Introduction

The current macroeconomic landscape is shaped by high inflation, increasing interest rates, and growing risk aversion. The diverging realities nations are facing due to the Russia-Ukraine war, the ensuing energy crisis, the COVID-19 pandemic, the looming global recession, and more, are putting policymakers’ decisions in the limelight.

Especially Japan find itself in a tricky situation. Its unique stance in the world from a geopolitical and economic point of view has catalyzed a quickly weakening Yen, sending the currency to multi-decade lows. Uncertainty surrounding the central bank’s approach has spurred speculation and thus gave room for raging volatility. Finally, the Bank of Japan (BoJ) decided to act by utilizing a tool it had not resorted to in over 20 years: the foreign exchange intervention.

There are many other contemporary as well as historical cases of FX interventions, and because we expect their frequency to increase, especially in more developed nations, we deem it appropriate to analyze FX interventions, their effectiveness, and their implications for FX market participants. To conclude we present a trade idea based on the assumed effectiveness by the BOJ’s recent FX intervention.

Primer on Foreign Exchange Interventions

Foreign Exchange interventions come in different methods and achieve different purposes. It is crucial to understand why central banks intervene in foreign exchange markets in the first place. According to a survey of 21 emerging market economies’ central banks by Patel and Cavallino (2019), the goals – “ultimate purposes of the intervention” – can be summarized as the following:

- Achieving price stability

Especially during this era of elevated price levels and unanchored expectations of these price levels, a feeble currency can be a catalyst for further destabilization. For instance, a weaker currency means that imports are relatively more expensive, and for countries that are reliant on imported inputs to drive their economy, this can strain medium-term growth.

- Financial Stability

Financial stability goals include building FX reserves, stabilizing capital flows, avoiding credit spillovers, alleviating FX funding shortages, and reducing FX speculation.

Starting with FX reserves, economies that are net exporters often intervene in foreign exchange markets in times of loose credit conditions – commonly when their currencies are appreciating in value – to build up a “war chest” that can be deployed when credit becomes scarce. An example of this can be seen today, where sharp rallies in the Dollar and increasing short-term interest rates in the dominant economies are weighing on emerging markets’ currencies. Thus, when volatility spikes, outlooks are unclear, and business confidence reaches lows, the central bank can intervene to ease tensions.

Secondly, foreign exchange interventions can be deployed to restrain adverse capital account developments. Little to no respondents intervene in FX markets for this goal because improving the exchange rate does not address the root of the issue of a worsening capital account. A worsening capital account is usually the result of a fiscal or monetary matter of orders of magnitude larger than the short-term effect a typical central bank could have on the exchange rate.

Reducing FX speculation was one of the most common reasons to intervene in the foreign exchange markets according to the responding central banks. Why is this?

A fear any central banker has, whether in a developed or a developing economy, is to experience a currency crisis – a sharp decline in one’s currency that raises the likelihood of a domestic economic crisis. Currency crises often develop through the sway of foreign exchange market speculators that predict these crises. But because the country’s prevailing exchange rates are one of the most important inputs in the economy, the speculators might directly influence the result they are betting on. Thus, by allowing these trades to become crowded, as the divergence of the exchange rate from what economic fundamentals would allow grows, a “new reality” forms that may shock market participants, and thus hurt the economy on a longer-term basis.

To summarize, we can quote the most famous foreign exchange speculator of all time, George Soros: “When I see a bubble forming, I rush in to buy, adding fuel to the fire. That is not irrational. And that is why we need regulators to counteract the market when a bubble is threatening to grow too big.” While foreign exchange speculation may be beneficial to realize the discovery of an equilibrium exchange rate in a timely manner, allowing speculators to destabilize the market through uncontrolled volatility leaves the economy exposed to a fat tail risk that burdens them in rare and regular occasions alike.

- Others

These may include increasing export competitiveness and easing pressures resulting from commodity price volatility. These reasons were less popular in the survey and can be explained by two factors: 1) Supporting these objectives is usually outside the central bank’s purview. Most central banks’ mandates are to minimize unemployment while maintaining price levels at low and stable growth rates. While providing downside pressure to increase export competitiveness may help achieve these goals through second-order effects, it is unconvincing that the marginal long-term effect that these interventions produce outweigh the draining of central bank resources. Furthermore, IMF rules prohibit central bank intervention for these purposes and rulebreakers often feel the wrath of more influential global players such as the U.S., the EU, and China. 2) As touched upon in the last point, these activities may take significant financial resources to undertake. As will be discussed later, it is difficult to argue that long-term foreign exchange interventions work, and if they do, come at hefty costs for the central bank, and therefore, that country’s population. In other words, profligate spending on maintaining export-friendly exchange rates is not something any nation can pursue.

