Introduction

This is the second and last part on BSIC’s report about the oil industry. In this article, we set out to discuss the most relevant determinants of oil demand in the short to medium term. We analyze the effects that a predicted economic slowdown would have on the consumption of petroleum. Moreover, we discuss the extent to which the market for maritime transportation will be disrupted thanks to the implementation of IMO 2020. Finally, we take a look at the longer-term prospects of growth in the industry and the effects of a wave of backlash against oil from governments.

Global economic slowdown effects

Reaching an $86/bbl high in 2018, many analysts thought Brent crude oil prices could rise to over $100/bbl. On the contrary, the average closing price of 2019 remained low at $64/bbl, with estimations projecting the latter to fall to $60 in 2020 as a result of a reduction in oil demand. As stated in its short-term energy outlook, the US EIA forecasts oil Demand to increase by just 0.9mbbl/d this year, the slowest growth rate since 2011. The main reason for this is the current weak global outlook, mainly caused by trade tensions and slowdown in major economies. An executive from an Indian oil company even stated that the fact that oil imports were flat was surprising when prices were stable, indicating that demand not picking up was the only possible reason.

According to recent estimates, China and the US economy slowdown projected for the next few years, together with India’s industrial output decline and prolonged US-trade tensions, are the main factors that will contribute to lower oil consumption in the years to come. With Chinese car sales falling 14% in the first half of the year compared to the same period in 2018, OPEC forecasts oil demand growth from China, the world’s biggest exporter of commodities, at 2.4% in 2020 down from 2.8% in 2019.

In India, petroleum products demand went down to 105.7 tones reaching a two-year low in September. This was mainly because of a significant decrease in consumption of auto fuels, petrol and diesel, as a result of the country’s economic slowdown. It weighs particularly on the Indian auto market, as testified by the 41% fall in car sales compared to the same period one year earlier. In this way, India went from being the major source of incremental demand, with an annual average rate of roughly 5% compared with a worldwide average of 1.5%, to cause a reduction of world growth by 1mbbl/d, trimming at least 100,000 bbl/d from global consumption growth in 2019.

As if this was not enough, US-trade war and general geopolitical uncertainty among investors are projected to cause a significant deceleration in manufacturing activity and freight movements. With trade flows estimated to grow at the weakest pace since the financial crisis this year, US factory activity hit a ten-year low in September with Supply Management Manufacturing index falling to 47.8, the lowest level since June 2009. These trends are going to weight mainly on fuel and petrochemicals demand. In particular, distillates will be the most affected category given their intensive use in manufacturing, freight transportation, mining, and oil and gas production.

The IMO 2020 effects

The International Maritime Organization, IMO, is an entity dedicated to setting out the common rules for navigation across the globe. In 2020, the organization’s new regulations on the amount of sulphur in fuels are set to change drastically the way shipping is done. It is normal, thus, to expect some difficulties in adaptation in the short term.

What will happen in January of 2020 is the enforcement of Annex VI of MARPOL, The International Convention for the Prevention of Pollution from Ships. The most recent version of the law establishes the limit for the presence of sulfur in fuel at 0.5%, down from 3.5%. Even though the global average lies below the older threshold, at around 2.54%, the change is still significantly disruptive. It is, for instance, expected to reduce by 77% the emissions of sulphur oxides and by 34% adult mortality from lung cancer and cardiovascular diseases. The implementation of the regulation will not, however, disrupt shipping all across the globe. That is because ships in Sulphur Emissions Control Areas (SECAs) are not allowed to use fuels with more than 0.1% of sulphur content.

For the rest of the world, there are two alternatives: to substitute the fuel being used or to install scrubbers, which allow continuing use of high sulfur fuel oil (HSFO). Until the first half of 2018, scrubber orders were very low and the market was anticipating a large disruption in the fuel demand. Starting July, however, the order book started to fill up and the gains from production on large scale have attracted even more buyers.

