In the past few years, cryptocurrencies have made the headlines on many different occasions and many think that they are here to stay, for better or worse. Regardless of their social impact, we believe that they have introduced interesting contrasts to traditional finance in their market microstructures. In this article, we explore some of the trading instruments that are very prominent in the crypto space but less so in traditional finance.

This article does not necessarily review trading instruments that never existed nor were proposed as ideas before the crypto industry. Rather, it reviews products that did not see widespread adoption as tools of speculation and hedging before digital assets saw their popularity rise.

Perpetual Futures

Perpetual futures contracts, also known as perps or perpetual swaps, are special types of futures contracts. As can be deduced from the terminology, these futures contracts are perpetual, meaning that they do not have an expiry date. First suggested by Nobel laureate Robert Shiller, perpetual futures generally aim to enable a liquid derivatives market for illiquid assets, a category that undeniably includes digital assets.

Thus, perpetual futures became more attractive as trading instruments than spot trading for those looking to hedge efficiently and speculate on a wide variety of cryptocurrencies, often with leverage.

Mechanics

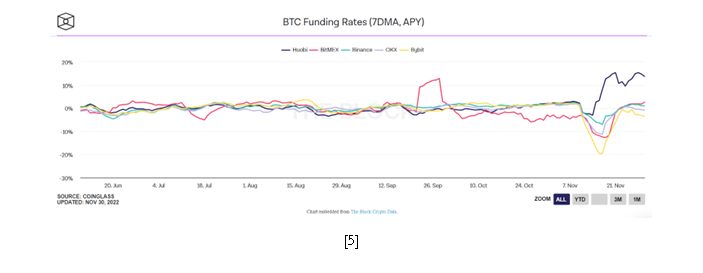

Since there is no expiration date, perps have an embedded funding rate to ensure that the perpetual futures price accurately reflects the index price. The funding rate is a periodic payment between the two sides of the contract that aims to balance supply and demand for long contracts versus short contracts. For example, if there is a lot of buying pressure, and the perp is trading at a premium to the index price, the funding rate will become positive, and long positions would be paying short positions a fee – the funding rate – which is proportional to the difference between open long and short contracts. This would discourage traders from being long while incentivizing short parties, thus retaining the relative equilibrium in both positions and prices. The chart below shows the changes in funding rates for the last six months in some of the most liquid centralized crypto exchanges.

Source: Collective Shift, Bocconi Students Investment Club

It should be noted that the funding rate is not a fee paid to exchanges; it is strictly a payment between market participants and exchanges do not profit from it. Usually, funding payments are carried out every 8 hours. However, there are exceptions, most notably decentralized perpetual futures exchanges – exchanges that are built on top of a blockchain – for example, dYdX, where funding is settled once an hour. Traders are liable for funding payments if and only if they have an open position at the funding times. For example, if you choose to close a position prior to the funding time, you will neither pay nor receive any funding for that hour.

The calculation of the funding rate varies between different exchanges based on preferences regarding exchange risk, risk exposed to traders, and user experience. In the following, the most popular perpetual futures exchange by volume shall be analyzed: Binance. Funding payments for all Binance perpetual futures markets occur every 8 hours: at 00:00 UTC, 08:00 UTC, and 16:00 UTC. The Funding Amount that is paid out is calculated by multiplying the value of the trade by the Funding Rate:

![]()

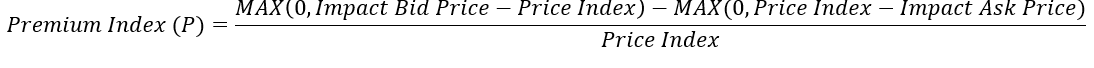

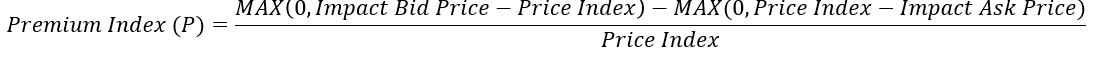

The two main components that determine the Funding Rate are the interest rate and the premium. Because of the notion that holding cash equivalent returns a higher interest than BTC equivalent, Binance utilizes a befitting flat interest rate. Right now, this difference is stipulated to be 0.03% per day, so an interest rate of 0.01% per interval is employed, however, this may be subject to change depending on market conditions. The Premium Index follows any deviations in the price of the contract and the Index Price, and it is calculated separately for each contract using the following formula:

