As everyone knows, a commodity is a raw material – fungible by definition – that is supposed to trade in any market of the world for the same price. But when it comes to crude oil, things are not as simple.

As it is widely known, the two main qualities of crude are represented by the indexes Western Texas Intermediate (WTI) traded on NYMEX in New York and the Brent traded on ICE in London. As long as the former provides a benchmark for most of the oil produced and traded in the United States, the latter represents the leading international benchmark for oil produced in the North Sea region and more generally, worldwide. These two commodities not only differ for their areas of production, but also for their physical qualities, such as colour, viscosity and purity. Most importantly, ever since 1970s, the US Government has lifted a ban over exports of oil produced in the US, and all these reasons combined, cause the WTI and Brent indexes to perform somehow differently. Let’s explore how…

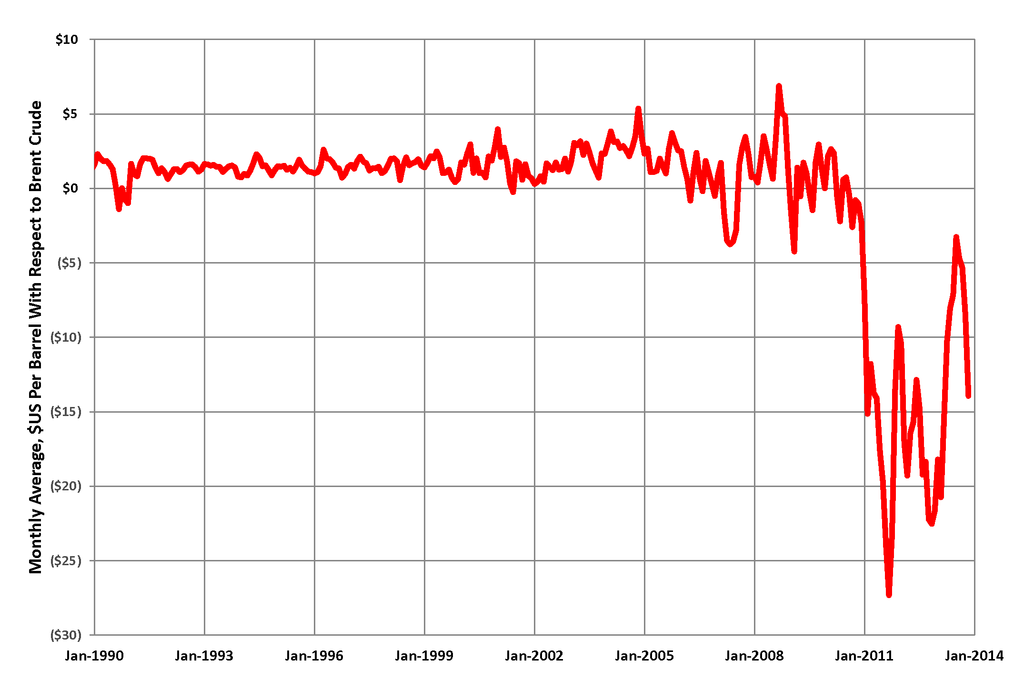

The chart below refers to the WTI and Brent prices over a time span of 5 years and two points are worth pinpointing: first, the Brent has almost always topped the WTI and second, the two quotes tended to move in the same way, meaning that they are exposed to similar factors. Running a statistical analysis we get that Brent and WTI prices display an 89% correlation, confirming the fact that those two quotes are highly interdependent. These properties imply that, despite some shocks affecting only one of the two product in the very short time, the spread between them is given by fundamental differences that should persist over a long time horizon, thus causing WTI-Brent spread to show a mean reversion tendency. Wider and narrower spreads over time may be caused by demand and supply factors specific to WTI (mainly U.S.) or Brent separately. This spread is at a current level of 9.29 and it is represented in the graph for the last 5 years.

Source: Bloomberg

The main reason for this spread to widen is the ban over US oil: the ban has caused in the past oil to bottleneck in Cushing, OK, increasing the size of the supply in the US, hence discounting price of WTI compared to Brent (Picture_1). The gluts were the result of a combination of oversupply due to US overproduction and physical difficulties to manage the settlement (transporting oil ashore is tougher and more costly than with pipelines off-shore).

Today, after US oil rig count has decreased for 11 straight weeks, oil price has mildly recovered, but the spread WTI-Brent has widened up to $9.29. The main reason is that oil stockpiles in Oklahoma jumped the most in six years to 425.6 million barrels, building downward pressure on WTI price.

The two main events that can affect the WTI/Brent spread in the next months are: a weakening in the US export ban and a worsening of the political situation in Libya.

As stocks of crude have now reached the historical maximum level, the US government could decide to reconsider its position on the ban over oil exports not to weaken its shale industry further. Such a move would lighten the pressure on internal stockpiles and could give some relief to the sector.

On January 2015, the Obama administration has set the stage for a fierce debate over the US ban. However, the administration will have to mediate between a new regulation favourable to crude export and the large environmentalist base who support the Democrats.

Considering all these aspects, it is likely that the intervention of the Obama administration will only change the regulation on a small range of products called oil condensate that represent only a small portion of the total volumes of crude distillates. In our view this change will not allow the spread to close significantly.

The second scenario is tied to a worsening of the situation in Libya. Even if International Organization are trying to manage the Libyan situation through diplomacy, it is clear that the geopolitical tensions inside the country are no longer manageable. A strong decline of Libyan production and the rise of tensions around a possible block of exports in some regions of Iraq could lead to a comeback in oil prices and to further widening of the spread between Brent and Crude. Our view is that this scenario is realistic and it is likely that, in the coming weeks, the spread might slightly increase.

[edmc id= 2381]Download as PDF[/edmc]

0 Comments