In our previous article, REITs: Is Liquid Real Estate the Solution for the Late Cycle? – Part 1 (https://bsic.it/reits-is-liquid-real-estate-the-solution-for-the-late-cycle-part-1/), we looked at the business cycle and historical REIT returns during its different phases. While some of the findings point to REITs as potential additions for a late-cycle portfolio, this article aims to establish focal points to take into account when investing in REITs in the unique current macroeconomic climate.

The Basics of REIT-picking

- Dividend yield of RIETs is more crucial than that of standard stocks. As mentioned in our previous article, one of the requirements for a REIT classification is that the company pays at least 90% of its taxable income in the form of shareholder dividends (figure given for the US and varies by country; a 2014 Italian legislation on Società di Investimento Immobiliare Quotate (SIIQs) lowered the dividend distribution requirement to 70% of recurring rental income from 85% & set the income from net capital gains distribution obligation to 50% in the 24 months that follow the year that they are realised). This results in the average dividend yield for REITs to be significantly higher than that of S&P500 stocks. For example, the Vanguard Real Estate ETF (VNQ) recorded an average dividend yield of 3.86% in 2019 compared to 1.83% of SPY. It is worth noting that this yield is currently experiencing a drop with the TTM yield being 3.16%, which is one of its lowest levels ever since the inception of the ETF 10 years ago. This elevated importance of dividend yield makes it important to analyse total returns of REIT investments rather than focusing solely on capital appreciation.

- EPS and the dividend payout ratio shouldn’t be looked at the same way as in other types of stocks including dividend stocks. In fact, there is a key metric specific to REITs that’s very important to investors. This is the Funds From Operations (FFO), which is a metric that defines the cash flows from a REIT’s operations. FFO is also sometimes quoted on a per share basis, which is a REIT’s alternative to EPS.

- FFO = Net Income + Depreciation + Amortization – Gains on Sales of Property

- There is also an Adjusted Funds From Operations metric (AFFO). To calculate it recurring expenditure that is capitalized and then amortized and straight-lining of rents is subtracted from the original FFO value. This metric can also be thought of as funds or cash available for distribution.

- Management is arguably even more important than in other types of companies. While liquidity of REITs might give off a different impression, investments in them are still directly tied to physical real estate (besides the case of mortgage REITs). Thus, the way properties to which a REIT is tied are managed directly affects its financial performance. Due to this selecting a REIT whose management possesses a good track-record and experience can mitigate accumulating unnecessary risk.

- Research the properties under the management of the REIT. Judging a functioning property is fairly accessible in the sense that occupancy rates, average rents, location, and the current fairing of the real estate market in a specific location can be evaluated through a range of accessible data. This is especially relevant to investors looking to invest in their local market of which they have a first-hand understanding.

- Finally, understanding the different property types that different REITs manage is especially key when using them to navigate the challenging waters of a business cycle and the current macroeconomic climate. Classifications of REITs by property types can vary from general to very specific property types, while some can be diversified. On the surface of it, this means that current economic trends may have very different impacts on REITs based on the sector of their focus. For example, outbreaks such as the coronavirus can greatly hurt Lodging/Resorts REITs linked to tourism while giving a boost to Health Care ones.

REITs – A sector picking game?

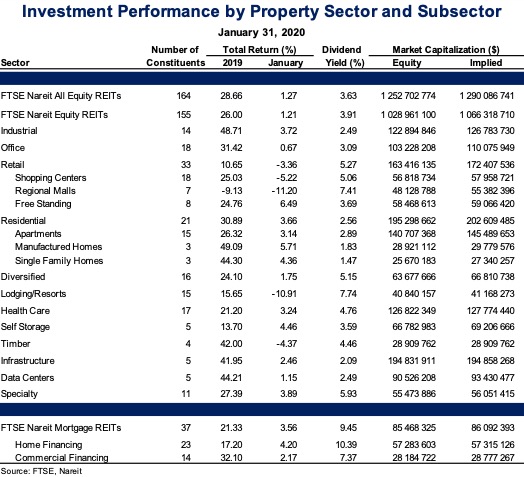

When finding a REIT that checks all the boxes from points 1 to 4, perhaps a key to picking a winner is placing a special focus on how the current macroeconomic climate may boost performance of specific sectors. Below is a table that looks at total returns of nearly 200 US REITs in 2019 and January 2020. It is worth noting that 2019 has been an exceptional year for equities, and hence the majority of REIT returns comes from capital appreciation. This perhaps signals that if positive conditions for rising stock valuations continue, a traditional approach of dividend yield focus described in point 1 can be side-lined for the time being.

Industrial REITs had an incredible run in 2019, producing returns close to 50%. Industrial output was fairly stable with the Industrial Production Index hovering around the 109 mark. Several big-name brands also decided to bring their production to the United States, as firms continue to be attracted by the Tax Cuts and Jobs Act of 2017. While January gave the sector a strong start with returns at 3.72%, the current coronavirus crisis adds significant risk to any long positions. As production facilities in most of China are still halted and are only beginning the process of returning to original functioning, the whole world has been hit by a supply shortage. This has unavoidably impacted supply chains of many US industrials with automakers such as GM fearing they could be forced to temporarily halt production on their home soil (as they were forced to do at their factory in Serbia). It is unlikely that the outbreak would disrupt Chinese producers to the extent where they’d be forced to relocate, perhaps driving the US industry. Hence, currently the Coronavirus poses the sector with mostly downside potential, and its developments should be awaited to avoid taking on extra risks.