Where Impact Bid Price and Impact Ask Price are:

Impact Bid Price = The average fill price to execute the Impact Margin Notional (IMN) on the Bid Price

Impact Ask Price = The average fill price to execute the IMN on the Ask Price

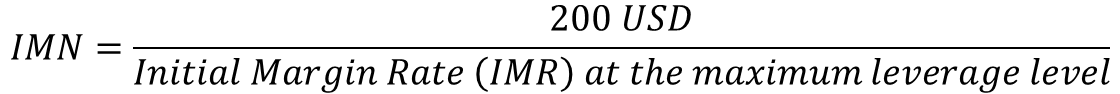

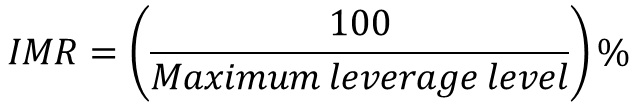

IMN for USD-margined contracts is the notional available to trade with 200 Binance USD (BUSD) worth of margin. IMN for COIN-margined contracts is the notional available to trade with $200 worth of margin (price quote in USD). IMN is used to locate the average Impact Bid or Ask price in the order book and is derived relative to the maximum leverage of the pair:

For example, if we look at the BTCUSDT USD-margined contract its maximum leverage is 125x, so the IMR would be 0.8% and the IMN is 25,000. This just means that with just 200 USDT of margin one could open a position as large as 25,000 USD notional because of the utilisation of leverage. This of course holds only if the position does not get liquidated. As a result, the system would take an IMN of 25,000 USDT every minute to measure the average Impact Price throughout the orderbook.

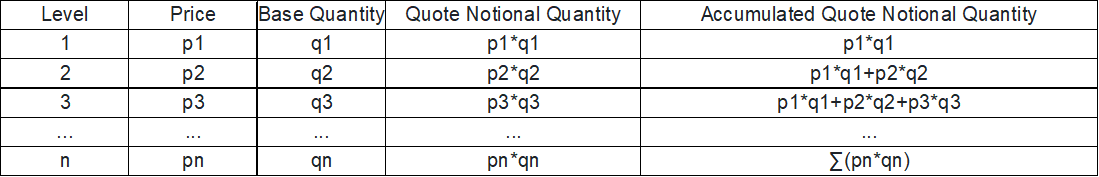

Finding the Impact Bid and Ask Price requires multiple levels of the order book data. If we assume a book structure of the following:

If sum(px*qx) > IMN in level x and sum(px-1*qx-1) < IMN in level x-1, then we can find the Impact Bid/Ask Price from the Level x order book:

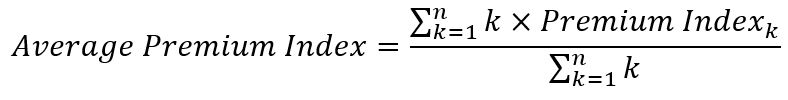

As already mentioned, the Funding Rate also takes into account the Premium Index series, which is calculated as shown:

The Premium Index is being calculated every five seconds, 5760 times for every funding period, and the Funding Rate takes into account the whole series, utilizing the Average Premium Index during the whole 8-hour period:

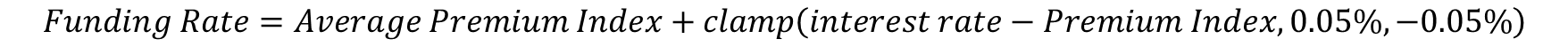

Where “Premium Index_k” is the k-th recorded premium index, and n is the number of recorded instances during the period, in our case, that is 5760. After all of this, the Funding Rate is calculated using:

Where clamp(x, min, max) is a function that if (x < min), then x = min; if (x > max), then x = max; if max ≥ x ≥ min, then return x. This ensures that huge deviations in the Premium Index won’t cause an excessive increase in the funding rate.

Inverse Options and Futures

The second primitive products to be discussed are inverse options and futures. Fundamentally, these are products equivalent to the standard ones because profits and losses are calculated in the quote currency (most commonly USD) but are margined and settled in the base currency, in this instance, a cryptocurrency. For example, a Bitcoin Inverse Option would revolve around some BTCUSD rate as established by the respective trading venue to determine profits and losses at expiration but would be settled in BTC and margined by the short party in BTC. In principle, these are similar to standard foreign exchange options with the key difference that the payoff is denominated in the foreign currency [1].

