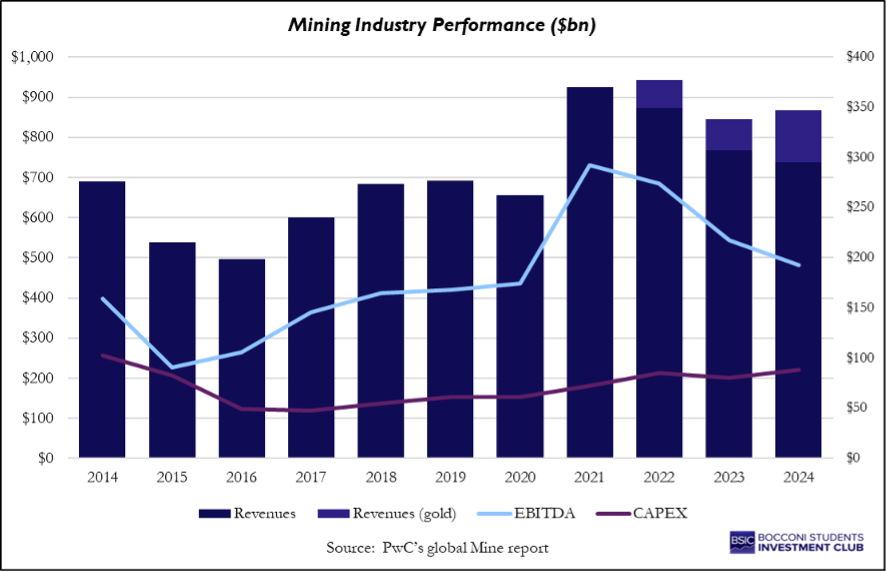

The global mining industry has recently been under the spotlight with the announcement of a $53bn merger deal between Anglo American [LSE: AAL] and Teck Resources [TSX: TECK.A], the largest deal in the sector in over a decade. Mining remains a cornerstone of the global economy. From supplying energy commodities on which the majority of our power generation capacity depends, industrial metals for construction and manufacturing, to specialty metals employed in the renewable energy transition, as well as precious metals, the sector is deeply related to macroeconomic cycles and is facing structural changes. For mining companies, except for gold miners, 2024 was a challenging year: revenues and EBITDA for the top 40 global mining companies (excluding gold-focused firms) declined by 3% and 10% respectively, as rising costs compressed margins to 22% from 24% in 2023. In contrast, record gold prices as investors relied on the metal’s safe-haven reputation amid global uncertainty, pushed gold miners’ revenues up 15% and EBITDA up 32%. Higher capital expenditures and dividend distributions by gold miners also masked the weaker performance across industrial and energy commodities.

Against this backdrop, this industry primer provides a comprehensive overview of the mining industry, including a detailed analysis of the Anglo-Teck merger and an informed future outlook for the sector.

Categories of mined commodities

Mining commodities can be broadly grouped in the following main categories.

Precious metals such as gold, silver, and platinum group metals (so-called PGMs) have a significant presence in the financial market as monetary assets. They are perceived as safe havens against inflation and economic/currency instability. In fact, both governments and banks use gold to hedge uncertainty. Silver possesses similar qualities but given that it retains industrial applications it is still correlated to GDP swings.

Industrial metals including iron, copper, and aluminium are often seen as direct bets on economic growth. Their widespread application in construction, manufacturing, and infrastructure ensures that demand rises and falls with the health of global economies. In recent years, the transition to renewable energy and electric vehicles has significantly reshaped this space, driving demand for copper, nickel, and specialty metals such as lithium and cobalt, which are critical for batteries’ manufacturing.

Energy commodities, mainly oil, natural gas and coal, remain essential to powering global industry and transport, despite the gradual shift toward cleaner alternatives. They are also deeply tied to geopolitics, with prices often swinging due to supply disruptions, conflicts, or policy changes. Because energy costs feed into nearly every sector of the economy, these commodities can function as hedges both against inflation and global stability.

As each group of commodities follows different trends, it is imperative in the mining industry to properly diversify the ores mined in order to shield oneself from potential economic downturns. While completely shielding is impossible, one can mitigate the financial damage of price fluctuations in mined commodities.

