US

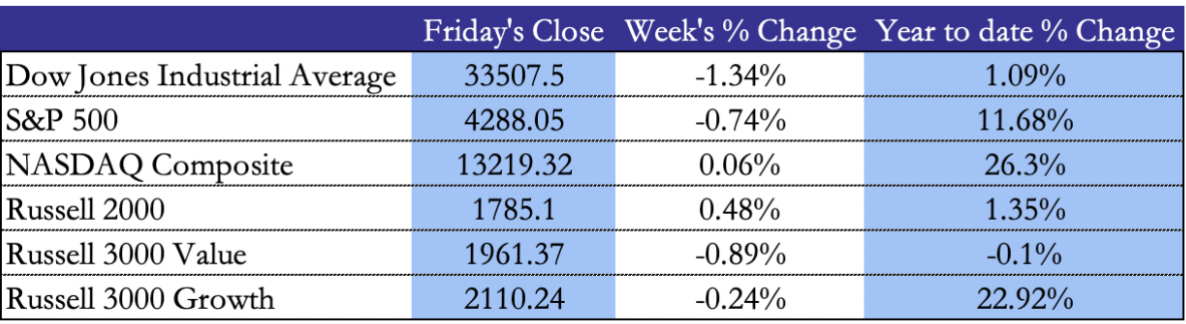

The week in US markets was marked by losses in all major indices apart from the Nasdaq and Russell 2000, up 0.06% and 0.48% respectively. The S&P closed the week down 0.74%, the Dow Jones was down 1.34%, the Russell 3000 Value and Growth were down 0.89% and 0.24% respectively. This marked the first quarterly lost for the US stock market in 2023. The CBOE volatility index closed the week at 17.52.

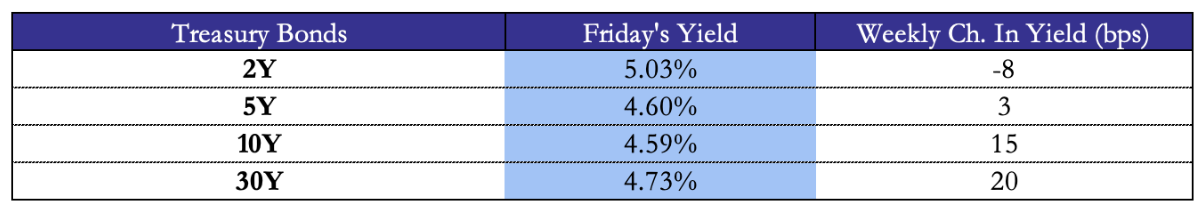

The week started with 10-year rates reaching 16-year highs, rising 10 bps, to 4.54%, while the S&P rose 0.3% driven by the energy and materials sectors and the Nasdaq was up almost 0.5% on Monday, showing that markets were steadying after three consecutive negative weeks, awaiting the start of Q3 earning season.

Uncertainty in US markets was exacerbated by the fear of an impending government shutdown, with the House of Representatives pushing for steep spending cuts, which could trigger a partial shutdown and suspend public services. In this environment, US stocks fell steeply on Tuesday, with the S&P and Nasdaq down 1.5 and 1.6% respectively as the “higher for longer” narrative began to hit market expectations after the FED’s dot-plot showed that rate cuts in 2024 might come much more slowly than previously anticipated by market participants.

US stocks closed marginally higher on Wednesday while Yields continued to climb amid a sharp sell-off in US treasuries as durable goods orders rose 0.2% and orders for non-defense capital goods rose 0.9% month over month, both beating expectations. The S&P and Nasdaq extended their gains on Thursday, adding 0.6% and 0.8% respectively as oil prices slowed down and the 10-year yield fell by 4 bps.

The week closed on Friday with the release of core personal consumption expenditures, which fell from 4.3% in July to 3.9% in August and adding 0.1% MoM versus a consensus of 0.2%. The S&P lost 0.3%, with a quarterly drop of 3.7% and the Nasdaq rose 0.1% for the day but recorded quarterly losses of 4.1%.

