Introduction

Allegations against one of India’s largest conglomerates have sent shockwaves throughout India and the rest of the world. Gautam Adani, an Indian industrialist, and billionaire was ranked the 3rd richest person in the world only last month. He has now fallen to the 25th spot as almost $135bn has been wiped from the Adani Group’s total equity value since late January when the activist short-selling investment research firm, Hindenburg Research, accused the firm of fraud. The group, which focuses on large-scale infrastructure development in India and abroad, was accused of financial irregularities, stock manipulation, and social and environmental violations. The accusations have launched a regulatory investigation by the Securities and Exchange Board of India and have forced the group to cancel both a follow-on public offering and the acquisition of a coal power plant.

Adani Group

The Adani Group was founded by the current chairman Gautam Adani in 1988 and has now grown into one of India’s largest conglomerates. The group started as a commodity trading company and evolved into an importer and exporter of raw materials and finished goods based in India. The firm built its own port, Mundra Port, in 1998, which stands as India’s largest private port with an annual handling volume of 5.6m twenty-foot container equivalents. The Group then began developing roads, airports, and power plants, diversifying into the transportation, logistics, and energy sectors. In 2006, the company became India’s largest coal importer, and after acquiring various coal mines in India, Australia, Indonesia, and several other countries over numerous years, solidified its position as a crucial player in India’s energy market. During the 2010s, the Adani Group expanded its portfolio of renewable energy plants and projects and formed Adani Green Energy, its renewable energy brand in 2016.

In 2011, the Adani group bought the Abbot Point port in Australia one year after acquiring the Galilee Basin mine, located in the same area of the country. In 2014, the mining branch of the group began the development of mining and railway operations to export coal mined from the Galilee Basin through Abbot Point. The project received numerous criticisms and protests from climate activists causing international banks to refuse to finance the construction and development of the mine and railway. This led to Adani announcing in 2018 that it would finance the entire $21.5bn 60-year cost of the project on its own.

