Athene Holding Ltd [NYSE:ATH] Market Cap as of 25th March 2021: $9.56bn

Apollo Global Management, Inc. [NYSE:APO] Market Cap as of 25th March 2021 $20.86bn

Introduction

On March 8th, 2021, Apollo Global Management, Inc., a major publicly owned investment manager, and Athene Holding Ltd, a leading retirement services company, announced a definitive agreement for Apollo to acquire Athene in a $7.2bn all-stock transaction. Apollo currently owns approximately 35% of the outstanding Athene’s common shares. Following the transaction Apollo will become the 2nd largest financial conglomerate after Blackstone with a Market Cap worth approximately $29bn with prospects for inclusion in S&P 500. The transaction is expected to close in 2022, and after the merger current Apollo shareholders will own approximately 76% of the combined company while Athene’s shareholders will own approximately 24%.

Apollo created Athene in 2009, as an opportunity to expand to the insurance business buying corporate debts and out-of-favor credit assets at low prices using clients’ capital. Athene became one of Apollo’s biggest client contributing to approximately a quarter of Apollo’s asset management fees. The relationship between Apollo and Athene went under public pressure in 2019, when it was found out that Apollo was significantly overcharging Athene compared to the market standards. Taking into consideration the long-lasting relationship between Apollo and Athene as well as public and Athene’s shareholders’ pressure on the improvement of corporate governance, the announced deal comes at no much surprise and can potentially serve as a solution to a complicated situation.

About Athene

Athene is a leading retirement company headquartered in Hamilton, Bermuda and mainly operating in the United States. Athene issues, reinsures and acquires retirement savings products designed for the increasing number of individuals and institutions seeking to fund retirement needs.

Athene began operating in 2009 when the financial crisis and the resulting capital demands caused many companies to exit the retirement market, creating the need for a well-capitalized company with an experienced management team to fill the void. In 2009 Rowan, Apollo’s founder, bought cheaply the annuity policies of American Equity Investment Life and then advised and supported Athene on making a permanent business out of his one trade-off deal with AEL.

The company provides annuity retirement solutions to its customers and reinsures guaranteed, fixed deferred and indexed, immediate annuities, and institutional products. It also offers funding agreements and pension risk transfer transactions.

From its inception in 2009, Athene has grown to $202.8bn in total assets with around 50% of its portfolio invested in Corporate and Government Bonds and 20% in commercial and residential mortgage loans.

Athene Holding began trading on the New York Stock Exchange on December 9, 2016, under the stock symbol “ATH”. Athene’s initial public offering raised $1.1bn (100% secondary), making Athene the third-largest IPO in 2016. Apollo, which had been one of the most relevant initial investors of Athene and sold down a part of the stake in the IPO retaining 45% of the voting power.

Athene showed a strong improvement in operating performance in the past years with Operating Income growing from $760m in 2016 to $1.24bn in 2020. EPS grew from $3.93 in 2016 to $6.97 in 2019 with analysts’ consensus growing at $8.2/share in 2021, following a decrease during 2020 due to the COVID-19 pandemic. In terms of Net Invested Assets, Athene grew with a 17% CAGR in the past 5 years from $67bn to $150bn in 2020, while Gross Assets increased from $72bn to $175bn in 2020.

Due to the uncertainty and market skepticism related to Athene’s controversial relationship with Apollo, its superior operating performance is not currently reflected by its market valuation. In fact, its share price is currently down by 10% compared to 6-months post-IPO valuation with P/E ratio down at 5.4x vs 12.2x and P/B ratio down at 0.86x from 1.63x.

About Apollo

Apollo Global Management is one of the world’s leading alternative investment managers, ranking as the second-largest investment fund after Blackstone with its $433bn of Assets under Management. Founded in 1990 and headquartered in New York with additional offices in North America, Asia and Europe, Apollo manages capital for hundreds of fund investors including endowment and wealth funds, in dozens of countries. Its alternative investments strategy includes investment in the private equity market with a focus on leveraged buy-outs and distressed debt.

Apollo was originally founded by Leon Black, former head of mergers and acquisitions at Drexel Burnham Lambert, with Marc Rowan and Josh Harris. In 1995 the investment in the Samsonite Group established Apollo’s reputation for growing domestic businesses. In 2006 Apollo started expanding, opening the two first international offices. In 2011 Apollo Global Management, LLC, that later changed legal form to INC, made its IPO on the NYSE.

Today Apollo seeks to make investments up to $1.5 billion and to invest in companies with Enterprise value between up to $2.5bn acquiring minority and majority positions in its portfolio companies.

Apollo showed a strong performance improvement over the last years with AUM increasing from $192bn in 2016 to $455bn in 2020 with a 19% CAGR and Fee-Related Earnings growing with a CAGR of 15% from $530m to around $1bn in the period 2016-2020.