Mining value chain

The mining value chain can be divided into seven sections: exploration, development, extraction, processing, transportation, market usage, and closure. If not evident from the long list, this process is lengthy, typically spanning decades. Exploration or prospecting is done to understand key characteristics of the mineral/ore deposit. Type of mineral, ease of extraction (economically recoverable part of the deposit), quality, and engineering implications are all factors included in a preliminary economic assessment to determine if a project should continue.

After determining the financial feasibility of a project, a firm will begin developing the mine for future operations by constructing the required infrastructure and sourcing the necessary equipment. This process will continue throughout the mine’s lifecycle to maintain operationality. Development is essential due to the complex logistical challenges that characterise this industry. Without proper planning, mines can easily suffer large setbacks, which can lead to significant losses. Challenges include the removal of overburden (rock above the desired mineral/ore, which is extracted from the mine), future planning for closure (many countries will not issue mining licences without a proper plan in place for closure), and waste management of toxic materials. Extraction of the mineral/ore deposit is done through either surface or underground mining on either the placer (found in rivers and streams) or lode (contained between rock bodies) deposits. Every deposit has its own unique geology, requiring a distinct approach. Surface mining includes methods such as open-pit and strip mining. Open-pit mining involves drilling holes into rock to set up explosives and liberate ore hidden beneath the surface. Strip mining follows the more stereotypical idea of surface mining, with excavators digging down to the ore level in strips. Underground mining includes approaches such as drift, slope, and shaft mining. All these approaches create access tunnels to reach ores. Drift, slope, and shaft mining use horizontal, sloped, and vertical access shafts, respectively.

Processing involves the refinement of the mineral/ore, such as smelting copper or turning iron into specific variants of steel. This transforms the base good into a usable uniform product with much higher value relative to its raw form. Transportation of the mineral/ore is then arranged for its desired market. This is typically done through blends of rail, road, and ships (pipelines in the case of gas/oil). As the product reaches its end consumer, the minerals and ores are converted into a wide variety of products, such as automobiles and electronics.

Lastly, when the mine becomes financially unviable, closure plans are implemented. The main goal is to restore/repurpose the mines to the original state. Firms typically opt to create agricultural fields, forests, and public works centres to fulfil their duties to the community. In the past, the mining industry has been guilty of irresponsible use and faulty reclamation plans, resulting in long-term negative environmental impacts through erosion, poor air quality (due to carbon emissions), and water pollution. With tighter regulations and heightened public scrutiny, firms have significantly improved their ethical and environmental standards. This, however, has been more noted in the West rather than other less regulated areas of the world, such as Asia or Africa.

For what concerns the distribution of operating costs across the mining value chain, a survey of hard-rock mining projects published in 2014 shows that expenses are divided mainly between mining and processing, each absorbing on average around 43 to 45% of total site costs, while general and administrative requirements typically account for about 10 to 13%. In particular, open-pit operations direct a larger share to processing, close to 49%, with mining closer to 40%, whereas underground operations see the opposite pattern, with mining costs rising above 51% and processing dropping to about 34%. A more recent study from 2025 focuses on the cost structure of open-pit copper mines, particularly relevant in light of the Anglo–Teck merger revolving around a major open-pit copper operation in Chile. Drawing from the case study of a copper mining operation in the Democratic Republic of Congo, it finds that nearly 70% of total costs were tied to processing, with milling alone close to 60%, while mining-related activities together represented just over 20%, with hauling standing out as the largest individual component.

Risks and mitigations for mining companies

The mining industry is risky and capital-intensive, as firms invest vast sums of capital over multiple years with hopes of seeing large returns later in time. Additionally, the risk is increased by the intrinsic connection of mining to macroeconomic trends. Long investment horizons expose investors to significant changes in interest rates, currency fluctuations, and most importantly, commodity demand – also driven mainly by macroeconomic trends. In particular, high interest rates have multiple adverse effects on the mining industry. Increased borrowing costs drive down investment in exploration and the development of new mines. Due to most commodities being traded in U.S. dollars, when U.S. interest rates rise, the dollar appreciates, causing a decrease in demand for commodities exchange rate volatility impacts margins and global competitiveness. When the local currency appreciates against the dollar, firms experience higher relative costs (usually sustained in local currency) to revenues (in dollars). This leads to lower margins, diminishing competitiveness against producers in other countries. Ultimately, these risks are all secondary to the inherent risk of commodity demand. The value of the majority of mined commodities depends on GDP. When GDP decreases, the prices of industrial metals such as iron, copper, and aluminium decline as manufacturing and construction slow. Similarly, energy commodities are also sensitive to the decline in industrial activity and electricity usage when GDP contracts. Precious metals such as gold, silver, and platinum are less correlated with GDP, instead being more dependent on risk sentiment and overall growth expectations. When economic growth is uncertain, gold prices tend to peak.

