Introduction

Recently, the governments of Argentina and Brazil announced that they are considering the launch of a common currency and are aiming for stronger monetary and economic integration in South America. Furthermore, some of the biggest events in Europe in the last decade included the Euro Crisis and the rising Europhobia following Brexit, which both destabilized and put the Euro into question.

Thus, we decided to ask ourselves why these common currency areas exist, how to evaluate their success, the peculiarities of trading these markets, and how past scenarios and economic theory can apply to today’s case: Argentina and Brazil. We will introduce common currency areas, explain prevailing economic theories behind them, analyze the historical case studies of the Euro and the CFA Franc, and finally get on with Argentina and Brazil, analyzing the likelihood of this implementation and how one could trade it.

Primer on Common Currency Areas

Currency unions are areas that encompass multiple states or jurisdictions that share a single currency among themselves and adopt a single monetary policy and foreign exchange policy. Some of the first monetary unions to have existed were established in the 19th century with the German Zollverein, the Latin Monetary Union, the Austro-Hungarian Monetary Union, and the Scandinavian Monetary Union. The United Kingdom and France established currency unions in their respective former colonies to facilitate easier trade and maintain control.

One of the most important aspects of currency unions is that they share a single central bank that sets the interest rates in response to the macroeconomic conditions in all the member countries, acts as the lender of last resort, issues the currency, and can nowadays deploy more sophisticated tools to respond to different economic challenges in the countries.

The advantages of areas with common currencies are that it facilitates trade between the member countries and lowers prices as prices for goods in the member countries can be more easily compared, which results in increased competition, thus leading to lower consumer prices and allowing the members to focus on their competitive advantages leading to more efficient use of resources, and in turn also causing greater price stability. Common currencies enable businesses to trade more easily within the area and the rest of the world by avoiding the need for currency hedges in the area and possibly greater currency stability. This also leads to financial markets that are more integrated and thus behave more efficiently. The areas then also gain greater political and economic leverage in the world economy.

The largest disadvantage of common currencies is that the member states lose their independence in setting monetary policies. This can be a major disadvantage if the member states do not have converging economies and economic cycles. Political issues can also emerge between the different countries in cases where the people of one state feel like they have to pay for other states’ shortfalls.

The Euro, currently the most prominent common currency, was introduced on January 1st, 1999, in electronic payment and accounting form, and has been used as cash for 21 years now and will be used as one of the currencies to help analyze the prospects of the proposed Brazil & Argentina common currency.

Optimum Currency Area Theory

The Optimum Currency Area Theory states that certain geopolitical areas that share certain traits should adopt a common currency. In 1961, the Canadian economist Robert Mundell proposed the Optimum Currency Area building upon the previous work of Abba Lerner. Such an Optimum Currency Area could be multiple nations, regions of them, or just regions within countries. His own definition was not limited to just single currency areas, however, but defined it as a domain within which exchange rates are fixed. The four initial criteria for an optimum currency area to exist were labor mobility, capital mobility, risk-sharing mechanism and similar business cycles.

Labor mobility is essential to an optimum currency area as it allows unemployment to remain at similar levels within the area as the unemployed would move to parts of the area with more job openings, thus evening out inflationary pressures in the whole area. Without labor mobility, shifts of demand from one region to the other would cause different inflationary pressures, which would cause lower interest rates for the region with lower unemployment to exacerbate its inflationary pressures while aiding the one with higher unemployment.

Capital mobility is required to eliminate regional trade imbalances, as the inflexibility provided by a common currency cannot stabilize trade within the area. Risk-sharing mechanisms can be in the form of central budgets enabling wealth redistribution. Shared business cycles are required for avoiding significant macroeconomic differences between the regions of the currency area in the case of economic shocks. Economists have since proposed additional criteria such as production diversification.

These requirements are reflected in the Euro Convergence Criteria that require EU member states – that already have labor mobility and share many regulations – to have price stability, an inflation rate no higher than 1.5% than the three best-performing members, should have sustainable public finances, maintain exchange rate stability with the euro for at least two years, and have similar long term interest rates. The ten proposed convergence criteria for the ECO, a proposed common currency by the Economic Community of West African States, are similar albeit less strict.

