Introduction

We have seen some of the unique trading instruments introduced by the crypto space in our last article, namely perpetual futures and inverse futures and options. Building on our knowledge from another prior article where we introduced cryptocurrencies, basic blockchain infrastructure, as well as some decentralized finance (DeFi) market microstructure, we will take a look at:

- Bitcoin Hashprice Non-Deliverable Forwards (NDFs)

- Impermanent Loss Protection Options

- Power Perpetuals

Bitcoin Hashprice Non-deliverable Forward

Hashprice is a term coined by Luxor Technologies, a company focused on providing Bitcoin mining services. Hashprice reflects the revenue miners can expect to earn from each unit of hashrate, where the hashrate is the speed, measured in hashes per second, at which a computer can perform an operation in a cryptocurrency’s code. The table below exhibits the most common units of hashrate:

Table 1: Hashrate Measurement Conversion Table

Source: Luxor Technology Corp.

Essentially, the Hashprice attaches a concrete monetary value to miners’ computing power. Following the logic, thanks to computing power miners can mine Bitcoin, which in turn has a specific monetary value. Therefore, the Hashprice is a function of four inputs: the block subsidy (amount of Bitcoin minted in each block), transaction fees captured by the network, network difficulty (how difficult it is to produce a new block), and the Bitcoin price. Hashprice is positively correlated with changes to Bitcoin’s price and transaction fee volume but negatively correlated with changes regarding Bitcoin mining difficulty.

Since the derivative is a non-deliverable forward, the contract is always cash settled. For NDFs in general, the difference between the fixed price in the contract and the settlement value of the underlying commodity at the expiration of the contract is paid in cash from one party to the other. In the case of the Bitcoin Hashprice NDF, the value of the underlying commodity is the hashrate value for which the Bitcoin Hashprice Index, provided by Luxor technologies, is used as a reference rate.

Figure 1: Bitcoin Hashprice Index Time Series

Source: Luxor Technology Corp.

Bitcoin Hashprice Non-Deliverable Forward contracts themselves are traded over-the-counter (OTC) and therefore tenors can be adjusted to the counterparty’s specific needs, though generally, the contracts are executed on a monthly basis. Regarding the contract size, the Hashprice is quoted in USD/PH/Second/Day and is settled in USD.

With Bitcoin prices, electricity costs, and hash prices being some of the major inputs that determine miners’ profits, the use case of this derivative for miners is quite apparent. They naturally have a long exposure on the Bitcoin Hashprice Index and therefore can use the NDF to hedge their positions and lock in the hash price by going short, i.e. selling the contract. The buyer of the contract (going long the index), on the other hand, is able to get non-physical exposure to the Bitcoin mining industry. Intuitively, the natural flows of the product would be rather skewed to the short side. However, this does not mean that the market as such cannot thrive.

The VIX futures market can act as a good comparison of how naturally one-sided markets can manifest themselves. Conversely to the Bitcoin Hashprice NDF, demand for going long the index is dominant in VIX futures markets because of its negative correlation to the S&P 500 during crashes. This, among other reasons, leads to VIX futures historically being traded at a premium, as the market balances demand and supply. To be able to sell contracts and not have exposure to the VIX itself, market makers or more generally contract sellers try to hedge their short exposure by going long the SPX using options.

We see a possibility for a similar evolution in the market for Bitcoin Hashprice NDFs. Since natural flows would intuitively be skewed to the short side in this market, market makers would need to act as buyers. In order to hedge their long position in the Bitcoin Hashprice Index, they could enter a short position in Bitcoin since there is a positive correlation between the Hashprice Index and the Bitcoin price. It is important to note, however, that the price of Bitcoin is only one of four inputs that determine the Hashprice Index, making the hedge rather difficult and somewhat incomplete.

Finally, even though there is a somewhat imperfect comparable market that exists since 2004 in the VIX futures market, the question of whether the Bitcoin Hashprice Index Non-Deliverable Futures market will flourish remains to be seen.

Impermanent Loss Protection Options

The dominant way to currently trade assets using a blockchain is using an automated market maker (AMM), which determines the price one receives using the inventory of the assets one is swapping between in the liquidity pool. For instance, if the ratio of deposited USDC to ETH in the liquidity pool is 2000:1, then the price of ETH in terms of USDC is 2000.