While the consistent improvement of Apollo’s operating performance is reflected in the significant appreciation of the share value which increased from around $16/share in 2016 to around $48/share today, in the last 2 years Apollo has been slipping behind its peers with a share appreciation lower by 20% on average compared to its industry peers.

Industry overview

The life insurance sector has undergone substantial growth in recent years, with many new markets opening up, especially in emerging economies. The global life insurance business generated total gross written premiums of about $2.7bn in 2020, with a compound annual growth rate of 2.2% between 2016 and 2020. Nevertheless, recent estimates point that the market’s performance will continue its growth, with an awaited CAGR of 4.6% for the next five years and a market value of $3.4bn, to be tracked by the end of 2025. Behind such results, there is undoubtedly low consumer confidence in their own financial ability and the long-term economic prospects of their countries (hugely worsened worldwide after the spread of COVID-19), paired with an averagely high household disposable income.

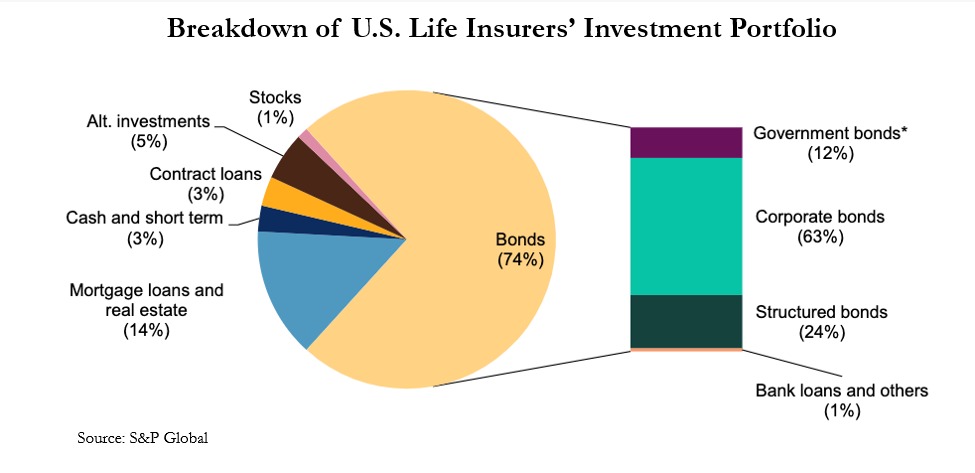

However, the fashion through which life insurers sell their policies has altered forever because of the pandemic’s spread, as COVID-19 provoked ample global repercussions. Interest rates have shrunk dramatically worldwide, affecting life insurance market players’ profits significantly. Life insurers are jeopardized by interest rate risk through investment leverage, as they favour guaranteeing their customers fixed interest rates for an extended period. As a result, their assets’ duration typically does not match their policies, with a sequential reinvestment risk: life insurance players may struggle to generate higher returns on their assets. A tendency in the market also worsens this risk: insurers, in the hunt for better returns, have increased their exposures through holding corporate bonds. For example, U.S. life insurers are among the largest groups of institutional investors holding fixed income securities. As recent research shows, more than 70% of the industry’s portfolio is invested in fixed-income securities (with the majority of funds invested in corporate and securities). The remaining allocation is dedicated to structured finance securities and bank loans, mutual funds, and exchange-traded funds (ETFs).

Many of these bonds are now at risk of falling below investment grade. When coupled with the establishment of low-interest record rates set by Central Banks, it puts further strain on fixed-income investments. Besides, insurers have to handle higher claims due to COVID-19 related deaths as well. Due to the global nature of the pandemic, the extent of disturbances is challenging to gauge. However, it is already clear that insurers will need to readjust their business models accordingly.

