Avago Technologies Limited (AVGO): market cap (as of 25/09/2015): $34.2bn.

Broadcom Corp. (BRCM): market cap (as of 25/09/2015): $31.4bn.

Introduction

Following a wave of consolidation in the semiconductor industry, which culminated last March with the NPX/Freescale $11.8bn deal, on May 27, Avago Technologies Limited and Broadcom Corporation announced that they have entered into a definitive agreement under which Avago will acquire Broadcom in a cash and stock transaction, worth approximately $37bn. Upon completion of the acquisition, the combined company will be the world’s sixth largest chipmaker by revenues, approximately $15bn, and will be valued at $77bn enterprise value (EV). The NewCo will have the most diversified communications platform in the semiconductor industry.

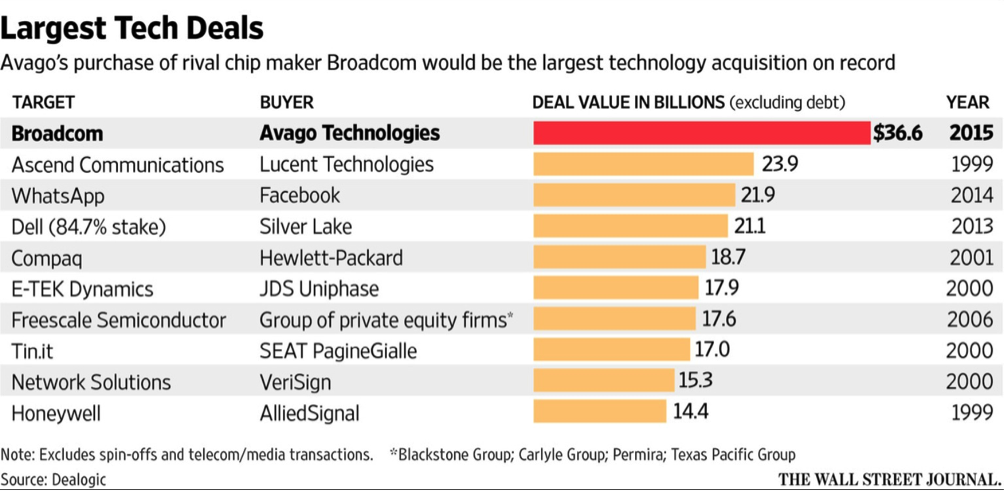

The acquisition is the largest pure technology deal on record, according to data provider Dealogic and is expected to close in Q1 2016.

Source: Wall Street Journal

About Avago

Avago, based in Singapore and San Jose (California), makes semiconductors for the cellular, automotive and defense industries. The company’s product portfolio is extensive and includes thousands of products in four primary target markets: wireless communications, enterprise storage, wired infrastructure and industrial.

The business was initiated in 1961 as an electronics division of Hewlett-Packard Co. It then became part of the Agilent Technologies Inc. spinoff from Hewlett-Packard in 2000. In 2005, a group of private-equity firms, including Silver Lake and KKR & Co. acquired the business for $2.7bn. Avago was then IPOed on the NASDAQ in 2009 with a market value of $3.5bn and grew exponentially since then via an aggressive acquisition strategy. Since 2013, Avago has purchased five companies valued at about $8bn in total, including acquisition of last year of rival LSI Corp. for $6.6bn. Avago generated revenues of $4.3bn in 2014 (+ 69% yoy).

About Broadcom

Broadcom Corporation, headquartered in Irvine (California), is a chipmaker, leader and innovator in semiconductor solutions for wired and wireless communications. Its product line spans computer, smartphone and telecommunication networking with focus on products for enterprise/metropolitan high-speed networks, as well as products for SOHO (small-office, home-office) networks. Broadcom counts Apple among its most important clients and its chips are used for iPhones. Founded in 1991, Broadcom became a public company on the NASDAQ in 1998 and now employs around 11,750 people in more than 15 countries. Broadcom generated $8.5bn revenues in 2014 (+ 2.16% yoy).

Sector overview

Consolidation is a major trend in the semiconductor industry whose total value has been estimated at c. $336bn. The wave of merger has swept over the computer chip industry as manufacturers have sought to expand to keep pace with customers like Apple and Amazon. Several giant acquisitions have already been announced this year. First, NXP announced its agreement to buy Freescale for $11.8bn. In addition, four days after Avago announced a deal to acquire Broadcom, Intel agreed to buy Altera for $16.7bn in cash.

In recent years, price competition, along with increasing R&D costs, has deteriorated the industry’s return on invested capital (ROIC). To face this challenge, chipmakers have turned to buying growth to cut costs, using mergers to combine sales forces and back-end operations. In addition, a bigger scale allows them to stay attractive to customers who want to cut the number of suppliers for their products.

Furthermore, as the semiconductor industry is highly cyclical, companies face constant booms and busts in demand for products. Demand typically tracks end-market need for personal computers, cell phones and other electronic equipment. However, given the fragmented structure of the industry, different sectors peak and bottom out at different times. As a result, achieving diversification through acquisitions may result in lower exposure to cyclicality for incumbents.

Strategic rationale

Avago-Broadcom deal aims at creating the world’s leading diversified communications semiconductor company. Indeed, the merger will give birth to a $77bn EV behemoth that will most likely put pressure on the current industry leaders, namely Intel and Qualcomm.

In line with the industry trend, the main objective of the merger is to achieve greater scale so as to lower production costs and capture a larger share of the market. As a matter of fact, the combined company is expected to deliver $750m in annual cost synergies within 18 months of completion of the deal. Additionally, given Avago’s Singaporean domicile (approximately 5% in corporate taxes), the acquisition is expected to be very tax-advantageous, resulting in further cost savings.

Last but not least, the two companies have a very complementary portfolio. They offer different products that do not compete with each other but would probably appeal to the same customers. Hence, there is potential for revenue due to an increase in the customer base.

Looking forward, Avago has aggressive goals for the combined company, targeting 40% operating margins by 2019, from Avago’s current 38% and Broadcom’s 24%.

The deal structure

The deal values Broadcom equity at $37bn. Under the terms agreed upon by the companies, Broadcom shareholders may choose either $54.50 per share in cash, roughly 0.4378shares of the NewCo, or a combination of cash and stock. Over all, Avago plans to pay out about $17bn and the equivalent of $20bn worth of stock. The offer results in a 19% takeover premium, in line with comparable transactions. Current Broadcom shareholders would own about 32% of the combined company. The bidder intends to fund cash part with its own reserves and $9bn in new financing from a consortium of banks. Moreover a breakup fee of 3% (c. $1.1bn) was agreed upon by the parties.

We present the multiples of the transaction and we compare it with those of precedent deals.

From the table, the average multiple of trailing-12-month (LTM) EBITDA was 18.9 times. Broadcom is being taken out at 18.8 times LTM EBITDA, in line with the deal comparables. Precedent comparable transaction average multiple of LTM revenues was 3.6 times, slightly below Avago-Broadcom transaction multiple of 4 times.

Market reaction & closing

The market reacted positively to the announcement, showing genuine interest from investors in the deal. On May 27, after the deal was announced, Broadcom’s shares jumped 21.3% from $47.56 (opening price on May 27) to a record high of $57.70. Avago share price increased 12.1% between May 26, when the Wall Street Journal reported earlier that the companies were in advanced merger talks and May 29 when it peaked at $148.07.

Financial Advisors

J.P. Morgan and Evercore advised Broadcom. Avago was advised by Deutsche Bank, Bank of America Merril Lynch, Barclays, Credit Suisse and Citi.

[edmc id= 2867]Download as PDF[/edmc]

0 Comments