Introduction

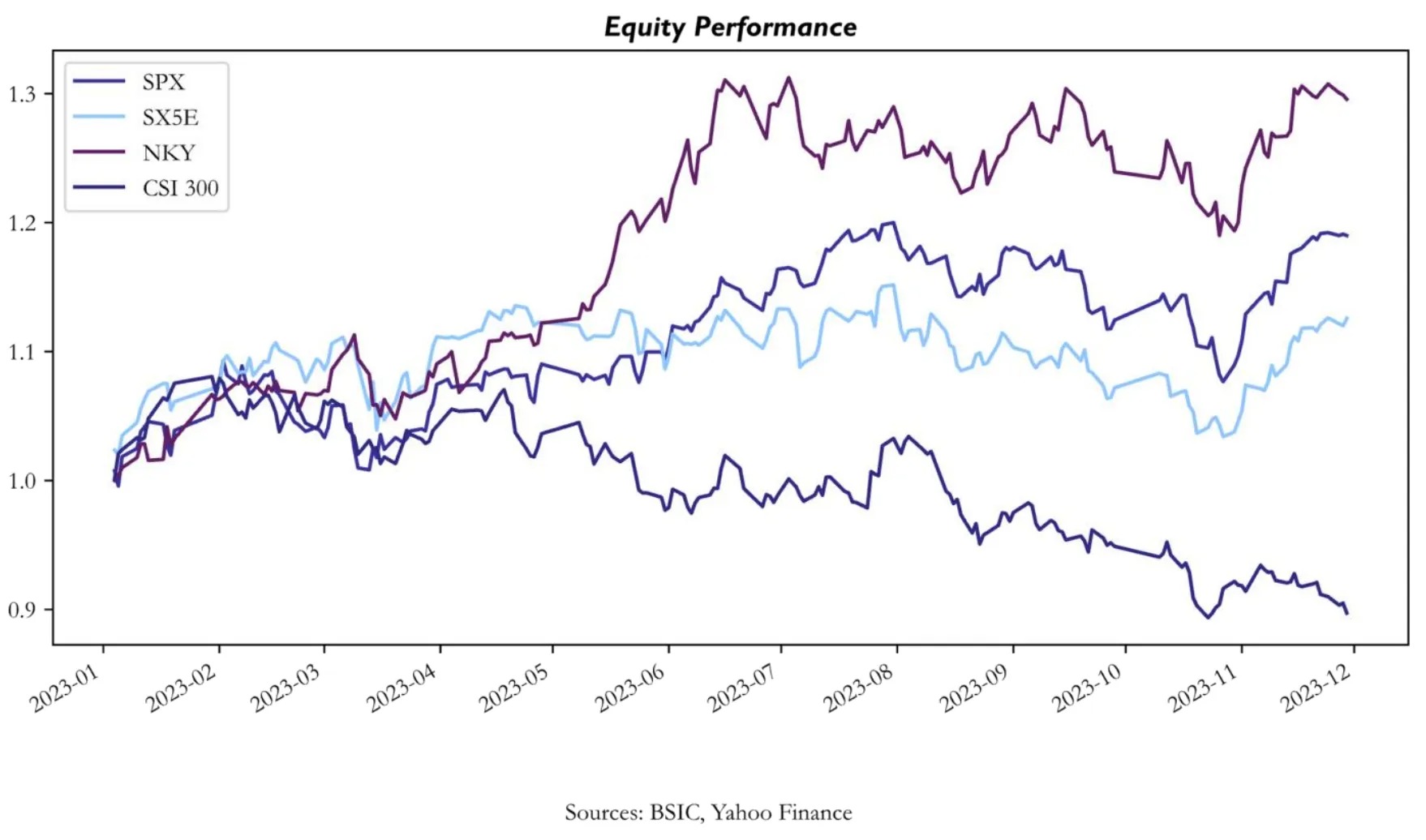

In 2023, the global economy has exceeded expectations, with projected global GDP growth set to beat consensus forecasts from a year ago. Core inflation has seen a significant drop, plummeting from 6% in 2022 to 3% across economies recovering from the post-COVID price surges. Notably, the US economy is on track to grow 2.4%, more than 2% above the market consensus in December 2022, when recession fears loomed. In the third quarter, major central banks concluded their hiking cycles, pivoting the discussion on interest rates to the anticipation of cuts for 2024. The majority of global equity indexes have displayed positive performance throughout the year. The S&P500 has risen by 19% year-to-date, the SX5E has recorded a 14% increase, and the NKY has experienced a substantial 30% surge. China stands out as an exception to this trend, as the economic slowdown and the real estate market collapse have resulted in a 10.4% YTD decline in the CSI 300 index.