How do Central Banks go about Intervening?

Broadly, central banks set “intermediate objectives” that help achieve their short- to medium-term goals. For example, limiting exchange rate volatility and providing liquidity in a thin market can greatly reduce the impacts of speculation and contagion.

Similarly, providing directional pressure that is opposite of that of international investors can alleviate the financial system of immediate strains. For example, in times of global risk aversion, U.S. investors may want to reduce their foreign passive equity fund exposures which can be very significant in size. When they do so, it often comes at velocities that significantly shift exchange rates from economic fundamentals as these foreign liquidity issues are at the forefront. Therefore, to protect domestic players, central banks can provide support by counteracting these flows.

Contrary to what an “intervention” may sound like, most of the job is done through signaling. A vital ingredient to effective signaling is a credible central bank. That is, market participants believe the central bank is willing and able to back up its word with action. In the case of an FX intervention, this means having enough relevant foreign currency reserves and showing the willingness to deploy them in the given situation. Moreover, making the goals clear to the market is vital so that informational asymmetries are smoothed out and volatility dampened.

Central banks then need to purchase or sell their currency in the spot market to achieve their intermediate goals. Few central banks admitted to intervening in the FX market to alter the exchange rate to a rate that it deems fair. The list is long for why central banks should not and cannot attempt this, but they can be summarized by realizing that central banks are not there to determine equilibrium rates. Rather, they are there to oversee, work within their mandate, and step in only when necessary to ensure stability.

Sterilized vs. Unsterilized FX Interventions

Sterilized foreign exchange interventions do not influence short-term interest rates, whereas unsterilized foreign exchange interventions affect short-term interest rates not necessarily through the central bank’s interest rate policies, but also through changes in portfolio compositions of domestic and foreign private entities. Therefore, a sterilized FX intervention may entail buying (selling) the currency in the spot market while selling (buying) short-dated government bonds to impose upside (downside) pressure on their yields, counteracting the flows you would expect given a change in exchange rates, all else equal.

It is also worthwhile to mention that having the central bank change benchmark interest rates is a conventional method of combating a currency crisis, but as it does not have first-order effects on the FX market, it cannot be considered a tool of FX intervention and thus will not be covered in this article.

Empirical Evidence on Intervention Effectiveness

The literature on the effectiveness of FX interventions has grown substantially over the last several years due to innovative identification approaches and a better data availability. Nevertheless, the debate on the effectiveness of FX interventions is far from settled despite more recent studies indicating different beneficial outcomes. In the following, we briefly present recent studies and display historical examples of (un)successful interventions.

Two key reasons for the rather inconclusive evidence might be limited data on interventions (mostly available only from the 1990s) and the difficulty of identifying exogenous regressors. The latter relates to the fact that the decision by a government to intervene in FX markets is likely to be driven by prior exchange rate movements, leading to an endogeneity problem. A simple linear regression of FX changes on any proxy for currency interventions would thus yield counterintuitive signs for the regression coefficients. That is, the regression would indicate that the selling of domestic currency would lead to an appreciation and vice versa. The literature accounts for this by either using instrumental variables or high-frequency data. More recently, the use of Structural VAR models gained popularity in the field as well. For reasons of brevity, an in-depth explanation of these approaches is left out here.

In general, there are two channels by which FX interventions are assumed to impact a country’s exchange rate. First, the portfolio balance channel assumes that foreign and domestic assets are imperfect substitutes of each other. As a central bank conducts a sterilized intervention, it alters the relative supply of domestic to foreign assets. Since interest rates remain unchanged, the exchange rate must adjust to reflect the change in relative value. Second, the signaling channel presumes that there exist information asymmetries between market participants and authorities. By intervening in the foreign exchange market, a government or central bank reveals private information on its preferences or the macroeconomic environment and therefore alters market expectations. [2]

For emerging markets economies, Blanchard et al. (2015) find that countries conducting FX interventions in response to global capital flows are able to significantly reduce the impact of these shocks on the exchange rate. The difference between so-called interveners and floaters is significant for up to a year after the occurrence of the shock. Fratzscher et al. (2019) take a more qualitative approach by calculating success rates for historical interventions indicating whether the authority was able to either (a) impact the exchange rate directionally, (b) reduce volatility, and (c) reduce the trading range. Their results indicate that central banks are overwhelmingly successful in achieving the latter two goals (~80% of the time) while it proves to be more difficult to directionally influence exchange rates (~60%). Interventions tend to be more successful when they are large, executed in line with prior price trends and go toward the long-run fundamental equilibrium rate.

