Introduction

Global macro strategies, which aim to profit from economic and political trends across markets and asset classes, have been a staple of the investment world for decades. In recent times, these strategies have gained in popularity as investors seek to diversify their portfolios and take advantage of the growing interconnectedness of global markets. However, after an outstanding performance in 2022, global macro strategies have struggled to repeat their success in 2023, thus leading some to question whether the strategy has run its course, or whether it is simply experiencing a temporary setback.

In this article, we will explore the evolution of global macro strategies, examine the reasons behind the disappointing performance in 2023 thus far, and consider whether or not these strategies are likely to rebound in the foreseeable future.

Definition and evolution of global macro strategies

Unlike most of the widely adopted hedge fund strategies, global macro strategies are market and asset class agnostic, allowing investors to seek out opportunities in any part of the world through any instrument at their disposal. This peculiarity makes defining global macro strategies a challenging task, as there is no single agreed-upon definition or set of criteria. The first step towards defining global macro strategies is dividing them across three foundational dimensions: discretionary versus systematic, fundamental versus technical and trend-following versus relative value.

Discretionary strategies rely on the intuition and expertise of individual managers to identify and act on macroeconomic trends. These managers often take a flexible and opportunistic approach to investing, adjusting their positions based on changing market conditions. On the other hand, systematic strategies rely on quantitative models and algorithms which provide trading signals based on macroeconomic data to exploit market inefficiencies. Systematic strategies have now grown to include quant macro strategies using alternative data in their models. Spending on alternative data has been increasing steadily from just over $200m in 2016 to over $1.5bn in 2020, according to Bloomberg. For example, during the pandemic managers were heavily relying on Apple and Google’s mobility statistics to track economic reopening. This trend has steadily continued over the last 3 years with 73% of asset managers surveyed by Coalition Greenwich reporting an increase in their usage of alternative data over the last few years, with 64% of them reporting an increase in their alphas.

Fundamental strategies focus on analysing macroeconomic data, such as GDP growth, inflation, monetary and fiscal policies, to identify trends and opportunities in the market. They often take a longer-term approach, looking for opportunities that may take several years to play out. In contrast, technical strategies rely on analysing market data, such as price and volume, to identify short-term trends and opportunities.

Trend-following strategies seek to profit from momentum in the market, identifying trends and investing in assets that are showing positive price momentum. This approach assumes that markets tend to underreact to news, and it aims to profit by going long assets whose macroeconomic trends are improving and short those with declining macroeconomic trends. In contrast, relative value strategies seek to identify mispricings in the market, investing in assets that are undervalued relative to their peers or the broader market.

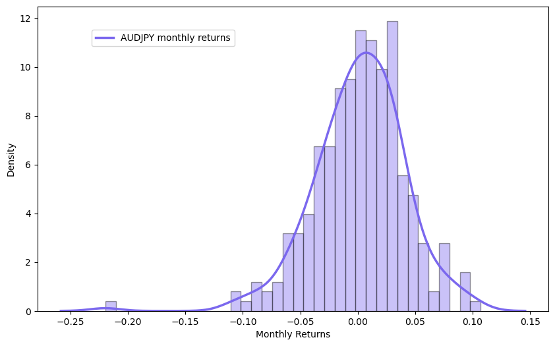

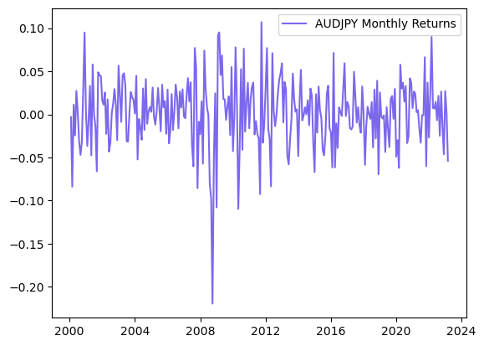

One of the oldest and most popular strategies in global macro is the carry trade: borrowing in a low-yield currency and investing in a higher-yield currency, with the expectation of profiting from the interest rate differential. Indeed, a carry trade strategy can be extended to any asset class. For example, in a bond carry trade, the carry is the difference between the yield and the financing rate or for an equity carry trade it is the difference in dividend yields between two indices. A carry trade is characterized by stable, slightly positive returns over time, as the interest rate differential between the two currencies (or carry in general) generates a consistent profit. However, the strategy is also associated with rare, very negative returns, particularly during times of high market volatility or financial crises. This is illustrated in the graph for AUDJPY, where the strategy exhibited a sharp decline during the global financial crisis in 2008.

