One of the biggest secular trends in central banking policy since its inception has been increased transparency through more regular and varied forms of communication. The hope is that by being transparent, market participants can price in the policy path more gradually, lowering the chances of wild bursts in volatility and market contagion. These policies have generally been seen as successful, and today they dominate the news flow. Therefore, it is incredibly important for any market participant to not only understand what they are, but how they work, and what the central bankers’ motivations are behind these pieces of communication.

This article will go over a brief history of central bank communication, the emergence of policy tools like forward guidance, and how traders can take advantage of them. Finally, we will use some recent central bank commentary in combination with fundamental factors to propose a trade idea.

A Brief History of Central Bank Communication

Central Banks at their genesis were inclined to be opaque. Montagu Norman, the Governor of the Bank of England from 1921 to 1944, reputedly took as his personal motto, “Never explain, never excuse.” [1] They believed that giving the public a glimpse of their thinking and their actions would reduce the effectiveness of their policies. But over the century, it has become clear that this is not the case.

Thus, central banks started introducing policies that would help market participants assess the state of the economy as well as the monetary policy-maker that can have such a powerful influence on it. The Federal Reserve proved to be ahead of its time, introducing its “Record of Policy Actions”, a report that summarized policy decisions and the main reasons behind them. While it was a big step forward, these were published with significant time lags, often several months after the FOMC meeting.

1978 saw the first Economic Symposium organized by the Federal Reserve Bank of Kansas City which later became annually held in Jackson Hole, Wyoming. In 1979, the Fed began issuing semiannual economic projections semiannually and in 1983 the Beige Book was introduced, which is a collection of anecdotal evidence of economic conditions as collected by regional Federal Reserve branches through their interviews with local business leaders, economists, market participants, etc.

Surprisingly, perhaps, it was only in 1994 that the Fed began issuing post-meeting statements, indicating whether there has been an immediate change in monetary policy. Until then, it was up to market participants to wait and see if relevant open market operations had been carried out by the Fed the day after the meeting.

Simultaneously, global central banks began adopting the 2% inflation target which comes with increased attention to central bank communication. To some extent, it flips the mandate of “price stability” from “make sure the rate of growth of price levels does not get out of hand” to “get to the inflation target and remain there for as long as possible.” Therefore, one could argue that inflation targeting made central banks take on more responsibility, and therefore, there has naturally been more demand to hear how they are intending to reach and remain at the target and why they are choosing certain strategies.

Later in Greenspan’s tenure, he helped introduce the balance-of-risks statement, and issued a statement after every meeting regardless of the outcome, even if no immediate changes to policy were made. Further, instead of publishing with a great lag, since 2002 the meeting minutes were to be released only 3 weeks after the meeting itself. Not much later, in 2005, the meeting minutes became more detailed and included a wider range of information on the views of the committee’s members. In 2007, the Fed began publishing the long-term macroeconomic projections of the committee. In 2011, the Fed Chair, Ben Bernanke, held the first ever post-meeting press conference, a practice that has since became tradition. And in 2012, the Fed began publishing the Dot Plot, showing the FOMC members’ projections on where monetary policy will be in the future.

One of the biggest changes, though, has been the way that individual governors of the FOMC communicate with the public. Before Greenspan, not only did members of the FOMC rarely give public comments, but the Chair scarcely spoke too (excluding testimonies to congress). Now, they give public speeches, participate in seminars, hop on radio stations, and much more. Since the early 2000s, Fed Presidents have increased the number of annual public remarks by more than 50% [2].

Furthermore, the average length of public remarks and speeches has increased [2]. One explanation for this is that, as central banks have rolled out unconventional forms of monetary policy, such as Quantitative Easing, more explanation has been required to quell “side effects” of the policies – for instance, the once-popular narrative that QE will lead to hyper-inflation – as well as reduce uncertainty surrounding the effects of the policies. Another explanation is related to the Financial Crisis. Because of the size of the crisis and its political significance, more attention was put on the central banks and how they thought about future policies.