However, a still considerable share of ships will have to run on alternative fuels, due to the high investment associated with the installation of scrubbers (the process takes 3-5 months and costs approx. $3-$5m per vessel). The two most common substitutes are marine gas oil (MGO) and very low sulphur fuel oil (VLSFO). The former is a well-known fuel that has been tested and that offers very low concentrations of sulphur but a higher price. The latter is a new and cheaper option that still faces resistance from ship operators. According to a McKinsey report, new data from the markets indicate that MGO is still preferred and that it will be the most important substitute immediately after the implementation of the new regulations. However, as time passes, the lower prices of VLSFO are set to increase its demand until an equilibrium is reached. The report also mentions a small participation of liquified natural gas on the composition of demand for ship fuels.

Source: McKinsey

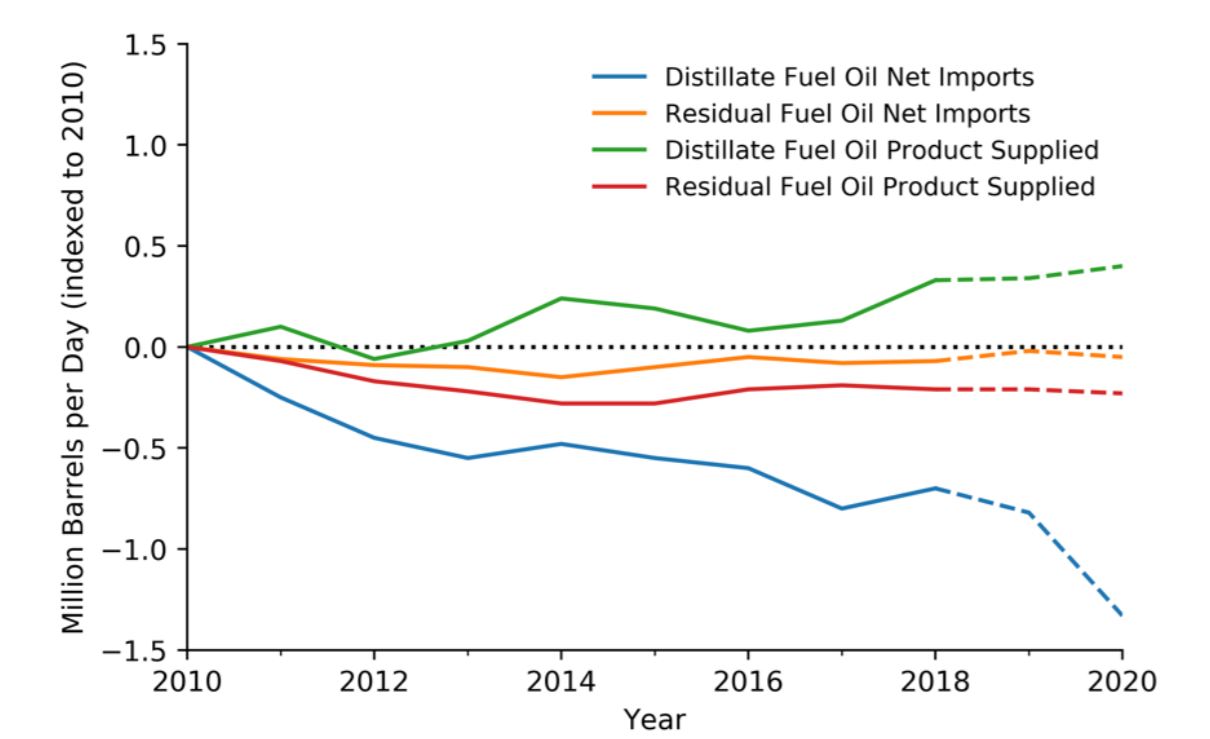

The sheer scale of the market, around 5,75 mbbl/d, can explain the level of disruption of the implementation of IMO 2020. Refiners are expected to suddenly shift from supplying HSFO to a mix of MGO and VLSFO over a very short period. The problem is that such substitution must be accompanied by large investments in specialized machinery, due to the difference in the refining process of the alternative fuels. The most probable scenario in the short term is a tightening of the market for distilled fuels (MGO and diesel included) and a flattening of demand for residual fuels (VLSFO and HSFO included). Projections from the Energy Information Administration point corroborate this scenario:

Source: EIA 2019 STEO

Probably none of the demand disruptions will remain in the long term. As more scrubbers are introduced in the market and refiners increase their production capacity, the market is expected to achieve a new equilibrium.

