US

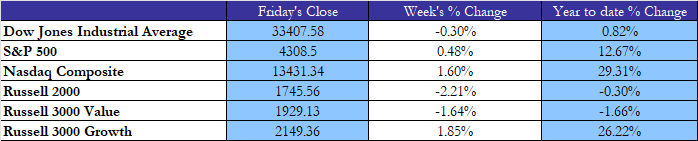

The week in the US markets was marked by choppy trading, with most indices being down during the week but recuperating their losses during the Friday rally. The S&P ended its longest weekly losing streak of the year by closing at +0.48%, the Nasdaq and the Russell 3000 Growth also ended in positive, respectively with a 1.6% and 1.85% gain. The Dow Jones, the Russell 2000 and the Russell 3000 Value all closed this week at a loss.

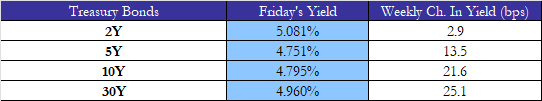

The release at the start of the week of better-than-expected data, more specifically the US manufacturing PMI (49.8 vs the preliminary estimate of 48.9) on Monday and US job openings in August (9.6mn vacancies vs 8.8mn expected) on Tuesday, fueled fears that interest rates may remain higher for longer than expected. This, combined with the ousting of Kevin McCarthy as speaker of the House of Representatives, lead the S&P500 and the Nasdaq to close 1.4% and 1.9% lower on Tuesday while bond yields continued climbing (30-year closing at 4.93). Despite this we also witnessed a moderation in the yield curve, with the spread between shorter and longer term dated Treasuries hitting the lowest level in six months.

Wednesday saw a reversal of the trends witnessed in the previous days, with US stocks achieving the biggest one-day gaining several weeks: the Nasdaq close +1.4% higher, primarily being carried by a rally in the “Magnificent Seven”, while the S&P gained +0.8%. The rise in treasury yields stopped, with the 10-year witnessing a 7-basis point fall.

On Thursday the release of positive unemployment data (207,000 filings against 210,000 expected), demonstrating the resilience of the economy despite the high interest rate environment, as well as data concerning the US trade deficit caused little reaction from the markets.

The week ended on a positive high owing to the release of blockbuster US job growth data, with employers adding over 336,000 jobs in September against an expectation of just 170,000. The S&P500 experienced a rally of over 1.2%, the biggest one day jump since august, and the Nasdaq increased by 1.6%; the yield curve spread in Treasuries shrank to their lowest levels in over a year, signaling the market sees a recession as less likely to happen compared to before.

EU

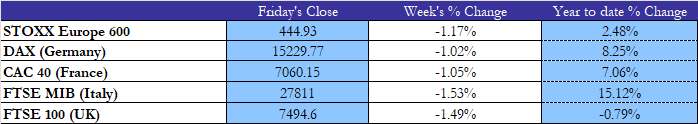

European markets continued their losing streak this week, with all the major indices being down weekly by more than 1%. The FTSE MIB had the biggest loss out of the pack at -1.53%, closely followed by the FTSE at -1.49%. The STOXX was down -1.17% while the DAX and France’s CAC were both down a little bit over 1%.

On Monday, European stocks fell due to a combination of factors, such as: the sell-off in bonds spreading to equity markets, the release of manufacturing PMI (in line with expectations at 43.5) indicating a further contraction and the decrease in oil price. The STOXX 600 lost 1%, falling to the March levels. Equity markets continued with their downturn also on Tuesday with the STOXX down 1.1%, the FTSE MIB down 1.32% and the DAX down 1.06%.

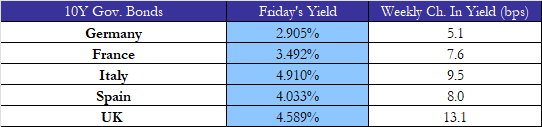

On Wednesday during early trading the 10-year German bond rose to 3.01%, its highest level in 12 years, before falling back down to 2.905%. The EU also registered the biggest month-on-month decline in retail spending since December (at -0.9%), highlighting the effects inflation and higher borrowing costs are having on the consumer. Equity indices remained largely unmoved during the day.

On Thursday and into Friday the market witnessed a rebound of European stocks, largely following the momentum of their American counterparts, however in this case it wasn’t enough to offset the losses accumulated intra-week. Bond yields also declined in the last part of the week, with the German 10-year bond yield closing at 2.905% and the 30-year yield closing at 3.143% (a weekly increase of 7.8 basis points).

Rest of the world

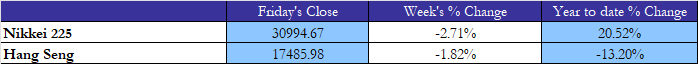

Asian markets closed on a negative key this week, continuing the downward trend form last week. Japan’s Nikkei 225 fell by 2.71% week over week while the Hang Seng fell 1.82%. Mainland Chinese markets, especially the CSI 300 and the Shanghai Composite, are closed this week due to China’s Golden Week.

The week started off with the improvement in sentiment among Japanese manufacturers, building upon the previous increase that took place last quarter. Despite this the Nikkei still closed 0.05% lower.

On Tuesday Evergrande’s shares began trading again on the Hong Kong exchange after being previously halted, although initially rising by 20%, the shares closed 14% higher. This gain as the week continues will be eradicated entirely as by Friday the price fell to similar levels as those before the halt.