Effectiveness of central bank communications

As communications and information processing technology improved, the ability of central banks to unanticipatedly shock the markets greatly diminished. Then alongside the 2% inflation target, central banks explored extending their monetary policy by issuing future policy intentions. With the inflation targeting frameworks the messaging thus should convey a formal policy regime and an accompanying quantification thereof, assessments of the state of the economy, explanations of their policy decisions, giving forward guidance, and release of economic data and forecasts. Following increased pressure in the western world aiming to create greater public accountability in institutions, transparency in central banks aids their operational independencies and is meant to enlarge trust. The main advantage of central bank communications arises from a predictable forward-looking policy that enables a greater influence on private sector expectations and helps in anchoring inflation expectations.

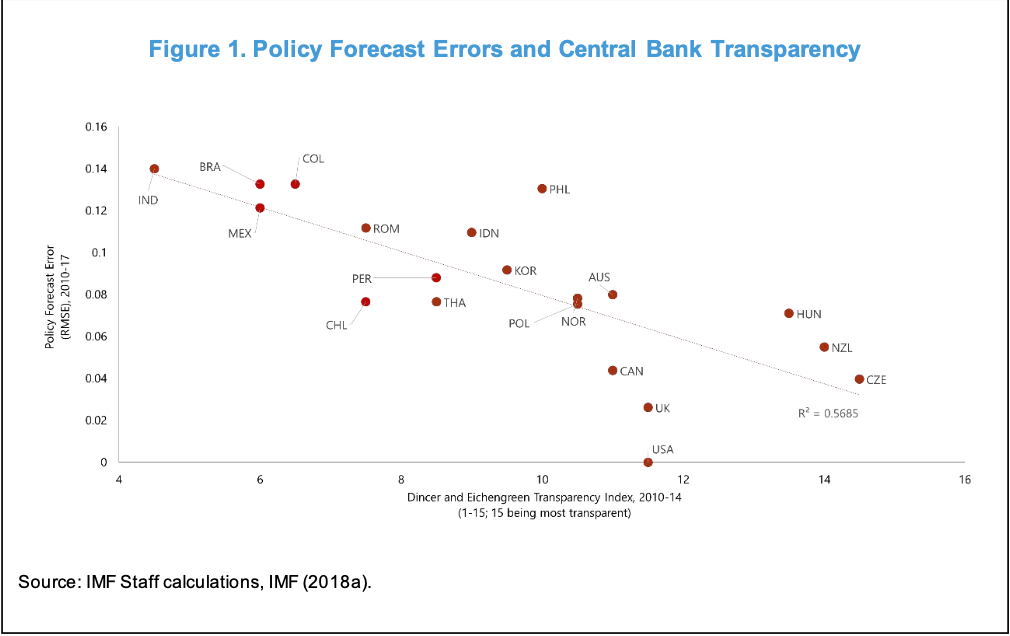

Predictability of policies through transparency aims to greatly improve the link between daily overnight rates that are under control of central banks and medium to long-term rates by giving guidance or expectations on the development of overnight rates in the future. In Dincer and Eichengreen (2014) evidence across countries is presented that strongly suggests that increased transparency (horizontal axis) decreases the private sector’s error in forecasting policies (vertical axis). Controlling for other factors, the paper suggests that a switch in transparency or lack thereof from the levels of the Reserve Bank of India -which was one of the least transparent before 2010- to that of one of the leaders the Sveriges Riksbank would reduce inflation by 11p.p. and inflation variability by 3p.p.

Effect of central bank communication in Latin America & terms of trade

During the last decade the LA5 countries – Brazil, Chile, Colombia, Mexico, and Peru – have experienced a series of terms-of-trade shocks causing large currency depreciations. This caused inflation to exceed targeted rates during times of subdued economic activity. Each of their central banks except Chile decided to increase interest rates while having to decide between increasing to tame inflation and keep inflation expectations anchored or to lower interest rates to combat negative income effects. This resulted, to a degree, in procyclicality in their policy responses.