Further, the recent work by Filardo et al. (2022) seems highly relevant from a policy perspective. Their results indicate that central banks can be successful in leaning against short-term misalignments of the exchange rate from its macroeconomic fundamentals. When considering longer-term horizons, i.e. more than four years, interventions do not exert a statistically significant impact on the exchange rate. This might be due to the fact that short-term misalignments are caused by external shocks and coinciding with shallow and illiquid markets, amplifying the intervention impact.

Historical Case Studies

In the following, we briefly discuss two cases of FX interventions which seem highly relevant amidst the current macroeconomic environment and the most recent intervention by the Bank of Japan.

First, the Mexican peso crisis of 1994 provides a glaring example of the limits of central banks to intervene in FX markets. At the time, the Mexican peso (MXN) was pegged to USD while most capital controls were removed in the years before. As the Fed started hiking interest rates, thereby reducing the interest differential to Mexico, and political uncertainty grew ahead of the Mexican presidential election, investors started to withdraw their capital putting downward pressure on MXN. To keep the peg, the Banco de Mexico intervened heavily in the FX markets, leading to a sudden depletion of its foreign currency reserves. This forced the government to give up the peg in December 1994, which led to a substantial depreciation and a rapid capital flight. The currency crisis led to elevated levels of inflation and a deep recession, requiring an eventual bailout by the US and the IMF. Further, the panic spread to other emerging markets, resulting in the Asian financial crisis of 1997.

Source: St. Louis Fed, Bocconi Students Investment Club

Source: St. Louis Fed, Bocconi Students Investment Club

Second, the 2011 intervention in the Yen market is an interesting case against the backdrop of the recent action by the BOJ. In the years prior to the action, the Yen rallied on the back of the expanding debt crisis in Europe. After the earthquake on 11 March, the Yen substantially appreciated further against the USD due to fears that Japanese companies and insurers would repatriate capital on a large scale to pay for the occurred damages, while volatility also exploded. Less than a week later, the finance ministers announced that they would intervene the next day to weaken the Yen, pointing to “excess volatility and disorderly movements” in the exchange rate. The Yen dropped by 3% immediately and volatility was reduced substantially the following days, despite the currency strengthening even further over the course of the year.

These case studies offer some valuable insights. First, when authorities are trying to strengthen the domestic currency, they are fundamentally limited by the amount of their foreign asset reserves. As reserves get drawn down, the credibility of interventions is undermined, potentially amplifying prior trends. Second, as indicated in the literature, interventions might be more successful when they work against a short-term misalignment arising from an external shock. Third, coordination between central banks and/or governments might enhance the effectiveness of interventions.

Recent Yen Intervention

Given the current global macroeconomic regime which includes a strong Dollar, elevated inflation rates, and rapidly rising interest rates, Japan is a clear outlier among developed nations. The country, which has suffered from decades of economic stagnation, is again experiencing less demand in its economy compared to North America and Western Europe. Now, though, lofty energy prices and irreplaceable food imports are contributing to an overshoot of the Bank of Japan’s (BoJ) inflation target, certainly a rare occurrence.

The BoJ is not convinced that demand is at a level that is consistent with its long-term inflation target and given the fact that it can do little to suppress the prices of imports, it remains focused on stimulating the domestic market. This is coupled with widespread beliefs that energy prices are trending downwards, as can be seen with many crucial energy futures markets which are in backwardation. In contrast, it has become clear that, for example, in the U.S., inflation has been mostly a demand-driven phenomenon.

