Introduction

From barters and coins to cash pooling to cashless exchanges, the payments industry has undergone a massive transformation since its inception. During the era of booming e-commerce, payment methods are evolving rapidly, with the scope of becoming faster, simpler, and more secure for all parties.

The main segments of the payment ecosystem include acquirers/processors, issuers, card networks, gateways, ISOs/MSPs, and non card payments.

- Acquirers/processors

Acquiring (merchant) banks, also known as payment processors , (e.g., Worldpay, Worldline, Barclaycard, First Data, Nexi, Ingenico, Nets) process credit and debit card payments on behalf of a merchant, that is a business that wants to take card payments. Acquirers allow merchants to accept payments from the card-issuing banks (see point 3) through a point of sale terminal. They offer both the hardware and the software needed to “acquire” the payments, meaning to receive it and correctly linking it to a network on the likes of Mastercard. Oftentimes, these players also develop software that the banks use to handle the volume of payments and even perform analysis on the flows. This is a particularly interesting and value added area that is receiving a lot of attention lately, as for the commercial banks it is more and more cost effective to rely on external IT software rather than bear the costs of developing it in-house.

In that regard, a particular solution is the ‘Payment as a Service’ (‘PaaS’) technology, which uses the Software-as-a-Service (‘SaaS’) model to connect a group of international payment systems, simplifying payments for the end customer. As banks do not typically offer payment services other than transfers (which are time consuming and unsuitable for retailers). With the PaaS model, banks and other financial institutions could offer customers cutting-edge products and services without exploiting resources to develop them internally.

- Card networks, such as Mastercard, Visa, and American Express, link merchants with cardholders. They do not process payments (processors do) but provide the infrastructure that the credit/debit card systems run on. They connect Points of Sales (a PoS terminal, which could be in the form of a cash register or a payment page on a website, is a hardware system for processing card transactions at retail stores) to banks in both credit card and debit card form.

- Issuers of cards (Citi, Barclays, Goldman Sachs, etc), i.e. the banks of the customers, rely on card networks and pay them a fee (the network gets paid also by merchants). Issuers are not involved in handling the payments unless they have an in-house processing business, as in the case of Citi, in the US or Barclays in the UK. But this is common only among the largest banking institutions, whereas the others rely on platforms such as Nexi or Worldline for the software necessary in handling the payments. The card issuers make money on the interest charged on account holders and bear the relative credit risk, thus they normally do not compete directly with the processors.

- Gateways – Alipay, Worldpay, PayPal, Ingenico, Paysafe

Payment gateways are merchant services provided by ecommerce application service providers that authorize card payments for businesses, without the need of providing financial information. They facilitate transactions, linking the payment portal (website/mobile phone) and the acquiring bank. This segment has been increasingly merging with the acquiring/processor one as a result of banks’ consistent efforts towards vertical integration recently.

A key trend in the industry is that acquirers/processors are vertically integrating with gateways to merge the in store Point of Sale business with the online presence. Thus, being able to offer numerous solutions to merchants, other than card processing, evolving into one-stop shops for customers. A fundamental example of this is Ingenico (now merged into worldline) that is able to seamlessly offer both in store hardware and multipurpose software at the same time.

- ISOs/MSPs – Versapay, Aliant, Paywire, etc.

Member Service Providers, more commonly known as Independent Sales Organizations, are third-party companies (it is important to note that they are not banks) contracted by credit card member (merchant) banks to procure new merchant relationships and process transactions for small businesses in exchange for a fee or percentage of sales. They tend to be smaller than acquiring banks/processors and merchants would often seek out an ISO if they are willing to open a card processing account for their small business. The ISO acts as an intermediary between the acquiring bank and the merchant. The ISO would provide the merchant with relevant information and, once the latter has completed its account application, the ISO would either forward it to an acquiring bank or would proceed with the account internally. After the merchant is approved, the acquiring bank/processor is able to process the merchant’s transactions. ISOs are organizations that are not Association (Visa or Mastercard) Members, but in order to be registered by either card association, the ISO must be sponsored by a processing bank that itself is a Visa/Mastercard member.