EU

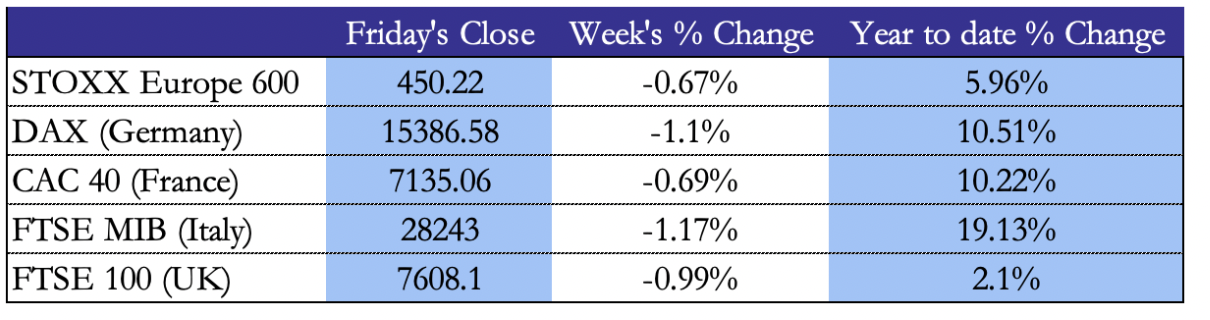

European markets were consistently down for the week, with the STOXX 600 down 0.67% from last Friday, Germany’s DAX and Italy’s FTSE MIB down over 1%, while France’s CAC 40 was down 0.69% and the UK’s FTSE 100 down slightly less than 1% at 0.99%.

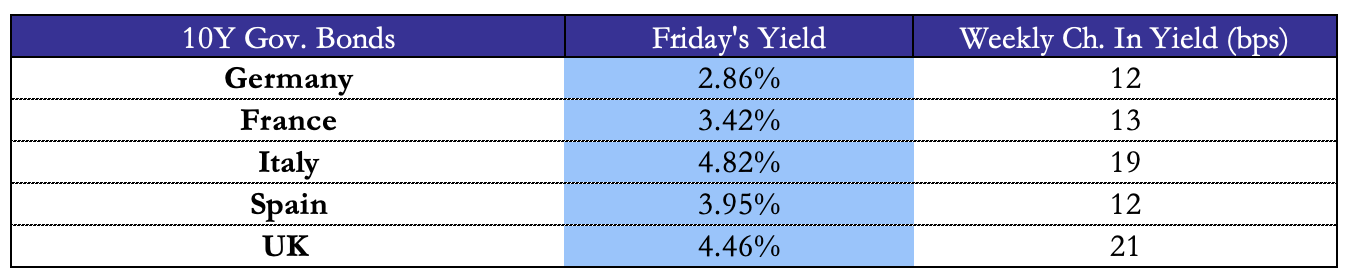

European markets opened on Monday with the STOXX 600 down 0.6%, and the DAX down 1% as European markets were impacted by the Chinese market downturn. As European equities fell, the yield on 10-year German Bonds reached a 12 year high at 2.81%. Christine Lagarde reiterated on Monday that the ECB will keep rates higher for as long as it is needed to bring inflation back to 2%.

The negative trend in European equities continued Tuesday, with the STOXX and the DAX down 0.6% and 1% respectively, marking the fourth consecutive negative day for the indices. Losses in the STOXX were extended on Wednesday, with the index dropping by another 0.2%.

European bond markets continued to suffer in Thursday’s trading, while stocks partially recovered their previous losses. The yield on the 10-year German bund continued to rise after surpassing 2011 highs and reached 2.93% on Thursday, while UK’s 10-year Gilts reached a yield of 4.48%. The STOXX added 0.4%, marking the end of its losing streak and the German DAX added 0.7% as German inflation came in lower than expectations at 4.5%.

Inflation data on Friday came in lower than expected at 4.3% versus a consensus of 4.5%, marking the lowest level in 2 years and substantially down from 5.2% the previous month. Markets welcomed the news, with stock indices gaining for the day and yields sliding after a week of yields increases across the continent.

