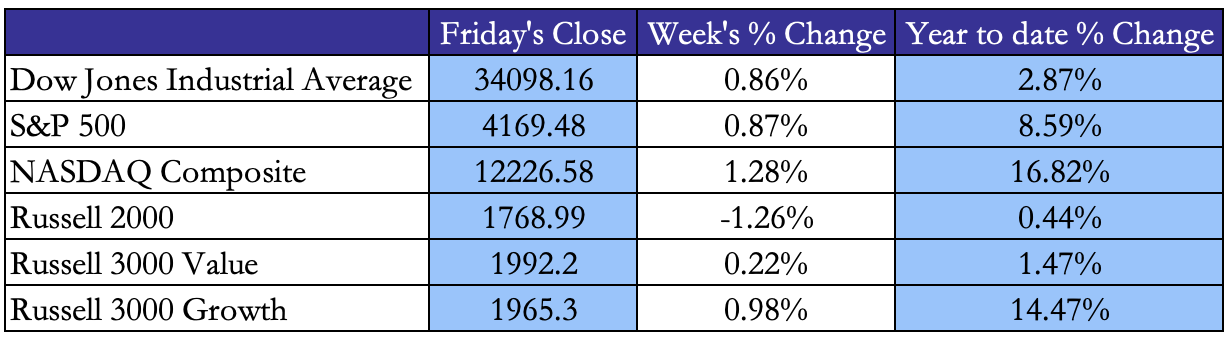

US

The US stock market closed the month of April with the S&P posting monthly gains for the second month in a row, adding 0.87% for the week and 1.5% for the month. All US indexes closed the week in the green, with the only exception of the Russell 2000 losing 1.26% for the week. The Nasdaq closed the week 1.28% higher amid strong earnings results from big tech companies. The CBOE Volatility Index (VIX) closed the week at its lowest level for the year at 15.78, falling 5.9% for the week.

Strong results for the US equity markets have followed better than expected Q1 earnings, with 267 S&P 500 companies having already reported earnings (60% of the S&P market cap) and the past week was the busiest of the season, accounting for 42% of the market cap reporting. Nearly 80% of companies so far have beaten estimates, 54% have done so by more than 1 standard deviation and only 10% have missed by more than 1 standard deviation with large beats currently performing 40bps over the S&P compared to an average of over 100bps in the past and large misses underperforming the S&P by -290bps compared to a historical average of -211bps.

The week started with Bed Bath & Beyond falling 39% to $0.18 a share after the company filed for Chapter 11 Bankruptcy on Sunday, while broader markets remained stable awaiting the biggest week of earnings for Q1.

On Tuesday, the S&P and Nasdaq suffered the biggest one day drops in over a month, losing 1.6% and 2% respectively following First Republic’s announcement that clients withdrew deposits for over $100bn over the last month. Shares of the California-based bank dropped 50% on Monday, while the KBW Banking Index fell 3.9% as worries for the US banking sectors persisted, reflected in 2-year yields dropping 21bps. UPS lost 10% after missing earnings.

Wednesday was a strong day for tech, as it was the only sector in the S&P up for the day following strong results from Microsoft, which ended the day 7.2% higher. The tech sector extended its gains to Thursday, when Meta rose 14% after beating estimates and the Nasdaq rose 2.4%, while the S&P closed its best day since January 6, gaining 2%. US government bonds lost some ground on Thursday as data showed GDP had grown at 1.1% annual rate versus 2% expectation for the first quarter even though unemployment applications fell for the week.

The US employment cost index came out 1.2% higher than last year for Q1, higher than consensus of 1.1%, while total pay for civilian worker rose 4.8% YoY and the PCE came out higher than expected at 4.6%. These data point towards a further 25bps rate increase for next week’s meeting, as a target rate of 500-525 bps is currently given a probability of 83.9% versus the 16.1% of the current target at 475-500 according to the CME group.