Mining companies must include all these risks in the formulation of a long-term strategy. Interest rates can be mitigated through various methods, such as an appropriate mix of fixed and free-floating debt (caps exposure to interest rates while allowing for upside if rates fall) or staggering debt maturities (prevents the possibility of large refinancings in high-interest rate environments by spacing out the debt). Currency fluctuations can be moderated through multiple mechanisms, such as financial hedging (through forward contracts, currency swaps, or options), geographic diversification (operating in multiple countries – expenses in different currencies), and unification of costs (paying suppliers in dollars). Commodity demand fluctuation can be moderated through financial hedging (through forward/fixed-price contracts, futures contracts, and options) and, significantly, diversification of production. Mining firms also usually diversify the commodity type mined to shield themselves partly from fluctuations due to the unique nature of each commodity type. Precious metals, industrial metals, energy commodities, and specialty metals all have unique determinants that determine changes in their market value.

Key players & geographies

The global mining industry is undergoing its biggest pivot in decades. Once dominated by coal, iron ore and gold, the sector is now being reshaped by critical minerals like copper nickel and lithium. In fact, the demand for critical materials and rare earths is expected to triple by 2030 and quadruple by 2040, driven by global ambitions for decarbonisation and electrification. This shift is forcing miners, investors and governments to reposition themselves across regions, commodities and technologies.

The competitive landscape continues to be led by the largest global diversified players with strong balance sheets. Among the top producers of iron ore, aluminium and copper is the giant Rio Tinto [ASX: RIO]. Currently, Rio Tinto is investing in low-carbon aluminium projects in Canada and developing lithium opportunities in Serbia, although permit issues persist. Another major player is BHP [NYSE: BHP], the world’s largest miner by market cap with core positions in iron ore, copper and metallurgical coal, focusing on growing copper exposure through projects in Chile and Argentina. In 2024 BHP made a $49bn bid for its rival, Anglo American [LSE: AAL], which was later abandoned due to its complex structure, including a required spin-off, which posed major regulatory and value-erosion risks. Anglo American is a strong player in copper, platinum and iron ore and is currently streamlining operations and advancing major copper projects in South America. Glencore [LSE: GLEN] is a unique player, whose copper and cobalt assets, combined with its trading arm make it pivotal in critical materials supply. Yet, consolidation pressures are rising, with major miners increasingly relying on smaller firms to secure new deposits, particularly in copper and lithium. Many adopt a strategy of outsourcing exploration risks before stepping in with acquisitions.

Beyond the mining companies themselves, service providers are playing a growing role in enabling technology-driven productivity. Among equipment makers two major players stand out: Caterpillar [NYSE: CAT], who supplies mining trucks, loaders and autonomous haulage systems, helping operators cut fuel use and improve safety, and Komatsu [TYO: 6301] – a rival equipment giant, pushing hard into zero-emission haul trucks, including hydrogen and battery-electric pilots. Digital solution providers include ABB [SWX: ABBN], a provider of digital platforms and electrification solutions enabling automation and grid integration and Schneider Electric [EPA: SU] – offers IoT-enabled energy management and automation systems, widely adopted for mine efficiency and electrification. Also important are drilling contractors like Thiess, Perenti [ASX: PRN], and Boart Longyear, who deliver exploration drilling, blasting, and contract mining, often de-risking early-stage projects for the major mining giants.