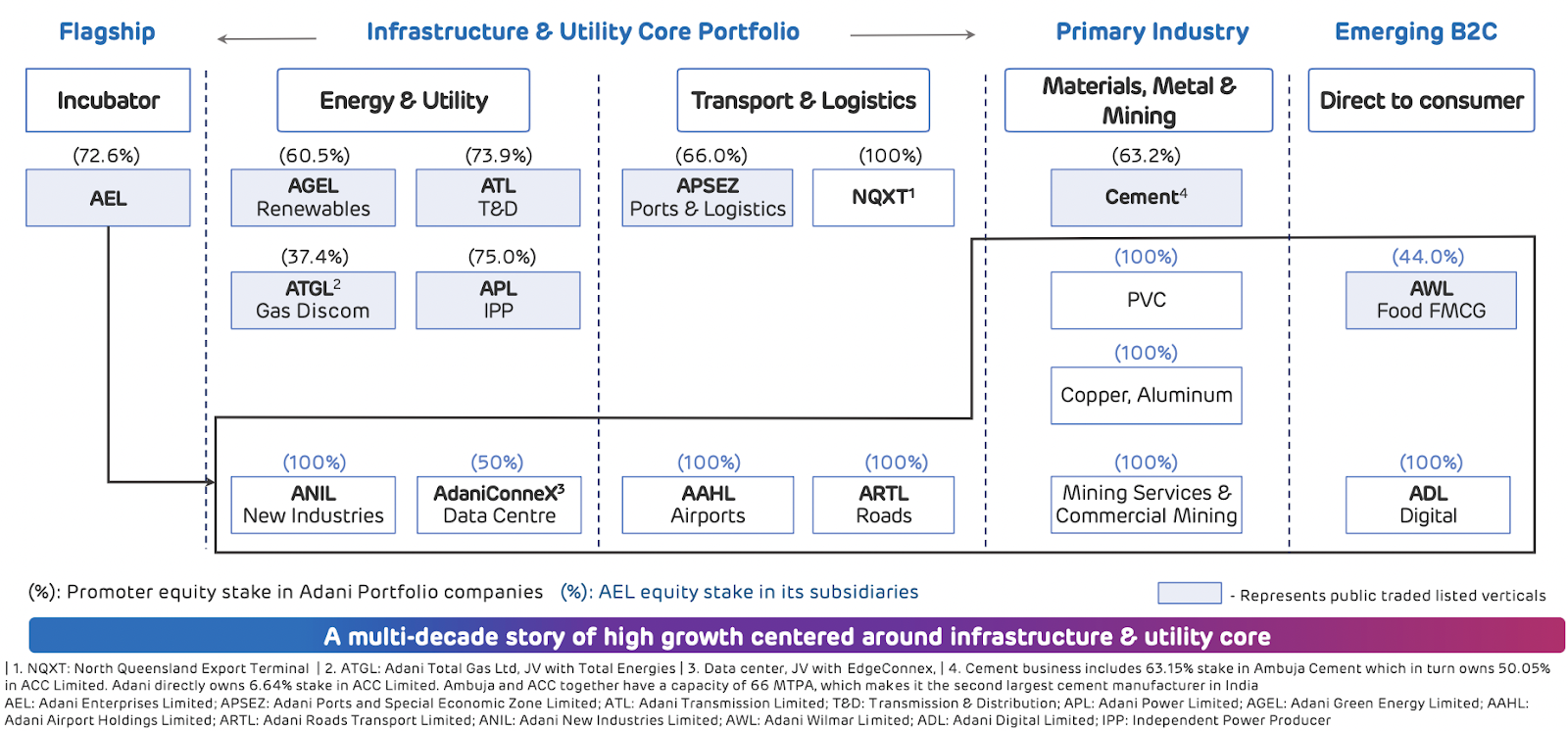

The Adani Group currently comprises a portfolio of seven publicly traded companies spanning four broad verticals: Energy & Utility, Transport & Logistics, Primary Industries, and Direct to Consumer.

Adani Enterprises Ltd (AEL) [ADANIENT: NSE] is the group’s flagship company, which has a primary focus on mining and trading coal and iron ore, while also acting as an incubator for Adani’s new business ventures. The firm itself has numerous subsidiaries operating across several industries such as data, food processing, airport operations, and road developments. Adani Green Energy Ltd (AGEL) [ADANIGREEN: NSE] is a renewable energy company with a current operational portfolio of 6,724MW and a project portfolio of 20,434MW. Solar power capacity currently makes up 70% of the firm’s renewable energy portfolio, which also includes the Kamuthi Solar Power Project, one of the largest photovoltaic plants in the world. Adani Ports and Special Economic Zone Ltd (APSEZ) [ADANIPORTS: NSE] was established with the construction of Mundra Port in 1998 and currently operates 10 ports across India, accounting for around one-quarter of the total cargo movement in the country. The Mundra port is connected to the Mundra Economic Hub, a Special Economic Zone (SPZ) spanning 8,400 hectares of land, which is a key free trade and warehousing domestic industrial area. Furthermore, the firm  provides land reclamation and dredging services for port and harbour construction.

provides land reclamation and dredging services for port and harbour construction.

Source: Adani Group Investor Slides – Adani Portfolio Overview Jan 2023

The Adani Group also includes Adani Power Ltd (APL) [ADANIPOWER: NSE], the largest private power producer in India, Adani Transmission Ltd (ATL) [ADANITRANS: NSE], Adani Total Gas Ltd [ATGL: NSE], a joint venture between Adani Group and TotalEnergies SE [TTE: EPA], and Adani Wilmar Ltd [AWL: NSE], a joint venture between AEL and Wilmar International, which produces a variety of cooking and edible oils. Alongside its strong presence in India’s industrial, commercial, and energy sectors, Adani also owns several sports teams, mainly men’s and women’s cricket teams in India.