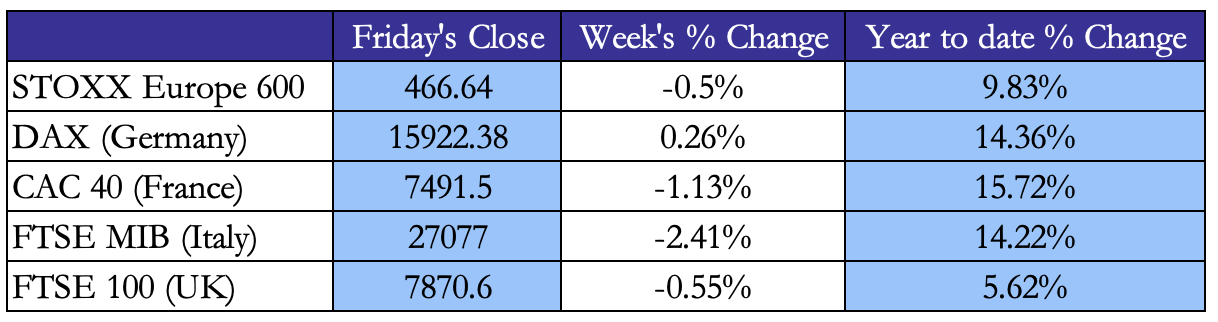

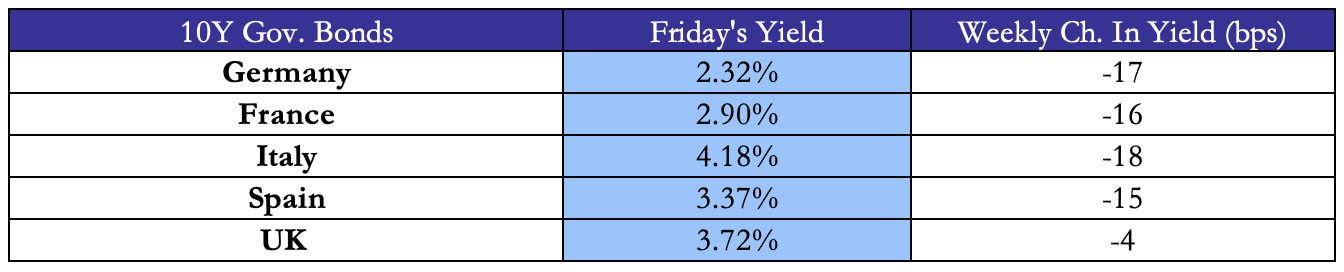

EU

European markets were mostly down for the week as the continent-wide STOXX 600 lost 0.5%, with Germany’s DAX being the only index in the green, closing 0.26% higher than the previous Friday. Yields on 10-year government bonds for the biggest European economies dropped, with Italy’s yield falling 18bps to 4.18%

The week opened with markets relatively stable after Credit Suisse announced it suffered more than $68bn of outflows in the first quarter as both the STOXX 600 and the FTSE 100 lost less than 0.1% and UBS stock closed 0.8% higher.

On Tuesday, the STOXX lost 0.4% as Pierre Wunsch, governor of the National Bank of Belgium and member of the ECB council, stated that the ECB will have to continue rising its target rates unless wage growth and inflation slow down as hourly wage growth in Europe outpaces the US, at 5.7% for Q4 2022.

European stocks extended their losses on Wednesday as the STOXX lost 0.8% as the Dutch chipmaker ASM fell by 7.5% following weak Q1 results. Thursday was the first positive day for European stocks as the STOXX added 0.2% following strong earning beats by Unilever, which reported record Q1 revenues of €14.8bn, Deutsche Bank, which gained 2.8% after reporting highest profits in a decade, and Barclays, which jumped 5.3% thanks to a resilient consumer banking segment. SimCorp (SIM.CO) gained 38.3% following a €3.9bn takeover offer by Deutsche Boerse.

German inflation eased in April, as harmonized consumer prices rose 7.6% YoY versus expectations of 7.8% and energy prices were up 6.8%, again showing a downward trend in energy prices, which have been driving German inflation. German jobless claims rose more than expected by 24,000 compared to expectations of 10,000.

Economic data released on Friday showed that the European economy grew only marginally after stagnation and decline over the last quarter of 2022. GDP in the Euro area grew 0.1% for the quarter versus a Reuters poll expectation of 0.2%, in particular Germany showed no growth, while Italy, Spain and France economies expanded for the quarter, showing resilience, with Italy growing more than expected at 0.5% quarter on quarter versus consensus of 0.1%

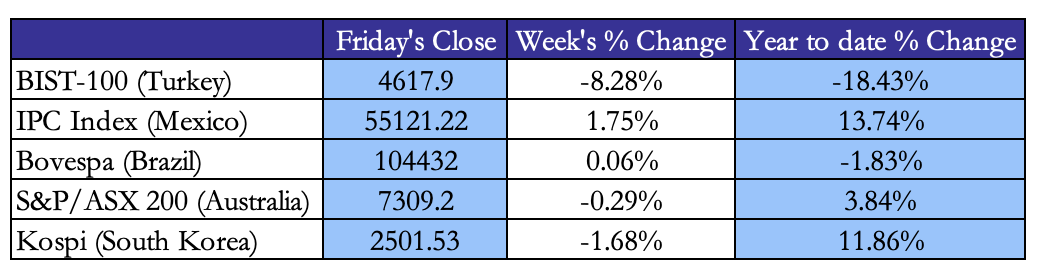

Rest of the world

Asian markets closed a mixed week, with the Nikkei 225 and the Shanghai Composite gaining 1.02% and 0.67% respectively, while the CSI 300 and the Hang Seng lost 0.09% and 0.9%.

