USA

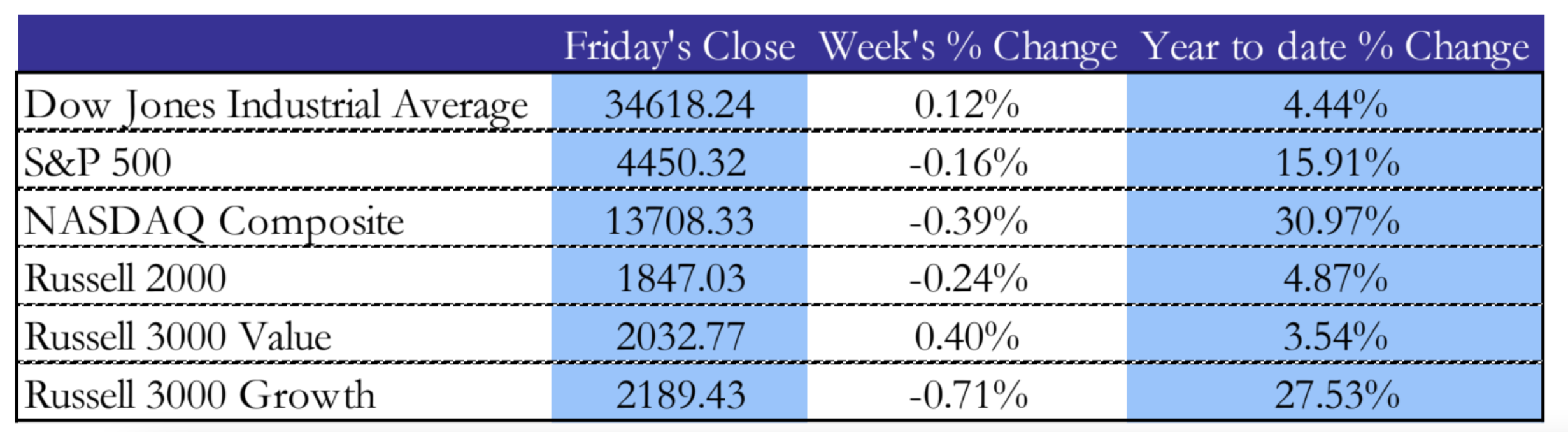

US equities traded mostly at a loss this week, with the S&P and Nasdaq closing the week at -0.16% and -0.39%, respectively. The Russell 2000 also closed below the weekly open at -0.24%, while the Dow Jones closed at +0.12%. Tesla (NASDAQ:TSLA) was the big mover among big tech, up +10.4% after news on its supercomputing business.

This week also saw ARM’s IPO, this year’s biggest initial offering, through which the company raised $4.87bn. Still owned for 90% by SoftBank, ARM was valued at close to $68bn. The trading debut was a success, with shares up 25% by the end of the session. Utilities and consumer discretionary were outperformers for the week, up 2.67% and 1.72% respectively.

This week’s main topic was economic data, led by the August CPI. While the headline came in line with expectations, although driven higher by energy prices, core inflation was slightly higher than expected. The news didn’t have a huge effect on the market, mainly because this release will likely have a small impact on the Fed’s decision at next week’s FOMC meeting. The consensus is for the Fed to hold rates in the current 5.25%-5.50% range.

The US indices rallied on Thursday, as the higher-than-expected inflation signaled a resilient and still strong economy. On Friday, some of the gains were shed due to the preliminary read for the University of Michigan’s consumer sentiment report, showing lower inflation expectations for both the long and short term.