The Adani Group is an extremely important conglomerate in India with a dominant presence in numerous key industries. The group is India’s largest port operator, handling over 300m metric tons of cargo in 2022. Furthermore, the Adani Group manages seven airports across India through Adani Airports Holdings Ltd, a subsidiary of AEL founded in 2019. The firm holds controlling ownership in Mumbai International Airport Ltd which operates the second largest airport in India, Chhatrapati Shivaji Maharaj International Airport. Acquisitions of projects, plants, and other firms have played a key role in the Adani Group’s growth and continue to be its main strategy for gaining a greater market share across the numerous industries it operates in. For example, it acquired Swiss building material company Holcim Ltd’s full stake in two of India’s largest cement companies in a $10.5bn deal standing as one of Adani’s largest acquisitions. Ambuja and ACC are amongst the largest cement producers in India, with a combined 23 cement plants, 14 grinding stations, 80 concrete plants and over 50,000 partners across India. The group expects the Indian cement industry to grow significantly in the future, as currently, India’s cement consumption per capita stands at half that of the global average. Furthermore, it can utilise cement production across all its portfolio firms to cut construction costs and exploit synergies. Looking to the future, the group is heavily betting on investments in the renewable energy sector. For example, in 2021 AGEL completed India’s largest renewables M&A deal, the acquisition of SB Energy Holdings Ltd, valued at $3.5bn. To fund many of these acquisitions and projects, the group has been using the green bond market, raising $750m in late 2021. However, the investments are predominantly financed by debt, causing the conglomerate to be deeply over-leveraged.

Hindenburg Research

Hindenburg Research is a financial research firm that specializes in short-selling activism and investigative research. The New York-based company was founded in 2017 by Nathan Anderson and has since been in the spotlight for its research reports on various companies, many of which have seen their stock prices plummet. Targeting companies with business malfeasances and potential red flags, the firm conducts its investigations by going through the target company’s public records and internal corporate documents, as well as interviews with former employees. Aiming to profit from the findings, Hindenburg and its limited partners open short positions before the findings become public. The publication of the result of their investigations on reports is disclosed on their website with detailed fraud and/or malpractice accusations, which are typically accompanied by supporting documentation. Amongst their past notable research are the Nikola and clover Heart reports.

Hindenburg’s Allegations

On January 24th, Hindenburg posted its latest report, this time, on the Indian conglomerate run by Gautam Adani. The accusations made encompassed many financial irregularities, stock manipulation accusations, and social and environmental violations, ranging from unethical practices to potentially illegal activities. The report with the accusations was followed by 88 questions for the Adani group.

The accusations on the financial front regard overinflated valuations and the manipulation of financial statements. According to the report, the Adani group was able to maintain the alleged fraud scheme due to its complex and opaque structure, with many subsidiaries and offshore shell companies.

Hindenburg accuses Adani of manipulating its cash flow statements in various ways. Firstly, the conglomerate is said to have been engaged with a technique called “round-tripping”, in which it inflated the transactions between its subsidiaries as a way of artificially boosting profits. Further, the Adani Group would have allegedly overstated cash flows from interest income by rerouting the loans through shell companies with inflated rates generating increased revenues. Also, the company allegedly capitalized their interest expenses. By adding them to the value of the assets, instead of recording them as expenses, the firm’s financial position would appear to be stronger than reality. Lastly, the Indian firm is accused of understating cash flows from investing activities, to generate higher returns.

Although in the past fraud schemes in firms audited by the Big Four, such as with Enron and Parmalat have been uncovered, Hindenburg also highlights that Adani’s group results didn’t undergo an independent and unbiased audit, which facilitated the maintenance of the scheme. Shah Dhandharia & Co, the company that audited the results for four of the conglomerate companies, has four partners and only 11 employees in total and has been under investigation by the Institute of Chartered Accountants of India (ICAI).

The Indian conglomerate was also accused of manipulating its stock and insider trading. According to the report, although the Adani companies’ stocks skyrocketed over the past seven years, an expected increase in earnings wasn’t observed, in fact, many still have negative cash flows to date. The report suspects that the stock increases are a result of stock manipulation.

Hindenburg discovered that over 38 shell companies related to the Adani group were owned by the founder’s elder brother, Vinod Adani, former director of six Adani group companies. Most of these shell companies were based in Mauritius and had no apparent sign of operations or reported employees. Nonetheless, the research firm found out that these shell companies had moved billions of dollars into Adani’s publicly listed companies, having over 90% of their total assets in stock of Adani businesses. The money managed by the shell companies would allegedly come from the Adani enterprises through Adani’s family offshore trust. Later, the money would once again be invested in Adani Enterprises stock, causing prices to appreciate. Hence, this would give the Indian group the opportunity of manipulating its stock for its own corporate needs.

