Devon Energy Corporation (DVN:NYSE) – market cap as of 9/10/2020: €3.9bn

WPX Energy Inc. (WPX:NYSE) – market cap as of 9/10/2020: €3.0bn

Introduction

Following months of global lockdown and a fierce oil price war hitting highly indebted American oil producers, a new wave of consolidation in the oil sector has begun. After Chevron’s takeover of Noble in July, another stock-for-stock deal was announced this week.

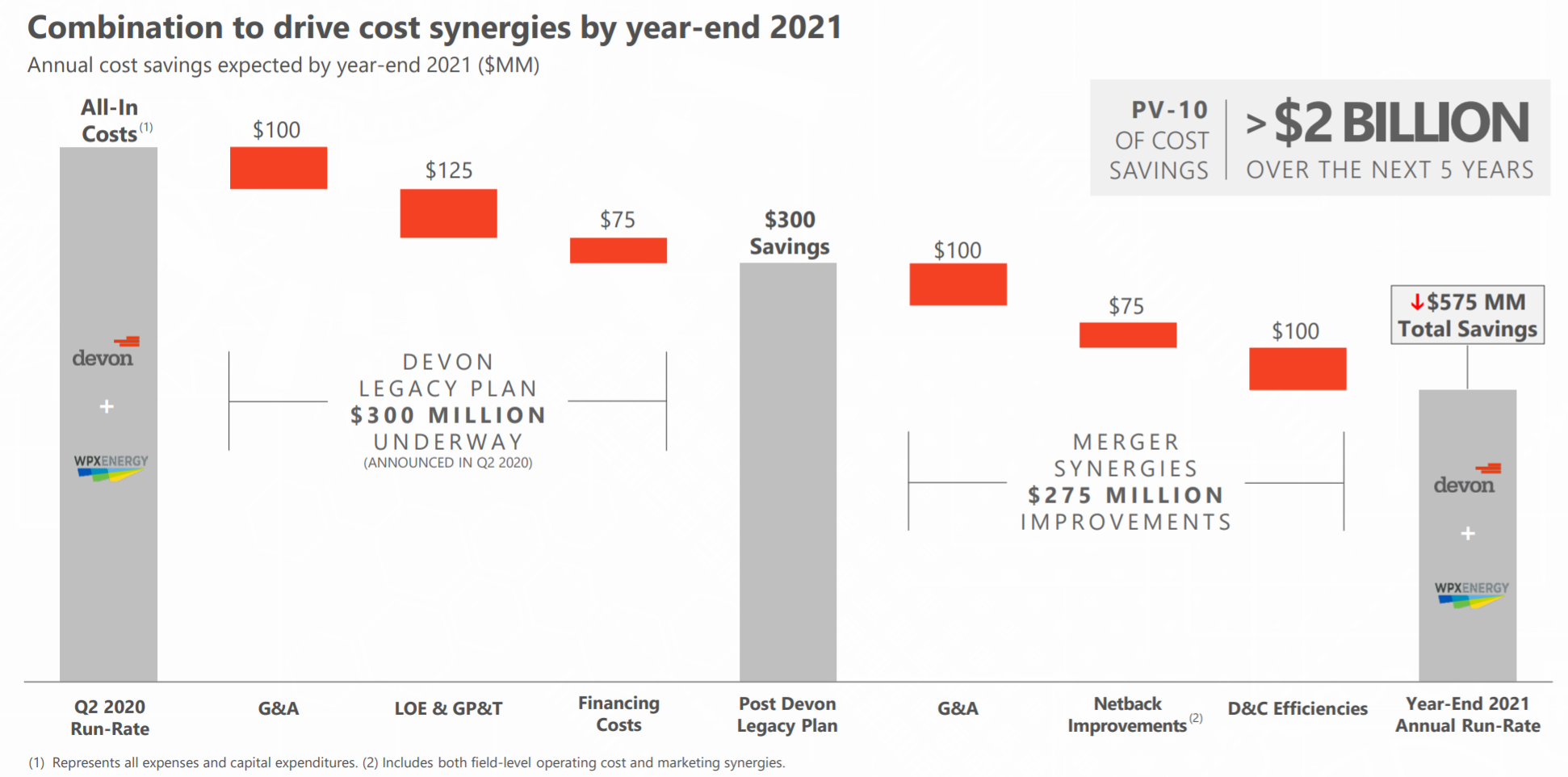

On the 28th of September, US oil producer Devon Energy agreed to merge with WPX Energy for a combined value of $12bn including debt of both companies, closing the largest deal in the US shale industry after the 2020 oil price war. With 525,000 barrels of oil and natural gas equivalents expected to be produced per day by the new entity, and $575m in synergies savings, the merger is an opportunity for Devon to build scale and cut costs at a critical moment.

About Devon

Devon Energy is an independent US company operating in the oil and natural gas exploration and production industry with headquarters in Oklahoma City, Oklahoma. The S&P500 company is listed on the New York Stock Exchange under the ticker DVN. With a production of approximately 140,000 bbl/d, 575m cubic feet of natural gas per day and 80,000 bbl/d of natural gas liquids, it is one of the leaders in the US oil market.

Founded in 1971, it has been a pioneer of the US shale industry since 2002. In that year, significantly before the boom of shale, it acquired Mitchell Energy, one of the original developers of the oil patch. Over the years, Devon Energy has become one of the leading producers in the Permian basin with a large property portfolio in the heart of US shale production.

After reaching a $54bn market capitalization peak in 2008, the company’s stock tumbled over the next 12 years to a market cap of just $3.9bn today. Over the last five years, Devon’s shares dropped by 12% per year reflecting a 15% yearly revenue decrease over the same period. The coronavirus pandemic and the 2020 oil price crush were just the cherry on top for Devon, which saw its market capitalization halve from February to August 2020, as the company posted a net loss of $1.8bn in the first quarter of 2020. However, the operating cash flow situation seems to be rosier. Year-on-year operating cash flow increased by 21% to $529m because of the CAPEX reduction programme started by the firm in 2018, when oil prices started to fall. This strategy has led to a 40% reduction in production volumes since 2018 and $1.5bn in cash accumulated.