Rest of the world

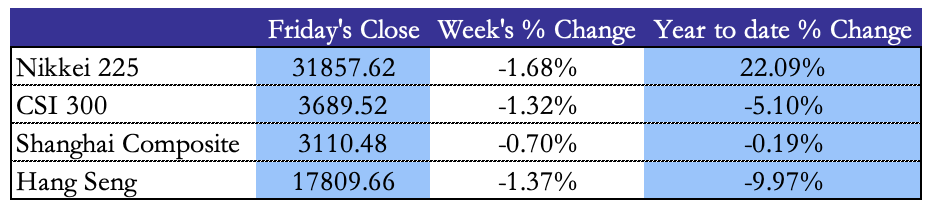

Asian markets closed a highly negative week, with the Nikkei losing 1.68%, the Hang Seng posting a 1.37% drop and the CSI 300 down 1.32% for the week, with the Shanghai composite being the only major index closing the week with a loss below 1% at -0.70%.

The week opened with disturbing news for Asian markets as the Chinese property giant Evergrande could not issue new debt due to an ongoing investigation into its principal subsidiary: Hengda Real Estate Group. Evergrande shares lost more than 20% dragging down the whole market, with the Hang Seng Property Index down 4.2%, while the overall Hang Seng was down 1.8% and the CSI 300 down 0.7%.

Data released on Wednesday showed that profits in the Chinese industrial sector were down 11.7% year on year compared to the 15.5% contraction in the first seven months, this led the Hang Seng and the CSI to gain 0.8% and 0.2% respectively. The Hang Seng lost 1.4% on Thursday, reaching its lowest level in 10 months but bounced back on Friday as Chinese internet regulators released a draft rule simplifying cross-border data transfers. The Hang Seng was up 2.5%, while the Hang Seng Tech Index gained 3.8% for the day with Tencent and AliBaba up 3% and 1.5% respectively. On Saturday, the NBS Manufacturing PMI came out at 50.2, above the previous release of 49.7 and consensus of 50.

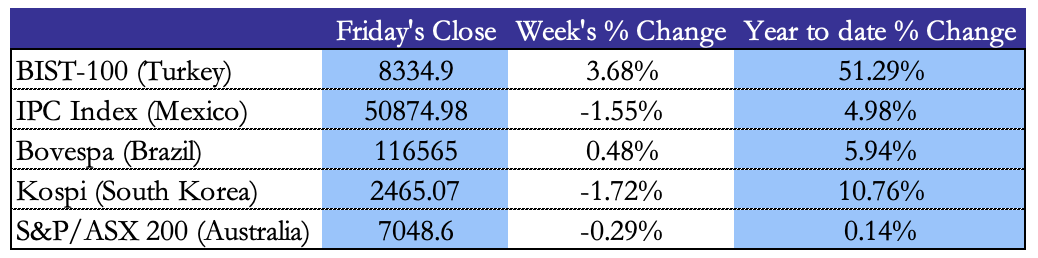

The rest of the world was mixed for the week, with Turkey’s BIST-100 continuing its stellar YTD performance adding 3.68% for the week, bringing YTD gains above 50%. Brazil’s Bovespa added 0.48% for the week as unemployment came out at 7.8% after the last reading of 7.9%. Korean Kospi followed the broader trend in Asian markets, losing 1.72 for the week. Mexico’s IPC index lost 1.55% for the week after unemployment came out at 3% after the previous reading of 3.1%. Australia’s S&P/ASX 200 was relatively flat, losing 0.29%, staying flat YTD at +0.14% for 2023 as the monthly CPI indicator came in at 5.2%, up from the previous 4.9%.

FX and Commodities

The Dollar index gained 0.35% on Monday as treasury yields rose, with the Euro down 0.58%, the Pound down 0.21% and the Yen down 0.31% versus the Dollar. Oil futures were mixed down for the day, with crude losing 0.39% and Brent up 0.02%.