Where does the capital in the liquidity pool come from? So-called liquidity providers (LPs) deposit capital in liquidity pools to profit from swap fees as well as earn capital earmarked by parties interested to incentivize liquidity provision, the infamous practice of yield farming.

Why do they not simply use a classic, order book microstructure to trade these assets? In short, popular blockchains like Ethereum have a block time that is too long for low-latency trading that characterizes electronic order book trading. For example, Ethereum Mainnet’s block time is around 12 seconds. Furthermore, many argue that trading fat-tail assets like cryptocurrencies is best accommodated by AMMs since it is very difficult for market makers to sustainably and profitably trade these assets and keep low spreads, especially in their early growth stages.

It is noteworthy to mention that there are some on-chain order book exchanges on less popular blockchains with lower block times such as on Solana, though these microstructures face their own problems, most notably, issues regarding miner extractable value (MEV).

What are the risks of providing liquidity on AMMs? As an LP, you usually provide two or more assets, meaning you are exposed to the price risk of these assets. This can be easily hedged by using delta 1 products, most commonly, perpetual futures. But that is not all. Because of the nature of cryptocurrencies, a common goal that AMMs share is guaranteeing liquidity for a token at any price, no matter what. This requires having a bonding curve that asymptotically approaches exchanging an infinitesimal amount of token A for an infinite amount of token B, and vice versa.

Figure 2: Constant Product AMM Bonding Curve

Source: Uniswap Labs, Bocconi Students Investment Club

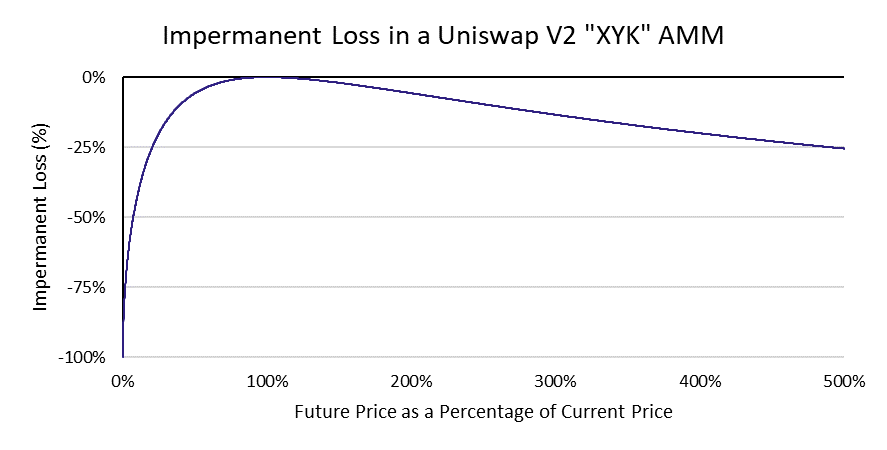

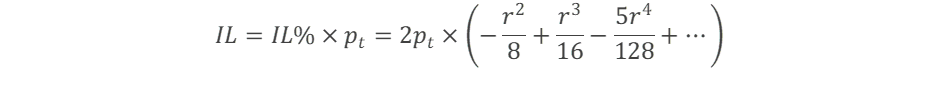

Thus, as a liquidity provider, the more one asset increases in value against the other(s), the less proportional the value they receive in return. Therefore, the more the price (token A in terms of token B, and vice versa) drifts away from the price at which the LP initially deposited, the larger this opportunity cost. This phenomenon is called impermanent loss and is an inherent feature of AMMs. For the classic, XYK AMM bonding curve (the one introduced by Uniswap V2, historically the most widely used AMM), this is the equation that gives impermanent loss:

Where pt is the price indicated by the liquidity pool at time t, the time when the LP deposited, and pt+1 is the price at any point in the future. Read our prior article for the full derivation.

Figure 3: Impermanent Loss Curve for a Uniswap V2 “XYK” AMM

Source: Uniswap Labs

Given this unique risk factor, can market participants adequately hedge against this risk, and if so, how?

