The Macro Environment

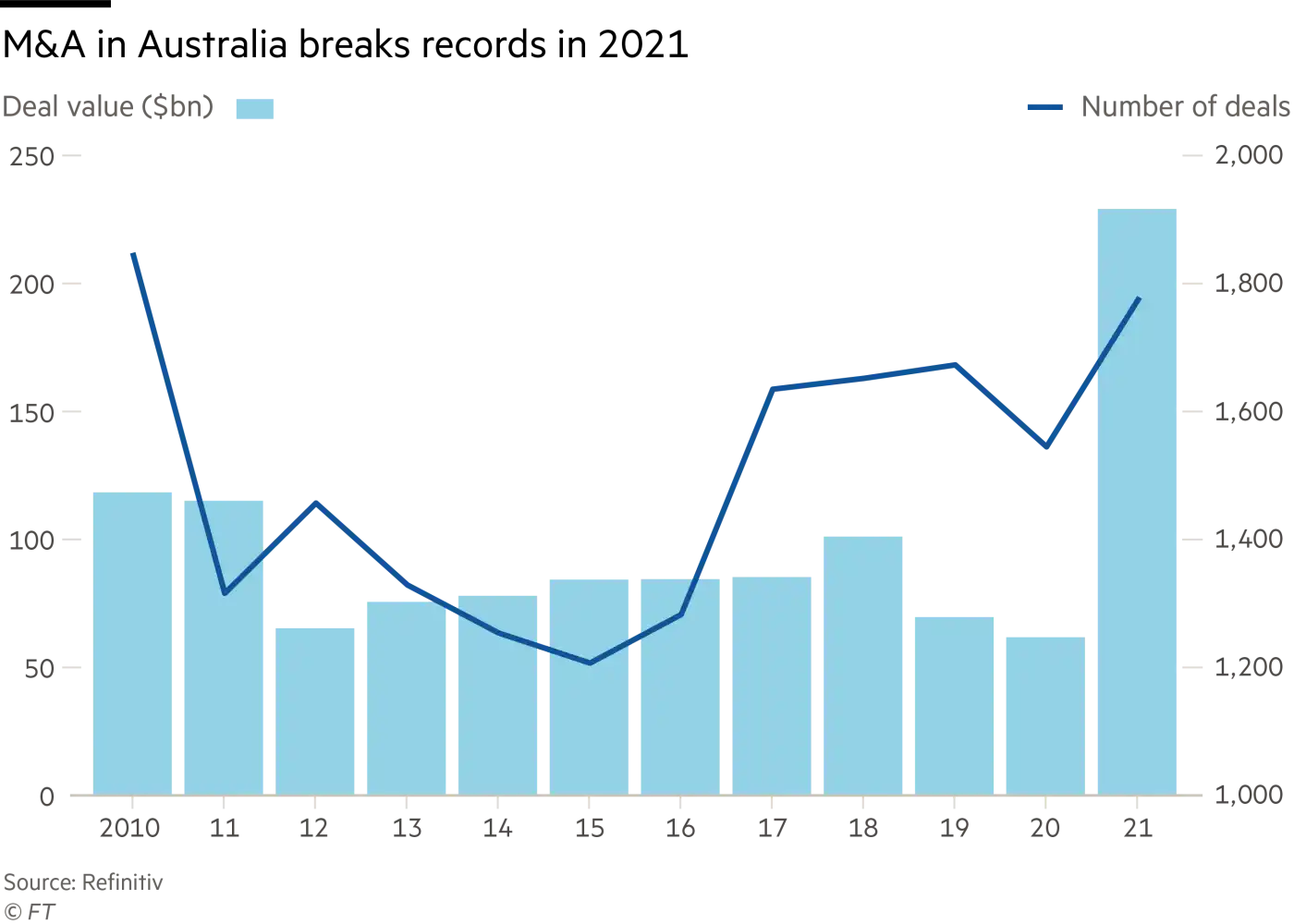

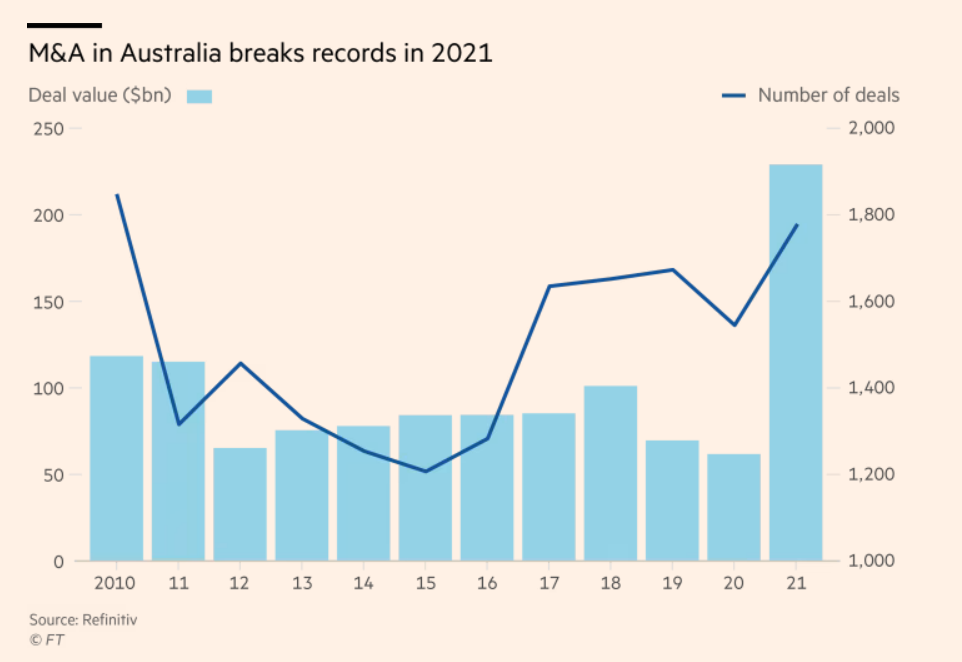

M&A activity in Australia has been on a tear recently. From every angle, deal activity in 2021 was unprecedented. A$308bn of deals were closed in 2021, compared with the 10-year average of A$100bn. A large amount of ‘mega deals’ pushed the average takeover size to A$3.8bn, compared with A$1.3bn in the years before. The most notable deals include the A$23.6bn buyout of Sydney airport by a group of financial sponsors, Afterpay’s A$39bn acquisition by Stripe, and the A$41bn merger of BHP’s petroleum assets with Woodside. Unsurprisingly, local bankers are calling current deal activity ‘unlike anything they have ever seen’. Even the Russia-Ukraine war has failed in slowing down deal appetite, as shown by the recent A$20.1bn bid a KKR-led consortium has made for Ramsay Health Care, Australia’s largest private hospital operator.

Naturally, this raises the question of what is driving the dealmaking-boom in down-under. Of course, loose financial conditions and a rebound from the COVID recession are a large reason. The cash rate at the Reserve Bank of Australia still stands at 0.1%, whilst the economy grew at an annualized rate of 3.4% in Q4 2021. However, another factor has also had a material impact.

It is the increased activity of financial sponsors in the space. Some of the largest takeovers of the past years, including Sydney Airport’s buyout, KKR’s potential buyout of Ramsay health, and Blackstone’s A$8.9bn acquisition of Crown Casinos, have been Private Equity backed. PE funds have raised unprecedented amounts of dry powder over the recent years, explaining some of the deal activity. But why would they deploy their funds in Australia, rather than in other geographies?

