Kraft Heinz Company (NASDAQ:KHC)—market cap as of 24/02/17: $112.79bn

Unilever plc (LON:ULVR)—market cap as of 24/02/17: £112.08bn (€133.46bn)

Introduction

On February 17, 2017, it was reported that Kraft Heinz had made a £112bn ($143bn) takeover offer for the Anglo-Dutch conglomerate, Unilever. A deal would have created the world’s second largest consumer company by revenues. Had it been successful, the transaction would have more than tripled Kraft-Heinz’s last year’s annual sales of $26.5bn and would have provided the US-based group with a deeper reach into emerging markets where Unilever holds a strong position.

Only two days after publicly confirming its interest, Kraft Heinz dropped its $143bn pursuit as its main shareholders, Warren Buffett and 3G Capital’s Jorge Paulo Lemann, concluded that prolonged public battle would have caused more damage than good. Following this announcement, shares of Unilever fell 8 per cent.

About The Kraft Heinz Company

The Kraft Heinz Company was established in 2015 through the merger of Kraft Foods Group and Heinz. The merger was backed by Berkshire Hathaway and 3G Capital. The firm currently is co-headquartered in Chicago, Illinois and Pittsburgh, Pennsylvania and has a portfolio of more than 200 brands sold in nearly 200 countries.

Kraft-Heinz is widely known for their portfolio of brands that includes eight brands with $1bn or more of annual revenues each.

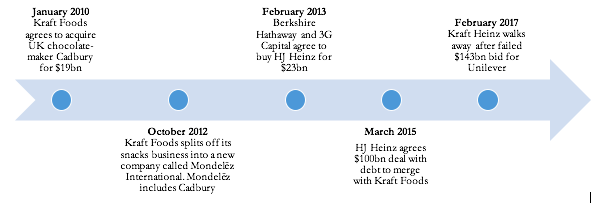

Timeline below shows evolution of Kraft Foods from 2010 until now.

Source: BSIC

In FY2016, the company reported $26.5bn of total revenues (44.4% YoY growth), operating income of $6.1bn (132.7% YoY growth), and net income of $3.5bn, a significant improvement from last year’s loss of $266m.

About Unilever plc

Unilever PLC is a dual-listed Anglo-Dutch multinational consumer goods company founded in 1930 through the merger of Dutch Margarine, Margarine Unie, and the British soap maker – Lever Brothers. The firm is co-headquartered in Rotterdam, Netherlands and London, UK.

Unilever has a global footprint with more than 400 brands that are available in c. 190 countries. Moreover, it has subsidiaries in nearly 100 countries. The company has thirteen major brands with €1bn or more of annual revenues each.

Unilever is organised into four main divisions: (1) Foods, (2) Refreshment (beverages and ice cream), (3) Home Care, (4) Personal Care. In 2015, the company shifted focus towards health and beauty products, away from food brands that had shown limited growth opportunity. Aligned with this strategy, in July 2016, Unilever bought the US start-up Dollar Shave Club for a reported $1bn (£764m) in cash to compete in the male grooming market.

In FY2016, the company reported €52.7bn of total revenues (1.0% YoY decline), operating profit of €7.8bn (3.8% YoY growth), and net profit of €5.5bn (5.5% YoY growth).

Key Players Behind the Scenes

On the Kraft Heinz side, two figures loomed over the deal: Berkshire Hathaway’s iconic founder and CEO – Warren Buffett, and 3G Capital’s founding partner – Jorge Paulo Lemann. The partnership between Buffett and Lemann goes back to 3G Capital’s acquisition of Heinz, a classic example of 3G’s playbook of acquiring household name companies in debt-fuelled transactions and aggressively cutting costs afterwards. When there are no longer costs to be cut down internally, 3G looks for potential mergers with industry competitors, specifically targeting cost synergies. However, bidding for rivals is often complicated due to the unwillingness of the targets to be acquired. Furthermore, whenever teaming up with Warren Buffett, 3G cannot pursue hostile takeovers, as Buffett is well-known to dislike this type of deal making.

With reports that 3G Capital had $15bn cash available, it had been long expected by industry analysts that Kraft Heinz would have attempted a major deal with other industry competitors such Mondelēz, General Mills, Pepsi, or Unilever.

