Introduction

Inflation made a return post pandemic and has been affecting all market participators for 18 months now. In this article, we will dive into the persistence of inflation in the UK specifically and the struggles the UK has had to face trying to cool this red-hot inflation down. Lastly, we will analyze some possible investment opportunities that have arisen from this complex macro and political environment in the UK.

An important metric that will be discussed in this article is RPI, Retail Price Index, a measure of consumer inflation used in the United Kingdom. Although it is no longer considered an official measure of inflation by the government since 2013, it is still widely used for payment calculations of index-linked securities. The measure differs from CPI as it includes private and social rents as well as mortgage interest payments, making RPI readings larger than their CPI counterparts.

Political context

The current political landscape of the United Kingdom has been marked by a period of great turbulence, with the Conservative party, the current ruling party, plagued by the effects of the series of controversies that have led to the resignation of two prime ministers last year. The occurrence of Partygate together with the string of sexual misconduct allegations made against MP Chris Pincher generated a fracture within the conservative party that caused a wave of mass resignations ultimately leading to the downfall of Boris Johnson. Johnson’s successor, Liz Truss, further contributed to the alienation of the British public from the conservatives when her cabinet announced the “mini-budget” which proposed a series of sweeping tax cuts, most notably scrapping the top rate income tax; the budget came under extreme criticism from both the public, the market and other institutions (such as the IMF) so much so that the Bank of England had to intervene and take measures to prevent the pound from nosediving. This failure forced Truss to resign, making her the shortest serving Prime Minister in UK history.

The incumbent prime minister Rishi Sunak entered Downing Street in October of last year, facing the difficult challenge of not only having to deal with the past failures of the previous governments but also having to navigate the current volatile economic situation engendered mainly by the current conflict in Ukraine. Inflation especially has been a thorn in the side of the government. While reducing the inflation rate has been declared by Sunak to be the first of the government’s 5 immediate priorities, his efforts so far have not reaped the desired rewards. This has recently led to mass strikes across all sectors (especially teachers and nurses) against the rise in the cost of living.

It is also important to note that Brexit continues to play a key role in UK politics as Sunak’s recently proposed Windsor Framework seeks to finally end years of disagreements on the Northern Ireland question between the UK and the EU by establishing a green lane, red lane system for goods going to Northern Ireland from the rest of the United Kingdom. While opposition to the deal remains, especially from the DUP as well a portion of the Conservative party, this marks a key turning point with respect to economic and trade relationships with the European Union, which had previously soured due to the UK’s withdrawal from the Northern Ireland Protocol.

Macroeconomic Background

The macroeconomic environment in the UK is still currently affected by the Covid pandemic and the consequences that derived from it.

The combination of a surge in demand for products and services, driven by government and central bank backed cash injections, and a grave instability in global supply chains caused inflation to ramp up world-wide for the past 18 months. What has become apparent however, is that headline inflation is much stickier in the UK in comparison to the US or the Euro area. The latest print was 10.1% in the UK, only 100bps off October’s high, while the latest print in the US was much lower, coming in at 5%, 4.1% lower than the highs recorded in June 2022. This means that the UK’s headline inflation differential with the US and the Euro Area has ballooned to 5% and 3.2% respectively.

On the other hand, this is not the case when looking at core CPI, where the UK’s figures are not as alienated. The latest print was 6.2% in March, only 60 bps higher than the figure posted by the US the same month.

This reveals that the UK’s inflation woes fall on the food and energy sector mainly, which unfortunately do not seem to be cooling down quickly. Food was up a disastrous 15.7% in April (over 19% in March), dairy goods suffering the largest increase. The food and energy issues are also highlighted by the fact that the BOE’s policy has been in line with those of the Fed and the ECB with hikes of over 400 bps, since the crisis started, helping to contract demand.

The stickiness of the UK’s inflation in these sectors arises from a range of factors. The plunge in natural gas prices has caused an inflation ease in Europe especially, which was badly affected by these prices since the start of the Russo-Ukrainian conflict. This has not occurred in the UK yet, due to how consumer energy prices are set, but these prices are expected to fall just as sharply as they did in Europe in the coming months. Furthermore, food price increases have reached their 45-year high, due to the transportation cost increase that has affected the UK since Brexit and aggravated since the start of the war, poor harvests in supplier’s countries, the weakness of the sterling and labour shortages caused by early retirement and changing immigration policies post Brexit. This latest factor has also contributed to keeping wages high, further worsening the inflationary pressures. It is difficult to judge how food price increases will descend in coming months, due to the nature of the issues that are causing these price increases. The key will be seeing how the UK will navigate the problems stemming from Brexit, which have caused these food price emergencies. So far there seems to be no viable short-term solution to mitigate this issue.