This article will go through the major events and trends which have impacted the global economy, and how they have been reflected in the markets. Finally, it will illustrate the core investment themes for the coming year.

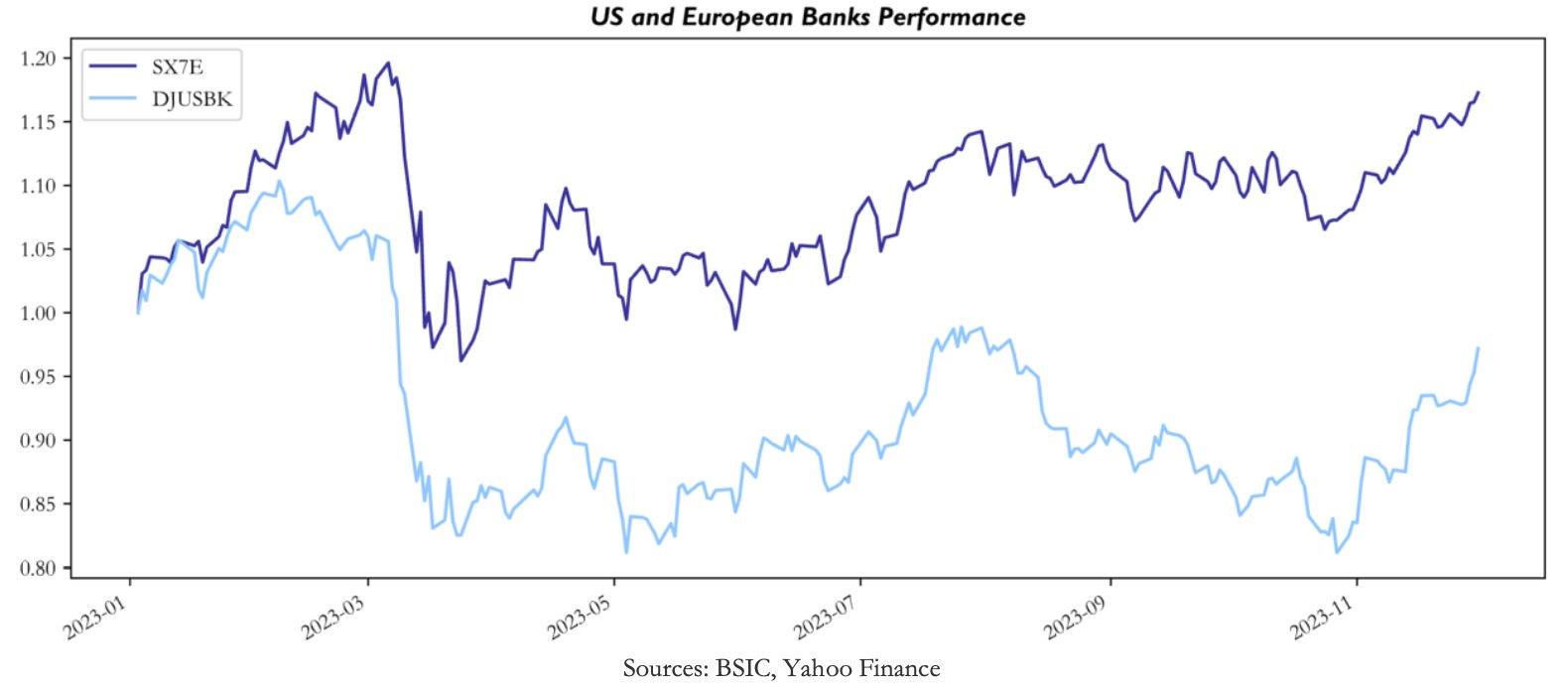

The Near Miss Financial Crisis

In the first quarter, the Fed raised rates twice, while the ECB hiked by 50 basis points in both February and March. The first systemic cracks caused by the hiking cycle materialized in one of the most relevant economic events of the year, the collapse of Silicon Valley Bank and the consequent wave of US mid-sized regional bank failures. To avoid a larger-scale financial crisis, the US government stepped in quickly, temporarily guaranteeing unsecured deposits at SVB and other failing banks and opening a lending facility. A week later, in Europe, UBS acquired Credit Suisse in a deal facilitated by Swiss authorities to help restore confidence in the global banking system. The financial sector in the eurozone, however, recorded gains for the quarter, with the challenges faced by Credit Suisse perceived as largely contained.