Historical Case Study – the Euro

The first step towards the Euro was set by the Maastricht Treaty that created the European Union in 1992 and established a basis for the common economic and monetary union under a governing central bank that would evolve to be as the European Central Bank. The European Currency Unit, which was solely an electric unit of account, was the predecessor of the Euro and lasted from 1979 until 1999 at which time it was replaced at parity by the Euro.

The European Exchange Rate Mechanism (ERM) was the first attempt to stabilize central European currencies around the German mark as Germany at this time was the largest economy in the future eurozone and had used robust monetary policy since World War II. The EMS pegged member currencies according to an allowed fluctuation margin which was ±2.25% before 1993. As a result of the dominance of Germany, it was the main driver of setting monetary policy, leading to negative economic effects on other members that did not have a similarly strong growth rate.

In 1990, cracks in the EMS started to appear due to different economic conditions leading to diverging monetary policies, the reunification of West and East Germany, and Britain’s decision to join after declining earlier. Denmark, Italy, and the UK pulled out of the ERM in 1992. Black Wednesday, also known as the 1992 Sterling crisis, forced the UK to withdraw within a few hours, after failing to adhere to the fluctuation margin. In a last attempt to keep the British pound up albeit experiencing large selling from speculators, the Bank of England raised the base interest rate from 10% to 12% at 10:30 am on September 16th. The speculators prevailed and the BOE announced Britain’s withdrawal from the ERM at 7:00 pm and lowered the interest rate back to 10% the next day. Following other bets against the French franc in 1993, the fluctuation band was broadened to ± 15%.

The three reasons that were blamed for the collapse of the ERM at that time were inadequate harmonization of past policies, future policies, and speculative pressures. The second Exchange Rate Mechanism, with which the introduction of the Euro took place, considered various convergence criteria for a country to be able to join the Euro, the broader fluctuation margins established in 1993, as well as a slight shift of attention in setting monetary policy towards peripheral members of the currency union. The convergence criteria that were set are price stability, sustainable public finances, exchange-rate stability according to the fluctuation band, and the difference in long-term interest rates to the three best-performing member states. On January 1st of 2002, the Euro notes and coins were finally launched in 12 countries.

The eurozone has since expanded to encompass 8 more countries with the latest being Croatia at the beginning of this year (2023). The Exchange Rate Mechanism II continued to favor Germany just like its predecessor had, which caused the weaker economies of Europe – Greece, Italy, Ireland, Portugal, and Spain – to suffer due to their high debts, interest rates, and unemployment. With a lack of sufficient fiscal controls on its member countries and the whole eurozone facing similar borrowing costs, these circumstances encouraged their excessive fiscal spending. After the onset of the global financial crisis of 2008, Greece reported in October 2009 that its budget deficit would clock in at 12% vs the expected 3%. In reality, it turned out to be 15.4% of GDP for that year, and a public gross debt level exceeding 127%. This resulted in the European debt crisis, which led to doubts about the stability of the European Union, especially in Silvio Berlusconi’s Italian Government which could possibly leave the Euro.

There are some quirks in markets related to the common currency area that are not all too well known and have been exposed by the Euro, the common currency area with the most liquid spot and derivatives markets for all types of securities. A significant example can be seen in rates, where a risk factor is introduced that does not exist elsewhere: redenomination risk.

Imagine the following scenario: a debilitated European economy is considering leaving the Eurozone and once again adopting its own currency, which almost by default is devalued when compared to the original currency. Now, because the government’s unit of account is the sovereign currency, some of its credits will be settled in this currency. For instance, as a holder of sovereign debt of the exiting nation, this reduces the net present value of your future cash flows coming from the debt. Thus, this is an additional risk factor investors must account for which is reflected in the prices of these securities.

While it may seem like this is an unlikely and ‘exceptional’ scenario, events like the Euro Crisis provoked investors’ assessments of these possibilities and greatly affected sovereign debt price action for significant periods. The general method of measuring this risk is turning to quanto credit default swap (CDS) spreads. Credit default swaps are financial swaps where a buyer periodically pays the premium as set out by the contract to a seller that compensates the buyer in the case of a credit event of an underlying debt security, for instance, a default on a sovereign bond, with a fixed amount. A quanto CDS is one where the underlying security’s denominated currency is different from the denomination of the premium. For example, a quanto CDS for an Italian government bond (BTP) – the underlying that is traded in Euros – is settled in Dollars. Again, while on its surface it may seem like a fairly exotic derivatives contract that may not trade in a liquid enough manner, the reality is considerably different. Because of the widespread view that in the event of a default of a major European government, the Euro would greatly depreciate, thereby decreasing the utility of these contracts – to speculate and more importantly, to hedge – Dollar-denominated contracts have seen increasing popularity over time and are now the standard for European sovereign debt CDS trading.