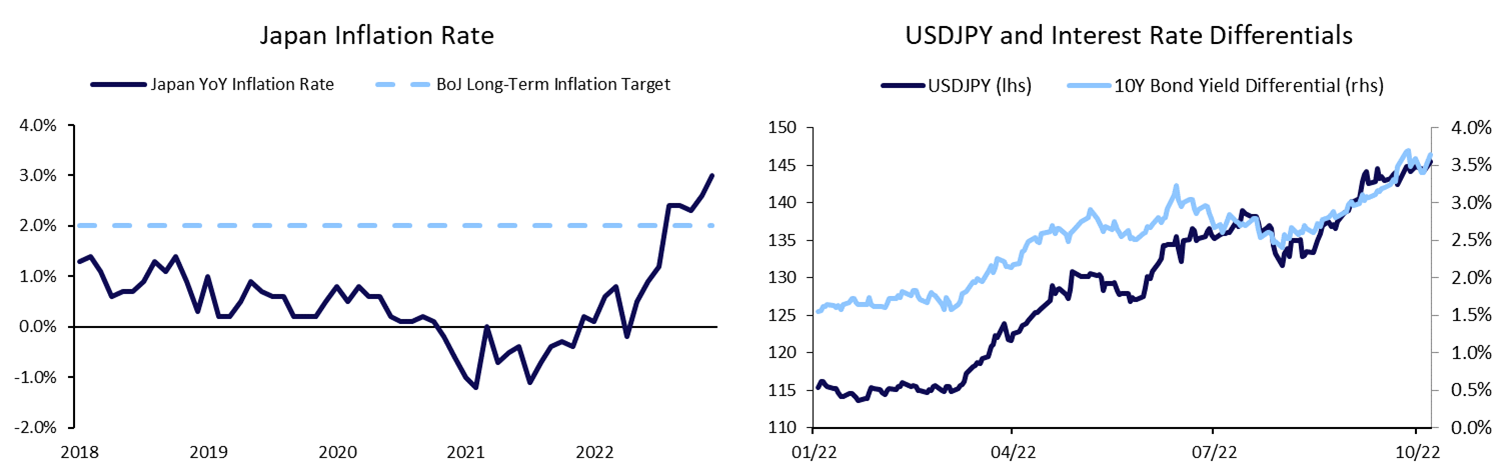

Source: Bloomberg, Bocconi Students Investment Club

Therefore, while tens of the world’s foremost central banks have been raising rates to level rapidly recovering demand with struggling supply, the BoJ has remained dovish, opting to keep its policy rate at -0.10%. This divergence in monetary policy was the main driver contributing to the weakest Yen in around 24 years.

Another factor that put downward pressure on the Yen this year was the BoJ’s introduction of the controversial yield curve control (YCC) policy. More specifically, the BoJ is targeting the 10-year JGB, setting a yield target of 0% and allowing fluctuations within a 25bps band. Once the upper explicit barrier (0.25%) is hit, the BoJ signaled its commitment to purchase virtually unlimited JGBs to defend its target. This culminated earlier this year and the BoJ’s vow to protect the yield level has been repeatedly tested, but the BoJ did not fold, thus handing investors excess Yen to invest in the domestic economy and abroad, where risk-free deposits have become increasingly attractive. Furthermore, risk aversion because of the Russia-Ukraine war and fears of a global recession has driven flows into the greenback, thereby further contributing to a weak Yen.