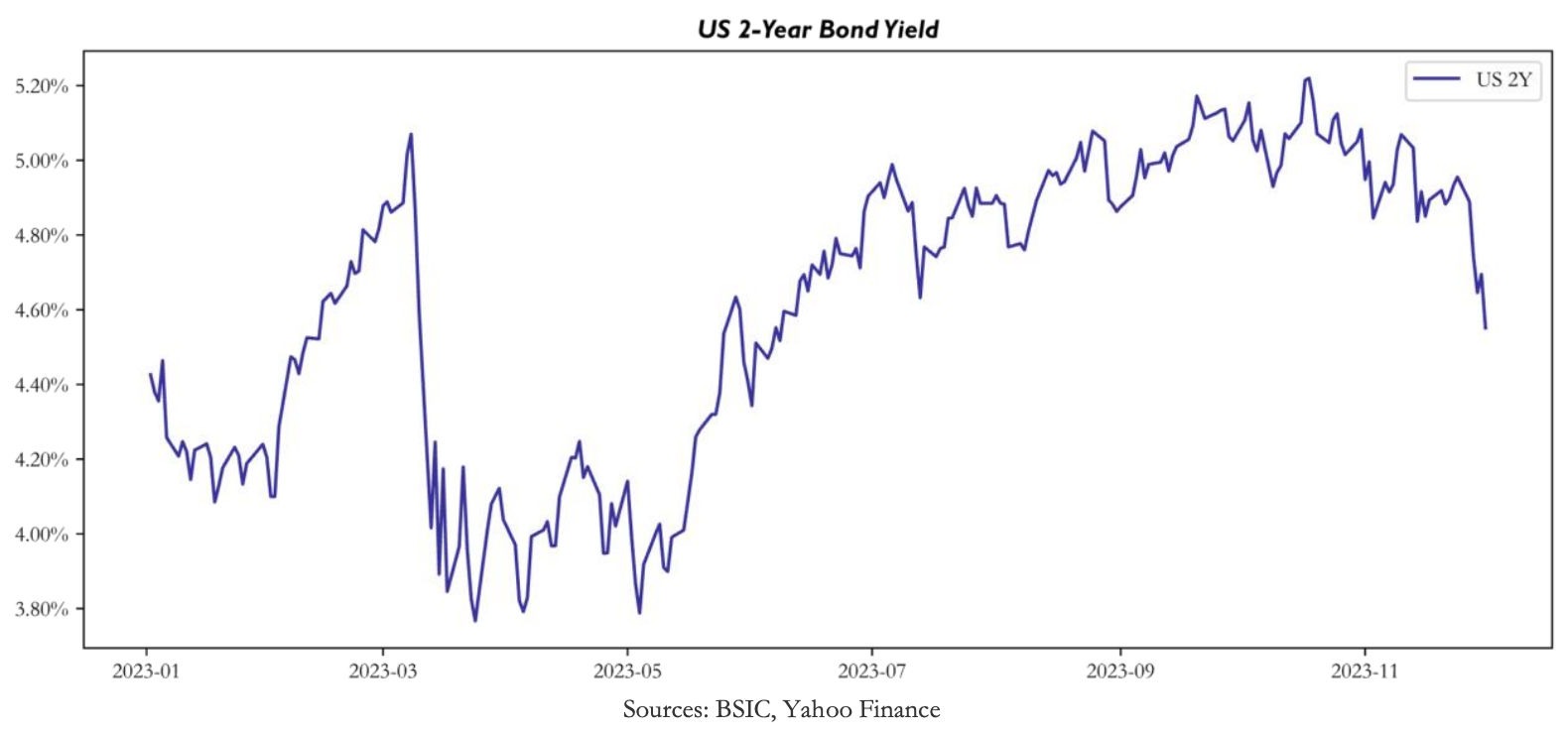

The SVB collapse drastically altered interest rate expectations. To prevent exacerbating stress on the financial system, the Fed, which was expected to hike rates unquestionably, started tempering its hawkish tone. Subsequently, bond yields experienced a decline in the following weeks, reflecting investors’ anticipation of earlier Fed rate cuts amid diminishing expectations for economic growth and inflation.