The answer to this lies in the country’s A$3tn superannuation pension fund sector, which attributes its size to pension saving being compulsory for Australians. To boost these funds’ performance, the government has been instating a variety of measures under the ‘Your future, your Super’ legislation. One such measure was introducing government performance tests, which were failed by 13 funds last year. These performance tests compared the funds’ performance with a benchmark over the past 5 years and also took management fees into account. Failing this test requires the fund to inform their customers of their underperformance and encourage them to use a fund comparison tool run by the Australian Taxation Office. This encourages more savers to move their money out of underperforming funds. Hence, funds that previously made their return through public markets investing are now increasingly forced into private markets. This has been shown through exactly these superannuation funds backing the deals of Ramsay Health and Sydney airport. Since both private equity funds and superannuation funds still have large amounts of capital to invest, we can expect this trend of increasing financial sponsor activity in Australia to continue. Already today, 36% of deals are financial sponsor backed, compared with 25% as the 10-year average. Further, the aforementioned new legislation forces Australian superannuation funds to improve their performance and possibly become more risk-friendly, which may push them further into private markets and thus LBOs. However, macroeconomic factors should not be neglected when looking at the overall M&A environment. The March Australian CPI reading of 5.1% topped expectations, making markets predict multiple rate hikes for 2022. Further, the economic outlook is all but rosy, due to weak growth in China and the Ukraine war. Therefore, it remains to be seen whether the boom in deal activity will prove sustainable.

Major Sectors

Mining: A major pillar of the Australian Economy, the gross value added by the mining sector to the Australian economy amounted to 198.7bn AUD (141.9bn USD) in 2021, which represented approximately 10% of the GDP. 147 thousand people were employed in the sector, which was valued at around $336bn.