About WPX Energy

WPX Energy is a US oil and natural gas exploration and production company with headquarters in Tulsa, Oklahoma. Included in the S&P500, the company is listed on the New York Stock Exchange under the WPX ticker. WPX Energy owns assets in the Williston Basin and the Permian Basin, which accounted for 42% and 58% of its 2019 production, respectively. WPX produces approximately 105,000 bbl/d, 27,000 bbl/d of natural gas and 35,000 bbl/d of natural gas liquids.

The company was founded in 2012 as a spin-off of Williams Companies and went public in the same year. Over the years, WPX Energy sold and purchased different oil-related assets with the aim of expanding its presence in the Permian basin. It now owns several hundreds of acres there, mainly thanks to its acquisition of RKI Exploration for $2.4bn in 2015 and of Felix Energy for $2.5bn just nine months ago.

WPX’s financial performance in 2019 was satisfactory. From FY 2018 to FY 2019, net income increased 70% to $256m. The company generated $101m in free cash flow in the second half of 2019. Production increased YOY to around 104,000 bbl/d. WPX’s share price performance has not been as good as its earnings results, however. The coronavirus pandemic brought the company’s share price down by around 60%, from $12 in February to $5 in October, corresponding to a $2.5bn market capitalization prior to the deal. Indeed, months of lockdown weighed on net income: it decreased to ($0.7m) in the first half of 2020 compared to $0.3m in the first half of 2019.

Industry Analysis

As the Covid-19 pandemic propagated around the world, a mass decline in production and a halt to the transportation industry decimated the demand for oil, natural gases, and other related products. Although it is hard to define the overall impact on the oil industry and its size, data on the demand, supply, and price of oil for the foregone months of 2020 is already available.