Office REITs continue to be fuelled by solid employment growth. The unemployment rate sits stably at 3.6% while nonfarm payroll employment continues to grow with a 225,000 addition in January. However, warning signs are beginning to show as latest employment numbers are beginning to lag estimates. It is also worth noting that the office sector is especially fragile to recessions, and hence caution should be taken as we drift closer to the end of the late cycle. If history is anything to go by, investors with long positions are at risk of big losses – with -41% total losses being recorded for the sector in 2008. This opens up opportunity for potential short plays for investors confident in their recession timing predictions. It could prove to be especially lucrative as some economists fear the incoming of a recession could be greatly accelerated by the coronavirus outbreak.

Source: FTSE, Nareit

Retail has been a long-struggling sector in the age of ecommerce and doesn’t have much behind it to attract investors. Nearly 9,100 store closures have been announced in 2019, which is nearly 55% higher than total closures in 2018. This is reflected by the sector also posting the weakest returns of the ones analysed in the table above, and regional malls even recording losses. While real estate companies are fighting to keep the sector alive, any long positions in the sector would be especially risky.

The residential sector is hot in the US right now, however, this shouldn’t be regarded as a safe bet. US cities are seeing a record number of new unoccupied apartments, while the Real Residential Property Prices index showed a minor turnaround away from positive growth in FRED’s latest available numbers for Q2 2019. Apartment List’s National Rent Index also sends warning signs with rents increasing at their second slowest rate YOY in the past 5 years. On the other hand, it is worth noting that the sector is relatively safe from major downsides in the case of recessions, as it is not faced with the risk of redundancy, but rather only economical downgrading towards more affordable options.

Lodging/Resorts should be avoided for fairly obvious risks related to the coronavirus outbreak. As millions are quarantined in China, and hundreds of flights into and out of the country are being canceled for prolonged periods, worldwide tourism and business travel is really taking a hit. In January alone, REITs in the sector posted losses in excess of 10%, and the situation does not yet have clear catalysts for improvement.

Health Care is closely tied to the political agenda, as the future of Trump’s Medicaid reform still stands unclear. Furthermore, this sector could be greatly impacted in the case of an election of a different president at the end of this year. Hence, until more clarity arises from the political side, it is hard to pass long term judgement on the sector.

Self-Storage has always been a big recession play, being the only sector to post positive total returns in the doom of the 2008 financial crisis – recorded at 5%. The reason is simple, as people downgrade their living conditions in the times of recessions, they often have to find space to keep the excessive things that won’t fit in their smaller homes. While going long can be linked with a sacrifice of potentially higher gains elsewhere, as the 13.7% total returns from 2019 look less than spectacular in comparison to other sectors, January has seen impressive 4.46% total return. With no immediate risks for the sector, these REITs are definitely worthy of consideration when getting ready for a recession.

Timber REITs own nearly 20m acres of US timberlands. They can be viewed as a link connecting the commercial REIT sector with the residential construction sector. This is due to the fact that residential construction is responsible for roughly half of wood product consumption in the US. Ultimately, a position in the sector can be considered as a play on the US housing sector, and more specifically, a view favoring the recovery in the single-family homebuilding sector following years of historically low levels in the post-recession period.

Infrastructure could prove to be an especially hot play right now as the sector’s REITs include many telecommunications towers. Those can see their value skyrocket with the widespread introduction of 5G in the near future. Furthermore, the sector benefits from an increased demand for warehouses driven by the expanding ecommerce. This is especially true when taking into consideration companies such as Amazon (with a whopping 35% market share in US ecommerce) which now have faster same-day delivery solutions as their top priorities. This concept primarily relies on the proximity of warehouses in many different locations across the country, driving up prices for existing ones and stimulating their construction.

Data centers seem to be faring well and will continue to see demand in the accelerating digital age. However, they could be faced with supply challenges if the previously mentioned coronavirus outbreak continues to wreak havoc amongst Chinese producers. There could already be signs of this struggle with REITs in the sector only posting 1.15% returns in January, which heavily contrasts the nearly unparalleled 44.21% run they experienced last year.

Mortgage REITs differ greatly from the standard REITs discussed earlier (for more details refer to Part 1 of the article). When making an investment in them it is worth noting several current risks. One of them stems from decreasing loan standards. While regulations applied after 2008 are supposed to eliminate the possibility of another CDO driven mortgage bubble, the still existing possibility of bad loans being given out in the increasingly laxer regulatory environment is a threat to mREITs themselves in case of an economic downturn. Other risks also stem from fluctuating interest rates. Should shorter term rates rise, the mortgage REIT risks paying more to borrow money than it can safely earn on its investments in home mortgages. This is especially risky due to mREITs having high amounts of leverage. One mitigation of this risk could be looking at mREITs’ rate sensitivities, which they are required to disclose.

All the above considerations form a strong basis for an individual investor’s judgement on potential investments that fit their risk profiles. After all REITs may be a good asset to diversify to in this challenging and hard to predict late cycle.

0 Comments