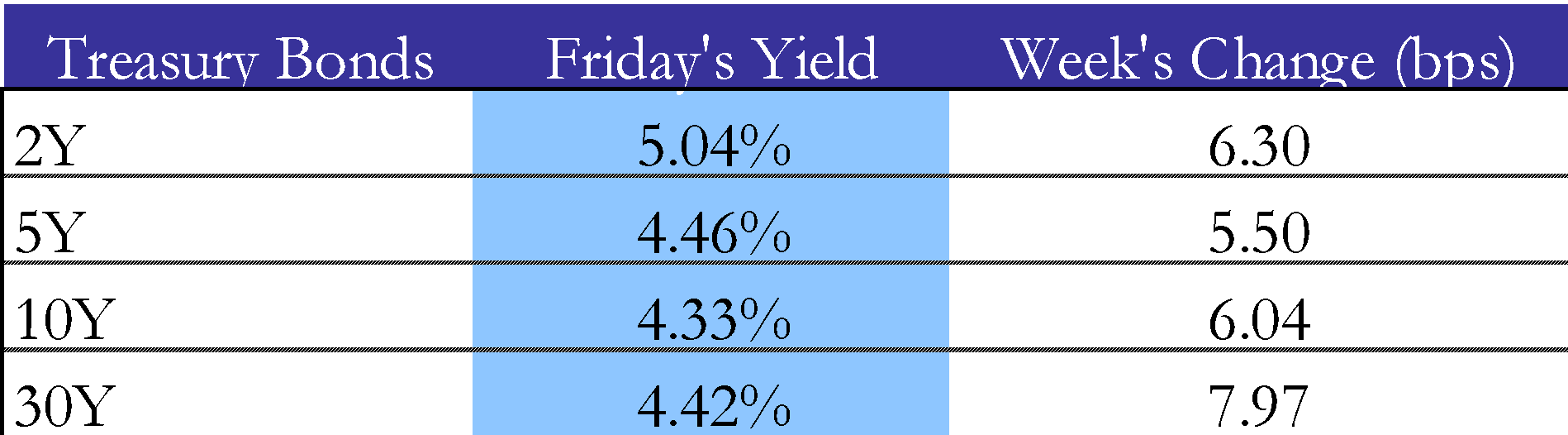

The Producer Price Index (PPI) came in 30bps hotter on headline for August (0.70% vs 0.40% cons.). Stripping out volatile food and energy costs, the core PPI was +0.2%, in line with estimates. Initial jobless claims reached 220k, in line with expectations. All this data is consistent with a strong economy, even in the prospect of higher interest rates for longer, which supports the narrative of a soft landing and has pushed yields higher. The change in yields was more pronounced towards the end of the curve, with the 30y yield gaining almost 8bps, reflecting the shared view that a recession in the US is becoming less likely.

Europe and UK

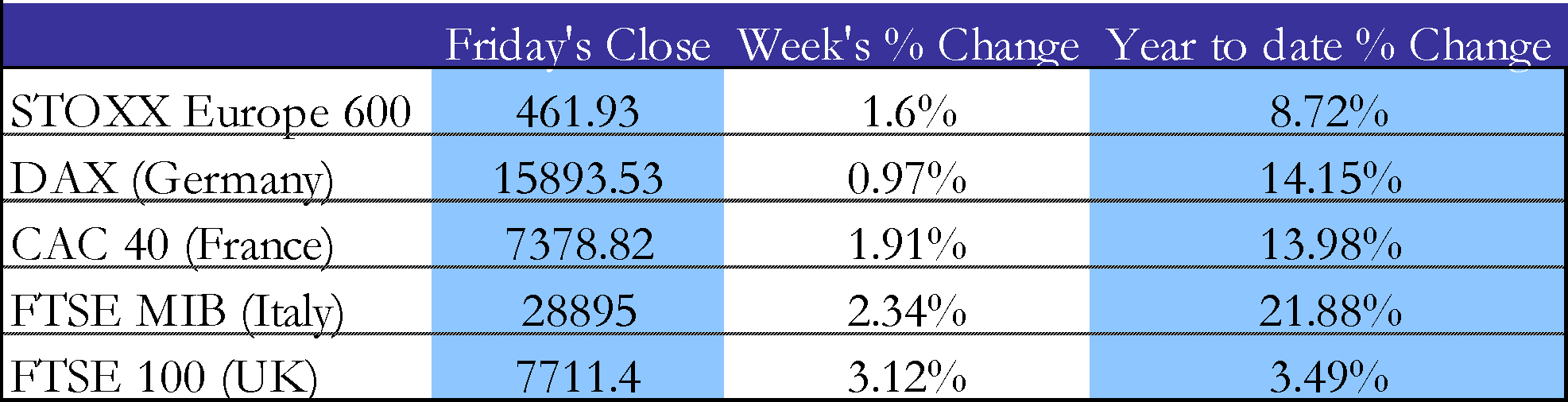

European markets ended the week positively, with the FTSE 100 gaining 3.12% and the FTSE MIB still strong, up 2.35% over the week and 21.89% year-to-date. Luxury, mining, and autos were the outperformers for the past 5 days. This was mainly due to better-than-expected Chinese data, which pushed luxury stocks up, and to the messaging from the ECB, which could indicate we are near the peak.

