The Coca-Cola Company (NYSE: KO) – market cap as of 18/09/18: 196.23 bn

Whitbread Plc (LON: WTB) – market cap as of 18/09/18; £ 8.61 bn

Introduction

On the 31st of August 2018, The Coca-Cola Company announced that it had reached a definitive agreement to acquire Costa Limited, one of the major coffee brands of the world. The acquisition represents yet another push from an established soft drink player away from its traditional market and into new avenues of growth, in an attempt to contest sour changes in consumer preferences plaguing the industry (Coca-Cola’s revenues have decreased by more than 16% in 2018). The acquisition will give Coca-Cola a strong coffee platform across parts of Europe, Asia Pacific, the Middle East and Africa, with the opportunity for additional expansion. Costa operations include a leading brand, retail outlets in the UK and abroad with highly trained baristas, a coffee vending operation, and an overall solid coffee vending platform. For Coca-Cola, the expected acquisition adds a scalable coffee operation with critical know-how and expertise in a fast-growing, on-trend category.

About The Coca-Cola Company

The Coca-Cola Company is one of the largest producers, distributors and marketers of beverages in the world. It is present in more than 200 countries and within its portfolio there are more than 500 brands. Coca-Cola is one of the most recognized brands globally.

The company was established 132 years ago in Atlanta, Georgia, where its headquarters are still located today. The flagship product of the company, Coca Cola, was invented in 1886 by Dr. John Styth Pemberton and the recipe for Coke is one of the best kept secrets from the 20th century.

Starting from the very beginning, Coke was distributed only as a syrup and not as a finished good. The syrup was sold to drugstores and other retailers who later added soda water and served the drink to clients. Nowadays, the sales model of the Company is still the same – it only produces the syrup which then is sold to the bottling companies. They are responsible for the creation of a finished product and for the distribution.

The success of the Coca – Cola is owed to extremely successful marketing campaigns which have had a huge impact on pop culture and society as a whole. Moreover, the company consistently increased its product portfolio by introducing other soft drinks such as Fanta or Sprite as well as through numerous acquisitions of other beverage brands. Currently, Coca-Cola is aiming to transform its portfolio by focusing on the reduction of sugar in its drinks and on the reduction of its environmental impact. The company has been trying to accomplish both goals by acquiring other players and pushing into organic and artisanal drinks. As of 2017, Coca-Cola, had $35.4bn in revenues.

About Costa Limited

Costa Limited is a British private multinational coffee house company founded in 1971 and headquartered in Dunstable, Bedfordshire (UK). It is the second largest coffeehouse in the world and the largest in the UK. Founded by the Costa family (Bruno and Sergio Costa) as a wholesale operation supplying roasted coffee to caterers and specialist Italian coffee shops, in 1995 it was fully acquired by the current parent company Whitbread PLC, the UK largest hotels, restaurants and coffee shops operator.

Costa Limited operates a chain of coffee shops in the UK and internationally, with nearly 2,400 retail outlets in the UK and over 1,400 stores in 31 international markets, a coffee-vending operation (8,000 Costa Express self-service units in a variety of on-the-go locations, including gas stations, movie theatres and travel hubs), for-home coffee formats and Costa’s state-of-the-art roastery. The company also provides its products online.

Costa’s revenue increased at the strong rate of 7.5% to £1,292m in 2017 (up from £1,202m in 2016) with underlying operating profit up 0.5% to £159m in 2017 from £158m in 2016. It also reported an excellent return on capital of 46.0%. For the fiscal year 2018 (ending March 1, 2018), Costa generated revenue and EBITDA of £1.3b and £238m, respectively.

Industry Overview

Many beverage companies have been undertaking acquisitions recently to expand to segments that seem to have better prospects, such as the acquisition of SodaStream (Israel-based manufacturing company best known as the maker of the consumer home carbonation product) by Pepsi, and the merger of Dr Pepper Snapple and Keurig Green Mountain.

More specifically, over the past year, coffee has become a significant and growing segment of the global beverage business, as well as a very active sector among food and drink companies. According to Euromonitor, the global coffee and tea industry is valued at more than $570bn and has been expanding by more than 5% in 2018. Before Coca-Cola’s announcement to acquire Costa, in May 2018, the Swiss group Nestlé agreed to a $7.15bn deal with Starbucks to sell its coffee products outside the US company’s coffee shop, adding Starbucks’ brand to its Nescafé and Nespresso portfolio. Similarly, in September 2017 the Swiss group accelerated its expansion in the US coffee market by taking a majority-stake in California-based Blue Bottles. These moves were largely driven by the need to contrast the competition from JAB Holdings, the European group, which owns brands such as Keurig and Stumptown, as well as the Peet’s chain.