If profits and losses of these products are computed in USD, then why not allow for the use of USD or USD-denominated stablecoins as margin?

The answer is quite simple. Historically, there has been a monopoly on the comparatively little options trading that has occurred in the digital asset space, a position held by Deribit. The incumbent exchange has only recently introduced USDC deposits as well as USDC-margined products, but until then it was only inverse products that existed on the platform. This may be for several reasons.

Firstly, when it was established, around 2015, there was considerably less regulatory clarity than there is today, especially regarding derivatives and leveraged trading and so a substantial disincentive existed for allowing for USD-margined derivatives trading on centrally-controlled platforms.

Secondly, stablecoin margining was risky for such exchanges because stablecoins were a novel concept at that stage. The fact that they were not battle-tested, and their opaque structures elevated the risks of a de-pegging event, where the stablecoin deviates significantly from the value it is supposed to stay pegged to. Such an event could easily cause insolvencies at exchanges that became overly reliant on these stablecoins and would permanently damage the brands these exchanges so heavily depend on because many users would have doubtlessly lost money in such an incident.

Furthermore, most traders at the time were perfectly fine with posting cryptocurrencies as margin without the need to hedge. Even today, trading with the aim of increasing the nominal value of one’s cryptocurrency holdings is a common strategy as traders accept the cryptocurrencies’ volatility and instead hope for a long-term upwards price trend of these assets against fiat currencies.

Thus, inverse options and futures became crypto’s gold standard. Over time, futures products gained steam, especially as perpetual futures contracts were introduced in 2016 by BitMEX, which improved liquidity and allowed for the trading of larger, more liquid digital assets and smaller, less liquid digital assets with leverage – sometimes as high as 125x. Due to their immense popularity on various exchanges, USD-denominated contracts were swiftly introduced and became paramount as trading instruments during the post-COVID boom.

On the other hand, the popularity of options contracts lagged as they lacked liquidity, only covered Bitcoin and Ether, and are significantly more complicated to understand for retail punters that dominated the digital assets ecosystem since the dawn of Satoshi Nakamoto.

Inverse Options Mechanics

To gain an intuitive understanding of the profit and loss functions of a long inverse option, one can look at the option writer’s perspective.

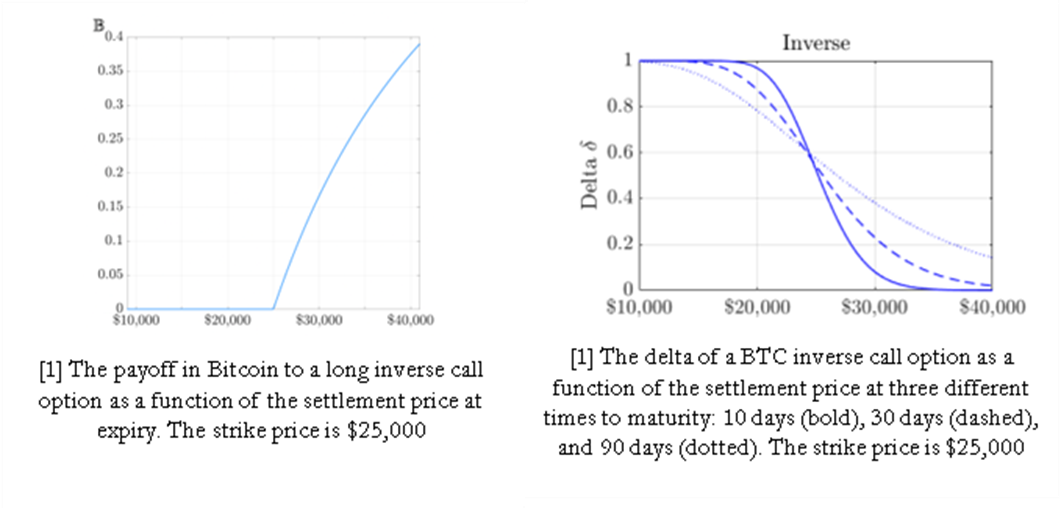

Given a call writer that is selling a BTC inverse call option with a strike price of $25,000 one can intuitively deduce the profit and loss function they, and therefore, the call buyer, experience at expiration. Like in a standard call option contract, the writer’s profit is the premium price if the price at expiration is less than the strike price (Price of BTC at expiry < $25,000). As the price of the underlying exceeds the strike price by larger amounts at expiry, the writer’s PnL decreases but because their margin is BTC, their margin also experiences an increase in value. As the price of the underlying at expiry further increases, the gains from the long BTC position (margin) increasingly outweigh the losses made from selling the call option. Therefore, the maximum loss (gain) from selling (purchasing) a call option is 1 unit of the measured underlying, or in this instance, 1 BTC.