The main catalyst that led to all the European indices closing in the green was the ECB speech on Thursday. The ECB delivered an additional 25bps hike, while at the same time messaging that the hike would be one of the last. Markets reacted positively to the news, but slightly rebounded on Friday after policymakers stated that interest rates will have to stay higher for longer and additional rate cuts are not out of the question. However, this was to be expected: the inflation outlook remains too uncertain to call the end of the hiking cycle, and the ECB likely doesn’t want to lose its credibility.

Finland reported its August CPI at 5.6% YoY, compared to the consensus at 6.5%, and -0.7% MoM compared to the estimate of +0.1%.

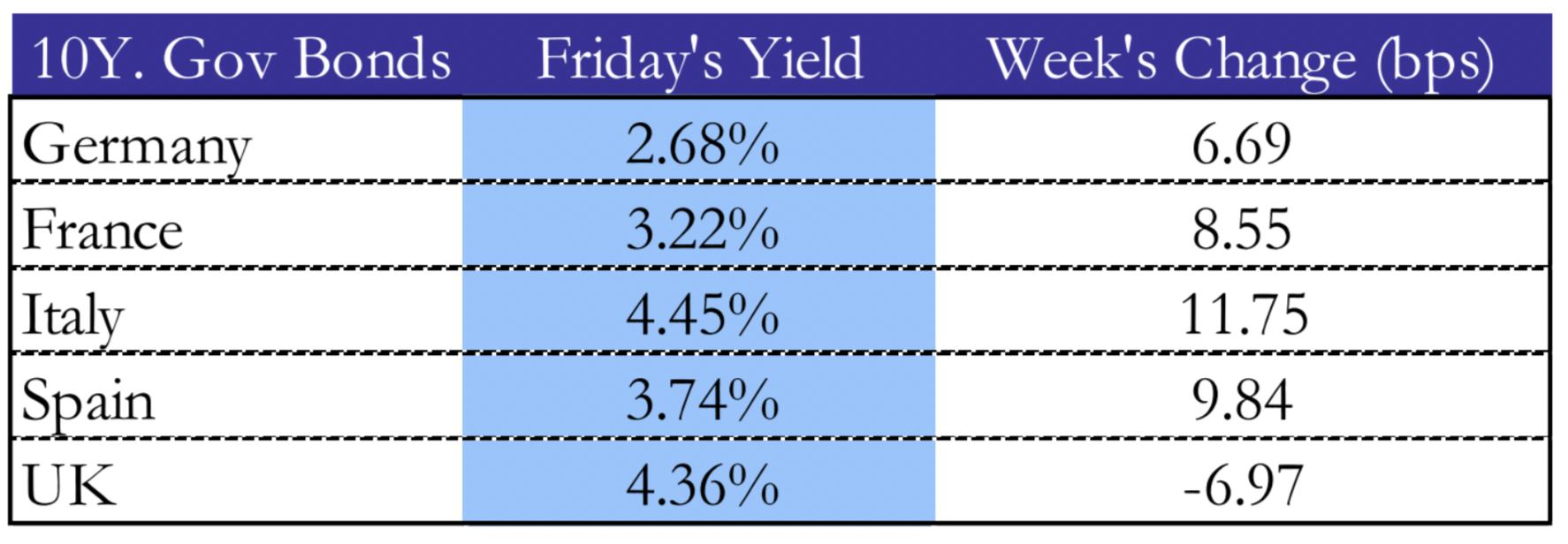

Bonds performed poorly, except for gilts, whose yield decreased by approx. 7bps. The worst performer was Italy, which saw yields increase by almost 12bps. Italy has been in the spotlight for the past weeks due to the 2024 Budget Law, with investors fearing a deceleration of the economy. 2Q GDP has decreased by 0.4% and the European Commission reduced its 2024 growth estimate to less than 1%, compared to the 1.5% the government was predicting. Lower growth means lower government income, and when combined with the country’s huge deficit, this led to a bond selloff, which drove the yield on the 10Y up by almost 12bps. PM Giorgia Meloni tried to reassure investors about Italy’s finances and reiterated the intention to go through with the tax on banks’ profits, which will bring approximately $3bn of additional revenue to the government.

