This article looks at the top trends impacting the semiconductor industry right now.

1. Moore’s law is hitting a brick wall

Moore predicted that the number of transistors on a chip would double roughly every two years. This held true for several decades and became known as Moore’s law. Chips got faster, smaller and more power efficient.

In recent years however, the law has broken down. Transistors became so small that electrons started behaving in unusual ways, making it complicated for chipmakers to squeeze more transistors into every chip. For instance, Intel is set to start production for chips with 7nm transistors in 2021, a full 6 years after it started producing 14nm chips. Other players progressed faster, but still slower than Moore predicted. TSMC, the leader in <10nm chips,

began using a 7nm process in 2017. It started producing 5nm chips three years later, in 2020. Both TSMC and Samsung only plan to start commercially producing 3nm chips in 2022.

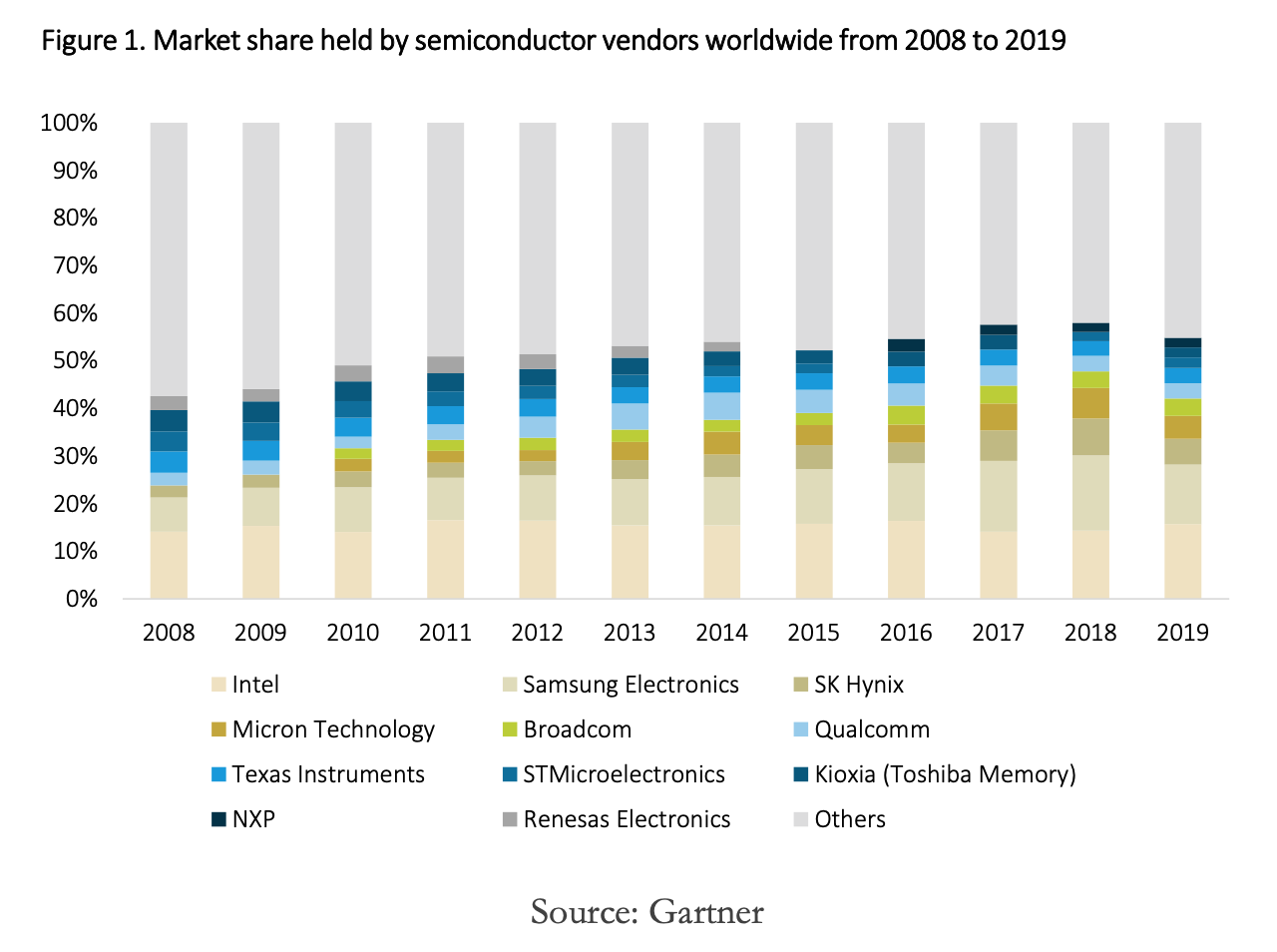

The race towards smaller transistors, which are in high demand by sectors like artificial intelligence and machine learning, has several implications for the semiconductors industry. Firstly, it implies a “winner-takes-all” market concentrated into the hands of the few companies that can produce the most sophisticated chips. Figure 1 shows how this has already started happening. Secondly, it implies much higher R&D costs. According to research by McKinsey, designing a 5nm chip costs about $540m, or about three times as much as the $175m required to design a 10nm chip. Finally, approaching the end of Moore’s law means companies need to find new avenues for innovation. Future advances in chip technology will likely come from chip architecture and software, rather than transistor size. Nvidia chips are an example: they improved their performance in a certain class of AI calculations by over 300 times between 2012 and 2020, solely through architecture and software improvements. Figure 1. Market share held by semiconductor vendors worldwide from 2008 to 2019