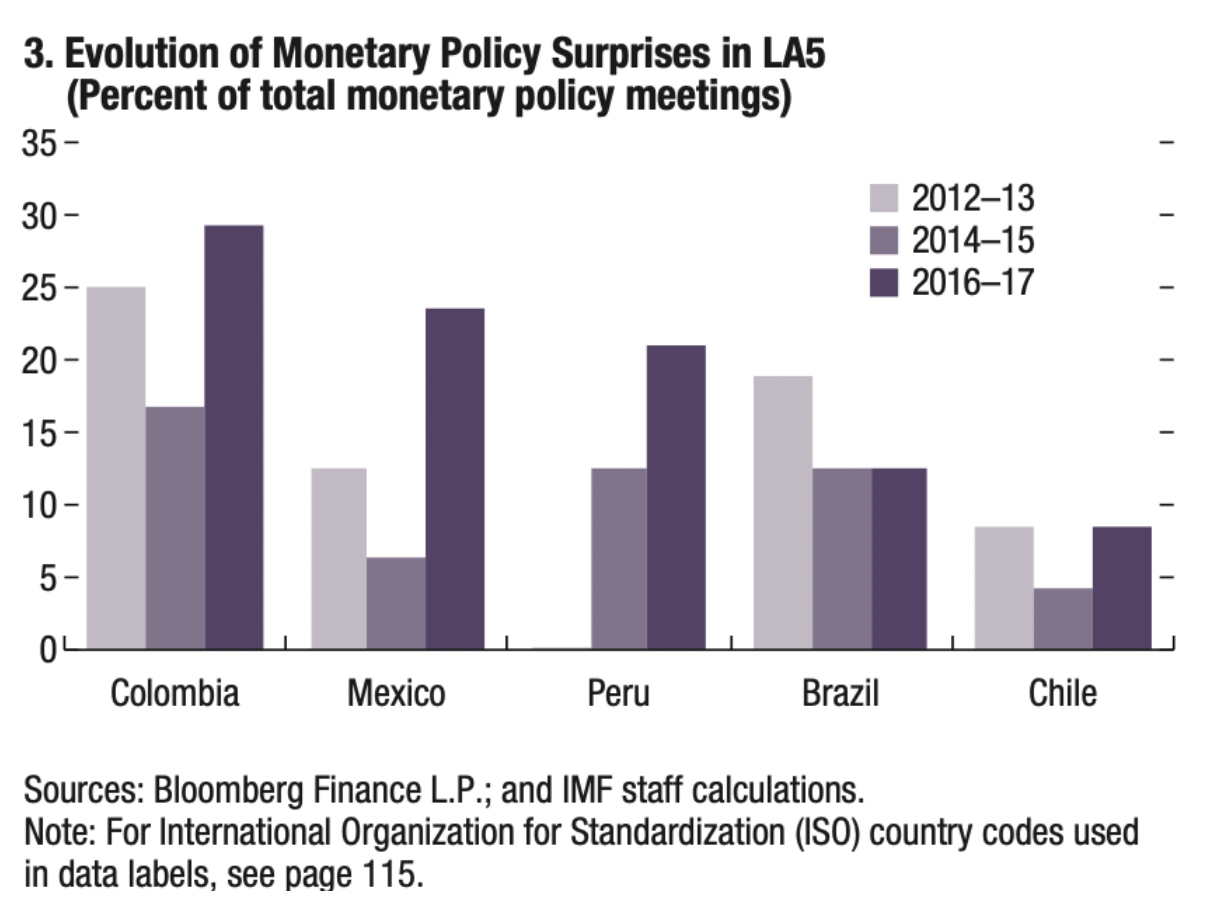

The short-term predictability of interest rate decisions remains low in Latin America with the exception of Chile, this is highlighted by the evolution of monetary policy surprises. The forecast errors by Colombia and Mexico are the largest in a sample of 18, however greater volatility of inflationary shocks can be partially responsible for contributing to monetary policy surprises. It is also argued that transparency can be greatly influenced also by lack of ambiguity and thereby clearness of the meaning of statements issued by central banks.