Rest of the world

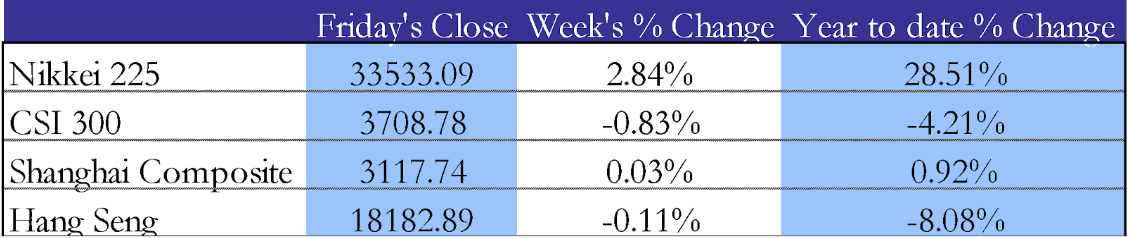

Asian indices performance was mixed, with the CSI 300 losing 0.83%, while the Shanghai Composite and Hang Seng were mostly flat. The only outlier was the Nikkei, which added a 2.84% gain and is up 28.51% YTD.

The Nikkei 225 regained some of the losses from the past week when the country reported GDP below the estimates from the previous quarter. In addition to that, the BoJ governor, Ueda, stated on Monday that an end to negative interest rates is possible, if policymakers become confident that prices and wages will keep going up sustainably. Japan’s 10y yields reached 0.7%, a level which was last seen in 2014. The expectation of rising interest rates supported financials, with Mitsubishi Financial and Mizuho gaining more than 3% on the news.

On Friday, China published the Industrial Production and retail sales data, which came out at 4.5% and 4.6% against the 3.9% and 3% consensus, respectively. This was likely the consequence of a summer travel boom for the country and an effective stimulus that pushed consumption and production higher. Beijing’s government is working hard to push the economy and markets are starting to become more optimistic about it succeeding. However, it’s hard to say, both because one month of data is not a significant sample, and because of the opacity of the data released by the government.

The better-than-expected data from China also provided some tailwinds for the Australian market. Led by miners’ stocks, the index posted a 1.3% on Friday and closed the week with a 1.71% gain.