Quanto CDS spreads essentially capture the difference between identical CDS contracts that are quoted in two different currencies, for example, the Dollar and the Euro. This is supposed to measure the rate at which investors value redenomination risk, because, for example, in the event of a default that has a massive effect on the Euro, insurance on this event occurring in Euros is no longer worth as much as the Euro is quite likely to depreciate. It is worth noting that some measures of redenomination risk use slightly different methods, utilizing the quanto CDS term structure[1].

In a studied example the French presidential election of 2017 is key in seeing this risks’ prominence in market pricing. In 2017, a foreseeable reality was that Marine Le Pen, a Europhobe, was going to win the election, which would come with the foreseeable reality that France would take action to exit the EU and/or the Eurozone, implying possible redenomination risk. It follows that redenomination risk dominated market pricing: in the months leading up to the election it accounted for about 40% of the French CDS spread [1].

Historical Case Study – the CFA Franc

What is usually referred to as the CFA franc is two currencies that are essentially interchangeable, the Central African Franc (XAF) and the West African Franc (XOF). The two CFA currencies are backed by France to some degree and are used in its former colonies. CFA initially stood for Colonies françaises d’Afrique (French Colonies of Africa) but the meaning eventually changed to the “French Community of Africa”.

The French government established the CFA Franc on December 26th, 1945 in 12 of its former colonies and 2 other nations to avoid the countries experiencing the same currency devaluation as the French Franc, as demanded by the Bretton Woods Agreement. Ever since the CFA Francs have been pegged to the French Franc and eventually to the Euro by rates controlled by France, some former members of the CFA have decided to leave the currency and create their own while others joined, and interestingly Mali left in 1962 but rejoined 22 years later.

As France ensured unlimited convertibility of the CFA Francs to the French Franc, then the Euro at 1 Euro = 655.957 CFA Francs, it set tight controls on foreign exchange deposits that the Central Bank of West African States and the Bank of Central African States had to have at the French treasury, starting at 100%, then decreasing to 65% in 1973 and 50% in 2005. France also is a voting member and holds a veto on the boards of these Central Banks, thereby being able to direct monetary policy in the region. Although the CFA francs have remained far more stable than most of the neighboring currencies, they have been criticized for extending post-colonial influence and implying less economic growth compared to other nations in the region. The issue with the fixed exchange rate is that it forces the states using the CFA franc to adopt monetary policy from the EU. The under-development of the franc zone is also influenced by political instability and poor economic decision-making, so it is non-trivial that their limited growth has been solely due to the currency pegs. On the other hand, it caused the inflation rate in the Franc zone to be lower than in the countries around it.

The Case of Argentina and Brazil

We are now sufficiently equipped to tackle the ongoing scenario around Argentina and Brazil. On January 22nd, Brazil’s left-wing President, Lula Da Silva, along with his Argentinian counterpart, Alberto Fernández, announced they would start preparations for a common currency. If passed in the respective legislatures, such preparations mainly include introducing the currency exclusively in trade between the two countries, meaning that it would run in tandem with the Brazilian Real and the Argentinian Peso.

The controversial proposal has been mostly shunned by mainstream economists and analysts as a political stunt, but what if it has some merit? South American politicians have been touting similar ideas for decades, arguing that greater regional cohesion is key to improving economic stability and supporting sustainable growth.

They would not necessarily be mistaken when they claim that this form of cooperation can foster regional growth. Brazil is Argentina’s largest trade partner for both exports and imports, and introducing a common currency would reduce uncertainty and therefore diminish foreign exchange risks for both sides of these cross-country deals. Clearly, this promotes increased trade with one another and can give the two economies a well-needed boost.