Source: Alexander et al. (2022)

The result: instead of purchasing convexity across the delta space, a long inverse call would get you concavity.

Conversely, for inverse put options, the intuition is as follows: as a put writer’s underlying asset decreases in price, the greater the loss in the short put position, and therefore more of the asset must be posted as margin, amplifying the loss. This results in a convex PnL structure for cryptocurrency-denominated traders.

Source: Carol et al. (2022)

Note that the PnL, delta, and other greeks are different when considering an investor denominating their profits in US Dollars and hedging their cryptocurrency margin. For such an investor, the profile would be similar in nature to a standard vanilla options contract. It is not equal, though, for several reasons. Firstly, on Deribit, for example, the price of the cryptocurrency that is used for determining PnL and margin is a 30-minute average of the cryptocurrency’s price on several venues that is adjusted for outliers. Because of the complexity of this measure and these assets’ high volatility and illiquidity, closely replicating this index may be impossible and most importantly, impractical.

Also, traders that are USD-denominated and hedge their cryptocurrency margin exposure may still be exposed to the short-term gyrations of these assets as even after they get paid out at expiry, converting the cryptocurrency PnL into USD or USD-denominated stablecoins may include steep transaction costs due to illiquidity and high volatility. This indubitably influences pricing by introducing liquidity premia to these options contracts [1].

Finally, due to a non-negligible number of market participants that do not trade to profit in Dollars or any other currency, but instead in cryptocurrencies such as Bitcoin or Ethereum, they, therefore, may display significantly different risk tolerance profiles to USD-denominated traders, thus resulting in distorted options premia.

An example of such a market participant is someone similar to an actor mentioned earlier: someone that is looking to increase the nominal size of their portfolios. Bitcoin enthusiasts of this class famously dub this investment philosophy “stacking sats” – a Satoshi, or Sat, is the smallest unit of measure of a bitcoin. Another example is funds that give their investors exposure to crypto through pursuing strategies within the digital assets space and bookkeeping profits and losses in Bitcoin or Ethereum.

Investors in such funds are commonly parties seeking exposure to crypto assets but do not want to custody cryptocurrencies nor engage in trading the cryptocurrencies themselves. Thus, some investors choose to entrust their funds with fund managers that seek to take advantage of the exceptional volatility the nascent space offers while remaining exposed to its overall growth.

A final note is that inverse options may be easy to confuse with quantity-adjusted Options, otherwise known as quanto options, which are popularly used in FX. These options have an exchange rate fixed in the contract whereas inverse options turn to the prevailing exchange rate to determine payoffs.

Inverse Futures

Using similar logic to the previous section, one can deduce that a holder of a long futures position with the margin being denominated in cryptocurrency increases in value at a decreasing rate as less cryptocurrency is gained due to the now higher price. On the other hand, when losses are being made from the futures position, an increasing number of the cryptocurrency must be paid to settle it. Thus, the payoff structure is concave for long positions and convex for short positions.

Source: Deng et al. (2019)

The Future – Are these success stories worth following?

Given crypto’s fast-moving nature, will these products be forgotten in a couple of years, or will they be staples of digital assets trading even as the industry matures? Is it worth following such developments even for those less riveted by the crypto space?

Perpetual futures, while introducing liquidity and simplicity to trading derivative products, face some upcoming headwinds. Alternatives, such as calendar futures and options are stealing market share. Calendar futures have seen remarkable usage this year as traders flocked to end-of-quarter Ether futures, especially those expiring at the end of September, to protect themselves from the tail risk that the Ethereum merge, which occurred during the middle of September, experiences difficulties or fails completely. Options pose greater opportunities to craft bespoke risk exposures to the wide range of institutional clients flocking into the space.

Their future is far from over, though, as perpetuals constantly evolve and cover an increasing number of digital assets, satisfying the almost insatiable desire for speculation. Moreover, due to the recent failures of large, centralized institutions within the crypto space, most crucially FTX, trust has taken a nosedive and therefore decentralized alternatives that are built on several leading blockchains have seen increased popularity with protocols like dYdX, GMX, Gains Network, gaining steam.

