XL Group Ltd (NYSE:XL) – market cap as of 09/03/2018: $14.4bn

Axa SA (EPA:CS) – market cap as of 09/03/2018: €54.5bn

Introduction

On the March 5, 2018, the French insurer Axa announced its intention to buy 100% of Bermuda-based XL Group, which also operates in the insurance industry, for $57.6/share. The implied valuation of Bermuda’s XL group implies a total transaction value of $15.3bn, to be paid in cash. Such move will allow Axa to focus on the property-casualty (P&C) insurance segment, thus moving away from its current predominant life & savings (L&S) business. The announcement, however, triggered a strong reaction in the market, where investors indicate that the value could have been overestimated.

About Axa

Axa was founded in 1985 by the alliance of three French insurance companies – Mutuelles Unies, Drouot and Allie Mutual Societites – which were joined by a fourth, Présence, one year later. The firm’s headquarters are located in Paris and its operations are mainly focused on Europe, North America and Asia. The firm’s three core businesses are Property and Casualty Insurance (P&C), Asset Management and Life and Savings (L&S). The P&C insurance division provides customers with personal belongings/property insurance and liability coverage. The Asset Management group invests clients’ cash and securities in the market and offers a wide range of traditional and alternative products such as fixed income investments, active investing portfolios and quantitative investing portfolios. On the other hand, L&S provides retirement products and personal protection coverage and was responsible for 54% of the €100bn in revenues in the latest financial year, thus representing Axa’s main business. The company is listed on Euronext and yielded a net income of €5.8bn in 2016. In the latest reported financial year, revenues remained constant while both net income and EPS figures rose, signaling a period of (sustained) margin growth. For instance, the growth in net income has been around 8.5% across the last 5 years and 6.5% in 2017. Due to such a sustainable positive trend, the firm was able to pile up a substantial amount of cash to finance M&A transactions and capex investments. Recently, Axa CEO, Thomas Buberl announced he is looking to reshape the firm’s strategy for a “new golden age of insurance” in which cybercrime threats, natural disasters and fast-changing habits (such as the surge in US motor claims) drive demand for coverage.

About XL Group

In 1986, 68 Fortune 500 companies founded EXEL Limited in the Cayman Islands. The original company, which later became XL Group, aimed at dealing with risk after the liability insurance crisis of the 1980s. Now based in Bermuda, the company is listed on the NYSE and has a market cap of $14.4bn. It serves clients in more than 215 countries and focuses on the P&C business on both insurance – which represents roughly two thirds of revenues – and reinsurance, accounting for the remaining third. For the past two years, the company has faced problems dealing with the expenses arising from the legal obligation of fulfilling the claims of its insured clients due to natural catastrophes such as the hurricanes Harvey, Irma, and Maria. In the latest reported financial year, those events alone accounted for $2.0bn in claims which, although representing a small fraction of the hundreds of billions of damages claimed in US, significantly contributed to the net losses reported in 2015 and 2016.

Industry Overview

Insurance and reinsurance companies compete in a progressively consolidating industry, where large players expand both horizontally (at the industry level, where incumbents buy each other to offer an enhanced portfolio of services and products, like in the Axa/XL case), and vertically (either expanding upstream or downstream in your business model by acquiring complementary resources – like in potential acquisition of a stake in SwissRe by SoftBank). Despite US acquisitions generally becoming more attractive because of a lower corporate tax rate, the entry of private equity firms in the North American insurance market should clear all doubts about the sector’s potential (indeed, the tax reduction taken in isolation is not a big enough driver to justify such an increase in the number of acquisitions in the sector).

Furthermore, the US tax cuts implemented by the Trump administration have put pressure on Bermuda-based insurance companies, since they made doing business in the US market more convenient. Moreover, the BEAT (Base Erosion and Anti-Abuse Tax) makes it harder and more expensive for insurers and reinsurers to shift business to their Bermuda-based subsidiaries: the BEAT, which tackles strategies undertaken by multinationals that exploit mismatches and gaps in tax schemes to artificially move profits to low or no-tax countries, aims at mitigating the erosion of the US tax base by those corporations that make deductible payments to affiliated non-U.S. entities. Such a regulation indeed applies to the abovementioned payments a minimum tax rate of 5% for 2018 and 12.5% for taxable years beginning after December 31, 2025. Therefore, it goes without saying that there are incentives for Bermuda-based insurance companies to sell to foreigners. The Trump’s tax overhaul also stops the so-called “Bermuda insurance loophole” that has allowed non-U.S. insurers and reinsurers with U.S. subsidiaries to elude US taxes by transferring reinsurance to their non-US reinsurers in the Cayman Islands and in Bermuda.

In addition, the implementation of the new international accounting standard IFRS 17 (effective in 2021) will bring new challenges to incumbents in the insurance market. IFRS 17 aims at standardizing and increasing transparency in the way insurance liabilities are measured. Therefore, it will likely increase volatility in reported equity capital and profits for life insurers holding long-term liabilities and embedded policyholder guarantees, due to the change in the way liabilities are valued. It follows that IFRS 17 – paired with Solvency II – will require adequate investments in new data collection systems and processes, thus possibly exerting negative pressure on future operational metrics.