Carry trades across different asset classes tend to have very low correlations, thus making a diversified carry trade strategy (currencies, commodities, bonds, and equities) an attractive option for macro traders, with a Sharpe ratio of 1.4 as shown by Pedersen (2015).

Source: investing.com, Bocconi Students Investment Club

Since the times of John M. Keynes in the 1920s, macro trading has been associated with a single, strong risk-taker who takes massive, often unhedged positions based on their research and economic trends. In the “golden age” of macro trading, George Soros and Julian Robertson revolutionized the way macro trading was carried out by adopting two very different approaches. Soros is known for his aggressive and often risky approach, often summed up by the quote “invest first, investigate later” and can be regarded as the first macro momentum trader following his theory of boom/bust cycles and reflexivity. In contrast, Robertson acted only on the basis of exhaustive fundamental research.

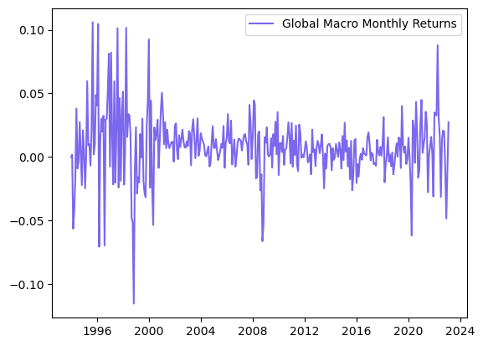

The flow of institutional investments into hedge funds through the late 1990s and early 2000s brought about a change in the macro trading landscape as shown by historical returns with volatility of 4.3% in the 90s compared to 1.8% from 2000 to now. In that period, Robertson’s Tiger had to shut down and Soros had to restructure his fund as the excessive riskiness of their investment strategies was incompatible with the needs of institutional investors. Managers had therefore to introduce stringent risk management and compliance measures and switch towards a multi-strategy approach that dominated the industry through the 2000s until the global financial crisis, when multi-strategies showed high left-tail risks in abnormal times while global macro strategies outperformed. This led global macro strategies to regain popularity due to their ability to outperform in abnormal times while still providing positive long-run returns.

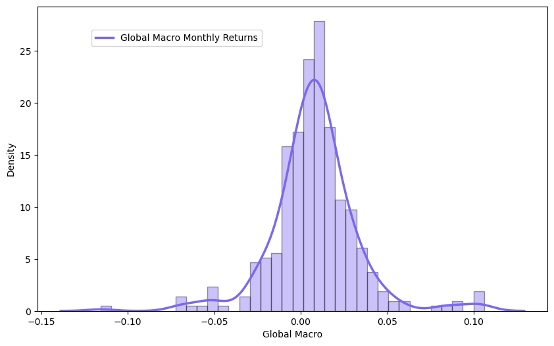

Source: Credit Suisse, Bocconi Students Investment Club

Global macro strategies tend to have low correlations to most asset classes and to most other hedge fund strategies, they therefore provide true diversification to investors. Macro trades take place in highly liquid markets, which make it possible for managers to exit their position when markets are struggling, as opposed to other strategies where positions cannot be exited in abnormal times due to the illiquidity of assets traded. Another differentiating factor for global macro strategies is their ability to have negative or positive betas depending on the overall market performance.

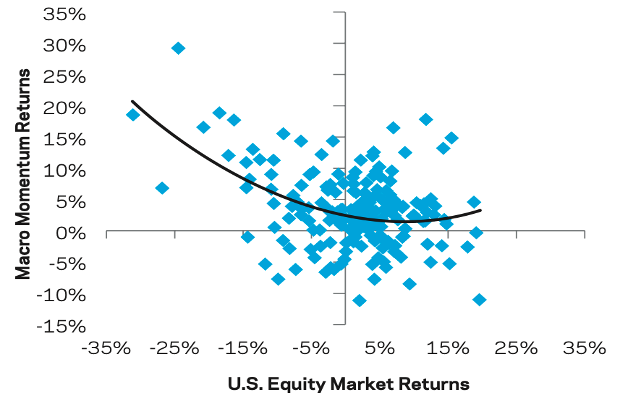

In fact, as shown by AQR (2017) the systematic macro momentum strategy tends to have a “smile” with respect to market returns, showing positive beta when markets go up and negative beta when markets go down. The economic rationale behind this behaviour is that bear equity markets are usually preceded by deteriorating macroeconomic conditions. What differentiates macro momentum from the classical trend-following strategies is its ability to better predict inflection points driven by macroeconomic trends, this explains how the strategy had positive returns in the biggest drawdowns for trend-following and vice versa (e.g., trend-following outperformed during the tech bubble when prices and fundamentals pointed in opposite directions).