On the Unilever side, the key figure has been the company’s CEO, Paul Polman – who, over the past years, has tried to lead the company to a sustainable growth path. While prudent, this path resulted in Unilever achieving very modest if not sluggish performance, as shown by 2016 operating margin of 15.3%, compared to Kraft Heinz’ 22.55%, Procter & Gamble’s 20.58%, or L’Oréal’s 17.4%.

So far shareholders have put up with the disappointing performance, but after the failed takeover attempt, Polman will need a new strategy to keep shareholders content.

Deal Rationale

The deal was backed by a strong rationale. Indeed, 3G Capital, has a history of pursuing business growth mainly through M&A activities. Given its $15bn in cash available, another major acquisition had been in the bull’s eye for a long time, although analysts did not forecast a target as big as Unilever.

In terms of strategy, the bid perfectly fits in the picture: Kraft Heinz’s largest shareholders, 3G Capital and Warren Buffett’s Berkshire Hathaway, are heavily focused on increasing shareholder’s value through aggressive cost-cutting policies. Since the two giant companies operate primarily in the food industry, considerable synergies could have been realized.

Nevertheless, increased profit margins are usually not a sufficient justification for a $143bn bid, especially when substantial clashes in corporate cultures can be expected. While Kraft Heinz primarily interest lies on maximizing short-term value, Unilever emphasizes responsible capitalism through sustainable business practices and preservation of its brand’s reputation. If such sizable differences posed a threat to a post-acquisition integration process and the possible synergies, why did Kraft Heinz initiate the negotiations in the first place?

Complementary geographies could potentially form an argument. Kraft Heinz has indeed been searching for access to non-U.S. consumers, shifting its main focal point to emerging markets and Europe. In 2016, US and Canada contributed 80% ($21bn) to its net sales, whereas the company has never achieved a satisfactory performance in Europe or elsewhere. Therefore, an acquisition of a consolidated firm in these markets looks like a plausible approach. Unilever might have been the most reasonable target due to its global exposure and strength in emerging markets. Indeed, Europe and Asia account for 70% of the company’s total revenues. Additionally, 43% of last year revenues (€22.2bn) originated from Africa, Middle East and Asia including Turkey, Russia, Ukraine and Belarus.

However, the failure of the merger demonstrates that the benefits of potential synergies did not overweight the possibility of a corporate culture clash.

Why Did the Deal Fail?

There are many factors that contributed to the failure of Kraft Heinz’s bid for Unilever including strategic, political, and cultural reasons.

From the beginning of the process, the negotiation style implemented by 3G Capital through its managing partner, Alexandre Behring, clashed with the expectations from Unilever’s top managers. According to the FT, when Behring made Polman (Unilever CEO) aware of the intention of the American group of pursuing a merger, the latter was taken aback by the offer, which he judged both misguided in its underlying rationale, and unfair in the bid price. Moreover, Polman believed that the corporate culture at Kraft Heinz was fundamentally at odds with the long-term focus cherished by himself and Unilever’s shareholders. Therefore, it was highly likely that a potential merger would have led the combined company to a culture clash.

Further, on the political dimension the deal was hampered by the actions of the United Kingdom government. After the bid was made public by financial media, the Prime Minister of the UK, Theresa May, ordered a full review of the transaction. Given the weaker pound sterling and the fall-back of the Brexit process, it would have been politically costly for May’s administration to stand by a foreign acquisition of a traditional British company, especially since the post-merger restructuring would have led to jobs cuts. The announcement of the deal review to be carried by the UK government was taken to indicate that there might be significant regulatory roadblocks were the merger to go ahead, and this is believed to be the main reason Buffett and 3G backed away from the deal.

Finally, the fast and effective counter-strategy assembled by Unilever’s top managers dealt the fatal blow to the attempted takeover. Polman and his colleagues put out a statement on Friday which contained an incisive rebuttal of the underlying case for a merger. In the process, Unilever’s top management made it clear that if the negotiations were to proceed, the acquisition would be a hostile one. Given Buffett’s distaste for hostile takeovers, this move greatly reduced Kraft Heinz’s room for manoeuvre, and was surely instrumental in its decision to stop pursing the merger.

2 Comments

The Opportunity Behind Unilever’s Transformation – My WordPress · 20 July 2020 at 5:59

[…] Source: bsic.it […]

The Opportunity Behind Unilever’s Transformation – My Blog · 20 July 2020 at 6:24

[…] Source: bsic.it […]