One major reason behind these moves is the trend followed by soft-drink producers of looking for diversification opportunities and new businesses to enter into. The reason being the fact that, worldwide, soft-drink has always been a largely fragmented market with no single company having a strong foothold across all parts of coffee. In addition to that, there is the need to follow the current wave of “health-consciousness” that is leading to a reduction in the consumption of sugary and fizzy drinks. Even if the beverage sector has always coped with changing consumer tastes, nowadays trends are becoming even harder to predict. Another trend that is characterizing the sector is the expansion towards Asia, where the coffee market and the coffee culture has lot of potential and is growing fast. Indeed, according to GlobalData, retail sales of hot drinks in China alone will hit $34.2bn by 2022. In line with this latter reason, several transactions took place: in October 2017, Costa itself acquired Yueda, a Chinese coffee chain with which it had operated a joint venture in China for more than a decade; and early in August 2018, Starbucks announced a deal with e-commerce giant Alibaba to expand its delivery services the country.

Deal Structure

Coca-Cola first expressed its interest in purchasing Costa in June 2018 for a price of approximately $5.1 billion (£3.9 billion GBP). The implied transaction multiple is 16.4 times EBITDA, which some analysts called “a rather punchy price”.

From a financing perspective, the acquisition is to be funded with Coca-Cola’s existing cash on hand, and the Net Debt Leverage is expected to increase by 0.3x which will doubtfully impact existing ratings.

Just before the deal announcement, the market capitalisation of Whitbread was around $9.5bn (£7.3bn GBP). According to the analysts estimates, around $3bn (£2.3bn GBP) of Whitbread market cap could be attributed to Costa. Revenues of Costa in FY2018 (which ended in March 2018) amounted to roughly to $1.7 billion (£1.3 billion GBP), while its EBITA amounted to $312 million (£238 million GBP). In line with that estimate, the price offered by Coca – Cola includes a premium of about 70% to Costa’s value. Coca-Cola will acquire all issued and outstanding shares of Costa. The transaction is estimated by Coca-Cola to be slightly accretive within the first year, which might however be impacted by the purchase accounting (not much in terms of cost synergies).

Deal Rationale

As sales for Coca-Cola have shrunk by 15.4% over the past year, the world’s largest producer of soft drinks looks for alternatives in the hot beverage marketplace to contrast adverse trends in consumer preferences, with customers shifting away from sugary drinks and towards healthier alternatives.

Consumers in general are becoming more health conscious, millennials specifically are attracted to diversity and genuine products, health agencies have aggressively confronted sugary beverages as a leading cause of health problems, and lastly, governments around the world have implemented concrete measures like “sugar taxes” to curb their purchase. In sum, soft drinks just don’t seem to fit the bill anymore. Sugary drink consumption is declining rapidly around the world (with estimates ranging around 11% in 2018), and Coca-Cola is not the only company struggling. Many of its large competitors are attempting to shift their business model or access alternative beverage segments, and some have already turned to M&A as a possible solution, an example being Pepsi’s recent acquisition of SodaStream for $3.2 bn.

Established players have been forced to seize growth elsewhere, and Coca-Cola was aware of the adversities in had in front of itself before announcing this acquisition. In the past, Coca-Cola had attempted to navigate this shift in consumer preferences, by beefing up and even expanding its fruit juice portfolio and even attempting to launch a naturally sweetened version of its flagship coke named “Coca-Cola Life”. Some attempts where more successful than others, and while the new coke was an overall failure (the drink has already permanently left the shelves), its juices have performed well overall. However, there was a clear sentiment that these attempts were not enough to revive revenues alone, and margins were going to suffer without a major play.

Coca-Cola’s headline response came in the form of a $5.1 bn acquisition for UK’s largest coffee chain Costa Coffee, an explicit attempt to enter the fast growing and profitable coffee and hot drink marketplace and marry Costa’s established coffee-selling platform with Coca-Cola’s remarkable marketing expertise and global reach. From a strategic point of view, the deal is far more transformative than it would first appear, with coffee presenting radically different customer and consumption profiles than Coca-Cola’s current battleground of NARTD (non-alcoholic ready to drink beverages). The differences between canned drinks and coffee go far beyond the fact that one is served cold and the other is served warm; consumption occasions are diametral (soft drinks are drank at lunch/evening while coffee is mostly consumed during the first half of the day), Cola’s are ready immediately at a can’s “pop”, while coffee is almost never ready to drink right away and it is inexorably tied to its antecedent preparation and its ritualistic nature. On an important note, Costa’s acquisition will also see Coca-Cola obtain a retail presence for the first time, as it will be forced to operate a network of stores and expand its focus beyond simply selling products.