- Non Card payments – PayPal, Worldpay, Visa, Mastercard, Revolut, Google & Apple Pay, Venmo

The development of non-card payments is another observed key trend in the industry. The use of such payments allows account-to-account transactions to bypass the need for credit/debit cards, which considerably facilitates the payment process. In fact, incumbents such as Mastercard and Visa are increasingly entering this new field to try and anticipate the new players such as Revolut or Venmo.

Current state of the payment processing sector

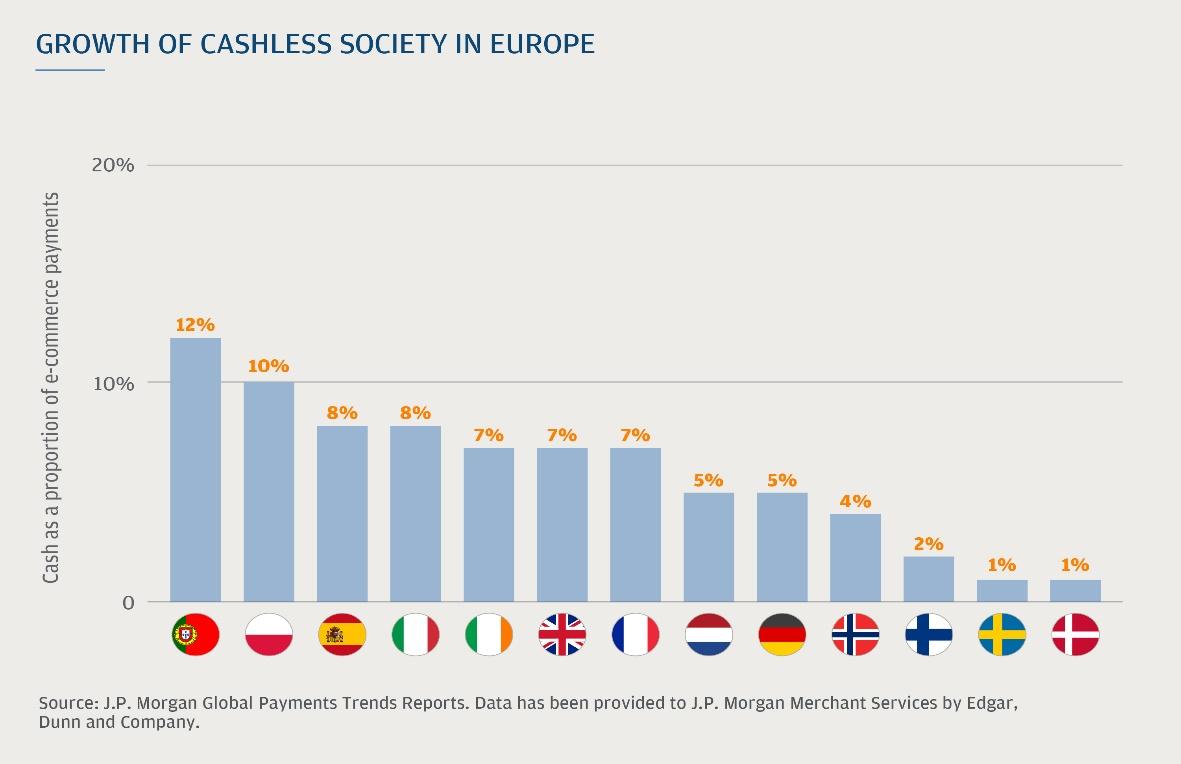

As already mentioned, the payment industry is undergoing a series of rapid changes. In the following we will focus on the European merchant processing sector, which is no exception in this regard. More and more people are abandoning cash in favour of new means of payment such as online or contactless payment. This effect is of course amplified by the Coronavirus pandemic, which incentivised consumers to experiment with online market platforms and new means of paying remotely. Indeed, online shops in the UK experienced an increase in order volumes on some products in excess of 200%. Moreover, studies show that 54% of people there have turned to a new form of payment during the lockdown. Merchants must react to this novel inflow of electronic payments by establishing new methods to effectively process them. Other meaningful changes include European Governments’ commitment to encourage new forms of payment in order to prevent tax evasion and higher processing costs for banks, both of which are caused by the usage of cash. An instance where merchant processors benefited from this change in sentiment is when the Italian government refrained from posing any hurdles for Nexi’s acquisition of SIA, which has secured Nexi a 70% market share in Italy.