Deal Structure

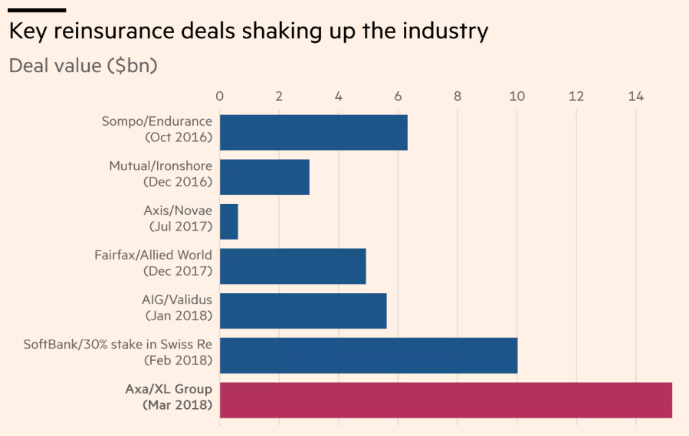

The one of XL Group is the largest deal that Axa has made in a decade. With its $15.3bn ticker, it is the largest in the sector since the beginning of 2018 and the largest in the reinsurance sector in the last two years, according to the FT.

Source: Financial Times

The transaction represents a major breakthrough for Axa and XL, as it accounts for 23% of the former’s market cap and 87% of the latter’s one. According to the transaction price will be fully paid in cash, €3.5bn (c. $4.3bn) of which directly coming from Axa’s sources, with the remaining to be financed through bridge financing already in place. Furthermore, two long-term sources will also support Axa in the deal: the expected €6bn (c.$7.4bn) IPO of its US life and annuity business and the issue of a €3bn (c.$3.7bn) subordinated debt.

Axa is paying a premium of 33% to XL Group closing share price on the trading day prior to announcement, amounting to purchase price per share of $57.60. The transaction is valued at c.11x forward P/E, including €360m of total pre-tax synergies split as follows: €180m in cost synergies, €90m in general revenue synergies and €90m in reinsurance synergies. Moreover, it’s foreseen that AXA will experience an 80% or more remittance ratio (the proportion of cash transferred from the operating units to the parent) from XL Group, having to move its cash pile from Bermuda.

The deal is subject to XL Group’s shareholders’ approval and is expected to be completed by H2 2018.

Deal Rationale

Zero-bound interest rates and falling prices have been dominating the financial markets in recent years and have put pressure on specialized insurers and produced substantial capital – typically alternative capital – inflows, propelled by investors in response to a decreasing long-term industry profitability. This environment laid the foundations of the currently witnessed consolidation wave, affecting a sector where Axa-XL is only the latest of a series of deals completed in 2018.

The deal was announced while Axa is in the process – announced in May and expected to take place in the next months – of free floating a minority stake of its US life and annuity operations. Although Axa confirmed that the acquisition is going to offset the EPS dilution generated by the aforementioned IPO, existing shareholders look sceptic towards this decision of making use of funds raised from listing to acquire such a big and recently not well performing player, as reflected by the French insurer’s post-announcement share price.

Besides the common cultural background shared by both companies concerning human resources, risk management and innovation strategies, the transaction is expected to mainly create value for shareholders from risk diversification and increased scale. The deal places Axa in a leading position in the P&C large and upper mid-market, accelerating the insurance provider’s shift from the previously predominant L&S risks towards pure insurance items. In light of the upcoming implementation of the EU’s Solvency II regulatory framework, this reduced share of financial exposures will also generate benefits to the French company in terms of strengthened capital structure. The following graph illustrates Axa’s revenue breakdown before and after the deal and the above-mentioned IPO.

The virtually inexistent overlap between Axa and XL’s operations – Axa’s P&C revenues only account for €2.3bn ($2.8bn), adding up to $15bn by combining XL Group’s revenue figure – ascribes to the deal the typical traits of a growth-oriented combination. Shareholders would therefore see their future growth opportunities enhanced, primarily relying on technical earnings and reduced market sensitivity – lower beta and cost of equity – as well as an overall improved cash remittance capacity. On top of this, the acquisition is in line with the customer segmentation preferences conveyed by Ambition 2020 – Axa’s industrial plan – and targeting high frequency customers, taking on board a significant and geographically complementary product portfolio.

Finally, both insurers share a remarkable drive towards innovation, with already established venture capital funds seeking investment opportunities in the boiling insurtech sector, from which potentially interesting synergies could also arise.

Market Reaction

Axa’s share price at €22.6 at the end of March 5, 2018, reporting a 10.7% decrease on Friday closing price and touching their lowest levels since the end of February 2017. It is most probable that such a decrease in value is due to investors’ expectations of a too high premium with respect to the long-term profitability and success of the combined entity. On the other hand, NYSE XL Group’s shares skyrocketed at $55.9, recording a 29.1% increase when compared to Friday closing price. Again, this surge in XL Group’s stock price is explained by the high acquisition premium paid by the bidder.

Financial Advisors

Morgan Stanley is acting as XL’s financial advisor, while Axa SA is assisted by JP Morgan for all financial matters.

0 Comments