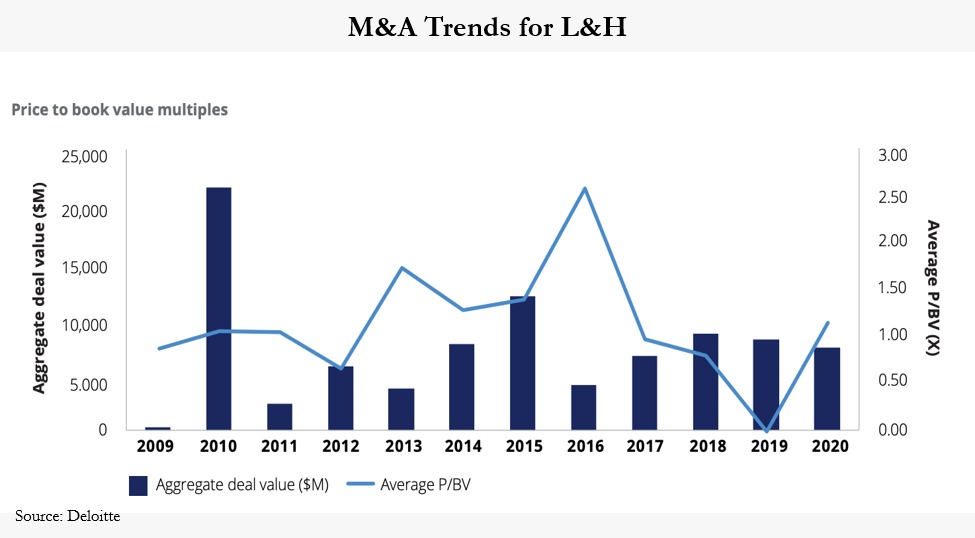

Meanwhile, the adverse effects on M&A deals in the health insurance industry due to regulatory concerns on competition have been exacerbated by the pandemic’s spread. M&A deals have declined by about 41% compared with 2019, while the aggregate deal value decreased by 10%. In contrast, the average deal value experienced a boost of about 6% YoY, showing an increased tendency towards transformative transactions. Indeed, in 2019, there was a single announced transformative M&A deal between New York Life and Cigna, carried out to restore New York Life’s business model and expand its customer base, together with the support of an experienced management team and high-quality workforce. In contrast, in 2020, we can consider at least three transactions as transformative: Fidelity National buying out two other owners in a $2.7bn worth deal; KKR buying Global Atlantic in a $4.4bn transaction; the Carlyle Group and T&D Holdings completing their acquisition of a 76.6% interest in Fortitude Group Holdings.

Therefore, some researchers presume that conditions are aligning for a positive insurance M&A environment in 2021. Companies are starting to look beyond COVID-19 and shape how to surge and come back to normal times. That is why they are examining how M&A, disposals, or investments can help them enhance their portfolios and accelerate the shift towards digital operating models. More specifically, there is an ever-widening tendency towards carve-outs, which is expected to improve in the next future, allowing companies to appraise their current service portfolio to ascertain which segments are performing satisfactorily and whether their investments produce as much value as expected.

Deal structure

The $7.2bn (purchase equity) deal for the acquisition of Athene is set to be all-stock, with the offered exchange ratio of 1:1.149 resulting in a 16.5% premium to Athene’s recent closing price (04-March) and price of approximately $57. The implied equity value is estimated to be in the range between $10.9bn and $11.1bn, with a valuation of around 7.0x P/E (LTM) and 0.6x P/BV. Being an all-stock deal, the merger is intended to qualify as tax-free for U.S. federal income tax purposes: taxes are paid only upon the sale of the stock received in the transaction. Upon closing the deal, current Apollo shareholders will hold roughly 76% of the combined company on a fully diluted basis. On the contrary, Athene shareholders will retain nearly 24%. The transaction will be performed through a specially created entity “Tango Holdings”. Prior to the completion of the acquisition, the entity will acquire Apollo to carry on a restructuring transaction. After the completion of the deal, Tango Holdings will be renamed to Apollo Global Management Inc.

Finally, the deal shall be completed in January 2022 subject to shareholder and regulatory approval, including the termination of the waiting period set up by the Hart-Scott-Rodino Act, according to which M&As cannot be completed until the U.S. Federal Trade Commission and Department of Justice determine that the transaction will not adversely affect U.S. commerce under the antitrust laws.

Deal Rationale

According to Athene’s CEO James Belardi, this merger is a logical and exciting next step to simplify the relationship between Athene and Apollo while driving significant strategic and financial benefits in both the immediate and long-term future. The two companies have developed a longstanding strategic relationship since Athene’s inception during the financial crisis, one based on the lucrative long-term agreement that vested Apollo with the role of managing 100% of assets backing Athene’s policies.

In 2018/2019 the private equity firm was found to be charging hefty fees for managing Athene’s asset base, reportedly at least twice as much as an independent investment manager would demand for similar services, which drew two lawsuits as investors raised concerns Apollo had exploited its outsized influence to profit off of such exorbitant fees. Eventually, the litigation was brought to a halt by a Bermuda court ordering that any lawsuit should have been filed in the island territory where the insurance company is incorporated. Yet, Apollo subsequently offered some concessions to Athene’s shareholders, ploughing $1.6bn into the company and cutting its voting stake. The merger, therefore, comes at no surprise as an attempt to mitigate the controversy surrounding the potential conflict of interest between the asset manager and the annuity provider. For Apollo, however, the move also represents the latest step to improve its governance and boost its share price which has dropped amid investor concerns following an investigation into CEO Leon Black’s business ties to the late financier and convicted sex offender Jeffrey Epstein, which resulted in Black’s announcement to step down as chief executive and chairman.