Inverse options, while convenient for wary exchanges and crypto-natives, complicate the process to gain exposure to risks made possible by volatility markets, never mind making otherwise routine processes deeply inefficient for Dollar-denominated traders. For crypto to be able to gain mainstream adoption, in part thanks to institutional capital, USD- or USD-pegged stablecoin-margined products must become the norm. In fact, this is beginning to materialize: Dollar-margined Bitcoin and Ether options markets launched on the CME several years ago and have bootstrapped to a non-trivial size. More and more centralized exchanges are competing with Deribit by listing options margined by USD equivalents. Finally, decentralized alternatives that live on-chain also pose a threat, albeit a long-term one.

Another reason why understanding these structures is vital is that they may be useful in legacy financial markets. A recent Bloomberg article argued that funding markets may prove useful in helping the utmost important financial institutions finance their intra-day operations. It follows that overnight funding becomes a less prevalent issue and that future crises may be better contained as a result. This would be a stark contrast to the daunting days of COVID-19, where central banks across the globe were forced to step in financial markets at an unprecedented scale. Funding markets like dominant structures in crypto are transparent and could alleviate reliance on the same few usual suspects when cash becomes scarce: the central bank and the big banks. In any case, the peer-to-peer ethos is tempting to consider more deeply.

Some put these notions into question. Due to their oversimplicity, perpetual futures as they are may not be ready for usage in such a controlled environment in what is one of the most important components of the plumbing of the global financial system. Funding rates are, by design perhaps, impossible to hedge and even anticipate. In total, they are an imperfect substitute for existing derivatives and solutions that, even though they have their own issues, cannot be solved by yet another iteration of financial engineering. The structural issues in money markets, it is argued, arise from the countless regulations and long-prevailing structures that make up the very foundations of the financial system.

Possibly, an area perps are better suited to is one they were intended for in the first place: markets for illiquid assets. For example, real estate, GDP or even NFTs. In other words, assets that lack forward markets can greatly benefit from the existence of a simple, liquid, and transparent derivatives market. Thus, funding rates could be a useful tool that market participants are happy to pay to be able to hedge their assets and portfolios from risks they could never have before, a net benefit to the financial system.

Sources

[1] Alexander, Carol, et al. ArXiv, 2022, Inverse and Quanto Inverse Options in a Black-Scholes World, https://arxiv.org/abs/2107.12041. Accessed 3 Dec. 2022.

[2] Kaminska, Izabella. “The Crypto Innovation Traditional Finance Needs.” Bloomberg.com, Bloomberg, 31 Aug. 2022, https://www.bloomberg.com/opinion/articles/2022-08-31/perpetual-futures-are-the-crypto-innovation-finance-needs-to-manage-inflation?leadSource=uverify+wall#xj4y7vzkg.

[3] Reiter, Jon. “Perps: A Product for Beginners.” Blockhead, 27 Oct. 2022, https://blockhead.co/2022/10/27/perps-a-product-for-beginners/.

[4] Deng, Jun, et al. 2019, Risk Structure and Optimal Hedging of Bitcoin Inverse Futures, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3450018. Accessed 4 Dec. 2022.

[5] “What Are Funding Rates?” Collective Shift, 21 Feb. 2022, https://collectiveshift.io/funding/what-are-funding-rates/#:~:text=Funding%20rates%20are%20periodic%20payments,that%20of%20the%20underlying%20asset.

[6] “Introduction to Binance Futures Funding Rates.” Binance, Binance, https://www.binance.com/en/support/faq/introduction-to-binance-futures-funding-rates-360033525031.

[7] “Funding Rates.” Funding Rates – CryptoQuant User Guide, https://dataguide.cryptoquant.com/market-data-indicators/funding-rates.

[8] “A Peep into Perps: Perpetual Futures Explained – Insights – Treehouse Research.” Treehouse, 29 June 2022, https://www.treehouse.finance/insights/a-peep-into-perps-perpetual-futures-explained.

[9] “A Deep Dive into Perpetual Futures.” Builder.news, 29 July 2022, https://www.builder.news/crypto-insights/a-deep-dive-into-perpetual-futures-KMFmm.

[10] Das, Lipsa. “Compare Crypto Funding Rates in December 2022.” Edited by Shannon Ullman, DefiRate, 28 Nov. 2022, https://defirate.com/funding.

1 Comment

benitto · 18 February 2023 at 23:44

I’m hard, this is better than Pornhub

congrats guys