Intro

Cross-currency basis swaps, also known as basis swaps, are contracts in which two counterparties agree to exchange interest payments according to two floating rates as well as notional principals denoted in two different currencies.

![]()

Theoretically, covered interest rate parity should hold in absence of arbitrage opportunities. Here S and F denote the spot and forward exchange rate in units of US dollar per foreign currency, r the US dollar interest rate, and r* the foreign currency interest rate.

Meanwhile after 2008, deviations appear as a result of combined reasons including credit deterioration of dollar-raising banks, strict regulation in both arbitrage activities and in FX hedging requirements for European financial institutions as well as divergence in monetary policy environments.

![]()

Using market spot and forward pair, the difference between is measured by basis b. When a foreign currency shows negative basis against dollar, it means extra costs for borrowing dollar and premium for lenders.

In this article we discuss how basis swap-indicated dollar hedging costs are influencing domestic and foreign trade sentiments, the dollar reflux pattern, thus the financial market movement.

Trending Trades

Basis swaps became the heart of some trading patterns that US investors have recently used to gain additional profits by investing in euro-denominated bonds over the US treasuries. This is given by a combination of facts that exacerbated the dollar shortage that the market has witnessed in response to the tax cuts operated by Donald Trump and the increasing amount of debt auctions needed to plug the widening US budget deficit.

The offshore dollar shortage caused the EU basis swap to turn even more negative and the diverging monetary policies that ECB and the Fed have operated in the last year did the rest. This particular combination of factors enabled traders to earn an extra return of up to 0.53% over 1-year US treasuries just by investing in negative-yield German Bunds and hedging through swaps: He would pay the negative Euribor (an actual inflow), receive the positive US Libor cash rate as well as the positive basis.

Nevertheless, we have noticed a convergence of the two 1-year returns ever since the highest difference in late March-early April with the extra return diminishing, but still present in the market. As of November 9, 2018, by investing in a negative-yielding 1-year Bund (-0.64%) an US-investor is actually able to extract a hedged annual return of 2.91%, higher than the interest rate on a 1-year US Treasury, equal to 2.73%. This is done by receiving a 3.13% 12 months US Libor, paying a -0.22% 12 months Euribor, and receiving an extra 0.19% from the EUR basis swap. Similarly, a European-based investor is strongly discouraged from investing in US Treasuries as, in addition to paying the US Libor and receiving a negative Euribor, he/she would need to pay 0.19% because of the negative basis swap. All in all, this would yield lower than the -0.64% 1Y Bund return. It is also worth noting that the Bund is also higher-rated than the US Treasury by S&P, so that investing in a similarly rated instrument denominated in euros would boost even more the extra return.

Moreover, we also went further to analyse the locked-in rate of return for longer holding periods that matter for many overseas pension funds. Nevertheless, in a 10-year horizon the EUR/USD does not seem to offer any particularly interesting occasion, with the 10-year basis swaps and the OIS rates allowing for a difference in returns among a hedged 10Y Bund and a 10Y US Treasury of just 0.01%.

Much more interesting is, on the other hand, the USD/JPY pair in the long term. In this case the market is probably pricing a longer-term divergence between the monetary policies of the two countries; which allows the arbitrage opportunity to persist also in the long term. Indeed, the 10Y JPY swap stands today at -0.07%, with a Japanese OIS Swap (used as a proxy for JPY Libor) yielding a 10Y annualized return of just 0.03%. Given that the 10Y OIS Swap annualized return for the US is as high as 3.27%; the possibility to receive the US Libor and the basis swap and paying such a low JPY Libor creates once again opportunities for US investors. Indeed, by investing in 10Y Japanese bonds with a YTM of 0.11%, they can actually earn a hedged annualized return of 3.73%; far higher than the 3.19% yield of the 10Y US Treasury. All in all, whether an US-investor is investing in the short (1Y) or long (10Y) term, it is in any case discouraged from buying US fixed income securities. Indeed, simply by hedging returns through swaps, they can get an extra annualized return by investing in German Bunds (1Y) or Japanese Bonds (10Y) of 0.18% and of 0.54%, respectively.

Market Reaction

As a matter of fact, the benefit of borrowing Yen has appealed to so many real money investors rich in dollars that foreign holdings of JP government bonds have increased 17.93% since midyear 2017, with total outstanding amount almost unchanged.