The geography of mining is also evolving alongside commodity priorities. In Africa, the focus is moving from fossil fuels to critical materials under the African Green Minerals Strategy. Zambia and South Africa have launched national critical materials strategies, while infrastructure projects like Lobito Corridor are being designed to connect regional mining hubs to global trade networks. Between 2024 and 2050, revenues from copper, nickel, cobalt and lithium are forecast to exceed fossil fuel revenues by 3.1 times. South America remains the world’s copper powerhouse, with Chile and Peru together accounting for roughly 40% of global copper supply. Brazil continues to be the second-largest exporter of iron ore after Australia, anchored by Vale [NYSE: VALE]’s operations in Carajás. Argentina, part of the “Lithium Triangle,” has rapidly scaled up output; its lithium demand grew 30% year-on-year in 2023, and the country is expected to capture a growing share of global EV battery supply. North America and Europe are focused on reforms to mitigate supply chain vulnerabilities. While the U.S. is encouraging investments in domestic production through introducing a 50% tariff on copper imports, Canada has committed $3.1bn to critical mineral projects since adopting its 2023 Critical Minerals Strategy. Europe is prioritising streamlining permit processes under its Critical Raw Materials Act and sourcing of responsibly produced materials. The Asia-Pacific region is quite diversified. Australia retains its position as a leader in lithium and iron ore, Indonesia has become the world’s dominant nickel supplier, accounting for nearly half of global output, supported by its ban on unprocessed ore exports. China continues to control the downstream, producing most the world’s rare earths, as well as holding a leading role in global refining capacity for several critical minerals.

The strategic role of M&A in mining

Unlike traditional industries, the mining sector faces higher barriers to organic growth. New projects can take decades to develop due to exploration, construction, capital, and regulatory hurdles, shifting the focus towards strategic mergers, acquisitions, or joint ventures. In recent years, this consolidation has become increasingly prevalent as companies race to reposition their portfolios away from carbon-intensive coal and oil, while switching exposure to metals central to the energy transition, including copper, nickel, and lithium. In 2024, there were about 754 acquisitions announced in the mining sector totalling $99.7bn, plus 30 mergers with a combined value of about $2.4bn. This marked a 4% increase in acquisitions vs. 2023 (though a 9% drop in merger count), showing activity is rising.

Recent years have seen several major consolidations in the mining industry, driven by the need to secure critical resources and capture both revenue and cost synergies across the value chain. Notably, Allkem Ltd. and Livent Corp. announced an all-stock merger of equals in May 2023 (closed January 2024) to combine into Arcadium Lithium plc. The deal valued the new entity at $10.6bn (56% ownership went to former Allkem holders and 44% to Livent), creating a global contender in the fast-growing battery materials market, spanning the full lithium value chain. Allkem contributed hard-rock mines in Australia and Canada together with brine operations (lowest-cost and most scalable source of lithium), whilst Livent brought long experience in lithium chemical processing and a strong network of auto/battery-makers to the table. Management highlighted expected operating synergies of $125m per year, plus one-off capital savings of about $200m (project build outs in Argentina). Just months after the merger, Rio Tinto, one of the world’s largest diversified mining companies, acquired the new conglomerate for $6.7bn in cash (approved by shareholders in December and deal closed in March 2025). Strategically, the acquisition supplied Rio Tinto [NYSE: RIO] with established production assets and business relationships in the lithium market, which it needed to supplement its existing brine projects in Rincon, Argentina and to complement its controversial Jadar project in Serbia (largest undeveloped lithium deposits in Europe). The deal highlights the fast-paced consolidation of the industry and the shift towards securing critical minerals that underpin the global energy transition.

