New Zealand as the trendsetter

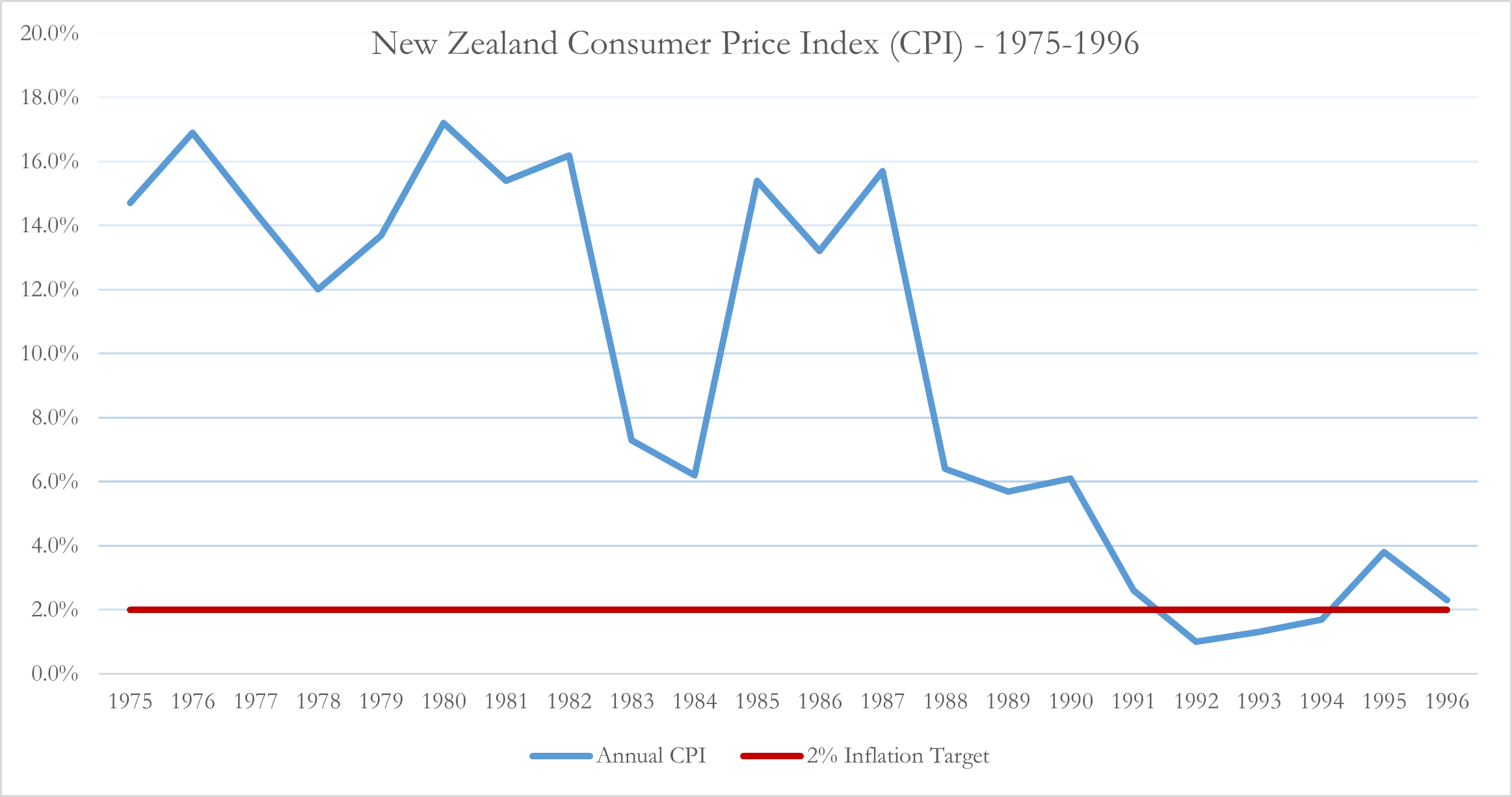

New Zealand saw its Inflation rate persistently over 5.5% between 1975 to 1990, with multiple years of inflation at or above 12%. However, starting from 1991, a sharp drop to around 1-2% is observable. One of the main drivers is the Reserve Bank Act from 1989, which essentially lead to a formulation of an inflation target by the then finance minister David Caygill and the Governor of the New Zealand Reserve Bank, Don Brash, as well as granting the Central Bank independent authority to operate within its mandate. As for the setting of the inflation target, the former finance minister, Roger Douglas, set the stage for a very low inflation target when in an interview in 1988, he said he would be aiming for 0-1 percent, effectively setting expectations very low. In an interview a couple of years later, Mr Barsh commented on the inflation goal articulated by Roger Douglas with the following: “It was almost a chance remark. The figure was plucked out of the air to influence the public’s expectations”. Even though being plucked out of the air, the subsequent CB target decision was highly influenced by Mr Douglas’ remarks.