A favourable response to MARPOL changes: South Korea

Korean refiners SK Innovation, S-Oil, Hyundai Oilbank, and GS Caltex are turning to low-sulfur fuel oil or marine gas oil by investing in desulfurization (the process of removing sulfur from oil). So far, the four firms have injected billions of their local currency to upgrade their facilities and give rise to low-sulfur oil production, which in the long-term will likely compensate for recent financial losses. For instance, the operating profit of SK Innovation and S-Oil is predicted to grow by more than 1.5 times (161%) in 2020 compared to the previous year, according to Daishin Securities research.

High sulfur fuel oil reportedly accounted for more than 70% of the types of shipping fuels used last year and more than 50% of global ship owners are expected to convert to low-sulfur fuel, thus meeting the new regulations. Such a shift represents a challenge to oil refiners and only time will show whether firms will actually reach the predicted rewarding outcomes from the substantial investments.

Government regulations

Denmark

Denmark is gradually converting to renewable energy, setting its target to becoming 100% independent from fossil fuels in the national energy sector by 2050, according to its 2050 Energy Strategy. The government’s initial action consists of ensuring a drop of 33% in oil, gas and coal consumption by 2020 while, in the meantime, focusing on establishing facilities to generate wind energy. In terms of oil consumption, the Danes have implemented several nation-wide restrictions ever since adopting the Strategy. These include the ban of installing oil boilers in new constructions from 2017 and the further increase in oil tax to discourage its use.