The week started with Asian markets in the red, with the CSI 300 down 1.2% on Monday, following last week’s news from Bloomberg that Joe Biden would impose further restrictions on US investment in the Chinese economy. Losses extended to Tuesday, as the selloff continued amid rising fears of US restrictions and uncertainty around the Chinese economy’s resilience. Wednesday was the first positive session for the Hang Seng, which gained 0.7 stopping the selloff that brought it down almost 5% in a week, gains extended to the end of the week, with the CSI and Hang Seng up 0.7% and 0.4% on Thursday and 1% and 0.5% on Friday respectively. Chinese banks released shrinking NIM results as loan repricing hit their core profitability.

On Wednesday, a Reuters poll showed that the Taiwanese economy is likely to head into a recession for Q1, with GDP likely to fall 1.25% due to decreasing demand for technology products.

Japanese stocks reached the highest level in 8 months as BoJ’s governor Kazuo Ueda kept a loose monetary policy stance, keeping ultra-low interest rates, but allowing for a review of the BoJ’s stance in the future as he wishes to avoid any premature tightening.

On Thursday, Samsung reported a record $3.4bn loss in its chipmaking division, compared to high profits from last year as the Korean giant has started production cuts due to extremely low demand as the Kospi lost 1.68% for the week.

South American markets closed the week in the green, with the IPC index up 1.75% and the Bovespa up 0.06% for the week. The Turkish BIST-100 closed a horrible week at -8.28%, bringing YTD losses to 18.43%.

FX and Commodities

The Dollar Index closed the week 0.15% lower than last Friday at 101.67, however the dollar rebounded on Friday as economic data pointed toward the expected 25bps rise by the next week.

The Yen fell sharply, as the BoJ confirmed its dovish monetary policy stance, reaching its lowest levels since 2008 against the Euro and in seven weeks against the Dollar. Over the week the Euro gained 1.8% against the Yen at 150 and the Dollar 1.6% at 136.2, making YTD gains of 6.9% and 3.9% respectively. The pound also gained 1.2% against the Yen, reaching its highest level in more than 6 months.

On Friday, the Canadian dollar gained ground against its US counterpart rebounding 0.3% from its one-month low as the price of oil increased 2.7% for the day, while Crude and Brent are down 1.59 and 1.71% for the week respective

Gold was up 1% for the month as it bounced back on Friday amid the US banking turmoil. Silver, platinum also closed their second back-to-back monthly increase despite a negative week for platinum, which was down 4.45% compared to last Friday.

Natural gas was up 7.39% for the week, posting monthly gains over 13%, while remaining heavily in the red YTD, down more than 46%.

Next Week’s Events

Brain Teaser #41

Ms. Three, Ms. Five, and Ms. Eight are making a cake. For this project Ms. Three contributed 3 lbs of flour, Ms. Five contributed 5 lbs of flour, and Ms. Eight, who has no flour, pays $8 cash. If the deal is fair, how much cash do Ms. Three and Ms. Five get back?

Source: Isichenko, Michael. Quantitative Portfolio Management: The Art and Science of Statistical Arbitrage. 2021.

Solution: In order for the deal to be fair, each participant must have provided the same weight of flour. There are a total of 8lbs of flour available, so hypotheticaly every one should have contributed with 8/3 lbs of flour. Keeping that in mind, Ms. Eight must have bought flour from Ms. Three, and Ms. Five, such that all of them have 8/3 lbs of flour at the end. This means that she bought 1/3 lbs of flour from Ms. Three, and 7/3 from Ms. Five, thus $8 of cash can buy 8/3 lbs of flour. At the end Ms. Three received $1, and Ms. Five received $7.

Brain Teaser #42

The cards in a stack of 2n cards are numbered consecutively from 1 through 2n from top to bottom. The top n cards are removed, kept in order, and form pile A. The remaining cards form pile B. The cards are then restacked by taking cards alternately from the tops of pile B and A, respectively. In this process, card number (n+1) becomes the bottom card of the new stack, card number 1 is on top of this card, and so on, until piles A and B are exhausted. If, after the restacking process, at least one card from each pile occupies the same position that it occupied in the original stack, the stack is named magical. For example, eight cards form a magical stack because cards number 3 and number 6 retain their original positions. Find the number of cards in the magical stack in which card number 131 retains its original position.

Source: 2005 AIME II – Problem 6

0 Comments