Projections & Analysis

Because wholesale energy prices have fallen so dramatically in the latest weeks, it is inevitable that energy prices will go down for consumers quickly in the next couple of months meaning the headline inflation issue in the United Kingdom rests solely on the prices of food. On Friday, the UK’s Minister of Food, Farming and Fisheries, declined the case for monitoring and restraining food prices at supermarkets, which came after the “profiteering” allegations, despite their historical levels. This is significant, because it heavily contrasts the measures that France recently adopted, where agreements were reached with supermarkets which are now setting “lowest possible prices”. This agreement resulted in April being the first month where food prices are down, since the crisis started, with food inflation in France in April being 100bps lower than in March. This new diverging policy compounded with the existing woes, could be an indication that food inflation could linger for longer, however improvements in global supply chains could outweigh these factors in the long-term, meaning that inflation will eventually fall in the UK, and that this policy will slow the rate of descent.

Another factor that could aid the UK’s inflation issue is the almost unanimously expected rate hike that could occur on May 11th. With headline CPI coming in 30bps higher than expected on April 19th’s reading, it is difficult to imagine the BOE will not follow the recent ECB hike with another 25bps. This hike, which was not anticipated by most before March’s CPI print, will contribute to mitigate the food price stickiness by further attempting to reduce aggregate demand in the UK.

Trade Idea

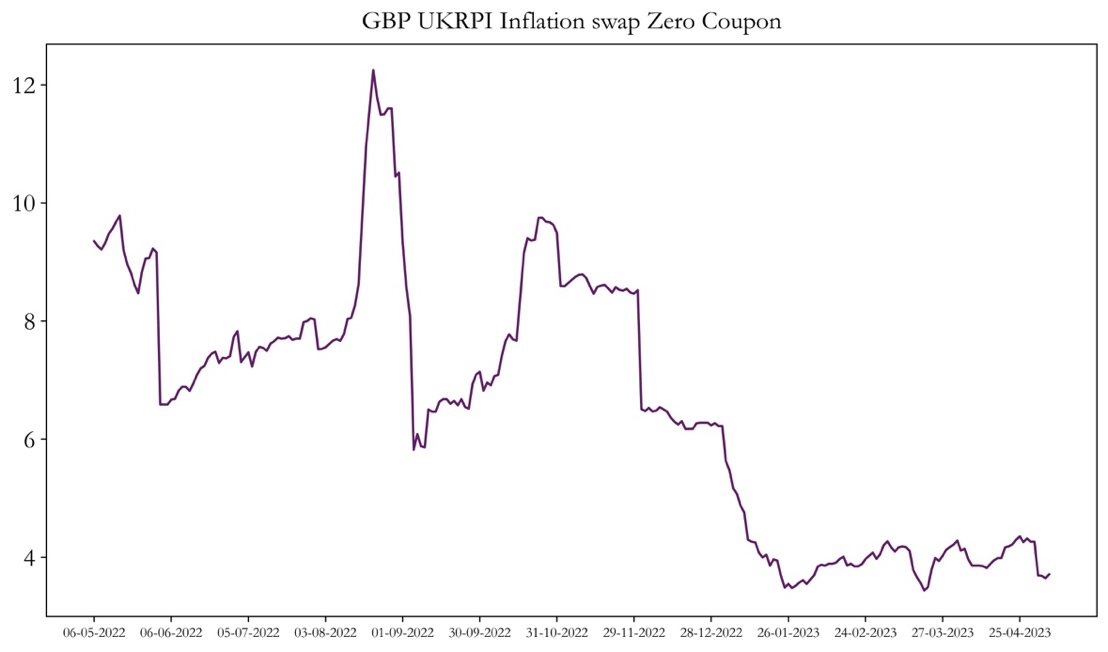

It is clear that the consensus is that inflation will go down in the UK in the next 12 months and beyond. However, it is equally as clear that the complex global macro environment and the UK’s pre-existing issues have caused great uncertainty regarding the speed at which inflation will fall. This is reflected by some market participators’ expectations, and the prices of related securities, and has given way for some trade opportunities. One trade idea that we see being viable is entering into a 1-year spot UKRPI zero-coupon inflation swap at 3.71%. To understand how an Inflation Linked Swap works, please refer to this introductory article. The reason why we believe that this trade is attractive is because we do not see the UK’s RPI reaching 3.71% by March 2024. The reason why the March 2024 reading is the one which affects this derivative is due to the 2-month lag that UK inflation swaps have.

We believe that RPI in the UK will not reach 3.71% (13.5% in March 2023), due to a number of reasons: Problems such as labour shortages and goods’ transportation costs are a consequence of Brexit, meaning that they will not fade as global macro conditions and supply chains constrains improve. Also, further political uncertainty will arise due to the recent losses of the conservatory party in recent local elections, preventing government policies aimed at reducing inflation, to work at full effect. Another factor which points at the fact that inflation will remain higher for longer are the wage growth numbers, which not only remained stubbornly high in the last readings, but also beat expectations. (+5.9% vs +5.1% expected). Historical figures also suggest that RPI will not go down to 3.71% by March 2024, as the average period of time taken for descents of 10 percentage points in UK RPI is over 15 months. Moreover, since it hit recent high of 14.2% in October, the last 5 Months have only seen a descent of 0.7%, with no consecutive months of decreases. As many of the drivers of inflation that the UK had in October persist, and are expected to remain, the 3.71% value remains farfetched in our view.