Because the only factors that matter in determining impermanent loss are the initial price and a future price, making it path independent, one can develop a simple exotic option that pays out the realized IL at maturity. Thus, pricing the premium to be paid only depends on the probability distribution of the final price that can be inferred from options prices.

Introducing Impermanent Loss Protection Options: a premium is paid upfront with the realized IL paid out at maturity. This structure, for example, is the one provided by OrBit Markets, an institutional liquidity provider of options and structured derivatives in digital assets.

With recent advancements in AMMs, liquidity provision has become more capital efficient. Most importantly, in Uniswap V3, now home to the most liquid markets in DeFi, instead of forcing every LP to contribute to liquidity across the entire curve – additional deposits increase k, meaning that slippage is decreased and therefore liquidity has improved across the entire curve – each LP can decide under which price range they want to provide liquidity for. Thus, compared to the full range LP of Uniswap V2, there is embedded leverage, thereby meaning that IL is more negatively convex in Uniswap V3.

Where

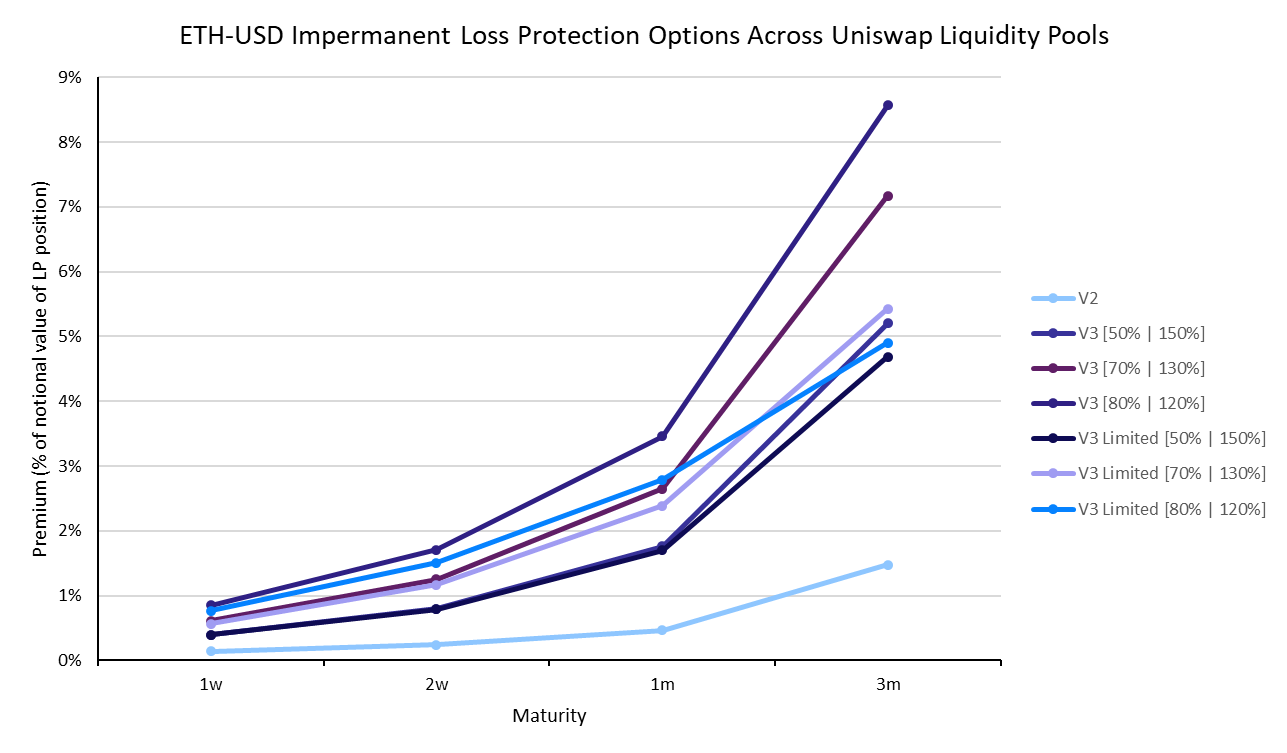

OrBit Markets, for example, publicly quotes two types of Uniswap V3 Impermanent Loss Protection Options: V3 and V3 Limited. V3 Limited has the property that it is cheaper because if the price of the underlying exits the desired range, the protection is paid out immediately and the trade is terminated. For both, there are numerous options for ranges that counterparties can choose from.