The AI Upsurge

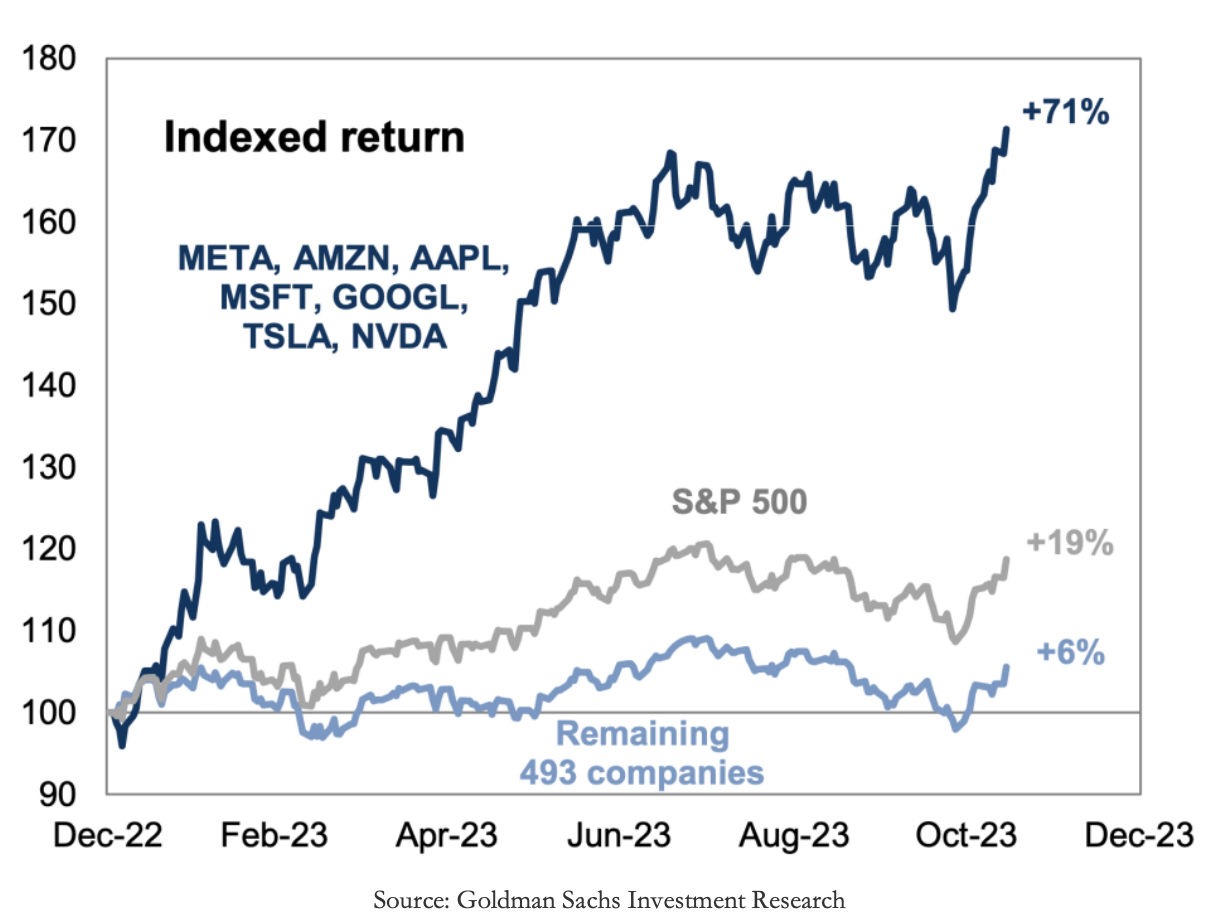

Since the release of ChatGPT in November 2022, AI companies have dominated equity markets, reflecting the potential for new growth and highlighting the influential role of narrative in shaping expectations. The interest surrounding AI has led to a re-rating of the technology sector, with a focus on companies actively innovating and investing in the technology. The Nasdaq has experienced a 47% increase this year, overperforming the S&P500 notwithstanding the influence of higher interest rates. This marked contrast from 2022, when the technology sector faced a de-rating due to higher interest rates, attributed to its long-duration cash flows and higher cost of capital. This difference suggests that investors are now assuming significantly higher future growth rates to counterbalance the impact of elevated discount rates.

Nvidia has emerged with an outstanding performance, surging over 200% year-to-date and surpassing a market capitalization of over $1 trillion. Fuelled by the AI explosion, the company has tripled its revenues compared to the previous year, anticipating strong growth in the years ahead. The positive US market performance has been driven by the massive outperformance of mega-cap technology stocks, the so-called “Magnificient Seven” (Amazon, Apple, Google, Meta, Microsoft, Nvidia and Tesla), now comprising 29% of S&P 500 market cap and collectively having returned 71% YTD in 2023, while the remaining 493 stocks in the index have returned just 6%. According to the Goldman Sachs Hedge Fund Crowding Index, hedge fund crowding is currently at its most extreme level in 22 years. Hedge funds significantly increased their exposure to the Magnificent Seven, reaching a new record in the third quarter, accounting for 13% of the aggregate hedge fund long portfolio, double their weight at the beginning of the year [1].

