[edmc id=1325] [/edmc]

[/edmc]

BSIC MARKET RECAP 22/02/2014

U.S.

Stocks in the U.S. edged lower on Friday after quite a good week data wise: producer and consumer price index coming in as forecasted but better than expected on a monthly basis, markit’s manufacturing PMI scoring the highest variation in nearly four years. The labour market was not so good: initial jobless claims were 1000 more than forecasted and existing home sales shortly under expectations. In spite of a not so exciting end of the week, the S&P 500 is 0,5 % below its record close in January. Many attribute the negative data to the bad weather, but we are not so sure. There seems to be a real slowing taking place due to high inventory levels and housing data losing momentum, but this may just be temporary. Next week’s Yellen speech will give us more of an insight in where the US economy may be going, but the fundamentals are not impressive at the moment.

Eurozone

On early Thursday, Markit PMI showed that manufacturing activity keeps on expanding in Germany. However, the positive reading of 54.7 didn’t meet expectations of 56.3 and the DAX index plummeted. However, good results from big players in the car making industry made it quickly recover the earlier losses. Data from France, the second largest economy in the Eurozone, were not as positive. Markit manufacturing and services PMI were both not only below 50 (threshold between expansion and contraction in the relative activity), but also below expectations. As for the DAX, the CAC40 slid and then started to rally again. The following chart shows the behaviour of the two indexes and highlights their correlation:

Source: FT

The EUR/USD was pretty volatile, but followed a similar path.

Source: FT

The two indexes and the EUR were positively influenced by Italian and Ukrainian political restructuring.

EMs

On the emerging markets side, loss in momentum can be found in the slowdown of the EM sell-off, with capital outflows diminishing strongly and making us believe there may be a return to EM in the coming weeks. (For more detailed data please refer to Friday’s article on the FT) This forecast may be directly observable from the chart below, in which we see a slight rebound on Thursday that also may be due to what looks like a settlement in the Ukrainian crisis.

Source: FT

CHINA

The Shanghai composite index fully reflects the main news from China released this week:

Source: Yahoo Finance

On Wednesday 19, the index soared due to new rules concerning banks’ liquidity. In fact, the China Banking Regulatory Commission set minimum limits for holding of cash and marketable securities in order to rein in excessive lending and prevent credit squeezes (i.e. further spikes in the 7-day repo rate). (full report on WSJ)

However, it slipped from its two-month high on Tuesday: the China flash Markit/HSBC Purchasing Managers’ Index (PMI) declined to 48.3 in February, a seven-month low, from January’s final reading of 49.5, as we had forecasted in last week’s article. The employment sub-index fell to its weakest in four years. This outweighed strong gains for Sinopec Corp, the oil company giant, whose stock price reached the 10% limit in Shanghai due to the first signs of reform at a state-owned enterprise. (full report on Reuters)

Less risk-adverse investors should consider the idea of moving back to EMs, but we are essentially short on China due to the slowdown in its economy and the distortions from China’s new year that altered January’s positive data. The real effects should kick back in the coming weeks and especially after February’s trade balance due on the 8th of March.

Australia (and follow-up)

Last week’s Australian trade yielded mixed results. GBPAUD opened on Monday morning at 1,8479, reaching the week’s high on Wednesday at 1,8648, as forecasted, but eventually dropped due to negative Chinese PMI. The pair was seesawing due to mixed data coming in from both countries. Aussie retail sales were 4 tenths of one percent under expectations on Sunday and new motor vehicle sales and the producer price index were deep in negative territory, but the Wage Price Index (QoQ) slightly grew on Wednesday morning. What kept the Pound from not striking a heftier move was its labour market data. The housing data came in positive, but we were expecting at least a confirmation of last month’s unemployment rate, which didn’t come (instead went up to 7.2 %) and led the Pound down again to the 1.847 level. What was positive instead was the claimant count change, that represents the number of people who claim unemployment benefits, whose negative variation was very strong and supports our bullish idea of the U.K. Next week should show us big moves due to the strong catalyser of the UK GDP results and also Australia’s trade balance expected to decline relative to the previous data.

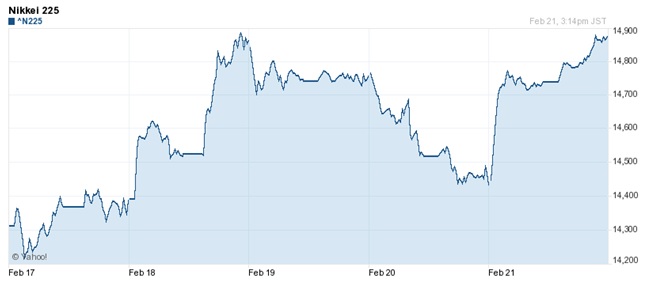

JAPAN

On Monday 17th, the GDP of Japan registered a modest increase of 0.3% in the 4th quarter, against expectations of 0.7%. This data seems to confirm that growth is slowing and the effects of Prime Minister Shinzo Abe’s reflationary policies are fading. BOJ governor Kuroda’s reaction was immediate: on Tuesday 18th, he extended special loan facilities by one year and doubled the size of funds available to banks in order to encourage them to boost lending. As a result, despite of disappointing data, Nikkei index surged 3.1% and Yen sank. Bank shares, indeed, mainly drove the increase in the index.

On Friday 21, positive signs from the US and the dovishness of minutes of the Bank of Japan’s Jan 21-22 policy meeting made Nikkei and other Asian stocks surge, and Yen plunge further. Yen had previously appreciated due to poor Markit/HSBC Manufacturing PMI in China.

Finally, on Wednesday 19 the government released its economic monthly report: it highlighted a positive outlook for growth and consumptions prices, which “rose moderately” in January. In particular, their gains are led by a weak yen and high energy prices.

Source: Yahoo Finance

Source: Yahoo Finance

[edmc id=1356]Download as pdf[/edmc]

0 Comments