Figure 4: ETH-USD Impermanent Loss Protection Options Across Uniswap Liquidity Pools

Source: Laevitas

Unsurprisingly, the longer the tenor, the higher the premium as there is a greater probability that the final price will be further away from the initial price. Logically, this probability is strongly correlated with implied volatility. Notice how V2 is by far the cheapest because it is the least concave, though becomes a little more interesting when analyzing V3 options: there is an overlap between regular and limited variants based on how tight the range is.

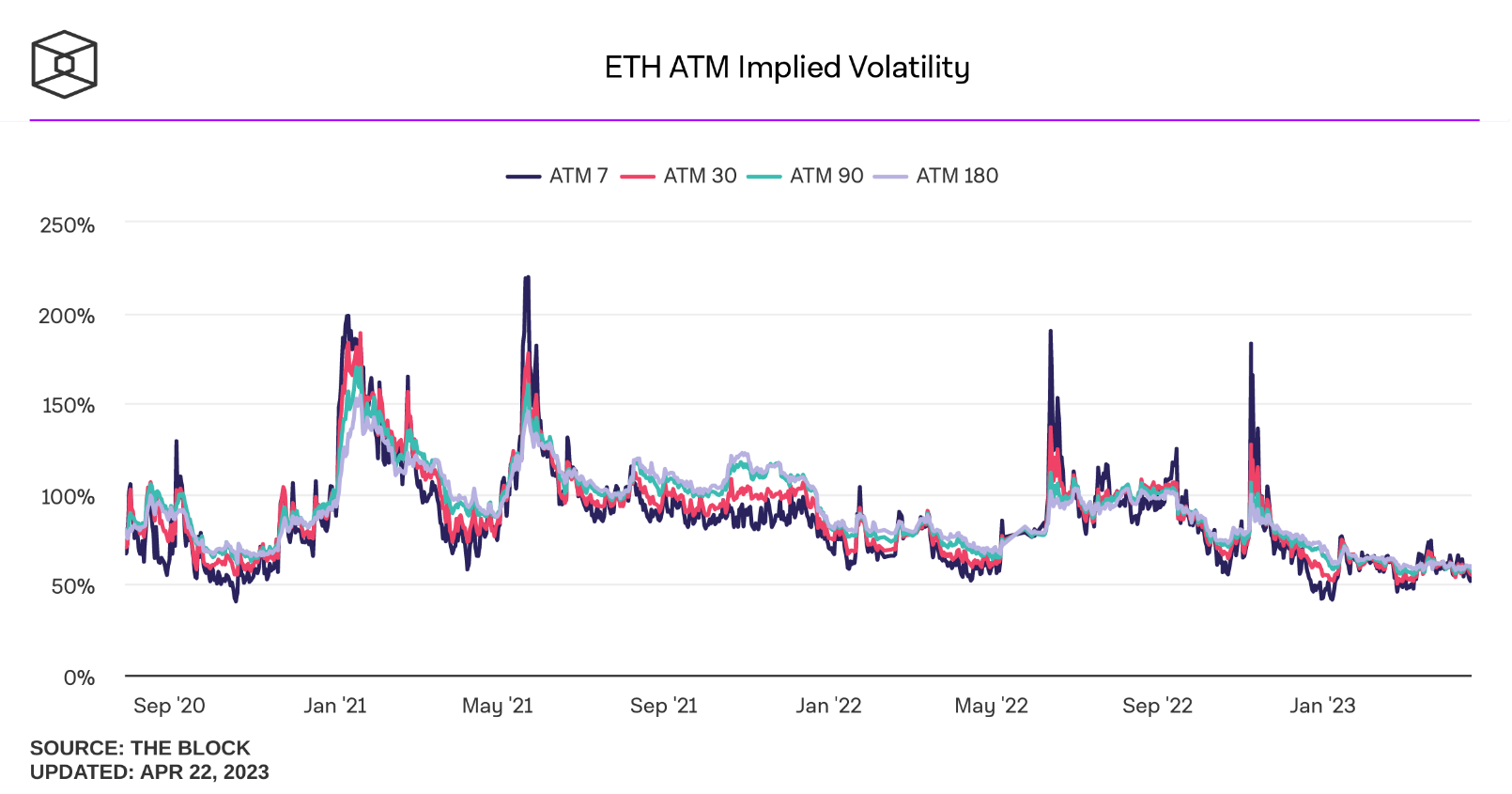

Figure 5: ETH At-the-Money Implied Volatility Time Series

Source: The Block

Since IVs have been trending lower the IL protection options have become cheaper which has contributed to their increased popularity, and now OrBit Markets offers IL protection options for liquidity pools for many of the top 50 cryptocurrencies by market cap.

How successful has this product been? Firstly, it is noteworthy to mention that several teams have been working on bringing such a product to a public market, but it has not happened to date due to the complexity at hand as well as the size of the market compared to – IL Protection Options are risky to build since they are dependent on incumbent AMM standards which regularly get challenged and iterated upon. Also, demand for such a product is difficult to gauge unless you are a market maker for this product in the OTC market. It is therefore only traded OTC.

There are some interesting considerations in pricing for an altcoin-USD liquidity pool. For instance, how can you estimate the probability distribution of prices for an asset that does not have listed options? For one, a market maker could use the OTC market they are operating in as a reference, but it is safe to assume that these are too