Source: Gartner

2. The semiconductor industry is rapidly consolidating

The semiconductor sector has witnessed a wave of consolidation recently, with an overall value of M&A deals in the industry of more than $330bn for the past 5 years. As companies are preparing for a status quo where all kinds of devices are connected to the internet, the largest incumbents are taking advantage of their scale to make strategic bids that enable them to supply chips for data centre servers and benefit from the development of new markets such as 5G, IoT, AI, and autonomous vehicles. The COVID-19 pandemic contributed to this trend by fuelling concerns about supply chain security and boosting demand for laptops, videogames, and data centres. This heightened demand for chips lifted chipmakers’ share prices, which facilitated M&A, as buyers could use their own stock as currency.

M&A activity in the semiconductor industry opens new market opportunities for both targets and buyers, allowing them to invest in different promising technologies or, alternatively, free themselves from certain business units that may be considered non-strategic. Intel, for example, sold its NAND business for long-term data storage to South Korean SK Hynix and invested the transaction proceeds in R&D for 5G networking and AI.

The table below shows the most recent mega-deals in the semiconductor space. Of note are the sky-high transaction multiples, averaging 29.8x EV/EBITDA and the frequent use of company stock as form of payment.

Source: Company information, Bloomberg

3. Asia is making more chips

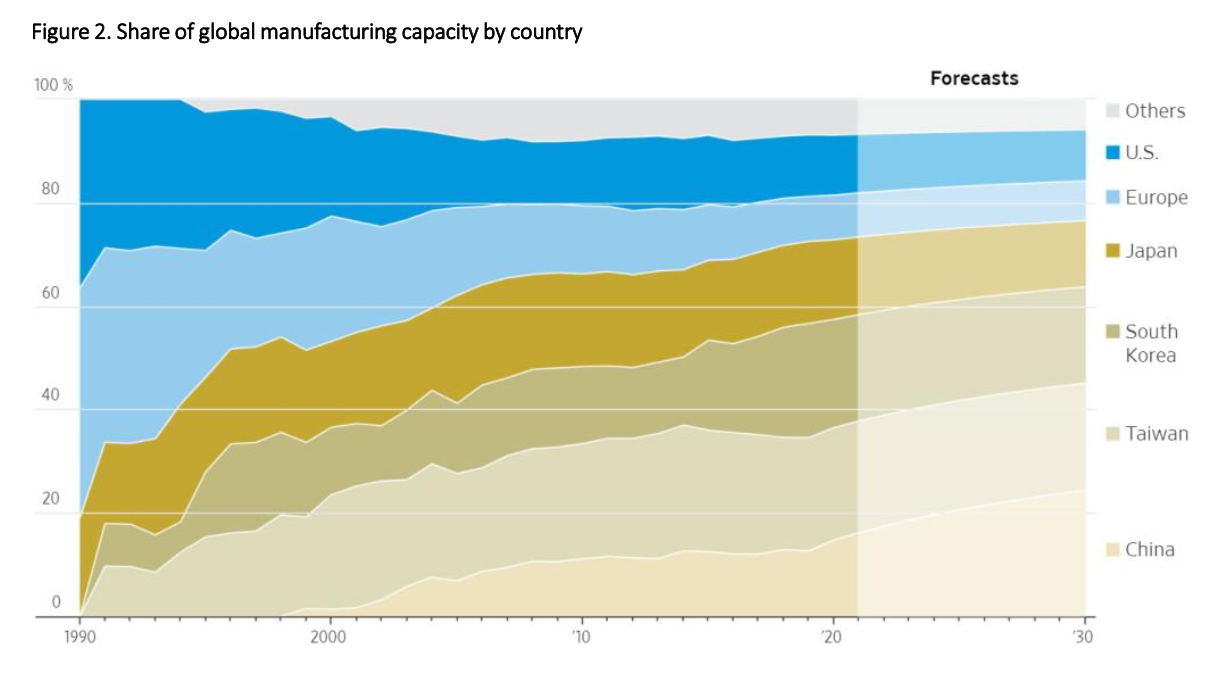

Asia now accounts for over three-quarters of global semiconductor manufacturing capacity. That number is set to rise according to the Figure 2, and China is poised to become the world’s largest manufacturer by 2030.