Further, regulations in India state that at least 25% of shares of publicly traded companies must be owned by external parties. Hindenburg highlights that the offshore shell companies have been used by Adani to overlook this rule, retaining higher inside ownership. Moreover, the report notes that these stock-parking companies were responsible for up to 30-40% of the trade volume of Adani’s companies, which in addition, were found to be conducted in a synchronized manner, which contributes to the hypothesis of stock manipulation.

Hindenburg’s report also highlights the Indian group’s poor governance, and states that the Adani group is a “family business”. Of the 22 executives of Adani’s group leadership, nine are direct family members of the founder. Further, Adani Enterprises have had 5 CFOs over the last eight years only, which are obvious red flags given the fraud scheme accusations. The report goes on with Hindenburg’s concerns over Adani’s close political ties with the Indian PM Narendra Modi. The firm alleges that the Adani Group has received preferential treatment from the Indian government in the form of land concessions, environmental clearances, and other regulatory exemptions. This becomes worrying as it adds up to former accusations faced by the conglomerate on illegal construction of ports, ignoring environmental regulations and labour rights issues.

The conglomerate answered in a 113-page statement and a conference held by their leadership. The Indian group denied all the allegations made by Hindenburg, stating they are false, misleading, and motivated by a desire to manipulate the stock price of Adani Group companies. The company states it is strongly committed to transparency and compliance and that it has strong governance in place. The group claims that it has delivered strong business performance, has a solid financial position, and that its stock prices and valuations are based on solid fundamentals. Finally, it stated that legal action has been taken against Hindenburg Research and its associates, alleging that they have engaged in market manipulation, defamation, and extortion.

The Consequences of the Allegations

Following Hindenburg’s allegations, the Adani Group witnessed a severe sell-off in stocks of its listed firms, resulting in a total market loss of $146bn in nearly a month. Hindenburg’s research stated that seven stocks within the group were about 85% overvalued and a month later from the publication of the report, one of the group’s stocks, Adani Total Gas, lost almost 85% in value. Furthermore, if one considers the fall in the group’s stock prices since their respective 52-week highs, an additional two firms are nearing an 85% drop, Adani Green Energy and Adani Transmission. The combined result of this sustained loss in stock prices resulted in the group’s market value declining by more than 60%.

About a week after Hindenburg’s allegations, the company agreed to repay a $1.1bn share-backed loan which was not due until September 2024. The loan was from several major banks, such as JP Morgan, Citibank, Deutsche Bank, and Barclays. According to reliable sources, as the share prices continued to decline, Barclays informed Adani of a margin call equivalent to 50 per cent of the loan in cash. Adani Group stated it did not receive a formal request for a margin call and that the full loan was repaid early “per our prepayment planning” and to reduce leverage. Repaying the entire $1.1bn loan instead of posting cash against it is a move to demonstrate the group’s financial strength. By showing that the group has more than $1bn in cash ready to be deployed, the conglomerate aimed to boost investors’ confidence. The early repayment of the loan had a “calming effect” and reduced pressures on international lenders that were facing demands from their risk-management committees to cut down their exposure to the Indian group. Adani said the share-backed loan repayment would release 168m shares in Adani Ports, 27m Adani Green Energy and 12m in Adani Transmission.

Another major decision the Adani Group took after the fall of its stock prices is calling off its $2.4bn equity fundraising. The group announced the cancellation after witnessing a $90bn loss in company value which took the shares below the deal price range. At the announcement, the management affirmed that the group’s balance sheet is “very healthy with strong cash flows and secure assets” and that they have an “impeccable track record of servicing debt”. The group emphasized that they called off the fundraising not due to a lack of confidence in their ability to perform, but as an act of respect towards the investors. The board stated that the best way to protect the interests of their investors was by insulating them from any potential losses given the “extraordinary” fluctuations in Adani Group’s share prices. The share sale had succeeded when Adani Enterprises’ stock price was already fluctuating below the offer price and, therefore, the investors were starting at a 30% loss even before the shares were allotted. This equity fundraising would have been highly beneficial for Adani, helping cut his group’s debt and boosting confidence in the group.