illiquid to be useful. An alternative is to use the much more liquid ETH or BTC options on a centralized exchange (CEX) like Deribit and fit the curve based on asset betas for these assets. The difficulties with that: some of these assets have not traded for long, may experience significant breaks in correlation with ETH/BTC due to idiosyncratic risks, could not correlate well with ETH/BTC in the first place, etc.

It should be noted that some altcoins have listed options on DeFi options AMMs such as Lyra, Premia, and Synquote, but the markets are too small and illiquid to treat as a reliable source of reliable data.

Impermanent Loss Protection Options solve the issue for LPs looking to hedge, but how do market makers hedge their risk?

Given the IL curve’s concavity, we can determine that delta hedging will not be enough, and dynamic delta hedging is impractical due to transaction costs that are especially high considering the high volatility and low liquidity that characterize cryptocurrency markets. Logically, we will have to find a way to acquire positive convexity that matches a similar profile to the negative gamma of the IL curve. How do we do it?

Firstly, let us decompose the IL curve. If

![]()

Then

The square root term can be expanded as a Taylor series, giving us

Thus, the optimal hedge would counteract all these terms. What are the alternatives? There are several considerations:

Thus, the optimal hedge would counteract all these terms. What are the alternatives? There are several considerations:

- Cost

- Complexity

- Hedging effectiveness

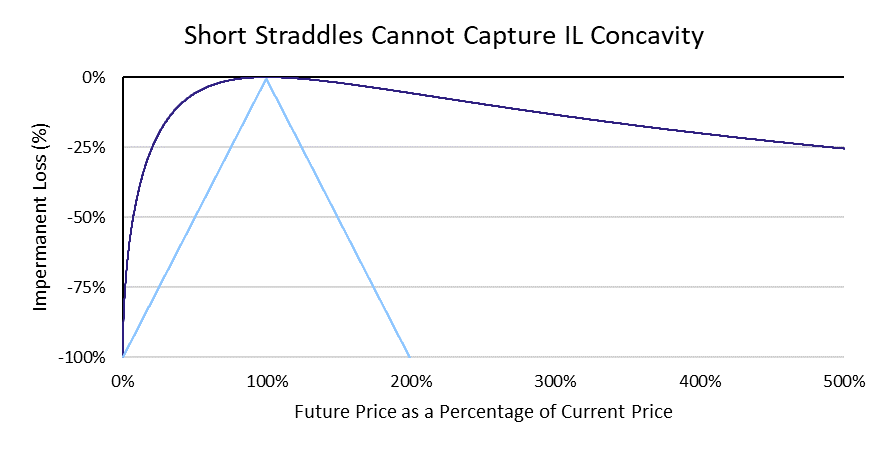

Let us first consider using vanilla options. A popular notion is that because of the negative convexity of the IL curve, one can hedge using short straddles. This is far from the truth, as the convexity profiles do not match at all.