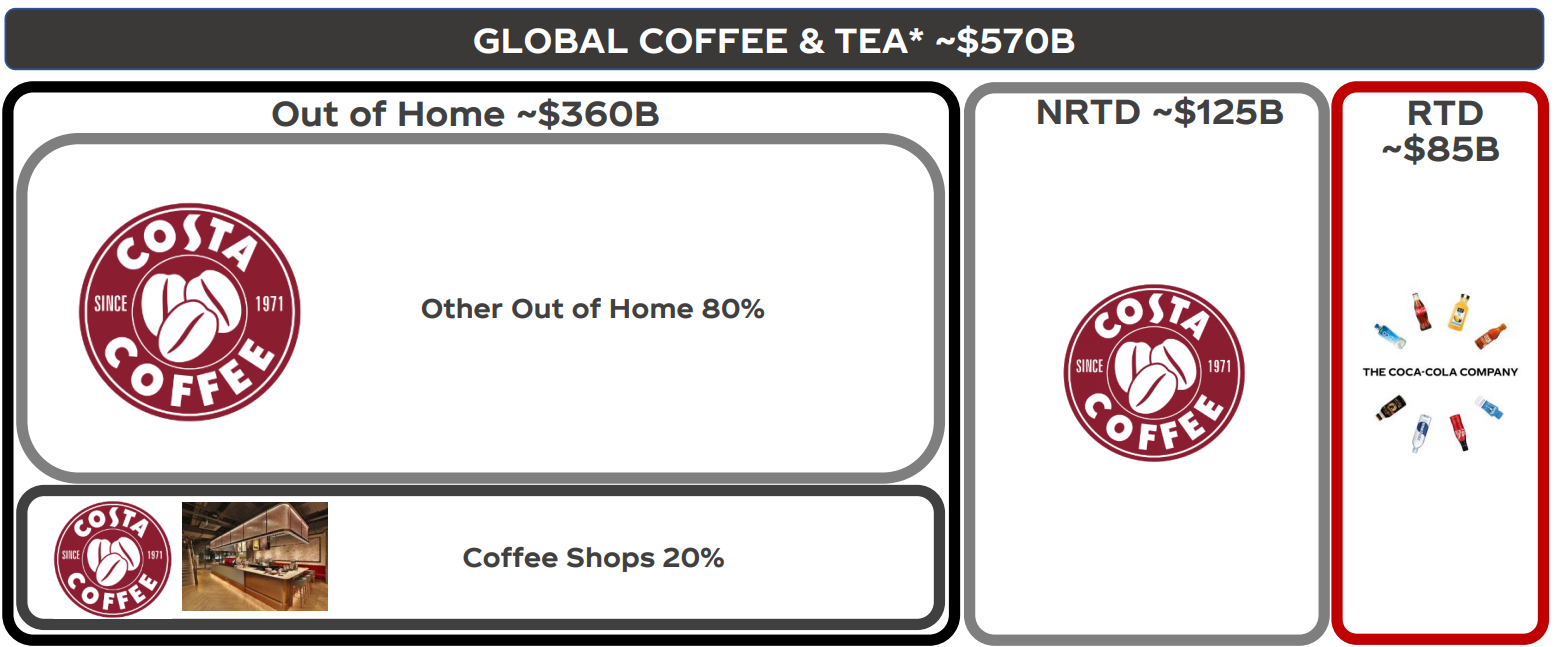

On the flipside, the opportunities are more than plentiful, and the coffee industry has considerably larger margins and is growing at a high 6% growth rate. From a schematic perspective, the global coffee and tea industry is about $570 bn and most of the consumption of these products takes place “Out-of-home”. More granularly, the coffee market can be subdivided into 3 subsegments: Ready-to-drink ($85 bn), Non-ready-to-drink ($125 bn) and Out-of-home ($360 bn). Of the Out-of-home segment, only 20% of it takes place at Coffee shops, and there are a lot of opportunities to sell these products at alternative venues. More interestingly, coffee is an extremely fragmented industry in which no major player currently holds a strong presence in all subsegments, notwithstanding their strong complementarities.