Executives for Athene have also been concerned about its sluggish performance on the stock market. The life insurance company shares have consistently underperformed the insurance sector following its IPO in 2016, reporting relatively flat stock prices, growing from $44.05 at the time it went public only to $48.88 before the deal announcement, even if it more than doubled its net income (from $805m in 2016 to $1.92bn last year) and displayed substantial earnings growth from $3.93 to $8.19 today. Therefore, Athene’s executives believe that, since its strong operating performance has not been reflected in its valuation, merging back with its asset manager creator will boost investors’ confidence in the new-born financial conglomerate and drive up stock prices.

Nevertheless, the combination of the two companies is not expected to generate any quantifiable synergies of personnel or cost savings, it instead pivots on the resulting deeper strategic and economic alignment of interests. The well-established close partnership and unique interconnection between the two clearly will result in low integration costs, alongside the established continuity of tenured management and the absence of a real consolidation as both entities will be maintained, which will consequently favour the proposed full alignment.

With the deal, Apollo plans to put in place a transparent diverse best-in-class governance and simplify its complex corporate structure, with a single class of voting stock and equal voting rights for each share. At the same time, Athene has eliminated its multi-class structure, resulting in greater float and more favourable trading characteristics, which will expand the company’s investor universe and broaden the appeal to a wider spectrum of active and passive investors. The resulting alignment between ownership and voting power, increased floating stock, enhanced liquidity and considerable size of the combined group will then pave the way for its inclusion in the S&P 500 Index.

Beyond deeper strategic alignments and the streamlining of its ownership structure, this deal comes at a particularly favourable time for Apollo: Athene traded at a P/E ratio of 12.2x six months after its IPO, compared to a P/E multiple of 7.0x right before the merger announcement. The company’s current undervaluation makes it an especially profitable investment opportunity for the asset management firm. Moreover, the move will significantly expand Apollo’s balance sheet, create accretion of $1.38 (or 68%) on the combined after-tax earnings for 2020 and give rise to a financial group with an enhanced credit profile, expected to distribute annual dividends of $1.60 that will grow with earnings.

Market Reaction

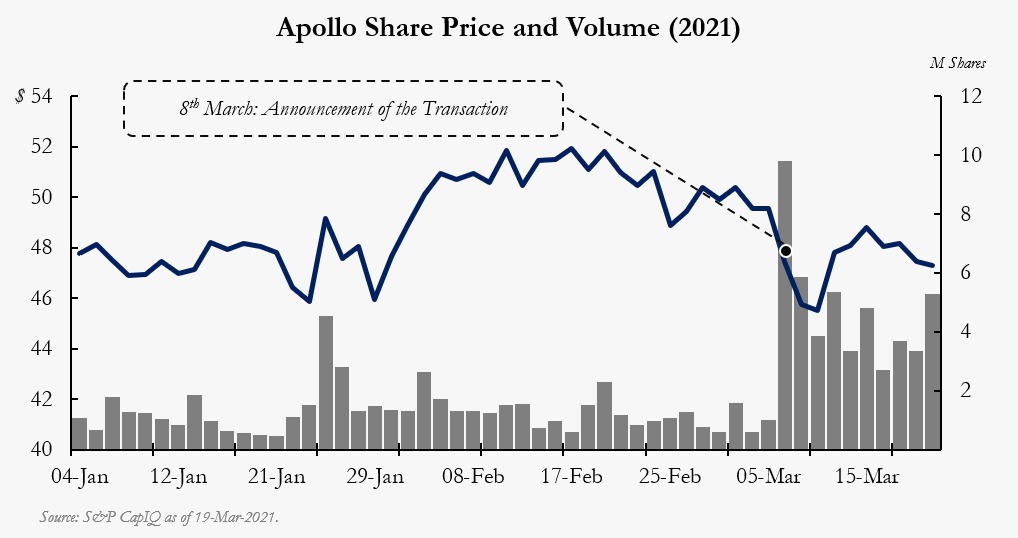

The stock market did not display much excitement over the deal. On the announcement date, Apollo’s shares fell by 4.24% and remained relatively flat in the following week due to investors’ persisting scepticism, as a consequence of the unease created by the long-term controversial relationship with Athene and its extensive influence over the annuity provider. Analysts’ mean consensus barely increased in the week after the announcement: from $56.14 to $56.92 resulting in a 1.94% increase.

For what concerns Athene, the news did not have a significant effect on the company’s share prices either, yet, unlike the asset manager, Athene gained 5.97% on the day of the announcement, which is far below the premium offered by Apollo. Nonetheless, the share prices plateaued in the following days, indicating market scepticism about the deal. At the same time, analysts’ target price mean consensus demonstrated a positive dynamic increasing by 4.69%, from $55 to $57.58.

.

Financial Advisors

Apollo was advised by Barclays and Perella Weinberg Partners LP, while Lazard Frères & Co. and Houlihan Lokey acted as financial advisors to Athene.

0 Comments