Figure 6: Short Straddle Options Strategy Profit and Loss Against the Impermanent Loss Curve

Source: Uniswap Labs, Bocconi Students Investment Club

One could combine a strip of options to try to closely replicate this exposure, but this would be costly and complicated, especially in the fairly undeveloped cryptocurrency volatility markets.

A new product that came to market has been Power Perpetuals which could solve this issue by simplifying and cheapening the hedging process.

Power Perpetuals

Power Perpetuals give a unique exposure to the power of a price of an underlying asset, for instance, the variance (2nd power), the skewness (3rd power), kurtosis (4th power), etc., of ETH, and have no expiry date (hence the “perpetual”) nor a strike price.

The main concept is similar to that seen in perpetual futures: the price of the derivative is kept in line with an index price using a funding mechanism where longs pay shorts or vice versa, thereby seeking to incentivize market participants to rebalance the market back in line. For example, in the ETH2 power perpetuals market, given an ETH price of $10 and an ETH2 power perpetual contract at $105 at the time when funding is paid, the long parties would pay shorts so the price of the power perpetual can converge to $100.

Continuing with the example, the exposure one receives from being long an ETH2 power perpetual is

Getting back to hedging IL, the nominal amount of IL is given by

Because of the diminishing returns from hedging the non-quadratic terms, as well as for the sake of simplicity, we will shift our focus to hedging the quadratic term, leaving us with wanting to open a position that gives the following exposure

Thus, being long a quarter of an ETH2 perpetual would eliminate the quadratic term, but also leaves you with some delta exposure that can be hedged out using futures contracts.

It is easy to see that the introduction of an ETH3 product would allow for even more complete hedging. In practice, the higher the power, the less likely the product is traded, and if it is, it will almost surely trade in a far less liquid manner, making near-complete gamma hedging unrealistic. Therefore, market makers are likely left with some risk on their books that can be dealt with through the internalization of other trades. Thus, it can finally be concluded that because fully hedging the entire risk is unfeasible for non-dealers, power perpetuals can be a product that can “complete” the market. It can be argued that its existence is positive sum as it is provides financial utility to all market participants; LPs can fully hedge themselves from IL risk that they could unlikely hedge themselves in vanilla or exotic derivatives markets. Nevertheless, non-dealers can use power perpetuals as a hedge for simplicity, and in reality, not many people hedge in the first place, so those that do may be content with leaving some risk on their books.

What are some further advantages of power perpetuals?

You may notice a trend with many popular products or innovations in the financial cryptocurrency space: that is, the abolishment of tenors. The main argument for this is that having a one-size-fits-all product greatly diminishes liquidity fragmentation – instead of many markets across many maturities, there is one. Why does this matter? Having greater liquidity for the hedging product makes funding rates more predictable, stable, and low, making it a better hedging tool overall. Maximizing liquidity is valuable since it is argued that this opens opportunities to trade the moments of the price of various assets deemed illiquid.

Furthermore, this product allows for a broader class of market participants to trade moments, most importantly, variance, as this is usually only accessible OTC for sophisticated market participants in legacy markets. Whether this is a positive thing is left to the reader to decide. In any case, allowing for speculation and hedging using these products comes with some utility to the market.

Additionally, while the barrier may seem high to truly understand the mechanics of this product, one can easily argue that power perps simplify the process of retaining exposure to a proxy of volatility. This phenomenon is strikingly similar to the situation in current financial markets, where, for example, a factor causing traders to decide to trade variance swaps instead of trading vanilla options is simplicity reasons. Vitally, market participants are willing to pay a price for this simplicity.

Another consideration is that because the only public power perps markets are built on-chain – and it is likely to stay that way – they are governed by smart contracts and thereby completely eliminate counterparty risk which has not only bedeviled the crypto space but those trading variance products in legacy markets.

This brings us to the other side of the equation. Because these markets are governed by smart contracts, the risk lies in potential bugs in the code or loopholes that can be exploited. Hacks and exploits are not a new concept in DeFi, and if there has been one lesson to be learned over the past several years, it is that even the biggest, most respectable, and most audited codebases are not completely safe. This is amplified by the fact that these particular codebases are especially complex due to their nature. Moreover, the fact is that there are relatively few smart contract auditors and developers using the codebase – which are often the discoverers of these bugs and loopholes – that are interested and have sufficient experience in the DeFi exotic derivatives space.