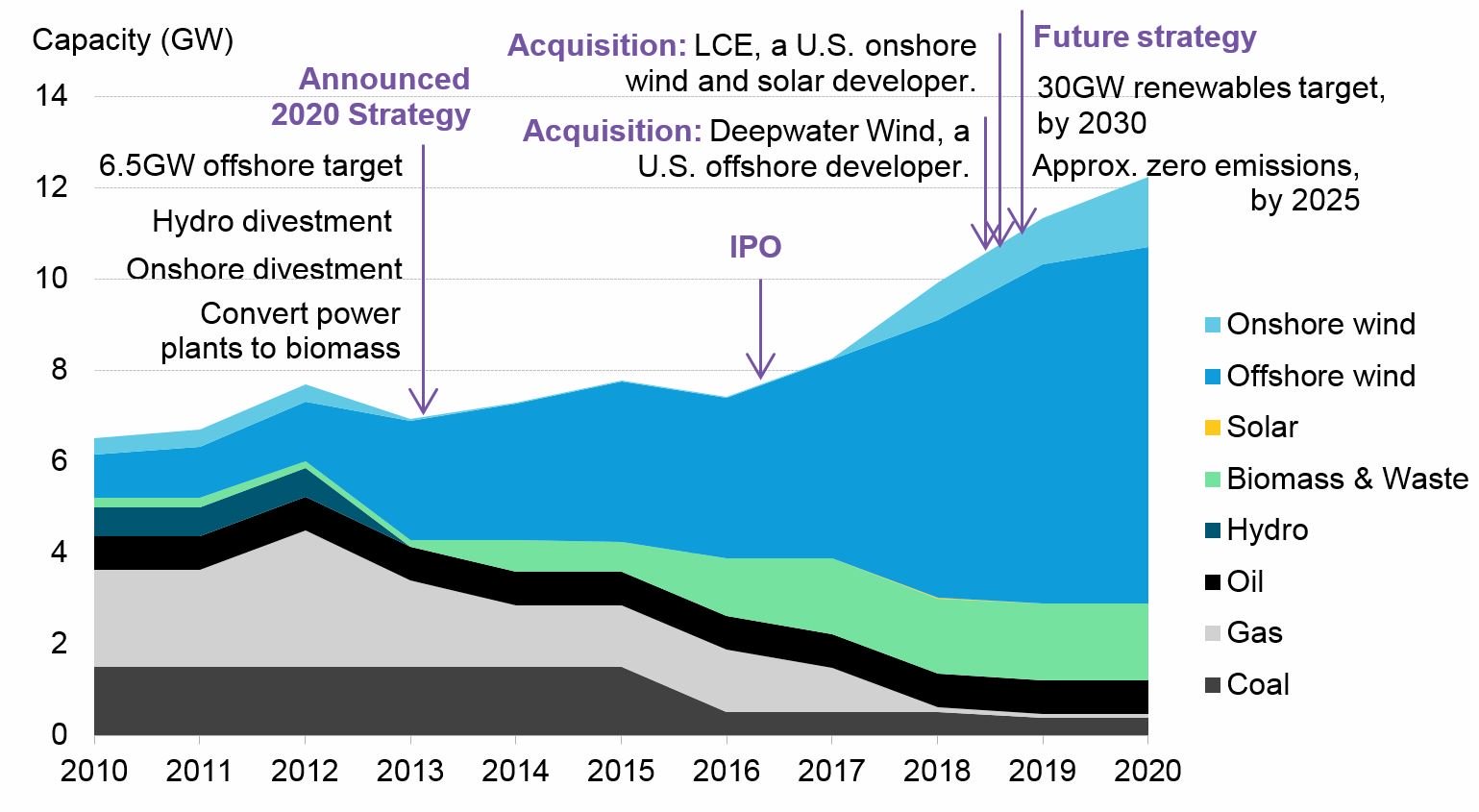

Firms in the oil sector have also been going green during the past decade as well. For instance, Ørsted, Denmark’s largest energy company, underwent a complete transformation from an oil and gas producer to offshore wind major in 10 years.

Orsted’s power assets. Source: BloombergNEF, Orsted. Notes: elaboration by Tom Harries and Meredith Annex found at https://poweringpastcoal.org/insights/economy/orsteds-profitable-transformation-from-oil-gas-and-coal-to-renewables