Source: AQR Capital Management

Over the last decade, opportunities for global macro have been scarce due to the expansionary monetary policies implemented by central banks worldwide. According to Berglund et al. (2020), most hedge fund strategies have displayed slightly negative alpha following unconventional monetary policy announcements during this period. Additionally, AQR (2017) has shown that macro strategies, particularly macro momentum, can benefit from raising yields, as was the case in 2022.

The stellar performance of 2022

In 2022 Stocks and Bonds lost their long-lasting negative correlation as the S&P 500 declined by around 20% and US Bonds, as measured by the Morningstar U.S. Core Bond Index, lost 12.9%. Nonetheless, Global Macro Hedge Funds had a stellar performance, with a 14.2% increase in the Hedge Fund Research’s macro index compared to a drop of 4.25% of the firm’s overall hedge fund index. Some Global Macro hedge funds such as Rokos Capital (51%) or BlueCrest Capital Management (153%) even had double and triple digit returns in 2022. Once again, macro hedge funds have proven to be a true source of diversification for investors during times where financial markets are in disarray.

The outspoken performance of macro hedge funds in 2022 was generally driven by rich macro-opportunities in the rates market, where traders were profiting from rising yields as well as in FX with a stark divergence of monetary policies globally. One of the most outspoken divergences between developed countries was between the monetary policy adopted by the Fed and that of the BOJ. Skilled macro traders were able to profit from the divergence by going long the USD and short the JPY, a classic example of a before explained carry trade. Generally speaking, macro hedge fund managers were able to generate alpha by timely identifying the new trends and extrapolating divergences across asset classes caused by the monetary policy regime change and increased geopolitical and economic instability.

Source: Federal Reserve, Tradingeconomics, Bocconi Students Investment Club

Out of Global Macro, systematic funds on aggregate generated more alpha for their investors compared to discretionary funds. Discretionary thematic and directional performed the worst (6.51% and 6.69% respectively) and systematic macro performed best (12.35%) in the last 12 months up to February. Leading to the conclusion that the more data sophisticated hedge funds were able to identify and execute on more macro-opportunities than its competitors.

2023 – Winners turned Losers

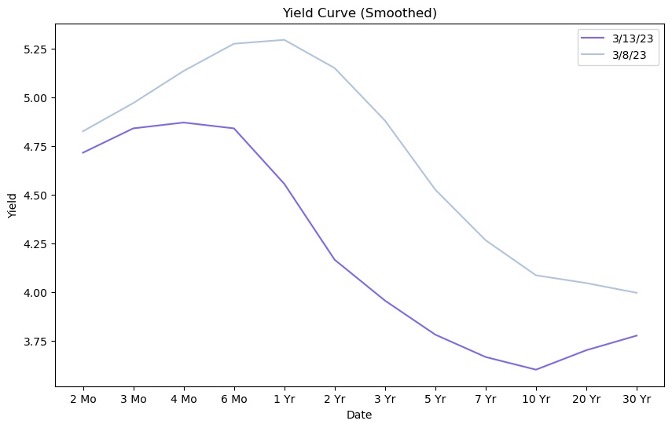

In both January and February of this year macro hedge funds were still recording profits as the HFRI 500 Macro Index increased by 0.83% but performing worse than the overall industry (1.75% – HFRI 500 Fund Weighted Composite Index). This underperformance can, in part, be attributed to the bullish sentiment on risk assets at the beginning of 2023 which enabled strategies like Equity Hedge to perform better. Not reflected in the data, however, is the dramatically increased volatility in bonds, that was caused by the sudden and for many unexpected closing of the Silicon Valley Bank at the beginning of march. The MOVE index, a key bond market volatility index, reached levels last seen during the GFC and 2-year Treasury yields recorded their biggest three-day drop since the Black Monday crash of 1987, indicating that the market pivoted from a “higher for longer” narrative to a scenario where the Fed is forced to cut rates soon.