In the end, the decided target in 1989 was between 0-2%. Having just received independent authority, the Reserve Bank of New Zealand was able to portray enough credibility for the unions, workers, and people of New Zealand to form their long-term inflation expectations in line with the CB’s target. As a result, workers tended to accept smaller nominal wage increases, which led to a deceleration of prices.

Source: Bocconi Students Investment Club

Major Central Banks Follow Suit

The United Kingdom and Canada were the first to follow in New Zealand’s footsteps. The Bank of Canada and the government agreed in 1991 to aim for an inflation target of 2% with a range of 1 to 3 percent. In the UK, a target of RPI 2.5% was initially set in October 1992 and was later changed to CPI 2%, plus or minus 1% (December 2003).

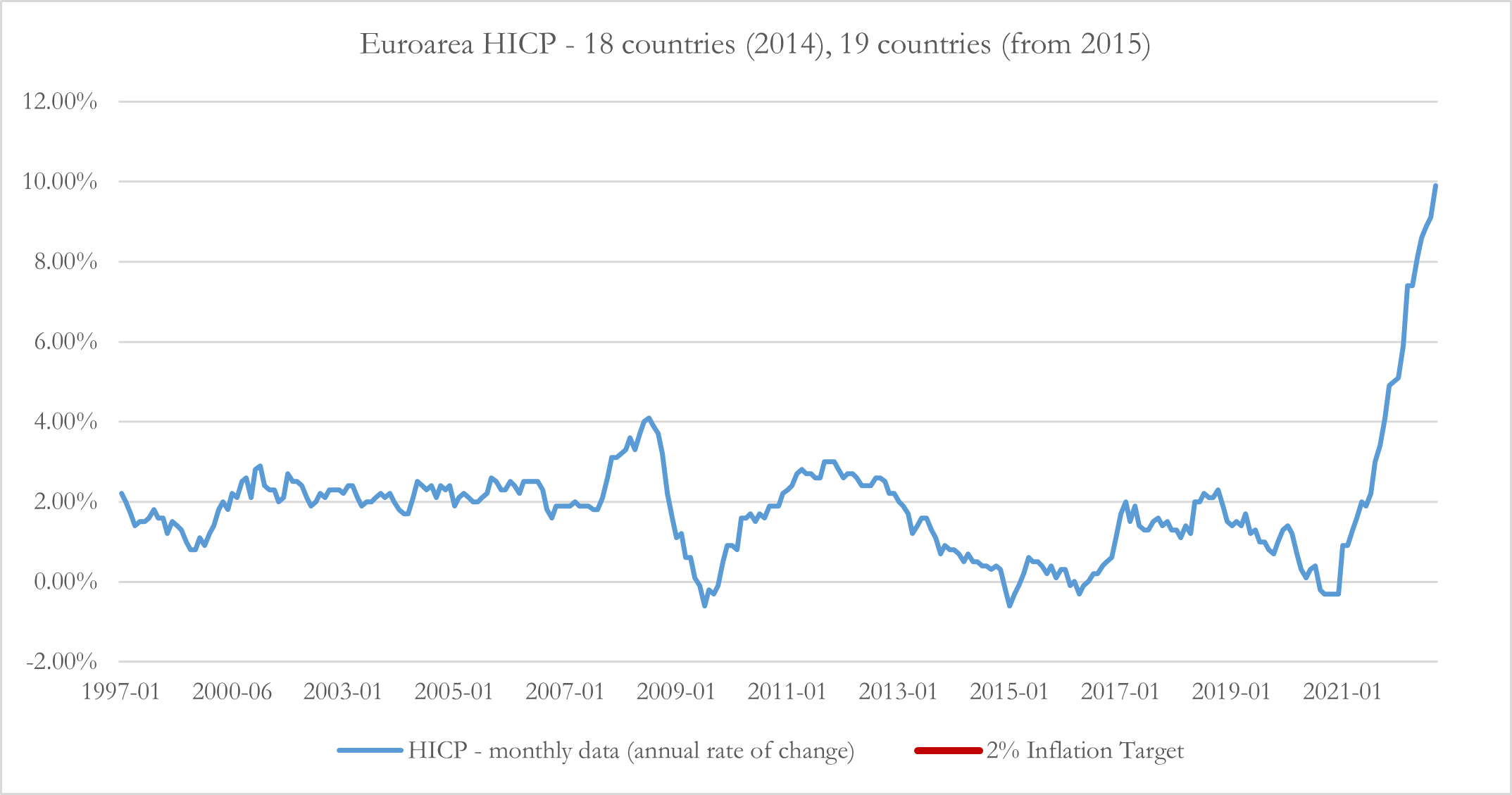

The European Central Bank does not consider itself an inflation-targeting central bank, but in acting on its mandate of price stability, the Governing Council of the ECB defined price stability in 1998 as “a year-on-year increase in the Harmonised Index of Consumer Prices (HICP) for the euro area of below 2%”. In May 2003, the Governing Council clarified that “in the pursuit of price stability, it aims to maintain inflation rates below, but close to, 2% over the medium term”. Just recently, in 2021, the ECB announced its inflation target to be a symmetrical 2%. This is a slightly higher target than before since symmetric means that it is equally undesirable for inflation to rise above or drop below the target.

The US Federal Reserve, on the other hand, did not have an explicit inflation target at first but regularly announced a desired target range for inflation (usually: 1.7% – 2%) measured by the personal consumption expenditure price index (PCE). Only on January 25th, 2012, did then Chairman Ben Bernanke set a 2% inflation target, even though some former FOMC members were reluctant to accept the loss of monetary policy flexibility involved in such a strict target setting. In August 2020, the FOMC stated that they desire to achieve inflation that averages 2% over time. This allows the FED to make up for periods of low inflation with subsequent periods of more elevated inflation prints. This way, the Federal Reserve hopes to anchor long-term inflation expectations more effectively.

The Bank of Japan formulated its first explicit inflation target (1%) in February 2012 but proceeded to raise its target on January 2013 to 2%. As of now, the aforementioned central banks stick to their inflation target as they are confident that it will keep on promoting balance in the economy and persistent growth.

Source: Bocconi Students Investment Club

The argument for a higher inflation target