Germany

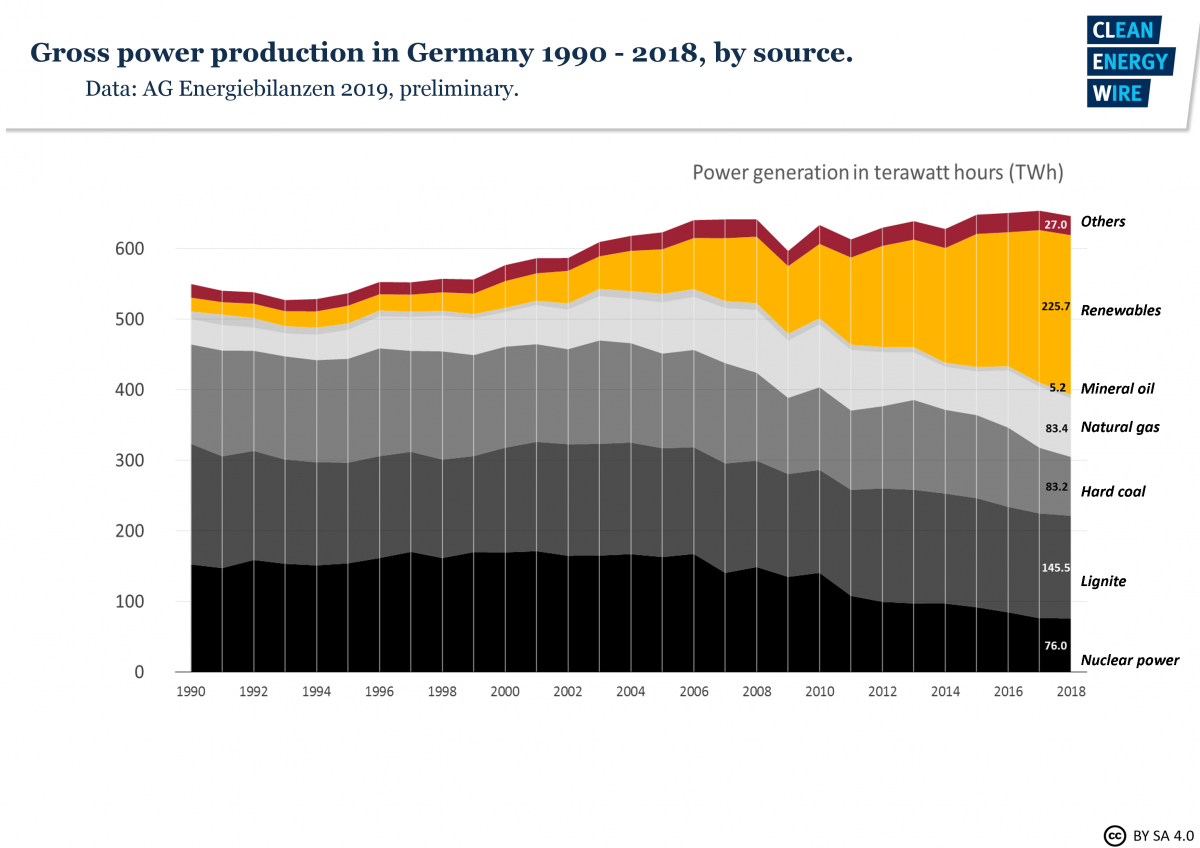

In recent years, Germany has been up to an energy transition (known as “Energiewende”) to a low-carbon and nuclear-free economy, which comes along with certain implications for the oil sector. Being a country highly dependent on fossil fuels in terms of energy generation, the transition may take place at a slower pace than wanted. Regarding the impact of Energiewende on oil consumption, it is small but evident: it has brought down the already minor role oil has in power generation given that affordable renewable energy has been driving out oil-based generation.

Germany is slowly shifting away from oil and increasing its focus on renewables. Source: CLEW

Germany is slowly shifting away from oil and increasing its focus on renewables. Source: CLEW

Oil should be eliminated from German energy consumption by 2050, according to the Climate Action Plan, the government agreed on in 2016.

Fracking, however, has been a more significant issue discussed by German law-makers and has, as a consequence, been banned in 2017. New legislation has prohibited unconventional fracking until at least 2021, while conventional fracking is regulated by much tighter rules. The Act is part of a package of laws and regulations about fracking and related mining, water, and environmental law issues. Similar to the situation in Denmark, the German government plans to ban installations of oil-fired heating systems by 2026.

France

The French government backlash against the petroleum sector is represented predominantly in the form of fuel taxes. France’s fuel taxes, which are among the highest in the EU (64% on unleaded fuel and 59% on diesel), have sparked a wave of protests market by the Gilets Jaunes in the past year. The country is to prohibit all oil exploration processes by 2040, as a result of adopting a plan to cut off the use of fossil fuels. Existing drilling permits are set to expire in 2040 and from 2017 no new ones have been reportedly granted.

The EU

Despite not having established obligatory regulations regarding oil consumption, the European Commission is engaged in hydrocarbon activities and their impact on the environment. As a result, it has published numerous guidelines relevant to regulatory authorities across the Union on how to reduce the damage from oil-related activities.

Such documents include The Hydrocarbons Guidance Document, which consists of a detailed set of recommendations about what best techniques to use for upstream processes (E&P), several Communications related to energy security and fracking, which is the case when an EU country decides to create or modify respective laws, and an array of directives and mid to long-term strategies for an environmentally conscious energy union.

