due to the increasing network hash-rate (global computational power employed in specific cryptocurrency), implying that without further investments in mining power miner’s share of the total network hash-rate (and in result earned share of mined cryptocurrency) decreases on the daily basis. At the same time, taking into consideration that the potential supply of Bitcoin is limited and that the reward is automatically halved every 4 years, it also implies that computational power (or “inputs/ resources”) required to mine each following Bitcoin also tend to increase.

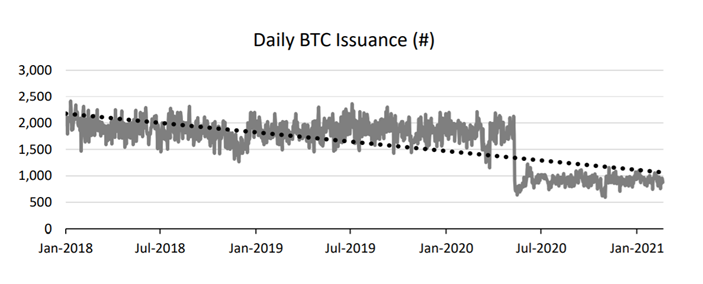

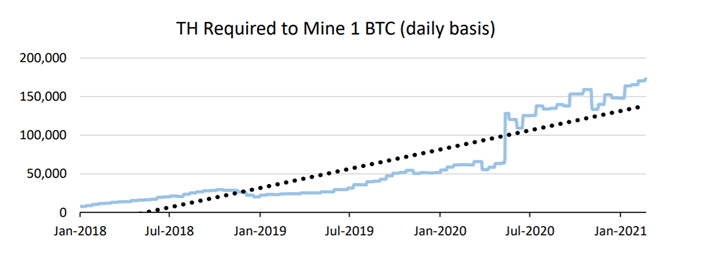

Overall, operating costs of BTC mining are pushed from two sides: on one side the amount of computational power offered in the market increases, thus increasing the competition for market share, while on the other side the amount of produced/ mined product decreases, which results in the increase of mining difficulty. For example, from the beginning of 2018 the number of daily mined BTC decreased by almost 55%, from approximately 2,000 to approximately 900 BTC mined daily, due to the halving that took place in May-2020 and at the same time the network hash-rate, or supply of computational power in the market, has increased by almost 1,000%, resulting in the average daily growth of BTC computational power requirement of 0.3% on a daily basis: in other words, assuming no further investments, miner will receive 0.3% lower compensation each following day.

In practice there exist two methods to estimate operating costs for cryptocurrency mining: the first method is based on the Bitcoin’s Cost of Production implied pricing model, while the second method is based on the research of Prof. Hayes at University of Wisconsin-Madison. While the first method relies on daily computational power required to mine 1 BTC, Hayes’ model rather focuses on the mining difficulty and potential block reward. While the models use different approaches, essentially, estimation of operating costs in both of them is based on the cost of electricity.

The method of estimating operating costs according to Bitcoin’s Cost of Production Model is a rather preferred one due to its relative simplicity. Operating costs are estimated using the following approach:

- Estimate the number of hashes required to mine 1 BTC (How much computational power needed to mine 1 BTC):

- In the estimation are used the following metrics: Networks Hash-Rate (usually measured on TH/s basis and has to be transformed to daily basis) and Daily Coin Issuance (the number of BTC issued daily)

- We will use 30D average data, which will result in the following inputs: Network Hash-Rate: 154,051,503 TH/s, Daily Coin Issuance: 915

- Daily Network Hash-Rate (Transformation from seconds to day base) = 154,051,503 TH/s × 60 × 60 × 24 = 13,310,050m TH/ d ( where m TH is used for simplification)

- Finally, the number of Hashes Required to Issue 1 BTC = 13,310,050 ÷ 915 = approximately 14,543 mil. TH

- Based on the mining equipment calculate time required to mine 1 BTC:

