US

It was a busy week for many economies around the world and especially the US had its share of important monthly data coming in.

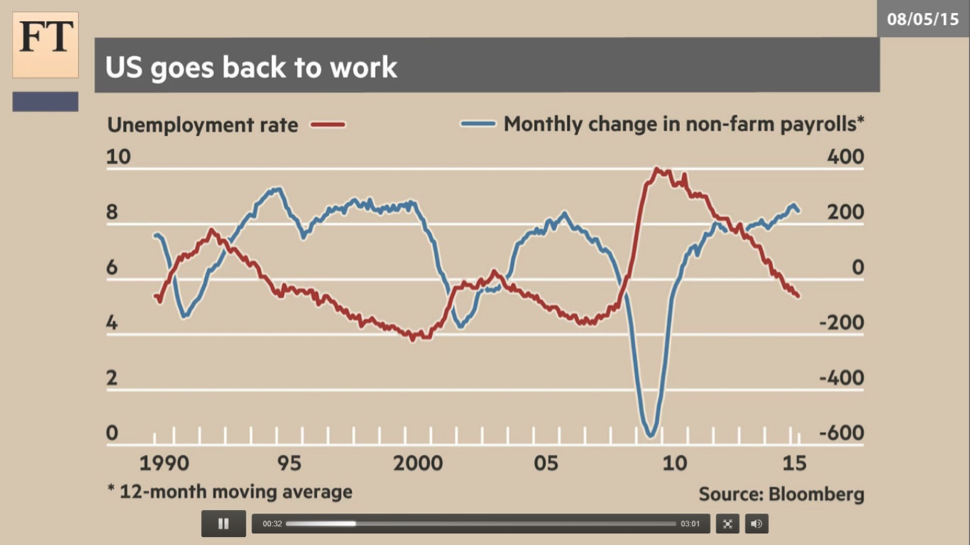

US equity and bond markets were driven primarily by monthly US non-farm payroll (NFP) and unemployment rate.

Economists’ average forecasts were for a net 224,000 jobs to have been created in April, and for the unemployment rate to fall from 5.5 per cent to 5.4 per cent. Moreover, the average earnings were expected to show a dip in growth to 0.2 per cent.

The report showed that US economy added 223,000 jobs last months, the jobless rate eased to 5.4 per cent from 5.5 per cent, as expected, while average earnings grew just 0.1 per cent month-on-month. In the chart below, we observe the unemployment rate and monthly change in non-farm payrolls plotted on the same graph, and their constant distancing apart in the last 2 years. Though the data is positive, we wouldn’t feel safe in saying that fundamentals justify a rate hike in the US just yet.

The data pointed to a pace of employment growth that was healthy enough to suggest that the economy may be on solid footing, but not so much as to quicken the first Federal Reserve rate hike.

Indeed, The S&P 500 on Friday closed 28.09 points, or 1.4 per cent, higher at 2,116.09 and gained 0.4 per cent over the week. The Dow Jones Industrial Average jumped 267.05 points, or 1.5 per cent, to 18,191.11 and finished the week 0.9 per cent higher. The Nasdaq Composite ended the session 58 points, or 1.2 per cent, higher at 5,003.55 and finished the week roughly where it started.

The strengthening price of oil, which jumped to the highest level in 2015 and neared $70 a barrel, encouraged expectation of higher long-term inflation rates, driving the sell of bonds in both Europe and US. Moreover, on Wednesday, Ms Yellen said at a Washington forum that “valuations are quite high”, leading the yield on 10-year debt up almost half a percentage point since the April low (2.35 per cent).

However, the jobs report fuelled a US Treasury rally and the 10-year yield slipped back to 2.13 per cent. The dollar edged 0.72% lower over the week against the major world currencies present in the dollar index basket, and 0.25% lower wrt the Euro.

As the Fed has signalled that the lift-off date and the pace of said increase will depend on two key elements, employment and inflation, market watchers are now turning their attention to the next round of U.S. economic data that will clarify whether the Fed’s 2% inflation target is anywhere close.

EU

In the latest week European investors observed an ironic trend both in the equity and in the bond market. As a matter of fact, after months of pressure on Greek bonds, the yield on the country’s two years bond maturing in 2017 dropped to 20.57 per cent on Friday, down more or less 10 percentage point from its recent highs. At the same time, the Athex General Composite share price is up 2.35%. These performances are mainly driven by growing expectations that some agreement will be reached. Investors seem not worried by the next repayment – of €763m – Greece is due to make to the IMF on Tuesday. Furthermore, the bullish view is underpinned by the latest Greek finance minister’s statements. As a matter of fact, Mr. Varoufakis, even though sidelined from negotiations, insisted that the country will meet the deadline. Maybe the market welcomed the contrarian stance taken by the minister on the country’s solvency.