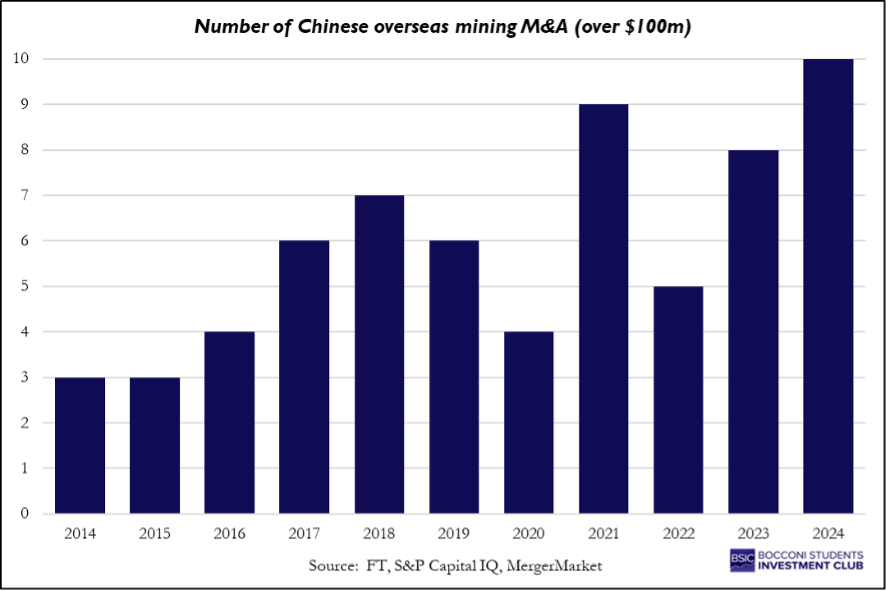

Similarly, Chinese outbound M&A deals are on the rise. In 2024, there were $22bn invested overseas, with 10 deals of above $100m in value, reaching the highest level since 2013. This underscores Beijing’s push to secure critical minerals for the energy transition. The trend has continued into 2025 with China’s Zijin Mining [HKEX: 2899] planning to acquire a gold mine in Kazakhstan for $1.2bn and Appian selling its copper and gold mines in Brazil to Baiyin Nonferrous Group [SSE: 601212] for $420m in April. The push reflects Beijing’s strategy to reduce reliance on foreign suppliers and strengthen control over minerals central to EV batteries and renewable infrastructure. Furthermore, analysts cite that China is attempting to get ahead of the deteriorating geopolitical relationships and secure long-term supply chains to strengthen their industries.

Anglo-Teck $53bn recent merger

The largest deal of the decade so far is the announced merger between Anglo American [LSE: AAL] and Teck Resources [TSX: TECK.A]. Anglo American, headquartered in London, employs operations spanning diamonds, platinum group metals, copper, iron ore, nickel and more. Like others in the industry, it has shifted away from thermal coal (spun off in 2021) towards commodities aligned with electrification, most notably copper and lithium. Teck Resources, headquartered in Canada, focuses on metallurgical coal, copper, and zinc, having sold ownership of the Elk Valley steelmaking coal business to Glencore [LSE: GLEN] for $6.9bn in 2023. Both Anglo and Teck have themselves faced take-over bids in recent years. Anglo rejected two successive takeover offers from BHP [ASX: BHP], the first worth around £31bn and a second improved bid of roughly £34bn, both of which the board said undervalued the company and imposed excessive restructuring risk. Anglo’s stock had been boosted since the initial approach, but the second rejection of the bid sent both stocks falling by 0.5% revealing disappointment of the market. Teck rebuffed a $22.5bn offer from Glencore in the previous year, representing a 22% premium, over concerns to its exposure to thermal coal and oil and cited that its planned metals–coal separation would deliver greater shareholder value. As both companies faced external pressures and were pivoting strategically towards critical materials and away from coal, this laid the groundwork for a merger of equals.

The strategic rationale of the deal rests on several pillars, but most notably the newly created entity will emerge as a top five global copper producer. The jewel of the integration is the combination of Teck’s Quebrada Blanca (QB) mine with Anglo’s Collahuasi operation in Chile, creating the world’s largest copper mining complex with an estimated annual output of approx. 1m tonnes by early 2030s. This increase in capacity is achieved through significant capital investments, including the plan to build a 15km conveyer belt linking Anglo’s mine with Teck’s new processing plant to add 175,000 tonnes of annual output. It must be noted that Anglo–Teck will derive around 70% of its annual revenues from copper, representing a significant exposure to the sector, whilst the individual companies only sourced 40-50% of revenue from the metal. Synergies are the second obvious strategic advantage. The companies estimate $800m in annual pre-tax recurring synergies from eliminating corporate overheads, optimizing marketing, procurement, logistics, etc. In addition, the fusion of the Collahuasi-QB mines is expected to yield an extra $1.4bn in EBITDA from 2030-2049, whilst the new entity further benefits from a stronger balance sheet due to a more diversified asset and cash flow base.