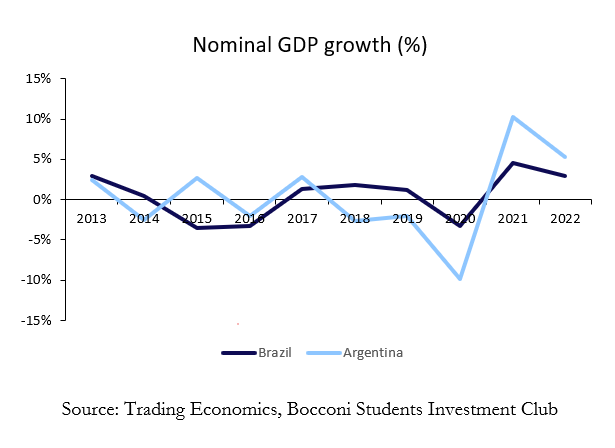

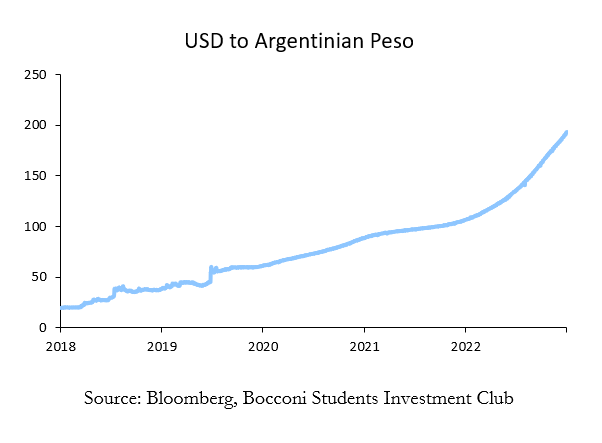

On the other hand, following the theories of Mundell on Optimum Currency Areas, one can immediately spot weak points in the ambitious proposal. Firstly, it is hard to argue that Argentina and Brazil follow a similar path in economic growth. Argentina suffers from sky-high inflation, having recorded an inflation rate of nearly 100% in 2022, and is expected to grow less than 1% in 2023 as its agricultural exports dwindle. It is also a debt-ridden nation, having its government default on its debts in 2020, the ninth such occurrence since its independence. This has effectively locked them out of international financing, relying solely on IMF agreements to help steady their path toward economic stability.

Brazil, though, is endowed with plentiful natural resources, many of which are experiencing what many are calling a supercycle. It has grown its GDP by around 2.8% in 2022, and although a global slowdown will hamper demand for its commodities exports, it is nevertheless expected to grow by at least 1% in 2023.

Notwithstanding the significant efforts to economically integrate the neighbors since the 1990s, the two countries do not seem to have similar, coinciding business cycles when looking at decades worth of economic data [2]. Argentina’s business cycles tend to be more volatile and prolonged whereas the variables composing Brazil’s economy are far more stable. Thus, the argument that business cycles will naturally smooth out in the long term is a weak argument. It will take a century-defining reversal in fortunes for Argentina to set itself on a similar path as Brazil. A reform such as introducing the common currency would have to be complemented by pragmatic, and most importantly, successful policies that quickly improve Argentina’s economic situation.

Another critical component that corroborates these arguments is the nations’ respective monetary policies. While Brazil’s policy interest rate is set at 13.75%, Argentina’s benchmark rate is hovering at a ludicrous 70%. The existence of a common currency in such a situation would make a carry trade particularly appealing: borrowing money in Brazil at a low rate and investing it in Argentinian assets, earning a considerably higher rate of return and not even incurring foreign exchange risk. At whose cost does this gain come? Those who fund the Brazilian government: taxpayers and investors. Not only would they fund Argentinian debt through fiscal transfers, but parties in this trade could rely on Brazil to bail out Argentina in the case of a default, making their trade reliably profitable. Therefore, it is trivial that Brazilian sovereign debt would take a massive hit from the introduction of a common currency, thereby converging in yield with Argentina’s debt, and hurting its reputation as a reliable, investable country in an otherwise difficult-to-navigate continent. Importantly, this applies even if they do not fully go ahead with the plan – the fact that they deliberated it and got somewhat close to implementing it can irreparably damage Brazil’s stellar reputation.

The second difference between theory and reality is regarding the free movement of labor and capital. Labor and capital act as adjustment vehicles between regions when different exogenous events affect the respective economies. As for labor, apart from urban infrastructure, transportation networks are relatively underdeveloped, especially when compared to developed and developing nations, making it difficult for labor to move around easily within the region.