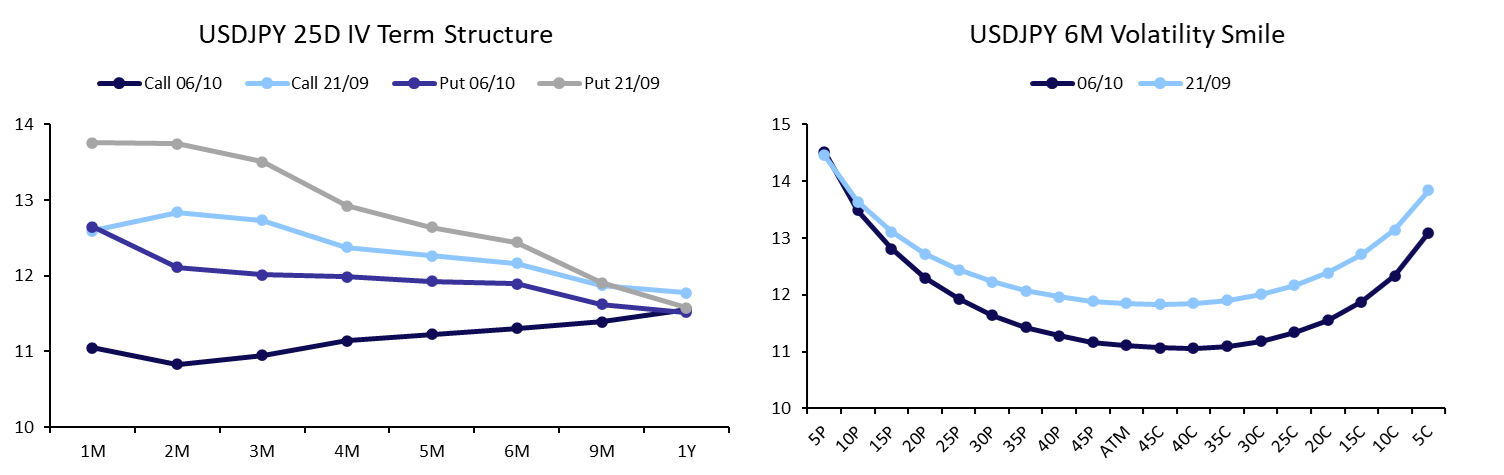

Finally, on the 22nd of September, the Bank of Japan decided to act by spending around $19.7bn in Yen purchases in the foreign exchange markets, making it clear that it is willing to defend the currency at a level that it believes can be justified by economic fundamentals. The effects of this: generational volatility in the Yen following the announcement, swiftly followed by a repricing near the market’s idea of the BoJ’s lower bound, right around 145 USD/JPY. Markets then also quickly adjusted future volatility expectations: lower implied volatility across the volatility surface.

Source: Bloomberg, Bocconi Students Investment Club

The Yen’s volatility surface, which has hung above the Euro’s and the Pound’s this year stooped well under them.

While the volatility surface overall shifted lower, the drop was especially pronounced for out-of-the money calls due to the perceived capped upside in USDJPY from the implicit “line in the sand” around the level of 146. This view seemed to be supported by comments of Finance Minister Shunichi Suzuki as the exchange rated moved towards 145 in the week after the initial intervention. He stated that the Ministry of Finance (MoF) would again “take bold action” if excessive one-sided moves occurred. As shown in the chart below, this led to a substantial drop in short-term risk reversals.

Source: Bloomberg, Bocconi Students Investment Club

In our view, this move might be subject to some reversion for several reasons. First, given the empirical evidence and historical examples, the success of the MoF in preventing the Yen to depreciate beyond the level of 146 might be temporary. This conviction comes from the fact that the current trend is not due to an external shock and/or limited liquidity resulting in a misalignment from macroeconomic fundamentals but rather driven precisely by these factors. Most importantly, the divergence between US and Japanese monetary policy is unlikely to cease in the short term as the BOJ remains committed to its ultra-loose monetary policy.

Further, the level of foreign asset reserves might undermine the credibility of interventions eventually. While Japan’s foreign currency reserves of around $1.29tn remain among the largest in the world, it already spent approximately $19.7bn during its first intervention. This implies that it would only have resources for a few further interventions of the same size. The academic literature thereby also suggests that the size of interventions must increase for subsequent intervention to achieve the same impact on the exchange rate. It is therefore likely that the central bank would not strictly commit to defending a certain level such as 146 but rather intervene if the Yen was subject to sudden drops in value.

Finally, while the risk reversals dropped significantly in the days before and after the intervention, the realized spot-volatility correlation remained largely unchanged. As can be seen in the chart above, for both a ten-day and one-month horizon, the correlation is around 0.5, substantially above the year’s average, only lower than during the onset of the Russian invasion of Ukraine when geopolitical uncertainty strengthened the dollar and shifted volatilities higher.

Based on these observations we present the following trade idea:

- Sell 3M 25D USDJPY Put (Strike: 137.75)

- Buy 3M 25D USDJPY Call (Strike: 149)

This long risk reversal position benefits from a readjustment in market perceptions on the effectiveness and commitment of the MoF to intervene in the FX market.

References

[1] Patel, Nikhil, and Paolo Cavallino. “FX intervention: goals, strategies and tactics.” BIS Paper 104b (2019).

[2] Sarno, Lucio, and Mark P. Taylor. “Official intervention in the foreign exchange market: is it effective and, if so, how does it work?.” Journal of Economic Literature 39.3 (2001): 839-868.

[3] Blanchard, Olivier, Gustavo Adler, and Irineu de Carvalho Filho. “Can foreign exchange intervention stem exchange rate pressures from global capital flow shocks?”. No. w21427. National Bureau of Economic Research (2015).

[4] Fratzscher, Marcel, et al. “When is foreign exchange intervention effective? Evidence from 33 countries.” American Economic Journal: Macroeconomics 11.1 (2019): 132-56.

[5] Filardo, Andrew, Gaston Gelos, and Thomas McGregor. “Exchange-Rate Swings and Foreign Currency Intervention.” IMF Working Paper WP/22/158 (2022).

0 Comments