The Chinese Economic Slowdown

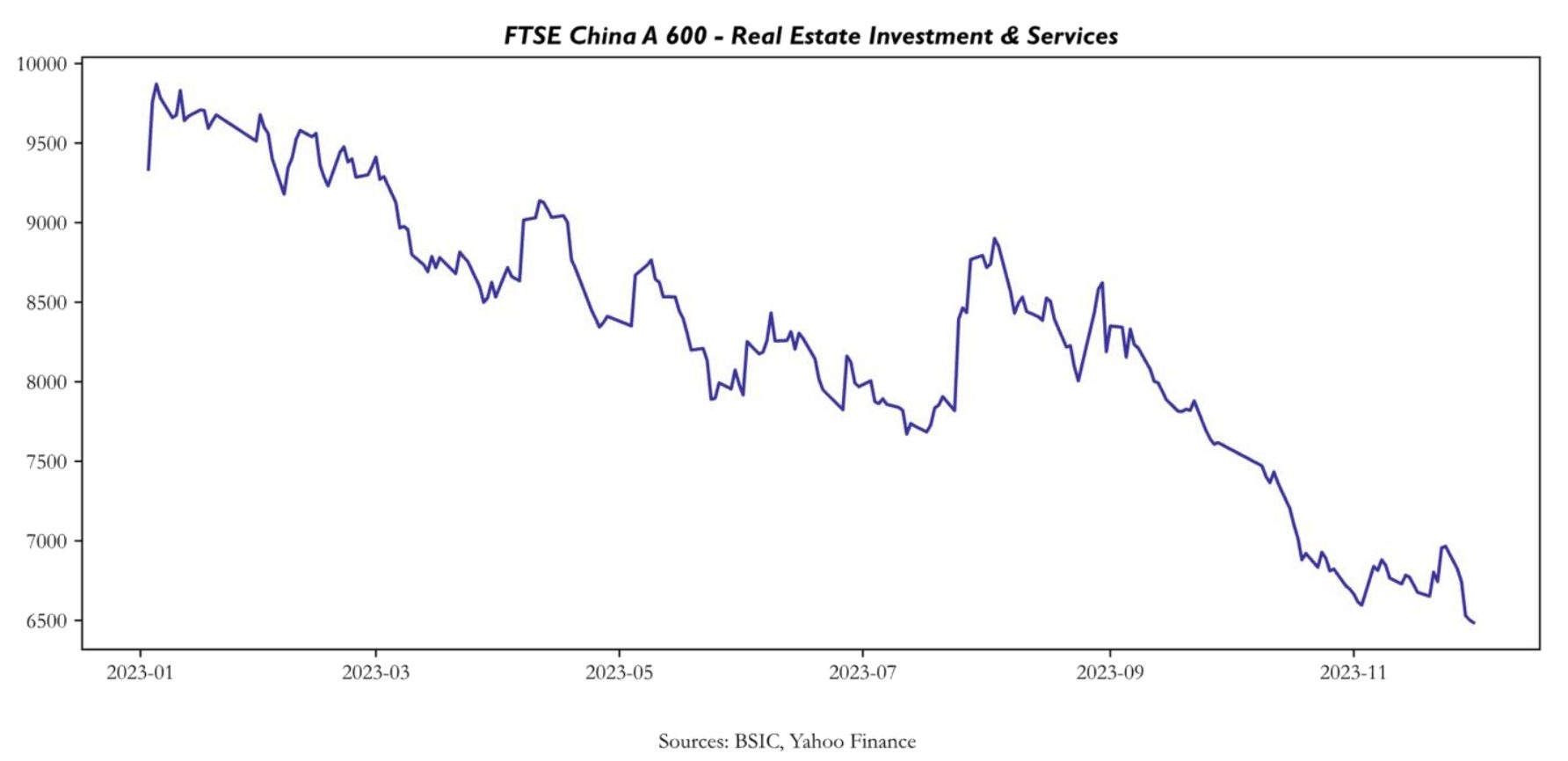

After a strong start to 2023, Chinese economic activity has significantly underperformed expectations, marked by a collapse in exports and in the real estate industry. The Chinese renminbi reached new lows in August and September 2023, reflecting concerns about the domestic economy. The turmoil among property developers is hugely significant for China, as construction and real estate have been core drivers of its growth: at its peak, China’s residential property sector was thought to contribute an estimated 25%-30% of the country’s GDP. More than two years ago, China’s real estate sector entered a crisis following a government-led crackdown on developers’ borrowing. The downturn has worsened into 2023, with property sales by floor area experiencing a 20% year-on-year decline and property investments dropping by 19% [2]. According to the FTs, more than half of China’s former top 50 developers have gone into default [3]. In August, Evergrande filed for bankruptcy in New York, and in October, the largest Chinese private property developer, Country Garden Holdings, faced its first-ever default on a U.S. dollar bond.

China is transitioning into a period of slower growth, worsened by unfavourable demographic trends, and rising tensions with the U.S. and its allies, which are posing risks to foreign investment and trade. The International Monetary Fund projects China’s GDP to grow just above 4% in the upcoming years, less than half of the rates observed for most of the past four decades. At these rates, China is at risk of falling short of President Xi Jinping’s 2020 objective to double the economy’s size by 2035.

A World at War

Geopolitical conflicts took centre stage in 2022, marked by the Ukraine War and the intensification of U.S.-China tensions. Unfortunately, 2023 saw no significant shift. The Ukraine War has settled into a costly stalemate, and though U.S.-China tensions have eased slightly, a conflict erupted between Israel and Hamas in October.