Conversely, European stocks have dropped sharply, mirroring turmoil in European bond markets. The bearish sentiment was boosted by the statements of two key market players, namely Mrs. Yellen and Mr. Gross. On Wednesday, the US central bank chair declared she considered both the global equity and the bond markets as overvalued. The former Pimco’s boss, instead, tweeted a couple of weeks ago that betting against the German Bund would have been the “short of a lifetime.

As of today, after European equity indices hit 15-years highs in April and some government bonds reached negative yields, it appears a correction has begun. For what concerns the European bond market, the twist is surprising if we bear in mind the ECB’s plan to buy up €60 billion each month until at least September 2016. As a matter of fact, this pledge should guarantee demand in the market and keep yields low. Anyway, with the oil price soaring and some signs of improvement in the Eurozone economy, investors maybe reassessed their inflation outlook.

The sell-off in the bond markets even accelerated in the last days of the week. Yields on 10-year German benchmark bonds, which had fallen close to zero after QE launch, have now soared up to 0.54 per cent. And both the yield on the equivalent Italian ten-yean security and the French one experienced the same trend, with the former rising at 1.69% and the second one at 0.85%.

The recent distorted bond and stock market correlation showed up even with declining yields. The DAX posted a weekly negligible negative performance of -0.2%, in line with the FTSE MIB which closed at 23312.

In light of this, the market is probably waiting for the forthcoming data concerning the European GDP growth rate. An eventual figure well above 1% will strongly affect the bond market through the inflation expectation channel. Anyway, the more likely signal of improvement will be probably linked to the industrial production.

UK

The single most important event for what concerns UK markets in the week just past us was the General Election. As we hinted at already last week, equities trading in the FTSE 100 has been jittery because of the uncertainty surrounding the outcome, with neither of the two leaders clearly ahead in the polls. The index was down one per cent for the week at the close on Thursday, with traders certainly not looking forward to a deadlock or to the prospect of higher income and corporate tax rates to fund the government deficit as proposed in the Labour manifesto. When the election results came out on Friday and the absolute majority obtained by Cameron’s party became clear, the FTSE 100 surged by 2.32% to close the week back above the 7,000 level, as it can be seen in the chart below.

Bonds gained as well on Friday; in particular, the yield on the 10-year gilt was down 4bps on the day. The 10-year had reached a high in yields at 2% during the week, although in the midst of a wider bond market turbulence, and it closed on Friday at 1.87%. The restrained fiscal stance of the Tory winners, as well as the fact that under the latter monetary policy is more likely to remain extremely accommodative, were certainly supportive of bond prices.

In currencies space, the British pound was a gainer for the week against the currencies of all major trading partners. In particular, the pound was up more than 2% against both the US dollar and the euro, while gains were slightly more limited against the Japanese yen at 1.81%.

While markets have cheered the election results, two longer-term issues stand out that will eventually need to be resolved. The first is Cameron’s promise of a EU exit referendum. Markets seem to be discounting very heavily this possibility, as the referendum would most likely be held in two years, and nevertheless, as the latest election proved, relatively unexpected outcomes are not to be excluded. The second point is the sweeping gain of seats in Scotland by the Scottish National Party, meaning that Scottish independence is still a widely felt issue in the region.

Finally, next week will be much richer in terms of economic news; on Monday we will have the BoE interest rate decision, on Tuesday data on industrial production will be released, then on Wednesday the figures for the unemployment rate and wage growth will be out. While this week political issues have taken the scene, we look forward to the end of next week to assess the state of the UK economy.

CHINA

It has definitely been a tough week for Chinese stock market; the Shanghai Composite index closing last week at 4441.80, after a seven years peak on the 28th April, experienced a dramatic drop touching an intraweek minimum of 4100 and closing at 4206.67 thanks to a final rebound.

However, we should still keep in mind that it is being traded at a value 70% higher than in November 2014.

The MSCI China index, that tracks the performance of Chinese equities accessible also by global investors, opening this week at 63.78 experienced as well a sharp decline on the 7th may touching 59.85 and finally closing at 61.58.

After the rally of Chinese equity pumped by retail investors in the last months, a realignment was expected by everyone, it was unknown however when and of which size.

With A-shares (the ones only available for purchase by mainland citizens) now collapsing towards their fundamentals, possibilities of short-term profitable long positions reside now on H shares (shares of a Chinese mainland’s company listed on the Hong Kong stock exchange and accessible to foreign investors) that seem not to be too overpriced and there is still space for a surge in their price.

In the long term however, taking into account the recent regulation allowing Chinese citizens to pledge Chinese provinces’ bonds as collateral for loans and a highly probable future rate cut by the Chinese central bank to stimulate a slower growth matched with a great capital outflow caused by a stronger US economy, Chinese bond and stock market is still a bull market.

[edmc id= 2771]Download as PDF[/edmc]

0 Comments