Speaking of complex smart contracts: the more complex the code to be executed, the more gas is required to compensate validators, meaning that users interacting with these contracts will have to pay hefty fees, thus introducing significant barriers to entry. Especially considering that most of these products have been built on Ethereum mainnet, these complex transactions can total hundreds, even thousands of Dollars. In the future, though, it is likely that these markets will expand to blockchains with lower transaction costs since they would be exposed to a larger user base that could participate. Also, codebases usually become more gas efficient over time as more people develop with them, and well-funded teams continuously audit their code over time for such purposes.

Most importantly, because the product is traded mostly on-chain, and there is no way to force anyone to add margin in a traditional, undercollateralized model, you need to force parties to overcollateralize short positions. This greatly reduces capital efficiency and makes the product far less attractive for the parties writing the options. The result is that there is far less liquidity in the market which can result in exorbitant and unstable funding rates, making hedging costly.

With these aspects in mind, how successful have power perpetuals been since their inception during DeFi Summer?

While there are a bunch of teams building power perpetuals products, the first team that brought a product to market, Opyn, is virtually the only one that has seen widespread success, all things considered. At its peak, their power perpetuals product, Squeeth (Squared ETH), managed to garner over $25m in Total Value Locked (TVL). Overall, TVL has not grown too much in USD and in ETH terms, but this can be attributed to the numerous systemic shocks that the crypto space has experienced over that time period. On the other hand, as a share of DeFi options TVL, Squeeth’s market share has been in a constant uptrend since its inception.

Figure 7: Opyn’s Squeeth Market Share in DeFi Options Market Measured in Total Value Locked

Source: DeFiLlama, Bocconi Students Investment Club

This can be attributed to numerous factors, but the most convincing argument is that the launch of several vaults managed to win over capital that was looking to earn income through yield in the DeFi volatility space. These vaults systematically manage capital, in part using the Squeeth market. There are currently two strategies, namely the Crab vault – a short volatility strategy – and the Zen Bull – a similar exposure to covered calls. Compared to other popular DeFi Options Vaults (DOVs) which sell volatility to market makers using an auction mechanism, the risks captured by Opyn’s vaults cannot be easily mimicked on CEXs, making them more attractive to prospective depositors.

Figure 8: DeFi Options Market Share in DeFi Derivatives Market Measured in Total Value Locked

Source: DeFiLlama, Bocconi Students Investment Club

Overall, though, Squeeth’s growth has been undeniably limited by the growth of the DeFi options space which has been dominated by the widespread usage of on-chain perpetual futures. This has not only been seen on-chain, though. Options have existed for fewer years than perpetual futures in the crypto space but have lagged tremendously in growth rate, and thus market share in the total crypto derivatives space.

So why have options not been as successful in the crypto space? There are several explanations:

Because of the high asset beta, low liquidity, and high volatility that characterize being long a crypto asset, many describe the asset as having “embedded leverage” and even “embedded convexity”. Pairing that with the high leverage that perpetual futures contracts offer, users may simply not want convex exposure since it already feels like they have one.

Another compelling argument is that because retail traders in the crypto space already deal with many abstract concepts that are developing at breakneck speed, adding options to the mix (for no “compelling” reason) simply adds to the cognitive overload. On the other hand, one can argue that legacy markets disprove this notion since they may be just as complex in the eyes of the average, invested retail trader, but have seen enormous success in recent history.

To reiterate, liquidity fragmentation may be a contributing factor, making perpetual futures a cheaper option to reliably get leverage.

To conclude, Impermanent Loss Protection Options and Power Perps are growing markets that have clear use cases in a thriving space, but as volatility products they are limited by their environment. Without the growth of the crypto volatility market, it will become difficult for market makers to expand their offering of products with attractive spreads. Whether this struggle is a sign of growing pains associated with bringing old concepts to a new field or simply incompatibility remains to be seen. Either way, the vast experimentation in the crypto derivatives place is surely needed to finally allow for more sophisticated hedging that was so lacking hitherto.

0 Comments