Figure 2. Share of global manufacturing capacity by country

Source: Wall Street Journal

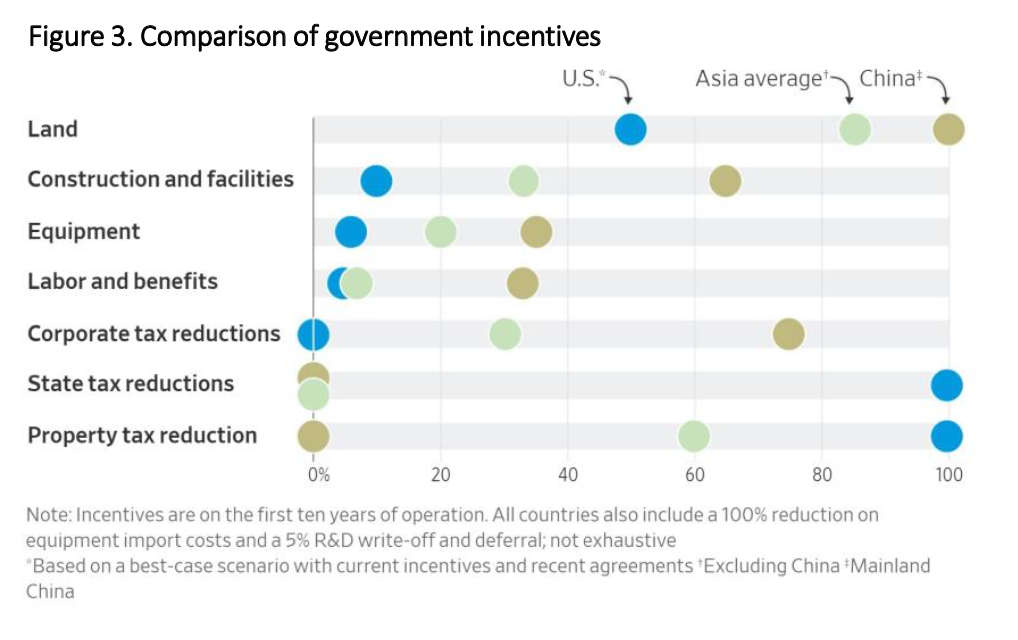

Asian manufacturers have squeezed out North American and European ones thanks to their much lower costs. According to a BCG report, the total cost of owning a semiconductor fabrication plant for 10 years in the US is 30% higher than in Taiwan, South Korea or Singapore and 37% to 50% higher than in China. Government incentives explain most of the gap. China, for example, offers semiconductor manufacturers free land, tax credits, grants, preferential leasing rates, loans at below-market rates and makes direct investments in domestic manufacturers. Natural disadvantages in factor costs further widen the gap between costs in North America and Asia. Indeed, labour costs in the US can be up to 2 times higher than in Asia and utilities can be nearly 25% higher. Asia’s competitive advantage is not set to reverse unless the US introduces significant incentives too.

Figure 3. Comparison of government incentives

Source: Wall Street Journal

4. Governments increasingly view chips as a national security priority

The US government has taken strong measures to protect its American semiconductor technology, which plays an important role in military tech and cyberwarfare. For instance, in March 2018, the Trump administration blocked the merger between US-based Qualcomm and Singapore-based Broadcom, citing national security concerns. In August 2020, the US government tightened sanctions on Huawei, making it harder for the company to buy supplies from American chip producers. This forced Huawei, which had no experience producing chips, to set up a chip plant in Shanghai that did not use American technology. Most recently, in September 2020, the US imposed sanctions on SMIC, China’s biggest chipmaker. With these sanctions, American companies need licences to export technology to SMIC.

5. The coronavirus brought about winners and losers

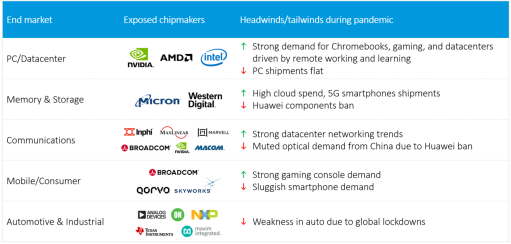

Semis exposed to Computers, Datacenters, and Communications showed strength during the pandemic while those exposed to automotive and industrials showed weakness. As shown in the table below, high Chromebook demand combined with cloud storage needs due to remote working and learning benefited players like Intel, AMD, and Nvidia. Memory, storage and communications players also benefitted from WFH tailwinds, despite the negative impacts of the Huawei ban. Automotive & Inudstrial fared the worse, due to drastically lower auto demand.

Source: J.P.Morgan

All the views expressed are opinions of Bocconi Students Investment Club members and can in no way be associated with Bocconi University. All the financial recommendations offered are for educational purposes only. Bocconi Students Investment Club declines any responsibility for eventual losses you may incur implementing all or part of the ideas contained in this website. The Bocconi Students Investment Club is not authorised to give investment advice. Information, opinions and estimates contained in this report reflect a judgment at its original date of publication by Bocconi Students Investment Club and are subject to change without notice. The price, value of and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. Bocconi Students Investment Club does not receive compensation and has no business relationship with any mentioned company.

Copyright © Nov-20 BSIC | Bocconi Students Investment Club

0 Comments