Long-term demand prospects

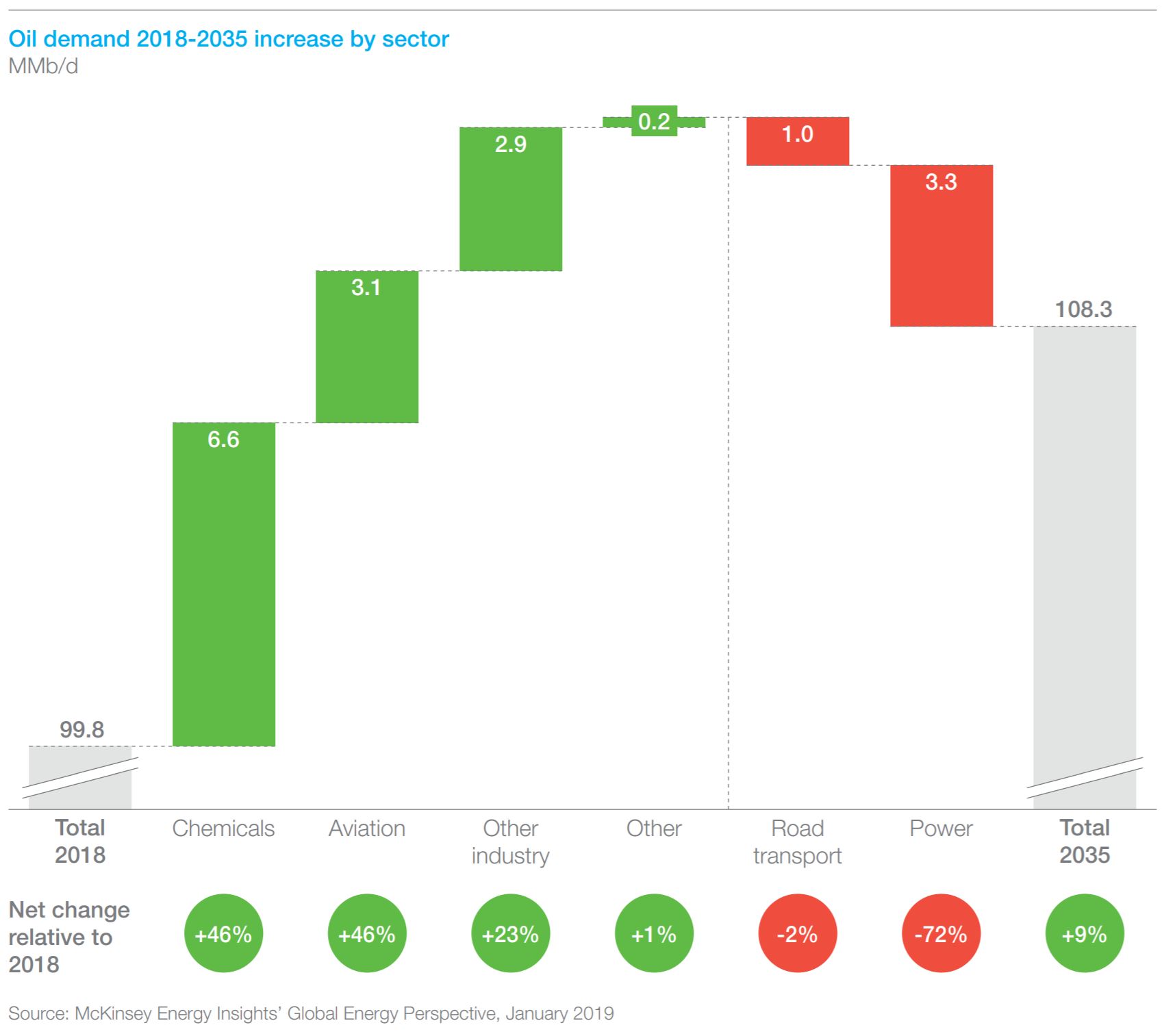

In spite of a predicted increased demand for energy globally, the demand for oil will reach its peak around 2030 according to a McKinsey report. The slowing search for petroleum will be offset by a growing interest in electricity, which is set to double by 2050. Moreover, as renewables become comparatively cheaper, they will represent a growing share of the global market for energy.

Source: McKinsey

The area in which oil will lose the most space will be power generation. The market already sees natural gas as a better alternative to generate electricity since it is more cost-efficient and releases less carbon dioxide. There is also a trend of higher adoption of renewable sources, mainly solar and wind, as the technologies continue to evolve rapidly.

Another important area of decline in demand for oil is road transportation. The development of more efficient electric vehicles (EVs) makes them a more competitive option vis-à-vis internal-combustion cars. By 2050, for instance, the proportion of EVs on the streets is forecasted to be 27%, from less than 1% in 2018. Although this effect is partially offset by the persistent growth in demand from developing economies, as EVs continue to be an unaffordable option for most households in such countries.

The largest contributor to the growth of demand for oil is the chemical sector. As a large part of industrial procedures and processed materials are still heavily reliant on oil, economic growth will likely also increase the demand for oil.

Source: McKinsey

Saudi Aramco’s response to demand trends

In response to the scenario described above, oil companies have taken measures to better position themselves for the future. Saudi Aramco has probably been the most active company in moving towards downstream production. It has historically been focused on exploration and production, but, in 2019 alone, Saudi Aramco has already deployed more than $70bn in acquisitions of downstream companies. The largest and most relevant deal was the purchase of a 70% stake on SABIC. Later on, the company also acquired 17% of Hyundai Oilbank and 50% of Shell’s Saudi Arabia refinery (SASREF). In this way, Aramco intends to boost its refinery capacity from 4.9mmb/d to 8.10mbbl/d until 2030.

0 Comments