- For estimation of time required to mine 1 BTC is used latest available ASIC equipment, the Antminer S19 Pro, as the model works under the assumption that the mining pool tends to use the most efficient hardware. The Antminer S19 Pro has performance of 110 TH/s and power consumption of 3,250 Watt/h

- Omitting daily increasing computational difficulty, it would take: (14,543 mil. TH ÷ 14 TH/s) ÷ (60×60) = ~36,725.2 hours to mine 1 BTC

- This results in: 36,725.2 h × 3,250 Watt/h ÷ 10^3 = 119,357 kWatt power consumption to mine 1 BTC

- Assuming an average electricity price of 0.077$ per kWatt, the operating costs to mine 1 BTC is $9,247.4

Compared to the original model, we implemented one major change: While the original model uses global price of electricity, we instead used the weighted average price of electricity based on the hash-rate distribution in each particular country (e.g. China with a mining share of 65.08% has electricity price of 0.08 $/ kWh, while the US with the share of 7.24% has the price of 0.15 $/ kWh).

Conclusion

The final cost of Bitcoin production can be estimated as the sum of operating costs (OPEX) and hardware (CAPEX) at effective price. A significant share of the total cost of BTC production (50 – 70%) is represented by the hardware (CAPEX). And while retail price for mining equipment stated by manufacturers can be considered rather attractive, the effective price can differ by 3/4x. For example, Antminer S19 Pro, which was used in the illustratory calculation, has a recommended retail price of approximately $2,500, while its effective price is on average between $8,000 and $9,000.

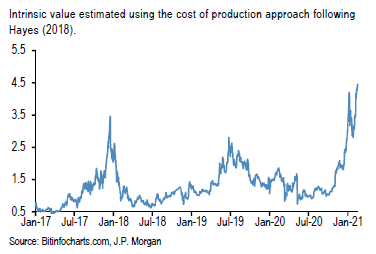

Summing CAPEX and OPEX obtained from illustratory example, we obtain that the total cost of production of 1 BTC, and so its implied price, is approximately between $17,247 and $18,247, which is far below the current market price, implying that currently, Bitcoin is significantly overpriced. To the same conclusion regarding the significant overprice of BTC also come analysts from J.P. Morgan that, in their report, based their implied pricing on Hayes’ model and computed the ratio of Bitcoin market price to intrinsic value/price as showed in the graph below.

Today’s situation highly resembles the situation observed in 2018 when the market price of Bitcoin significantly diverged from its cost of production’s implied price. Assuming that BTC market price will follow the same pattern as observed in 2018, it can be potentially expected that in the near future the market price of BTC will start to converge towards its implied price.

However, it should be noted that both the Bitcoin’s Cost of Production Model as well as Hayes’ model are heavily dependent on the made assumptions implying potential divergence from reality which is the main part of the critique of the models. Both models make ambiguous assumptions about the global mining hardware pool, which can diverge significantly from these assumptions. While Bitcoin’s Cost of Production Model assumes that the latest hardware is used, due to the high competition in the mining market, Hayes’ model relies on aggregated information about currently available equipment and calculates power-efficiency based on the simple average without exploring the global distribution of hardware.

Overall, due to the relatively young state of the cryptocurrency industry, there exist no generally accepted implied pricing models and existing ones can only provide a rough estimate of the potential implied price.

Additional Links:

JP Morgan’s Flows & Liquidity report which includes cryptocurrency: Flows-Liquidity_16Feb21.pdf (tbstat.com)

Hayes’ Cost of Production Model for Bitcoin paper: A Cost of Production Model for Bitcoin by Adam Hayes :: SSRN

Cost of Production Model for Bitcoin, our reference: Bitcoin’s Cost of Production — A Model for Bitcoin Valuation | by Data Dater | Coinmonks | Medium

1 Comment

Paul · 25 June 2021 at 17:25

Excellent article. thank you. Have you calculated the cost of production in the future given known reward cuts and estimated hash rate difficulty etc….? I would love to compare that to current price and understand that gap. With miners going public, I can only assume their assumption is the gap between cost of production and bitcoin price to be fairly wide (i.e., profitable).