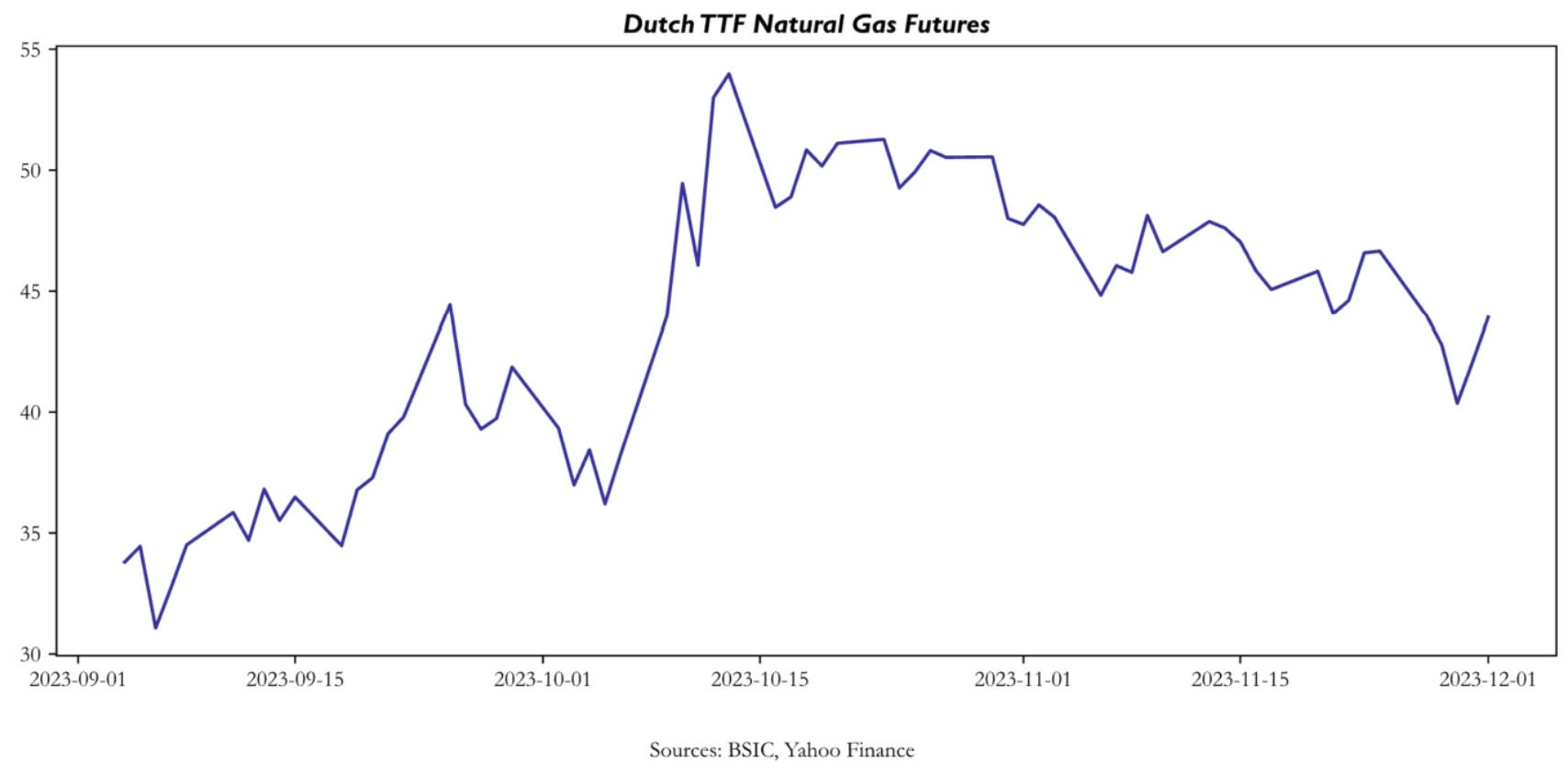

The war led to an 8% increase in oil prices and a 35% surge in natural gas prices in Europe. While the oil supply wasn’t affected, the closure of the Tamar natural gas field in Israel resulted in a 1.2% decrease in global LNG exports for October. Although the reduction in gas volumes was modest, the disruption highlighted the reduced capacity of the gas market to address adverse shocks, given its current state of supply constraints after the start of the Ukraine War. Although the likelihood of escalation in the Middle East region seems to have diminished with the cessation of fire from Israel in the hostage deal with Hamas, the persisting tensions in the area pose a significant threat to global growth. The potential interruption of trade through the Strait of Hormuz could result in a severe supply constraint, substantially increasing oil and gas prices.