The $2.4bn equity fundraising is not the only major event cancelled due to the publication of the allegations. Adani has announced the annulment of an $847m deal acquisition of DB Power, an Indian coal-fired power plant which was supposed to be concluded by the beginning of 2023. The deal’s time limit had expired and none of the parties was interested in extending the period. Adani’s decision not to go forward with the acquisition reflects a change in the strategy and direction that the group is taking. The company has announced that they plan to scale back capital expenditure for the new financial year starting in April and to temporarily halt further capital expansion. Adani Group, which has halved its revenue growth target, hopes that scaling back on capital expenditure will win back its investor confidence. Another deal threatened by the allegations is Total Energies’ $4bn hydrogen investment. Total planned to acquire a 25% stake in Adani New Industries Ltd as part of an ambitious hydrogen co-investment with Adani Enterprises. The French group, which had several interactions with the Adani Group in the past, decided to pause the investment waiting for more clarity on the fraud allegations. Total currently has over $3bn of investments in Adani and its CEO ensured that the businesses the group invested in are “backed by functioning assets and are healthy” and he defended the due diligence Total carried out on the deals.

Adani’s ports and logistics company also announced its plans to pay off debt and cut spending to alleviate investors’ unease due to the group’s considerably high leverage. Karan Adani, chief executive of the ports and logistics company, announced they are considering a total loan repayment of around $604m for the year ending March 2024. He said this would “significantly improve” the company’s net debt-to-earnings ratio, which currently stands at 3.5x. This move would bring the ratio closer to 2.5x by March 2024. The changes the group undertook after the allegations do not only relate to reduced expenditure but also to corporate governance. To appease investors, Adani has promised to improve oversight of the family side of the business. Among the changes, he intends to appoint a financial controller to supervise his trusts and other privately held companies to make the family office’s governance resemble a public company. This decision responds to Hindenburg’s criticism of the “maze” of Adani private companies currently controlling the conglomerate.

Adani Group’s crisis led to increased political pressures as Adani has been regarded as an ally of prime minister Modi. MPs from the Congress party and opposition groups demanded investigations into Adani’s businesses, and the intensity of Adani shares’ sell-off has prompted Indian authorities to try calm investors. The Securities and Exchange Board of India (SEBI) has confirmed the existence of an investigation on the group in its Supreme Court filing. SEBI is still in the early stages of examining both the allegations made in the Hindenburg report and the market activity before and after the report publications. They are also examining trade patterns and any potential irregularities in the $2.4bn equity fundraising that Adani Enterprises cancelled due to the fall in its shares. In support of their investigations, SEBI is currently seeking details of all ratings of local loans and securities of Adani Group’s companies from credit rating firms. Rating firms will have to provide all outstanding ratings, outlooks, and any updates from discussions they might have with the group’s management. Until now, only international credit agencies, such as S&P and Moody’s, have changed the outlook on some of Adani’s companies from stable to negative. On the contrary, local agencies are waiting to see if the group can recover as they are confident that its current liquidity is more than the total maturing debts in 2023-24.

Outlook

Hindenburg Research disclosed with the report that it had taken a short position in Adani Group Companies through US-traded bonds and non-Indian-traded derivative instruments. With the Adani Group stocks plummeting, Hindenburg is undoubtedly set to make big profits out of such trades. Further, as the allegations made in their report against Adani Group are the subject of ongoing investigations and legal proceedings, as are the accusations of the conglomerate towards the forensic finance firm, it is still too soon to conclude what the outlook for Hindenburg looks like.

Nonetheless, this episode certainly reopens the discussion about short-selling activist funds, such as Hindenburg. Forensic finance firms play an important role in identifying potential fraud and misconduct in the financial markets. Their reports are indeed a valuable source of information for investors and regulators, helping improve accountability, efficiency, and transparency in the financial sector, and even prevent market bubbles. However, the conflict of interest is clear. As short positions are taken to profit from published reports, many argue that such funds are solely motivated by profit and are willing to use unscrupulous or unethical methods to achieve their goals, potentially crippling innocent firms.

0 Comments