Some renowned economists have entered the discussion about raising the inflation target. On one side, there are Olivier Blanchard, Jordi Gali, Adam Posen, and Paul Romer, supporting an inflation target of 3 or 4 percent. Ben Bernanke, Frederic Mishkin, John Taylor, and Janet Yellen, on the other hand, favor keeping the target at 2 percent because they believe that inflation above that level would not be consistent with the Fed’s legal obligation to achieve price stability. The economists supporting a higher target believe that the current target rate unnecessarily restricts the central banks in their monetary policy capabilities. This is because nominal interest rates cannot be negative, the zero-bound problem for central bankers. Even though nominal interest rates reached negative territory in some countries an effective lower bound still holds. Targeting a higher inflation rate would effectively raise the long-run levels of nominal rates, allowing for more significant decreases in rates before hitting the effective lower-bound (ELB), therefore increasing the central bank’s flexibility to restore full employment during an economic downturn. To better see this point let an economy start in a long-run equilibrium and r* be the long-run level of the real interest rate (independent of monetary policy). Also, consider * to be the inflation target. If r*=2% and *=2%, policymakers can reduce the nominal rate by up to 4%. However, if r* remains the same but * changes to 4%, the nominal rate can fall by six percentage points. Therefore, a higher inflation target allows central bankers to decrease rates by more, effectively making it more likely for CB’s to restore full employment by cutting rates.

In an economy with rates already close to the ELB, rates may reach that point without the economy receiving sufficient stimulus. In this scenario, an economic downturn and high unemployment can persist for a longer time period, with the central bank unable to decrease interest rates further to boost the economy. This phenomenon is also known as the “liquidity trap” articulated by Keynes in the “General Theory” (1936).

![]()

r = real interest rate; i = nominal interest rate; = inflation rate

However, historically this was not a practical problem for monetary policy since nominal interest rates were usually well above zero until the 1990s when the BOJ cut its policy interest rate from 6% (1992) to 0.1% (1999) to stimulate the economy. Similarly, in 2007-2008 the Fed reduced its federal funds rate target from 5.25% (2007) to 0-0.25% at the end of 2008. Simultaneously, the unemployment rate increased from 4.4% in 2006 to 9.9% in 2009 and stayed elevated for some time. Since the US economy was in a liquidity trap, the Fed sought to stimulate the economy through quantitative easing (QE).