Capital faces harsh constraints in Argentina, with a tightly regulated foreign exchange market that aims to preserve Dollars that are used to pay for imports. The market is so tightly regulated that black markets have sprung up, with some markets having the greenback worth up to 88% more against the Argentinian Peso than in official markets [3]. Cheaper imports mean that the overall trade balance improves, and the Argentinian government pushes this even harder by making it mandatory to have imports approved by a government agency so they can make sure that imports are utilized to increase output.

On the other hand, it is reasonable to assume that if a new currency was to be introduced, then capital controls would be loosened in Argentina. Regulatory convergence would surely ensue as Argentina can now make up for its Dollar shortage by turning to Brazil. Also, Brazil has recently implemented policies that have materially loosened capital controls and therefore improved its foreign exchange market efficiency [4], setting a higher bar that Argentina would be forced to either abide by or measure itself, thus incentivizing loosening its tight grip on capital.

Finally, there are political factors to consider. On the one hand, introducing a common currency is one set of policies that promote regional integration which is seen not only seen favorably by the domestic population but throughout the continent. Additionally, being less dependent on foreign powers, especially the US, has been a resounding theme in South American politics for decades, but has garnered particularly significant support in the past decade.

A vital characteristic of the Optimum Currency Area Theory is an effective risk-sharing system. This would be the main reason a common currency would not be implemented as it can be easily seen that a common currency would imply that Brazil would have to pick up the pieces for Argentina’s shortcomings. Fiscal transfers between the countries would primarily help cover Argentina’s vast debt pile, an exercise that can easily divide communities that were once strongly united, as exemplified in the case of Greece and western European economies. Especially with a volatile economy such as Argentina’s, further borrowing is foreseeable, especially in the case of exogenous shocks like the COVID-19 pandemic. Such incidences may elicit questions about whether Argentina has perverse incentives regarding borrowing on Brazil’s account and being bailed out if needed.

For this, and other reasons, the common currency experiment may inspire conflict with the IMF to which Argentina owes $72bn. They would undoubtedly be less willing to assist Argentina with the fledgling peso if a new legal tender were to become available. More crucially for the time being is that several public officials of these countries – most notably Brazilian central bankers and economists on both sides – have either publicly spoken against these measures or given claims that somewhat contradict the original statements. What this would mean for President Lula da Silva is that in order to push ahead, he would have to challenge members of his own government as well as heads of key federal institutions, moves notoriously done by his populist predecessor and current opponent, Jair Bolsonaro, which he has berated in his push for office just last year.

This makes it unlikely that if it were implemented, it would be carried out according to the literal interpretation of the two Presidents’ proposals. An example of this was shown by Brazil’s finance minister, who gestured that “the idea would only get off the ground as notes of credit that were backed by Argentinian commodities”[5], a ploy that is more akin to further borrowing than the minting of a new currency.

Given the long list of issues with the proposed common currency area in Argentina and Brazil, are markets taking these propositions seriously? Are there any action steps one can take to take advantage of one’s opinion of the most likely outcome of this conundrum?