Another characteristic feature of the sector in recent times is the abundance of mergers and acquisitions. This year, total deal value in the European payment sector amounts to $32bn, which is up from $8.5bn in the same period last year. This trend can be broadly explained by three factors: demand for integrated solutions, need for scale economies, and changes in consumers’ trust allocation. Customers are becoming more demanding in terms of which payment service they choose, insofar as they require an increasing level of interconnectedness and customization. Customers will favour those processors that can integrate all needed services into one product, and provide it at an affordable price. The rise in M&A activity is therefore partly due to incumbents acquiring specialists to diversify their portfolio and expand vertically. Additionally, they need to invest into new technologies in order to stay competitive. This naturally creates high fixed costs which processors may want to spread across larger foundations. This is another incentive to consolidate. Lastly, according to the McKinsey Global Payments Report 2019, customers are becoming more trusting of the services of providers that are nonbank-branded, such as fintech disruptors. Since this makes it easier for innovators to get access to customers, the competition becomes fiercer, and the services provided more extensive.

European consolidation in payments

Recent acquisitions which have pursued the goals described above are Worldline’s takeover of domestic French rival Ingenico for €7.8bn and Nexi’s merger with SIA and acquisition of Nets, valued at €15bn and €8bn respectively. When taking into consideration the previous activity in the industry, one sees that these developments leave the European payment sector largely consolidated. There now exist two pan-European leaders, Worldline-Ingenico, valued at €19bn, and Nexi-SIA-Nets, valued at €22bn.

Thanks to Ingenico, Worldline now has access to first-class payment hardware, such as in-store terminals, which, combined with its merchant acquiring services, enables it to provide services along the entire value chain to its customers. Economies of scale are going to enhance efficiency and increase returns. Besides holding on to its home markets of Switzerland, Benelux and Austria, Worldline can now strengthen its grip on France. Furthermore, through Ingenico’s joint venture Payone with bank DSV in Germany the company will gain access to a country still heavily reliant on cash and thus rife with opportunities to grow the business. Run-rate synergies are expected to be around €250m by 2024.

source: JPMorgan global payments trend report

As mentioned earlier, Nexi’s merger with SIA makes it the Italian market leader with 70% market share. This is all the more valuable as Italy is still very much dependent on cash and therefore offers a lot of room to expand. In addition, the combined firm will be able to internalize a large part of the value chain by combining SIA’s processing capabilities and its numerous Point of Sale locations with Nexi’s merchant services. The rationale behind Nexi’s latest acquisition, namely the one of Nets, is to give it access to the fast-growing German and eastern European markets. This is possible because Nets has been consolidating as well by acquiring a leading German payment processor, Concardis, in 2017. This makes the deal worthwhile in spite of Nets’ home markets, the Nordics, already being mature regarding the digital payment industry.

The new group consisting of Nexi, SIA and Nets has thus expanded its addressable market by 4 times, when compared to Nexi standalone. The penetration of digital payments in these regions amounts to an average of 33%. Moreover, it presently has access to a full portfolio of solutions across the payment sector and can act as a one-stop shop for many of its customers. In this instance, this means that it is able to provide services in fields ranging from acquiring over e-commerce to client service. Furthermore, the new group can now help merchants interpret data from various payment channels and rails. In addition to the €150m in annual synergies from the SIA acquisition, it will also benefit from €170m in run-rate synergies from the Nets deal.

Future Outlook:

Following the increased M&A activity this year, the payment processing sector is largely consolidated under two European champions, Worldline and Nexi. Since both companies are faced with high debt levels (Nexi’s debt to EBITDA approaches 3 times), they will have to refrain from further acquisitions in the near future. Smaller companies will thus have some room to grow, be it organically or by consolidating themselves. This may constitute the last chance for them to prevent getting swallowed up.

1 Comment

Andreas Blom · 26 July 2021 at 21:55

Great article! I really enjoyed reading it! I am currently working on a paper focus on the Nets-Nexi deal for my M&A course and this really creates valuable insights. I would like to ask the author about your sources?