Source: U.S. Treasury, Bocconi Students Investment Club

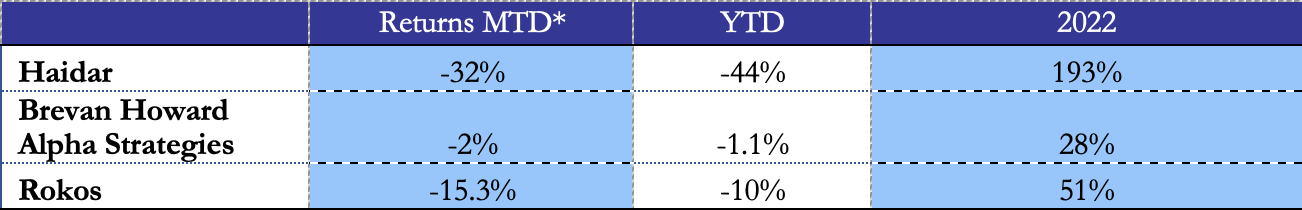

Many traders got caught up in these outsized bond market swings. CFTC data in March showed that funds and speculative accounts had an aggregate net short position in the three-month Secured Overnight Financing Rate (SOFR) of 1.17 million contracts – a record short. The table below lists some of the biggest macro winners of 2022 turned losers in 2023 so far.

*returns through March 17th

Source: Bloomberg, Bocconi Students Investment Club

Outlook

We believe that the 2023 global economy will continue to be guided by a regime of push and pull factors. One such push factor is the greatly anticipated Chinese reopening, which you can read about more in this article. The Ukraine war as well as the current Regional Banking Crisis in the U.S. on the other hand are obstacles to increased economic growth and geopolitical certainty. Adding to that, increased uncertainty about monetary policy paths globally remains with the Fed having to manoeuvre what could turn out to be a major banking crisis as well as inflation pressures and with Japan just recently appointing a new governor for the BOJ.

Concluding from that, macro-opportunities are expected to remain rich throughout 2023. Or as Joe Dowling, global head of Blackstone Alternative Asset Management put it: “It’s the perfect environment for macro hedge funds: central-bank policy divergence, interest-rate differentials, geopolitical tension, bottlenecks and each country on its own. It presents a ton of opportunities”. However, important to note is that due to the less liquid environment caused by CB tightening and spikes in short-term volatility, macro hedge fund managers should adopt a more dynamic approach as the performance of more traditional strategies can get diminished by higher volatility in longer-term trends. Nimble managers that can monetize the volatility around the core trends, or effectively protect themselves against the downside risk, will have an edge over their competitors. Macro hedge funds that, on the other hand, are caught wrong footed, can get wiped out quickly as we saw in March of this year.

Sources

[1] Pedersen, Lasse Heje “Efficiently Inefficient”, 2015

[2] Rozanov, Andrew “Global Macro Theory & Practice”, 2012

[3] AQR Capital Management “A Half Century of Macro Momentum”, 2017

[4] Berglund et al. “Monetary Policy after the crisis: a threat to hedge funds’ alphas?”, 2020

[5] “Hedge Fund Strategy Outlook”, Franklin Templeton, 24 January 2023. https://franklintempletonprod.widen.net/content/ebmakaykr3/pdf/hedge-fund-strategy-outlook-1q-2023-a.pdf

[6] Chan, Tillu, Quinones, “Modern Macro: A New Approach to an Old Strategy”, Pimco, 22 March 2023. https://www.pimco.ch/en-ch/insights/investment-strategies/featured-solutions/modern-macro-a-new-approach-to-an-old-strategy/?r=Financial%20Intermediary&l=Switzerland&s=true&lang=en-ch

[7] McGeever, “Column: Funds face massacre on record short US rates position”, Reuters, 20 March 2023. https://www.reuters.com/markets/us/funds-face-massacre-record-short-us-rates-position-2023-03-20/

[8] Brozek, Callahan, “Can Macro Hedge Funds Continue to Shine?”, iCapital, November 1 2022. https://icapital.com/insights/hedge-funds/can-macro-hedge-funds-continue-to-shine/

[9] Hedge Fund Research, Data. https://www.hfr.com/family-indices/hfri-500-hedge-fund-indices#

[10] U.S. Treasury, Data. https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202303

0 Comments