Oil demand tumbled as transportation halted due to Covid-19 restrictions. 2020 world oil demand figures are projected to be 8.1 Mb/d lower than in 2019 (y-o-y). More precisely, for OECD countries, oil demand is set to decrease 4.2 Mb/d, and for non-OECD, the oil demand will fall by 2.8 Mb/d. Geographically, oil demand is projected to fall by 2 Mb/d in the Americas, by 1.5 Mb/d in Europe, and by 420 kb/d (thousand barrels per day) in Asia and Oceania. Non-OECD countries, such as China, and Asian countries will see a smaller contraction in demand for oil in 2020 as they faced the pandemic earlier and returned to a quasi-normal life for the rest of the year. U.S. traffic is still 50% lower than pre-pandemic levels, as is traffic in the rest of the world. Demand for air travel, one of the biggest oil-consuming industries, is still about 70% less than in 2019. The world’s largest airlines said their demand y-o-y is still between 25% and 40% of that of 2019, and they expect to need between 12 to 18 months for air travel demand to reapproach normal levels.

Despite the short-term effects on travel, there could be long-term behavioural changes in how and how much people travel. In fact, last year about 8% of the world’s population worked from home, while this year’s pandemic boosted that number to 18% approximately. Restructuring at large companies seeking to cut costs could see workers remaining home or “teleworking” (e.g. using Zoom meetings) to avoid long-distance travelling costs. Besides, during the lockdown, most major cities designed cycling lanes, and began incentivizing the purchase of electric bikes and other electric vehicles. The urban population might stick to these practices as they embrace more healthy and eco-friendly lifestyles, which could have a long-lasting effect on the demand for oil and natural gas.

As demand shrunk during 2020, so did supply. At the beginning of the year, global oil supply fell immensely by almost 15 Mb/d, and it is expected to end 2020 with a substantial reduction of 7.2 Mb/d (million barrels per day) on average. It is expected to recover only by 1.8 Mb/d in 2021. Taking May 2020 as an example, the reduction was of 12Mb/d y-o-y, and further reductions in the following months reduced monthly oil production to 2010 levels. This fall in oil production came after several nations and producer organizations, such as OPEC, announced record-breaking cuts. OPEC+, for example, reduced its oil production by 9.9 Mb/d on average every month until June, when it agreed to ease the restrictions.

While most of the world was on lockdown, we lived a historic moment: the Crude Futures Front Month Closing price went below 0. Since then, the same prices have recovered to about $35 per barrel and are still increasing. However, due to remaining uncertainty, these prices remain well below the approximately $60 per barrel prices pre-pandemic.

Halcon Resources, Vanguard Natural Resources, and Weatherford International are only three of at least 20 oil companies that operated in the Permian Basin to have filed for bankruptcy this year because of Covid-19. Most of these companies, however, filed for a chapter 11 bankruptcy. This is a reorganizational form of bankruptcy, where businesses propose a plan of reorganization to keep operations going and repay creditors over time. This year is projected to set a record for the crude crunch phenomenon, which started in 2010.

Source: Bloomberg

At end of 2019, creditors had already begun to criticise the shale industry for its high levels of indebtedness. Producers had to slash their spending below their revenues, which exposed smaller companies to price volatility. Shale oil companies, which are now the biggest U.S. oil producers, can hardly make any profit despite their rapid growth in the past. For instance, Chesapeake Energy became the largest shale gas producer in the U.S. but kept borrowing dozens of millions of dollars to buy land. It filed for Chapter 11 bankruptcy this summer as it could not get over its massive indebtedness. A new Deloitte reports says that the U.S. shale industry has in fact never been profitable. As such, oil companies are turning to M&A to cut costs and save their operations. Recent examples include the Devon-WPX merger, but also the Midstates Petroleum-Amplify merger in 2019.

The future of the U.S. oil industry will be determined at large by November’s Presidential Elections, as Trump and Biden have opposite agendas on drilling reforms. If the current President is re-elected, the great push for energy dominance will continue, increasing drilling. On the other hand, if Vice President Joe Biden is elected, reforms addressing climate change will threaten the survival of oil companies, as he promised to limit drilling on federal acreage.