The BoJ carried out a string of unscheduled purchases of Japanese government bonds on Wednesday after the 10-year yield hit its highest level in a decade. According to the BoJ, it offered to buy $4.52bn of bonds with 5-to-10-year maturities. Despite the effort the 10-year Japanese yield continued rose to 0.783%, ending the week at 0.799%, as investors suspect that a shift from the negative interest rate regime implemented in 2016 might happen soon.

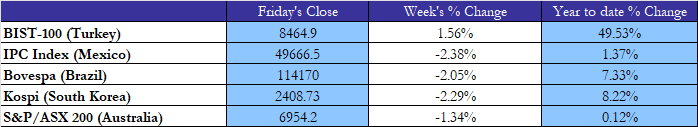

The rest of the world’s performance was mostly negative, with the exception being Turkey’s BIST-100 which continued its spectacular rally by closing 1.56% up, for a total of 49.53% Year to date. While all major emerging market indices were down, the IPC lead with the heaviest losses at 2.38%, this is a result of the passing of a new law changing the fees on airport tariffs on Thursday, leading to steep declines for the shares of Mexico’s airport operators and dragging the IPC down 3% in the afternoon trade.

FX and Commodities

Oil prices suffered their biggest weekly decline since March, with the Brent losing 11.26% while the WTI losing 8.82% as concerns regarding cuts in production made by Russia and OPEC were overshadowed by worries that a sustained period of high interest rates might permanently handicap global growth and demand for oil. While the prices held up for the first part of the week, Brent even climbing to 91.14 on Tuesday, Wednesday registered the single biggest one-day loss for oil since August 2022.

Following the price of oil, diesel price also fell both in the US and Europe following both the negative momentum of oil and the announcement that Russia would resume seaborne diesel exports.

Natural gas has hit 9-month highs after a stellar week that saw its price increase by 13.96%, the increase began after the EIA reported a build up of 86 billion cubic feet of storage instead of the 94 billion cubic feet expected. An increase of 7.53% on Thursday and a further increase of 5.09% on Friday helped gas achieve an incredible weekly return.

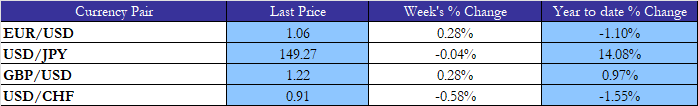

The main currency markets moved little this week, with the EUR/USD and the GBP/USD both eking out a 0.28% gain while the USD/JPY closed with a -0.04% change. In the intra-week the USD/JPY surpassed the 150-yen barrier but in a few hours tumbled back down to the 148.76 level. The Japanese authorities have said that they are closely monitoring the situation and might intervene in case of extreme volatility.

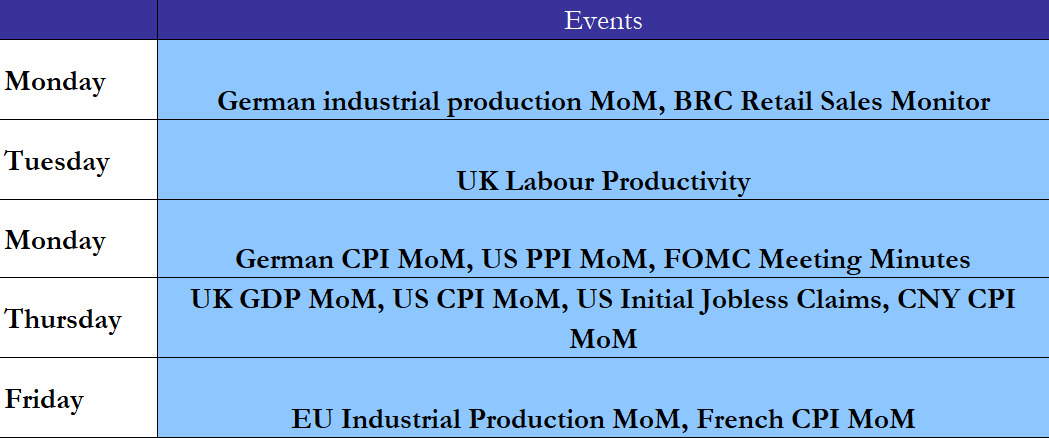

Next Week’s Events

Brain Teaser #03

An Egg breaks only if dropped from above a threshold floor, within a 100-story building. Every time you drop an egg, it is counted as an attempt. You are given 2 eggs to deduce the threshold floor, with a minimum number of attempts in the worst case!

SOLUTION: Imagine we drop our first egg from floor n, if it breaks, we can step through the previous (n-1) floors one-by-one. If it doesn’t break, rather than jumping up another n floors, instead we should step up just (n-1) floors (because we have one less drop available if we must switch to one-by-one floors), so the next floor we should try is floor n + (n-1). Similarly, if this drop does not break, we next need to jump up to floor n + (n-1) + (n-2), then floor n + (n-1) + (n-2) + (n-3) … We keep reducing the step by one each time we jump up, until that step-up is just one floor, and get the following equation for a 100 floor building: n + (n-1) + (n-2) + (n-3) + (n-4) + … + 1 >= 100. This summation, is the formula for triangular numbers (which kind of makes sense, since we’re reducing the step by one each drop we make) and can be simplified to: n (n+1) / 2 >= 100. This is a quadratic equation, with the positive root of 13.651, which we round up to 14.

Brain Teaser #04

We have a weighted coin that shows a Head with probability “p” and tails with “1−p”, (0.5<p<1). How would we define two equally likely events using this coin?

0 Comments