Skyrocketing commodity prices since the start of the pandemic helped attract new funding into exploration, which had been declining slowly since a peak in 2012. Global exploration budgets of mining companies targeting Australia increased 38.8% year over year in 2021 to $1.90bn, exceeding the average global budget growth rate of 35%. Western Australia region remains the most popular destination for new endeavors, comprising 70.8% of the total budget for exploration.

Several different mineral fields exist below the country. Australia is estimated to have the largest mine reserves of gold at 11 thousand metric tons, outstripping Russia’s 6.8 thousand, a distant second. In 2019, exports of gold reached 361 tonnes, which was valued at $16.4bn. Additionally, Australia is the top producer of iron ore, lithium, bauxite, the second largest of manganese and lead, and the third largest of zinc, cobalt and uranium in the world. The growing popularity of electric vehicles and the global energy transition represents an opportunity for producers, in the form of increased demand for many of these minerals.

Australia also lies on top of major energy resources. 149 billion tonnes of coal make the country’s reserves the world’s third-largest, behind the US and Russia, though extracting this reserve has been getting less economically viable with increasing ESG pressure and slowdown of trade with China. Value of coal exports fell 43% from $49.6bn in 2019 to $27.9bn in 2021. In late 2020, China advised copper smelters not to import from Australia, a move that, if enforced, can put pressure on other parts of the mining sector.

Some of the largest mining companies are based in Australia. BHP and Rio Tinto, the two most valuable mining companies with market capitalizations of $180.4bn and $146.7bn respectively, are both based in Melbourne. Alongside their Australian operations, BHP operates aluminum, copper-zinc, and nickel mines in South America; manganese, titanium, and coal mines in South Africa, and oil and gas developments in North Africa, the Gulf of Mexico, and Pakistan. Rio Tinto operates several aluminum mines in Europe, diamond mines in India and Zimbabwe as well as several copper mines all over the world.

M&A Activity has been high for the sector, with the year 2021 breaking records with a total of $8.3bn worth of deals. In February 2021 gold producer Northern Star acquired competitor Saracen Mineral for $4.1bn, which expanded the country beyond international borders into North America. In November 2021, BHP’s oil division and oil company Woodside announced plans to merge in an all-stock deal worth $13.7bn, which will create a roughly $40bn valuation energy giant; while Rio Tinto concluded an $825m acquisition of lithium producer Rincon in March 2022. High levels of deal activity are expected to continue in 2022, with similar trends of consolidation in gold companies and increasing interest in minerals for high-technology uses. ESG issues also continue to carry risks and offer opportunities in the form of increased shareholder value.

Financial Services: As a developed economy with a well-educated, English-speaking workforce, Australia is ideally positioned to serve as a financial hub within the Asia-Pacific (APAC) region. In 2021, Australia stood as the only country in APAC with 100% of the population having access to financial services. In 2018, there were over 800,000 people employed in Financial Services roles, accounting for over 6% of employment across the Australian economy.

Locally, some of the biggest players in the sector are the Commonwealth Bank of Australia with a $125.18 Bn market cap, National Australia Bank with a $74.8bn market cap, and Australia and New Zealand Bank with a $54.31bn market cap. Internationally, the Macquaire Group stands as the most recognizable brand, who offers global asset management and investment banking services with more than 17 thousand employees across 33 markets, a $55bn market cap, and $523.6bn of assets under management.

A very significant recent deal for the sector was the acquisition of AfterPay by Square in late 2021 for $29bn dollars, the largest buyout of an Australian firm to date, which magnified the rapidly growing interest into the “buy now pay later” model. Australia’s exceptionally large pension funds called the “superannuation funds” also actively targeted assets, exemplified by the acquisition of telecoms company Vocus for $2.47bn by Aware Super and Macquarie Infrastructure & Real Assets fund.

Healthcare: The Healthcare and Social Assistance sector is the largest employer in Australia. In 2021 1.8 million people worked in the sector, which is projected to increase to more than 2.0 million by 2025. Australia has one of the best healthcare systems in the world, ranking 5th on Bloomberg’s healthiest countries list for 2020.

Several Australian companies have a sizable global market in healthcare. CSL Ltd. is a major biotech company headquartered in Melbourne, with a market cap of $92bn and more than 25 thousand employees worldwide. It produces several influenza vaccines as well as vital antivenoms for treatment against wildlife encounters. Cochlear is a medical devices company headquartered in Sydney, widely known for pioneering hearing devices for deafness, that relay sounds to the brain without the need for surgery. It was named among the world’s most innovative companies by Forbes magazine in 2011. Ramsay Healthcare is a multinational healthcare provider and hospital network, with more than 80 thousand employees worldwide. It operates clinics in around 500 locations, mostly in Europe, Indonesia, and Malaysia alongside its services within Australia.