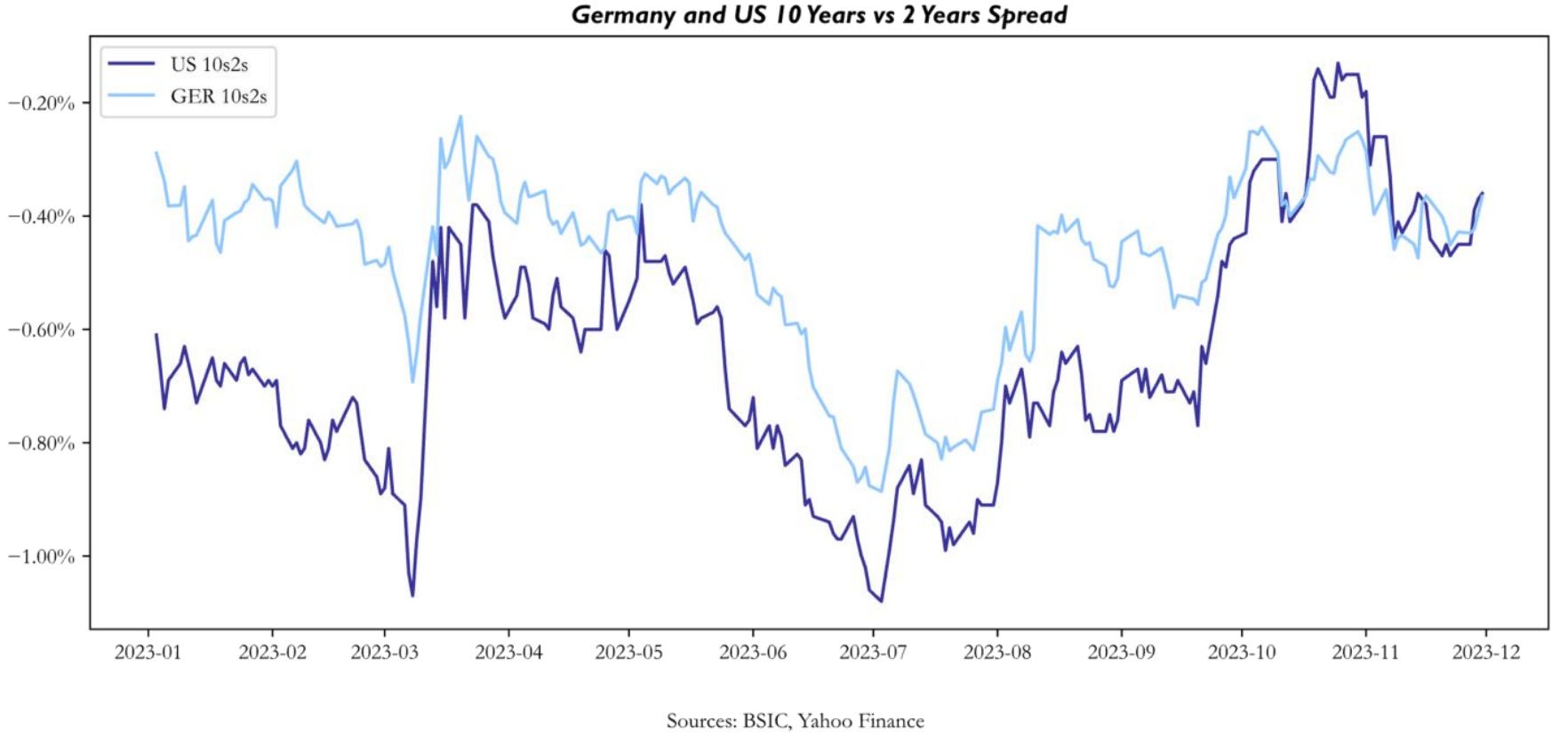

A Less Inverted Yield Curve

With the major central banks completing their hiking cycle by Q3, we have assisted in a decrease of the yield curve inversion, as strong data raised yield floor into year-end. During September and October, long-duration bonds experienced a dramatic sell-off, which pushed yields to historically elevated levels. The decline in bond prices primarily involved the long-duration ones, causing yield curves to sharply bear-steepen. Remarkably, the 10s-2s spread in the U.S., after being negative from July 2022, with more than 100 bps at the bottom, was close to turning back positive in October.

Two dynamics were involved: firstly, rate cuts were consistently pushed further away (initially from late 2023 to the beginning of 2024, and later to the second half of 2024). Simultaneously, there was an increase in expected long-term rates. In the U.S., this shift was driven by additional evidence about the resilience of economic activity and the stickiness of inflation. European countries, on the other hand, have been experiencing a completely different economic dynamic, with depressed growth outlooks and intact disinflationary forces. Nonetheless, European long-term yields followed the US, indicating an “imported tightening” of financial conditions which was inconsistent with domestic growth, inflation, and policy prospects. Finally, in November core government bonds reversed some of their losses on the back of hopes for rate cuts next year. The 10-year US government bond yield fell below 4.4% after having tested 5% in October, despite Moody’s downgrade of the US sovereign debt outlook to negative. German Bunds also saw significant yield declines, with the 10-year yields ending the month at 2.4%.

Main Themes for 2024