Central bank credibility is reflected by the anchoring of inflation expectation and can be measured by medium-term inflation expectations. For the LA5 economies that decided to hike rates survey-based medium-term inflation expectations stayed above the midpoint of the targeted range, this can also be observed in financial instruments. Economies with poorly anchored inflation expectations experience considerably widened inflation expectation gaps after terms-of-trade shocks with the lower quartile of central banks in terms of credibility experiencing a 30 b.p. widening of the expectation gap vs none in the most credible banks. Following a decline in terms-of-trade central banks with similar transparency scores as those of LA5 increased their policy rate by 50b.p. for every 100 b.p. increase in inflation whereas countries with relatively high transparency kept the rate stable.

Trade pitch

Over the recent year with inflation having peaked in June 2022 at 9.1% has been seen decreasing until it hit a low in June of this year at 3% and was currently sitting around 3.7% in August. We believe that US Inflation will persist and that interest rates will remain higher for longer than what is currently priced in the yield curve due to several fundamental reasons, therefore we suggest entering a curve steepener trade by going short 10 year treasuries and long 6 months.

Although we have seen a significant decline in the amounts added in the non farm payroll report, the jobs report has still exceeded consensus with 187 000 jobs added. The unemployment rate rose slightly but still remained on low historical levels. In August, US CPI came in the hottest since June 2022 with gasoline prices accounting for about half of the increase. We believe that the demand for jobs is unlikely to decline by much further thus adding to inflationary pressures due to an economy as well as a labor market that have much more momentum than previously expected. In the labor market we have witnessed a drop in female labour force participiation rate since the start of the pandemic as well as an increased demand for domestic production or at least closer production. This was first due to supply chain issues at the start of the pandemic which then developed into a rise in deglobalisation with geopolitical tensions between the US and China over Taiwan reaching new heights as well as the Russia Ukraine conflict and the Inflation Reduction Act which aims to bolster domestic production.

This week, FOMC target rate probabilities for the November meeting have shifted very little, whereas they have shifted well into mid next year towards higher Federal Funds target rates. This followed a revision in the dot plot with FOMC dots median showing higher Federal Funds rate into the second half next year with the possibility of another 25 basis point rate hike this year in either November or December meeting. Real GDP growth was also revised upwards by Summary of Economic Projections committee participants to 2.1%. During the meeting, Jerome Powell seemed more hawkish than anticipated, emphasizing the need to get inflation under control with mentioning the record of failures when rates where lifted too fast too soon stating that “it can be a miserable period to have inflation constantly coming back and the Fed coming in and having to tighten again and again”. He mentioned that robust consumer spending has been one of the main drivers of GDP growth and commented on rising crude oil prices and their possible effects on inflation expectations. This week, US crude oil prices traded at the highest levels this year following production cuts over the past year with WTI trading at $86 a barrel on Friday. The announcement of a Russian diesel export ban on Thursday heightened concerns of crude reaching $100 again and over possible “weaponisation” of its power on energy markets as witnessed last year. We believe that crude oil prices will continue to rise over the next couple of months and will have significant impacts on inflation expectations. One interesting message arising from the meeting was the possibility of a US government shutdown affecting the amount of data the Federal Reserve would be getting; we currently see a shutdown as possible. We currently hold the view that a US government shutdown, if it results in a further downgrade in the U.S. credit rating, as some are discussing, would benefit our position due to yields rising more on longer duration.

Looking forward in the long term, we would expect r* to be higher than in the past 20 years due to a decrease in globalisation and increase in geopolitical tensions globally with deadlines set by China on Taiwan approaching, and wage growth in production countries. Therefore we propose to implementing our curve steepener trade by shorting 10 year treasuries with a current yield of 4.44% and going long 6 month treasuries with a yield of 5.52%. By setting a stop-loss at a spread of 150b.p. between the two maturities and a take profit at a spread of 50b.p. We expect the time frame of the trade to be around 3-4 months depending on macroeconomic conditions.

Sources:

[1]https://www.federalreserve.gov/newsevents/speech/bernanke20071114a.htm

[2]https://www.stlouisfed.org/on-the-economy/2019/january/evolution-monetary-policy-communication

0 Comments