In late 2021, CSL announced it agreed to acquire Switzerland’s Vifor Pharma Group, for $11.7bn, which was the largest deal in the biopharma industry in 2021. CSL aims to diversify its portfolio, which is currently dependent on vaccines and blood plasma products, to include kidney treatment drugs and deficiency franchises. The sector is expected to continue growing strongly over the next five years due to Australia’s aging population, the increasing prevalence of many chronic diseases, and rising private health insurance coverage.

What value is in Australia?

Deal activity in Australia has been centered around the structure of its economy and how it will evolve in the future. Historically, Australia developed due to the substantial natural resources it holds. Amongst the most important are fuel minerals (e.g., coal, oil), iron ore, and precious metals. The production and export of these required the development of adequate infrastructure, which is now an attractive investment in times of inflation. Buying large infrastructure assets in Australia as an inflation hedge is the first popular inflation thesis driving investment in Australia.

Aside from the large Sydney Airport, Crown Casino and (possible) Ramsay Health deals, many smaller deals have also focused on infrastructure. Amongst these is the acquisition of shopping mall owner Aventus by the HomeCo Daily Needs REIT for A$2.8bn. The rationale for these investments is simple. On the one hand, being infrastructure or having infrastructure-like features, in the sense that they provide an essential service with little competition, means that they have relatively high pricing power, entailing more stable profits. On the other hand, the underlying asset is a physical one, meaning it will retain value during a sustained period of inflation. It must be added that this increased infrastructure is not just driven by funds with a broad investment mandate being interested in investing in infrastructure. Infrastructure funds are facing high investor demand, raising a record $136.5bn in 2021, with many of the funds being many times oversubscribed.

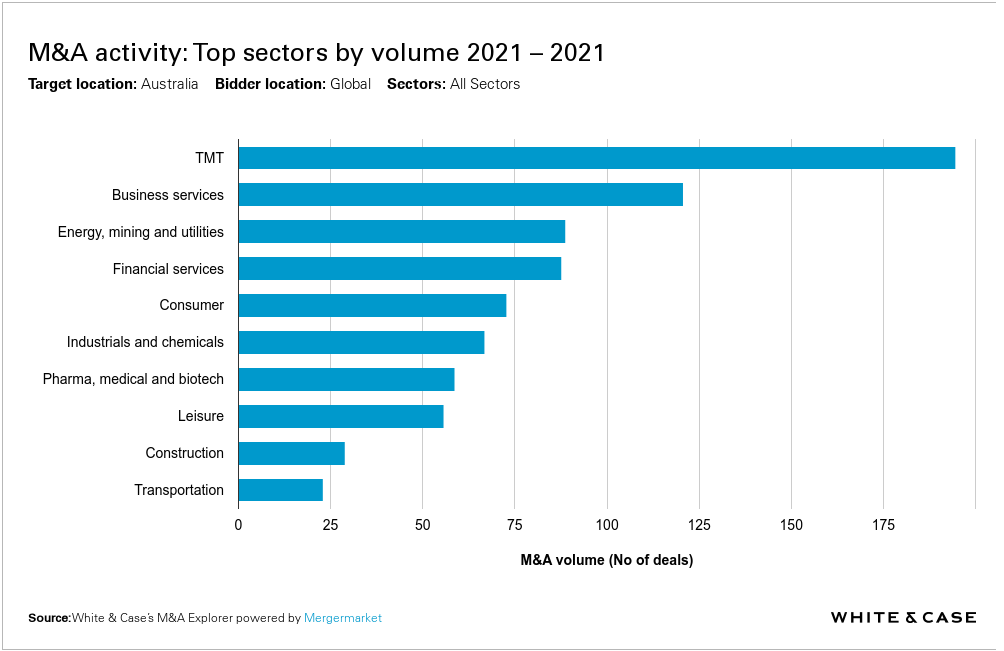

Another driver of dealmaking activity was based on the need for moving away from an industrial economy driven by the export of coal and other fossil fuels. The most notable example of this was BHP’s spin-off of its oil assets, to improve its ESG rating and therefore valuation.

Finally, technology and digitization were, as in other geographies, a driver of dealmaking, most notably seen by the Afterpay acquisition. Aristocrat Leisure buying UK gaming software company Playtech for A$5bn is another one of these deals. This activity by polluting firms and technology companies has led Luke Bentvelzen, the head of industrials and technology investment banking at Barrenjoey, an investment bank backed by Barclay’s and investment company Magellan, to state half of this year’s (2021) deals have been driven by decarbonization and digitization trends

0 Comments