Conversely, many attribute the recent US yield curve back-end sell-off to a lack of overseas buying from Europe and Japan as discussed above. Unlike the rising front-end which prompts money market funds’ investing offshore dollar back, steepening back end reflects an opposite direction. The pressure for further spike is more or less lessened with the Fed just softening its tone on rate hikes plan and market becoming costly for bearish bets, i.e. long maturity Treasury ETF saw implied volatility skew peaking decade high.

Nevertheless, for a government speeding up debt issuance, enthusiasm from offshore dollar is far from satisfying. Aside from carry seekers in Europe and Japan, emerging market counterparties calculating trade war casualties are reweighing their efforts in helping dollar financing, and oil producers are affected by the price as well as recent events. As indicated by the latest September data, foreign investment saw outflow of $29.1B, highlighting on outflowing China and Japan holdings of $13.7B and $1.9B MoM respectively. Domestic investors dumped $23.4B long-term securities.

| Amount($bn) | %YoY | %MoM | |

| China | 1151.4 | -2.61% | -1.18% |

| Japan | 1028 | -6.20% | -1.33% |

| Other Foreign Holders | 4044.5 | 0.52% | -0.33% |

| Total | 6223.9 | -1.24% | -0.22% |

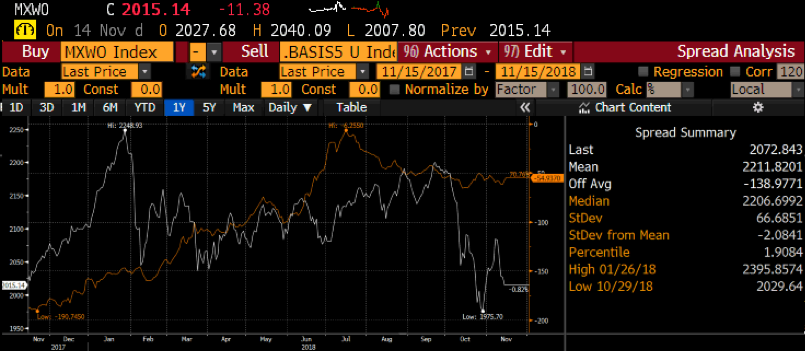

Hence basis swap, revealing dollar funding, could potentially influence equity market, especially if domestic investors start to rebalance their bond-equity allocation when overseas investors lose their interest.

Source: Bloomberg

We take the aggregation of 9 developed market currencies’ (G7 plus DKK and SEK) 5yr currency-swap basis to construct an index. By comparing its historical trend with MSCI, it is shown that in 2018, the divergence between two indices widened before events like February correction, Turkish Lira slip as well as the recent equity market wobble.

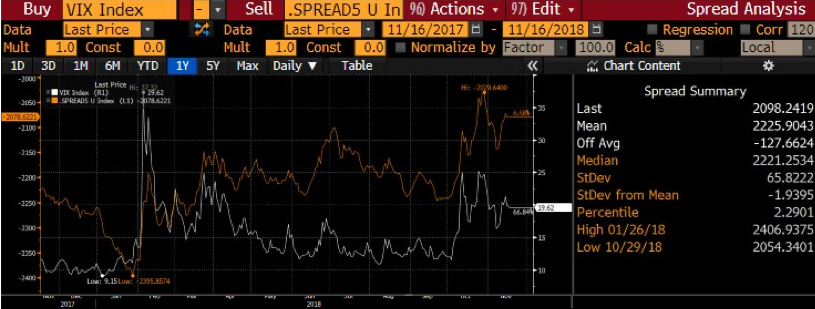

Source: Bloomberg

Then by comparing the spread with VIX index we could spot synchronization, which suggests that when basis swap shows offshore dollar funding pressure which has not been priced in stock markets yet, volatility is also brewing. Such mutual reinforcement makes basis swap meaningful for equity investors as well.

1 Comment

Trading the Russian Invasion – BSIC | Bocconi Students Investment Club · 27 February 2022 at 17:30

[…] is currently trading 17.97bps. The functioning of XCCY swaps is described in a previous article here. In this setting, we believe demand for dollar in the local (Russian) financial market could well […]