The Economist Joseph E. Gagnon of the Peterson Institute for International Economics argued in 2019 that when debating over a higher inflation target, the benefits to forward guidance and QE need to be taken into account as well. This is because both monetary policy tools operate by lowering longer-term interest rates, which are also subject to the effective lower bound because of the existence of paper currency as an alternative investment that yields a fixed return of zero percent over any maturity. This implies that QE and forward guidance lose their effectiveness should long-term bond yields reach the effective lower bound. Therefore, by raising the inflation target, the average level of interest rates would increase, giving the central bank even greater scope to fight unemployment in a recession.

Taylor Rule

The Stanford Economist John Taylor created the formula known as Taylor rule to offer recommendations on how a central bank, such as the Federal Reserve, should adjust short-term interest rates when economic conditions change to accomplish the bank’s short- and long-term objectives of inflation.

The economist Glenn D. Rudebusch used an adjusted Taylor rule in 2009 to showcase the significant monetary policy funds rate shortfall existing at the time. As a result, Rudebusch concluded that the funds rate would need to be at -5% to restore full employment. In this case, a long-term inflation target of around 4%, instead of the prevailing 2%, would have enabled the Fed to cut rates more drastically, arguably leading to a faster recovery.

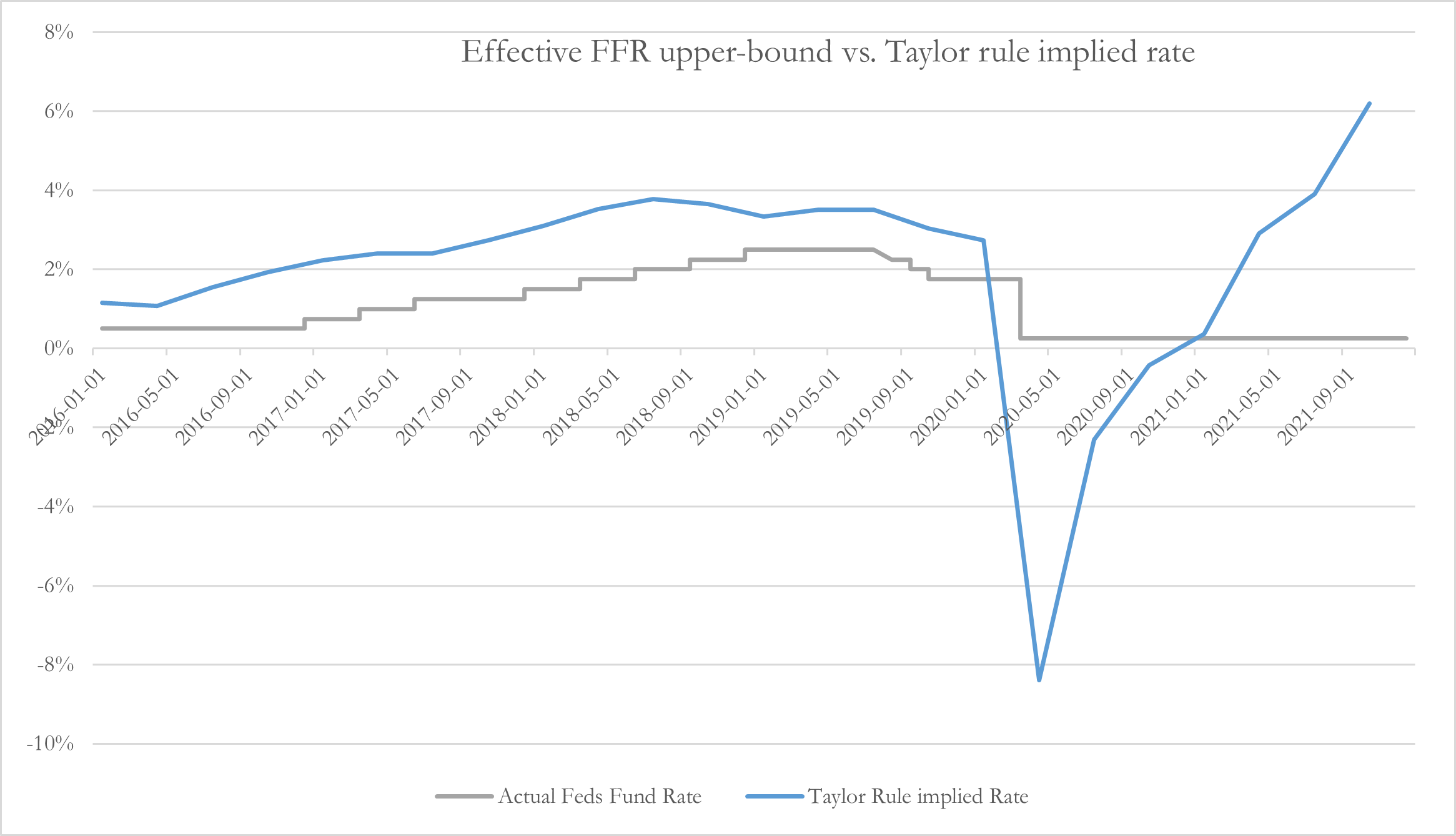

We now want to examine the Taylor rule implied federal funds target rate for the period of the Covid-19 recession to extract, if present, the monetary policy funds rate shortfall.

![]()

R = federal funds rate; RR = estimated value of the equilibrium real rate; = current inflation rate; Y = output gap

For this case, we are slightly adjusting the above-depicted Taylor rule, taking as an example the formula used by Janet Yellen, the current United States Treasury Secretary and former Fed Chair (2014-2018), in a speech in March 2015. Specifically, Janet Yellen approximated the output gap (Y) using Okun’s law (-2(Ut – U*)) where U is the unemployment rate and U* the natural rate of unemployment. In our case, we use the median Lubik-Matthes Natural Rate of Interest, published by the Richmond FED, as the proxy for the equilibrium real rate. Since the FED uses PCE as a benchmark for their 2% inflation target, we used PCE data to calculate the inflation rate.

Source: Bocconi Students Investment Club