If you’re looking for a more in-depth analysis of the pre-pandemic Oil Industry visit our industry-focused articles by clicking here (Part 1) and here (Part 2).

Deal Structure

The merger of equals involves an equity transaction for which WPX current stockholders will receive 0.5165 of Devon’s common stock for each WPX unit of common stock owned. Upon completion of the transaction, the resulting enterprise value will be of roughly $12bn (as of September 25th). The combined entity will keep Devon Energy’s name, as the latter will own 57% of the company, and former WPX shareholders will own the remaining 43%, on a fully diluted basis. The new company will have $1.7bn in cash and $3bn in credit facilities.

Current CEO of WPX Rick Muncrief will be appointed President and CEO of the combined entity. Devon’s former President and CEO will be appointed Executive Chairman of the Board. Devon Energy and WPX will bring to the newly formed Board of Directors 7 and 4 of their current directors, respectively. Another director from WPX will be appointed as lead independent director. Upon approval by Devon and WPX’s shareholders, the transaction is expected to complete within the first quarter of 2021.

Deal Rationale

The deal, first rumoured over the weekend, comes after Chevron’s takeover of Noble and fits into a new trend of consolidation in America’s most beleaguered oil patch, the Permian Basin. The region will likely see more consolidation in the future: otherwise, Exploration and Production companies (E&P) will start shrinking and going bankrupt. Oil prices have become too low to incentivize investment and a Democratic win in the November elections could further compromise the region, as Democrats plan to issue fewer new oil & gas permits on federal acreage.

Devon and WPX claim to be a good match. In fact, management predicts that by the end of their 2021 fiscal year, they will have accomplished $575m in annual run-rate cost-savings. Over a five-year window, these savings will have a net present value of $2bn. Merger synergies will be only $275m: $100m of which will come from reducing general and administrative costs, $75m will come from netback improvements, and the last $100m will come from improved efficiency related to drilling and completion activities.

Source: WPX Investor Presentation

Assuming target synergies are hit, the companies would see their combined operating cash flow increase by 5% to 10%, which would double free cash flow. Moreover, the combined entity’s WTI breakeven should drop to $33 per barrel. The company would also lower its exposure to “risky” federal acreage in New Mexico, which would decrease from more than 50% of Devon Energy to 35% pro forma.

Furthermore, the all-stock deal will preserve the companies’ financial strength since Devon and WPX have leverage ratios well below the industry average. The combined company will also have more than $1.7bn in cash and minimal near-term debt maturities but it plans to use a large portion of that cash to pay off $1.5bn in debt in the near-term to strengthen its financial position.

However, there have been concerns about the footprint and the synergy estimates. While the Permian acreage is promising and both companies post strong results, they have little geographical overlap. Devon Energy mostly operates in the Lea and Eddy counties, while WPX Energy mostly operates in the South: in Reeves, Loving, and Ward. Therefore, achieving $100m in drilling and completion (“D&C”) efficiency improvements from scale and $75m in netback savings improvement seems unlikely.

Another essential feature of this deal is Devon’s new dividend strategy: a “fixed plus variable” dividend. The base dividend would consume about 11% of the company’s operating cash flow, while the variable distribution would be up to 50% of its excess free cash flow. Devon would pay the additional dividend provided that it has at least $500m in cash and the commodity price outlook is promising. Devon expects to start paying this variable dividend as soon as it closes the WPX deal.

Market Reaction

On September 28th, the two E&P companies announced their all-stock merger and the share prices of both Devon and WPX rose suddenly. Shares in Devon, the larger company, rose by 11.1% closing at $9.80 and shares of WPX, the smaller company, gained 16.4% closing at $5.17. EnCap Investment L.P.’s, whose different funds own 27% of currently outstanding shares, supports the deal.

On the announcement date, the news also boosted the share prices of rivals such as Apache and Marathon, whose stock prices rose 4.2% and 3.6% respectively. Speculation that more deal making in the industry would follow likely caused the positive reaction.

Financial Advisors

J.P. Morgan advised Devon while Citi advised WPX.

0 Comments