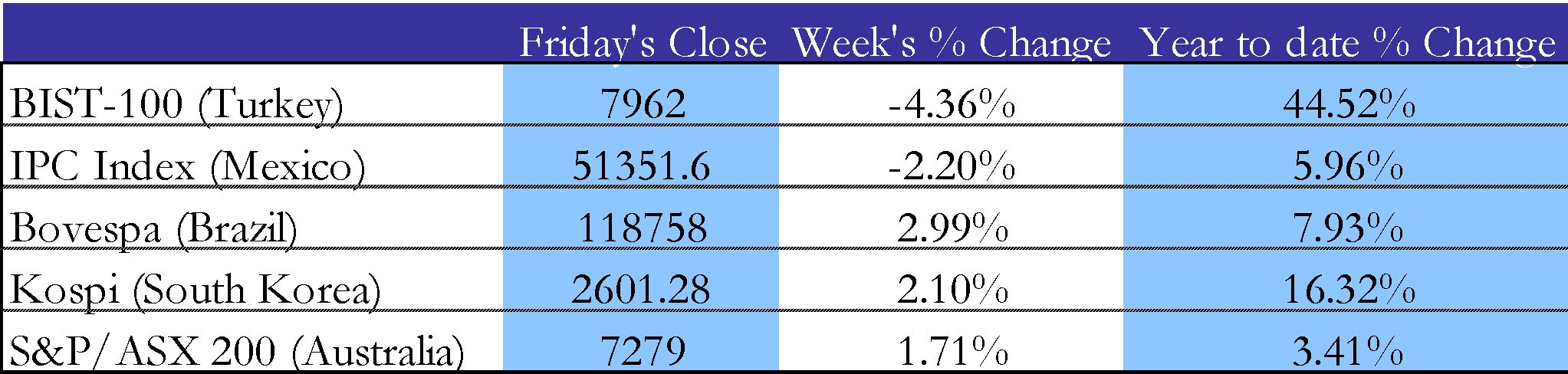

South American markets performance was mixed, with the IPC losing 2.20% as a consequence of the auto workers’ strikes in the US, which could heavily affect the auto parts manufacturers from Mexico that export to the States. Conversely, the Bovespa gained 3% on better-than-expected retail sales data (0.7% vs 0.3% cons.) The Turkish index shed more than 4%, due to a tightening in monetary policy aimed at supporting the Lira. The government has increased the reserves required for accounts with durations up to six months, thus increasing the cost for banks to provide short-term deposits and discouraging short-term speculation on the currency.

FX and commodities

The Dollar Index opened the week in the red, closing the first session with a 50bps loss. During Wednesday and Thursday, it rebounded after the higher-than-consensus inflation print and ended the week approximately flat. After the 25bps hike from the ECB, the EUR lost 0.80% against the USD, reflecting the messaging about the end of the hiking cycle. The Canadian dollar posted the biggest weekly gain since June, appreciating 0.80% against the dollar.

After closing Monday with a 0.80% loss, the USD regained ground against the JPY, ending the week flat at 147.85. This is coherent with the trend we have been seeing since January: only in the past 3 months, the USD has gained 4.22%, as the Bank of Japan has been holding its negative interest rate policy. However, after the recent statements by the BoJ governor, a change in yield curve control could be plausible and would provide a significant tailwind for the JPY to recoup some of the losses against the dollar.

Oil closed its third consecutive week in the green, hitting a 10-month high and leading to a 4% gain in both WTI and Brent futures. This was the consequence of the tight supply commanded by Saudi Arabian production cuts and the newly formed optimism around China. On Friday, Brent crude futures reached $93.93 a barrel, while WTI futures closed at $90.77 a barrel. Prices continue to be driven by supply and demand, especially after OPEC and Russia extended until the end of the year the supply cuts of 1.3m barrels per day. This, combined with the potential increase in demand coming from China, will likely support the prices in the near future.

The optimism around China pushed the futures on metals higher: on Friday, silver and gold recouped the losses of the previous days, ending the week flat. Platinum, on the other hand, closed the week with a 3.80% gain.

Next week main events

Brain Teaser #00

An island is inhabited by 100 smart lions who are good at math. A lion likes eating a human, but doing so would turn the lion into a human. Assuming staying alive is the highest priority, if a human arrives to the island, will he be eaten?

SOLUTION: If there is only 1 lion (n = 1), surely it will eat the human since it does not need to worry about being eaten. How about 2 lions? Since both lions are perfectly rational, either lion probably would do some thinking as to what will happen if it eats the human. Either lion is probably thinking: if I eat the human, I will become a human; and then I will be eaten by the other lion. So, to guarantee the highest likelihood of survival, neither lion will eat the human. If there are 3 lions, the human will be eaten since each lion will realize that once it changes to a human, there will be 2 lions left and it will not be eaten. So the first lion that thinks this through will eat the human. If there are 4 lions, each lion will understand that if it eats the human, it will tum to a human. Since there are 3 other lions, it will be eaten. So to guarantee the highest likelihood of survival, no lion will eat the human. Following the same logic, we can naturally show that if the number of lions is even, the human will not be eaten. If the number is odd, the human will be eaten. For the case n = l 00, the human will not be eaten.

Brain Teaser #01

You have two ropes, each of which takes I hour to bum. But either rope has different densities at different points, so there’s no guarantee of consistency in the time it takes different sections within the rope to bum. How do you use these two ropes to measure 45 minutes?

Source: “A practical guide to quantitative finance interviews” – X. Zhou

0 Comments