Source: Coca-colacompany.com

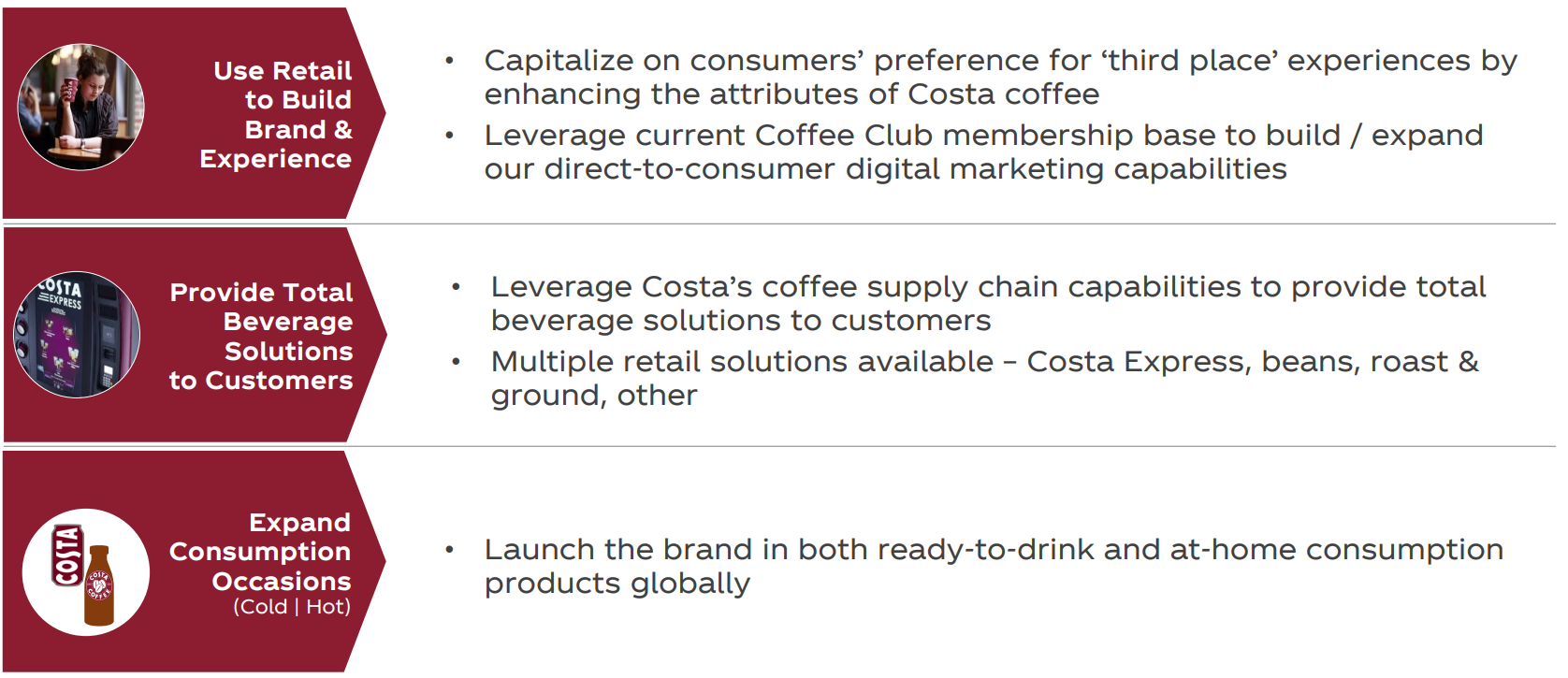

Coca-Cola’s strategy for this acquisition is a lot less about operating stores than it is about obtaining a strong foothold in the only non-alcoholic beverage segment in which it does not currently have an established presence. From this perspective, Coca Cola’s ambition is to go from the Coffee shop straight to the customer’s home, and it has chosen a strong vessel to support this quest. The ultimate objective will be to develop Costa’s existing proposition to achieve a global leadership position in coffee, starting from the retail coffee shop channel, across to vending machines at petrol stations and supermarkets, up to canned/ready-to-drink coffee products and all the way to selling coffee blend for customer’s home use. Substantially, Costa’s acquisition represents the platform upon which Coca-Cola will build its coffee proposition and launch new products across the hot beverage segment in all formats including ready-to-drink and at-home blends, while capitalizing on Coca-Cola’s expertise in marketing and product positioning.

Source: Coca-colacompany.com

Market Reaction

Chief executive of Whitbread, Alison Brittain commented that the transaction accelerates the realisation of strategic value that the company has developed in Costa brand and reflects its growth potential. Indeed, the deal was great news for shareholders. On the day of the announcement shares of Whitbread increased by as much as 19% and closed at 14.3% higher.

The share price of Coca-Cola was affected negatively by the news as it decreased by 0.4% after the announcement. This is, however, rather small impact which might be a result of two contradictory effects. On the one side, for Coca-Cola the acquisition is a great move towards diversification and a possibility to gain health-conscious consumers. On the other hand, investors raise doubts about profitability and point out possible pitfalls of the acquisition. The main concern is that Coca-Cola lacks retailing experience which is especially important in the coffee business. Companies such as Starbucks thrive on their unique way of treating customers and delivering a high-quality service. This might be a challenge for Coke, which is used to its traditional distribution model, and typically communicates with its customers solely through advertising.

Advisors

Rothschild acted as exclusive financial adviser to The Coca-Cola Company. Goldman Sachs, Morgan Stanley and Deutsche Bank advised Whitbread. Clifford Chance acted as legal counsel to The Coca-Cola Company, while Skadden, Arps, Slate, Meagher & Flom acted as its tax counsel. Slaughter and May provided legal advisory to Whitbread.

0 Comments