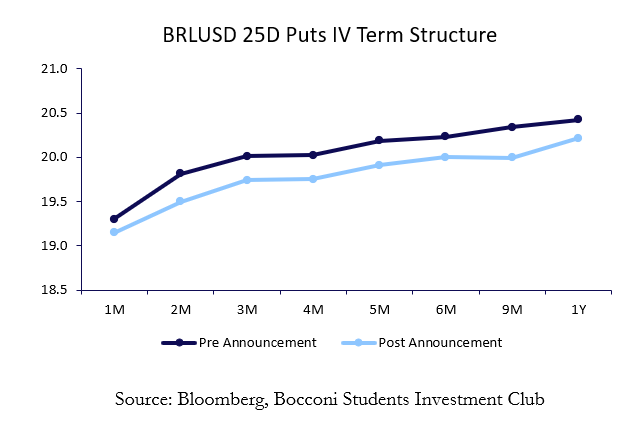

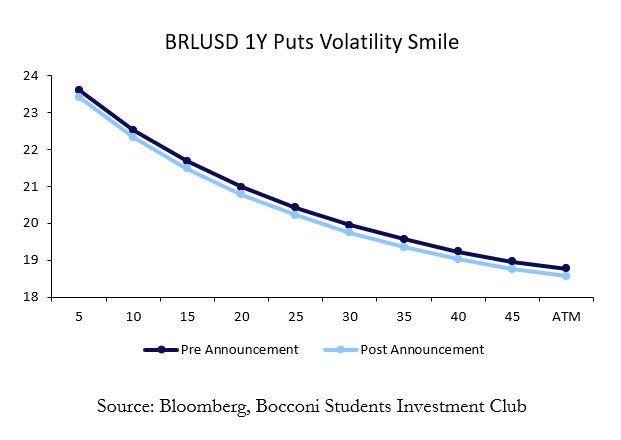

Although the ideas implied by the politicians’ ambitious rhetoric would take significant time to put into action and are highly likely to take different forms, markets are forward-looking, and especially for long-duration securities are likely to display pricing of these tail risks. Brazilian long-duration securities opened flat on the market open on Monday, the 23rd, and their subsequent movements during the week are inarguably caused by other risk factors e.g. global macro movements. Implied volatilities for the Brazilian Real actually inched lower during the session which is counterintuitive to our logic given that investors should expect higher volatility in the asset given the emergence of a tail risk. The evident conclusion is that markets were pricing in other risk factors and paid little heed to Sunday’s happenings. Even if they had shown corroborating movements along the volatility surface, drawing conclusions regarding something as long-term in nature is far-fetched.

Most notably, the shape of the 1-year volatility smile for puts is unchanged, meaning that the implied probability distribution of returns is also unchanged. This is almost irrefutable evidence that the market did not take the announcement seriously with regard to Brazilian assets. Taking a look at Argentinian assets, the same can be said for long-duration assets, displaying little to no changes over the weekend.

Nevertheless, we believe there is a non-trivial likelihood that we see further developments with regard to the introduction of a common currency area, at least from the perspective of increasing regional integration. How could an investor position themselves accordingly?

Due to Argentina’s previous defaults and the lack of sufficient liquidity across all maturities in its bond market, we believe that Argentinian government debt is not appropriate for taking views on the possibility of this proposed common currency area. A position in the Argentinian Peso is inadvisable as well due to the high inflation rate and its very consistent devaluation over the past years.

As Argentina accounts for 18.5% of global maize exports and 17.5% of global soybean production and it has a heavy reliance on fertilizer imports, economic issues arising from a common currency with Brazil could lead to higher input costs or even a supply shock for maize and soybean thus lowering production. Brazil itself produces 28.7% of soybeans globally, which would likely also experience similar economic pressures as Argentina albeit far less strongly. As the soybean market is already very responsive to supply shocks such as a lower-than-expected amount of rain, we believe that if an investor were to be certain that such a monetary union would happen, they could position themselves with a bullish exposure to the soybean market. This could be in form of soybean futures on the CME or foreign conglomerates that have exposure to soybeans such as Cargill.

As the time horizon is uncertain considering the amount of time it took for the European Union to form the Euro and develop significant economic issues, positioning in futures contracts would require an investor to be confident in the certainty of the monetary union as well as the time horizon. The difficulty of investing in equities with exposure is that many commodity corporations are heavily diversified in the number of commodities they trade or produce, and it is hard to isolate the exposure on soybeans from the other factors that contribute to the valuation of the company. It would, however, not be as affected by the ability to time the position. Therefore, we believe that a current position is not advisable, but would be worth revisiting if an investor has the required conviction and has good expectations for the time horizon regarding the implementation of a common currency area between Argentina and Brazil.

Sources:

[1] Kremens, Lukas. 2019, Currency Redenomination Risk.

[2] Jacobo, Alejandro D., and Alejandro Marengo. 2020, Are the Business Cycles of Argentina and Brazil Different? New Features and Stylized Facts.

[3] Raszewski, Eliana. “Argentina to Tighten Import Controls to Preserve Dollars-Sources.” Reuters, Thomson Reuters, 8 Oct. 2022, https://www.reuters.com/markets/us/argentina-tighten-import-controls-preserve-dollars-sources-2022-10-08/.

[4] “Brazil Enacts Legal Framework for Foreign Exchange Market.” EY, https://www.ey.com/en_gl/tax-alerts/brazil-enacts-legal-framework-for-foreign-exchange-market.

[5] “Argentina and Brazil Propose a Bizarre Common Currency.” The Economist, The Economist Newspaper, 28 Jan. 2023, https://www.economist.com/finance-and-economics/2023/01/26/argentina-and-brazil-propose-a-bizarre-common-currency.

0 Comments