The deal is structured as an all-share merger of equals, with no cash premium being paid. Teck’s shareholders will receive 37.6% of the new entity, whilst Anglo will receive 62.4% coupled with a $4.5bn special dividend ($4.19 per share) as their equity is slightly diluted and to deliver immediate, tangible value to investors. The merger announcement was perceived well by the market with Anglo rising over 7% and Teck’s shares surging 14%, indicating an undervaluing of its assets. The combined Anglo–Teck entity will achieve a pro forma market capitalization of $53bn, creating the fifth-largest copper company in the world. It is worth noting that the merger agreement includes a break-fee of $330m, underscoring that both companies can technically consider rival bids. The relatively modest size of the fee (0.6% of deal value) indicates that it is more symbolic as a higher bid would likely economically compensate for it. Anglo–Teck will be primarily listed in London (LSE) with additional listings at TSX/JSE and NYSE, whilst the company will be headquartered in Vancouver (one of the requirements by Teck’s controlling family to preserve heritage). Management will fall to Anglo’s CEO Duncan Wanbland, whilst Teck’s current CEO Jonathan Price is appointed as his deputy.

The transaction is subject to approval by at least 66.67% shareholders of Teck, as it operates a dual class share system. The Keevil family holds super-voting Class A stock, but they have already committed irrevocable support to the deal. Still there are several potential challenges for a deal of this size. Firstly, regulatory and antitrust approvals in Canada are the biggest near-term hurdle as regulators were already opposed to the Glencore bid. Still, the commitment to headquartering the new company in Canada “likely helps ease the way for approval”. Furthermore, antitrust issues potentially arise, especially due to its copper operations in Chile, but overall, the market should be fragmented enough. Nonetheless, approvals from the EU, UK, US, South Africa, Chile, and Peru are required and timelines can be unpredictable. A rival bid could disrupt the Anglo–Teck merger, especially since the current all-share deal offers no takeover premium and Teck shareholders might be swayed by a 20–30% cash uplift. However, such a move is considered unlikely given the sheer size of the transaction and the difficulty of launching a hostile bid against the wishes of the Keevil family and Canadian government.

Ultimately, the Anglo–Teck merger underscores how scale, copper exposure, and strategic positioning in critical minerals have become defining drivers of mining M&A, setting a template for how the industry may continue to consolidate in the decade ahead.

Future outlook

At its core, mining remains tied to commodity price cycles due to its high operating leverage. Cost inflation, energy prices and exchange rate movements add another layer of volatility. A recent example is the oversupply of nickel in 2024, driven by Indonesia and China, which forced Glencore and BHP to close their mines in New Caledonia and Western Australia. In contrast, copper surged to record highs amid supply concerns, before reversing as China’s property market slumped. Gold once again proved its value as a safe-haven asset, with demand remaining resilient amid geopolitical instability.

Yet cyclicality is no longer the industry’s only challenge, as ESG and geopolitics now carry equally important weight. ESG harmonisation is advancing, with the Consolidated Mining Standard Initiative set for rollout in 2025, while tailings safety remains critical, with over half of the sector’s market cap already aligned to the Global Tailings Standard. At the same time, resource nationalism is rising. Indonesia has banned ore exports, with Zimbabwe and Namibia imposing similar restrictions on unprocessed minerals. Political risk is also intensifying around permitting battles and local opposition.

Technology is another force strongly reinventing the industry. By 2023, 40% of mining projects globally had incorporated digital tools with copper mines leading the charge. Companies are leveraging AI-driven predictive maintenance to cut downtime, drones to map pits and digital twins to simulate operations. Some examples include BHP’s use of drones to measure stockpiles and autonomous fleets in Chile, which have cut safety hazards by up to 90%. Rio Tinto uses AI orebody modelling to optimise blasts, while Vale has joined efforts with Nokia Bell Labs to build a holistic digital twin to enhance performance and safety. Such technologies promise 10-20% throughput gains and up to 30% emissions reductions. Tech is becoming the industry’s new cost curve and those who adopt AI, digital twins, and electrification early will define the next generation of lowest-cost producers.

Looking ahead, three main forces are shaping the future of the mining industry. On one hand we see the increasing importance of critical materials. By 2040, revenue from energy transition minerals is forecasted to surpass coal revenues by 1.5 times. Second, despite volatile prices and geopolitical uncertainty, M&A activity is expected to remain high, fuelled by easing interest rates, global policies and the growing risk of supply shortages, incentivising mining companies to diversify and expand their portfolios. Finally, with the rising ESG harmonisation and technology advancement, early adopters of automation, electrification and ESG practices will be rewarded with better access to capital and lower costs.

0 Comments