As the year comes to an end, the key investment themes that are poised to shape markets in 2024 are already outlined. One pivotal discussion that has evolved over the recent months, the timing of central banks initiating rate cuts, is expected to remain on top of investors’ minds in the coming year. Although market expectations suggest rate cuts could commence as early as May, Federal Reserve officials have maintained a hawkish stance. There is still genuine uncertainty surrounding the pace at which inflation will recede to meet the 2% target. A second theme is the uncertainty regarding where the new rate equilibrium will settle. With real yields on core assets now largely returning to pre-GFC levels, the level at which they will stabilize remains unclear. While a higher-for-longer rate policy may be appropriate in the robust US economy, other parts of the world present more complex scenarios. In Europe, for instance, Italian sovereign spreads widened in October, raising questions about the sustainability of Italian debt at these elevated yield levels. High rates could also lead emerging market sovereigns to lose market access and force them into debt distress.

Whether the outperformance of the “Magnificent 7” mega-cap tech stocks will continue in 2024 stands as a crucial question in the equity landscape. These companies exhibit faster-expected sales growth, higher margins, a more substantial re-investment ratio, and fortified balance sheets compared to the rest of the index. However, this trade is not especially attractive given elevated expectations. In a broader context, the potential upside for US equity is likely to be capped: high cash yields represent a significant hurdle to beat, and above-average US equity valuations persistently weigh down on the overall forward return profile.

Sources

[1] Wigglesworth, Robin “Hedge fund herding is worse than ever”, Financial Times, 21 November 2023.

https://www.ft.com/content/047d52a0-01a1-4db5-b342-f7f159d10d84

[2] Gao, Woo “China’s falling property sales, investment weigh on recovery”, Reuters, 18 October 2023.

https://www.reuters.com/world/china/chinas-falling-property-sales-investment-weigh-recovery-2023-10-18/

[3] Hale, Leng, Lin, Locektt “How China’s property crisis has unfolded, from Evergrande to Country Garden”, Financial Times, 23 October 2023.

https://www.ft.com/content/a387a533-5995-43a9-b472-ce5691969657

0 Comments