The above graph, which plots the aforementioned adjusted Taylor rule and the Feds Fund Rate upper bound, clearly outlines the significant monetary policy funds rate shortfall during the Covid-19 Recession. In the second quarter of 2020, the Taylor Rule implied rate was slightly below negative 8% – this suggests that interest rates were 800bps above the level needed to restore full employment. With a higher long-term inflation target (= higher average level of interest rates), the Fed would have been able to cut rates more drastically – offering a higher stimulus to the economy, before hitting the effective lower bound.

Keeping the 2% target

However, with all the perceived benefits of increasing the inflation target outlined above, there are at least as many solid reasons for leaving the target at 2%. A finding of a research working paper published by the Federal Reserve Bank of Boston added to the argument of keeping the inflation target stable as it found that a rise in the inflation target will lower the equilibrium real rate, which would lead to a smaller increase in average nominal interest rates than previously assumed. This finding outlines that an increased inflation rate target is less effective in reducing the probability of hitting the ELB than previously thought. Another critical aspect to consider in the debate are the long-term costs for consumers and savers resulting from an increase in the target. For savers, the situation of a 4% inflation target is especially daunting since their savings could be cut in half every 18 years. Finally, central banks worldwide have spent decades building credibility around their price stability goal of 2% inflation. If they were now to raise the target rate, their credibility would take a huge hit. As Columbia University economist Frederic Mishkin put it, “the public is likely to believe that price stability is no longer a credible goal of the central bank, and then the question arises, if a 4% level of inflation is OK, then why not 6%, or 8% and so on.”

Sources

- Laurence Ball et al.; The case for a Long-Run Inflation Target of Four Percent; 2014

- Glenn D. Rudebusch; The Feds Monetary Policy Response to the Current Crisis; 2009

- Janet L. Yellen; Normalizing Monetary Policy: Prospects and Perspectives; 2015

- Christopher D. Cotton; The Inflation Target and the Equilibrium Real Rate; 2020

- New Zealand CPI (Data):

https://www.rateinflation.com/inflation-rate/new-zealand-historical-inflation-rate/ - Euroarea HICP (Data):

https://ec.europa.eu/eurostat/databrowser/view/PRC_HICP_MANR__custom_3793684/default/table - Lubik-Matthes Natural Rate of Interest (Data): https://www.richmondfed.org/research/national_economy/ natural_rate_interest

- Natural Unemployment Rate and Unemployment Rate (Data):

https://www.cbo.gov/data/budget-economic-data#11 - Core PCE Inflation (Data):

https://fred.stlouisfed.org/series/PCEPILFE

0 Comments