On Tuesday, the dollar continued its climb amid the treasury sell off as the dollar index rose 0.20% in the day, reaching a level of 149.03 against the Yen, with 150 being the level at which the Bank of Japan starts intervening. Oil futures settled higher with crude up 0.79% and Brent up 0.72% for the day.

Wednesday marked the fourth consecutive positive day for the dollar index, up 0.46% and reaching 149.65 against the Yen. Oil futures surged after a drop in US reserves sparked additional worries on the tightness of global supply. Crude was up 3.6% and Brent up 2.8%, reaching 1-year highs.

Thursday reversed the gains in the dollar index, which lost 0.47% for the day, with the Yen gaining 0.22%, the Euro 0.58% and the Pound 0.52%. Oil futures were down after the massive gains in the previous day, with crude and Brent down 2.1% and 1.2% respectively. Gold was having its worst week since February, as rising yields drove investors out of the precious metal, with spot gold down 0.4% on Thursday.

The dollar index was flat on Friday, adding 0.04% against other currencies. Oil was still down on Friday with crude down 1% and Brent down 0.07%, while spot gold continued to drop, losing 0.9%.

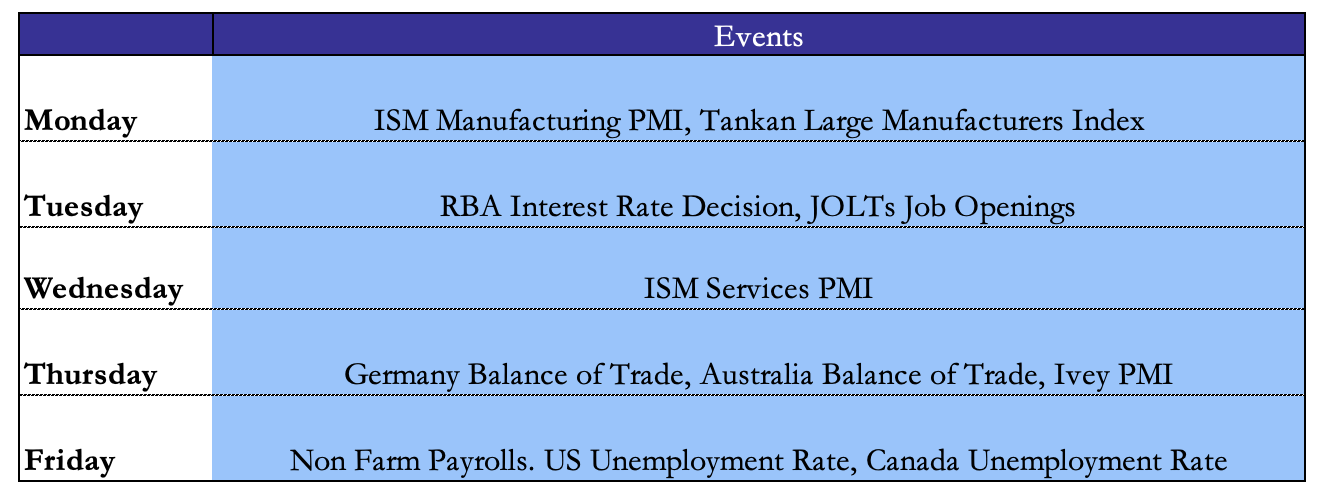

Next Week’s Events

Brain Teaser #02

Follow up to the previous brainteaser, if instead of having two ropes, what if you only had one rope, how would you measure 15 minutes?

SOLUTION: Break the rope into approximately half, and burn these two ropes from both of their ends. If both these ropes finish burning together, that means exactly 15 minutes have passed. If any one of these ropes finishes first, break the other rope from approximately the middle, and further burn all ends of these little ropes. Continuing this way theoretically leads to exactly 15 minutes!

Brain Teaser #03

An Egg breaks only if dropped from above a threshold floor, within a 100-story building. Every time you drop an egg, it is counted as an attempt. You are given 2 eggs to deduce the threshold floor, with a minimum number of attempts in the worst case!

0 Comments