The 3.71% price point is also attractive due to the fact that it has not increased substantially this last week, following the political events surrounding the diverging policy on supermarket price controlling and loss of support for the conservatory party in local elections.

Source: Bloomberg & Bocconi Students Investment Club

Another reason why we picked this given maturity for the derivative is because of its higher liquidity, which allows for lower transaction costs and hence greater possible returns.

The RPI projections made by top investment banks support our thesis. The analyst consensus is that by the time our derivative contract expires, UK RPI will be at 4.2% in the UK, 50 bps above the rate paid in the fixed leg of the contract, benefitting the position receiving the floating leg.

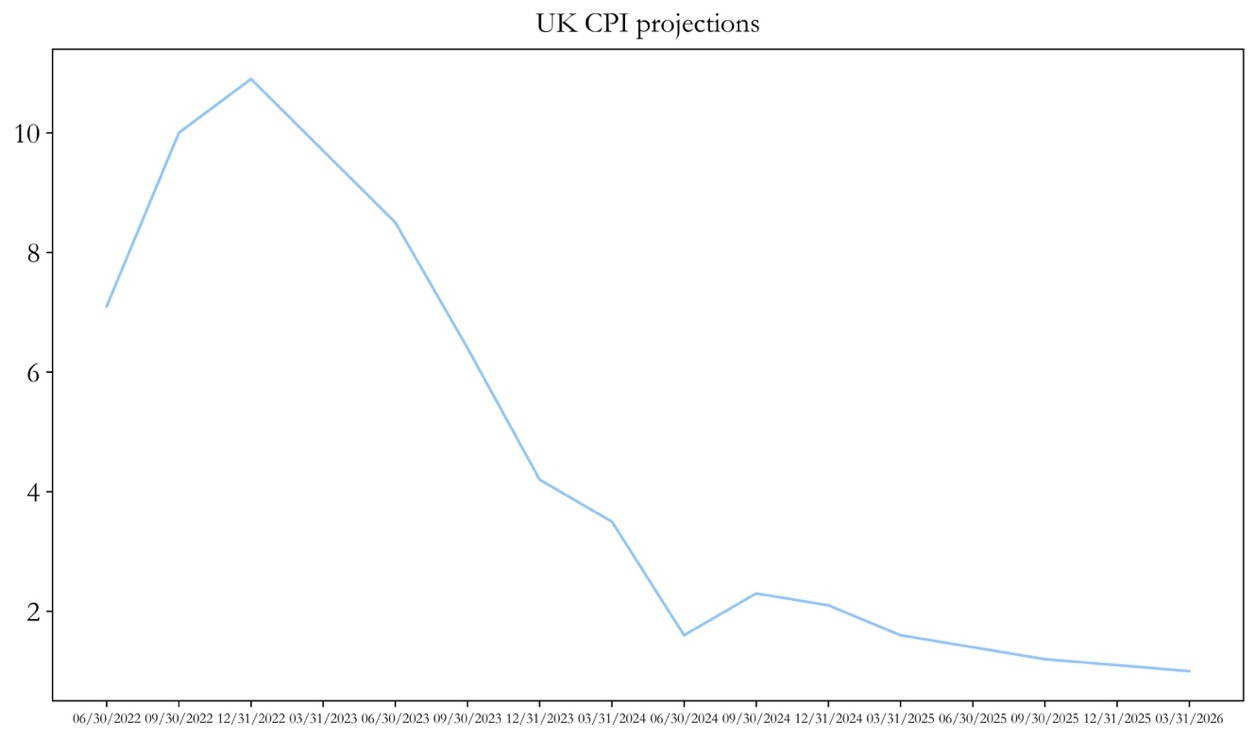

On a similar note, implied CPI expectations also favor our view. CPI values have consistently been lower in comparison to RPI values throughout history and in recent times (3.4% lower in March.) The graph below shows CPI projections for the UK based on market interest rate expectations. The value for Q1 2024 is 3.5% only 20 bps below the fixed leg of the swap contract, indicating that the market projects an RPI value that will likely be above 3.71% for the same period, based on historical spreads between both measures which are much higher than 20bps, especially in times of high inflation.

Source: Bloomberg & Bocconi Students Investment Club

Risks and Limitations

The principal risks surrounding this trade idea are linked to a hard landing in the UK. A large recession will most likely tame inflation greatly putting in jeopardy the validity of our claims. This risk could manifest itself in a variety of manners, but mainly due to an overly hawkish BOE. If rates continue to go up relentlessly, the breaks will be slammed on aggregate demand, causing sticky prices to cool down in a quicker fashion. However, the risk of stagflation in the UK should not be underestimated. Due to some of the inflation drivers being so UK specific, the risk that inflation stays high even during a recession still remains possible although market participants have edged away from this view in recent months. Inflation could also diminish if supply chain constraints ease and the UK’s good transportation cost decreases, or if commodity prices plunge too. One limitation to the trade idea is a lack of historical performance/overview. This is due to a lack of data which stems from the unprecedented nature of the situation at hand, with food price increases being at 45-year highs, it has been difficult to compare the current case with past occurrences.

0 Comments