Introduction

This article explores the short-term commercial financing landscape and the most important financial instruments therein. We elaborate on how the coronavirus affected short-term financing of SMEs and how institutions intervened to avoid large scale insolvencies. Subsequently, we detail the most important practices within trade finance and in particular, factoring.

Impact of the coronavirus on short-term commercial financing

SMEs have borne the brunt of the economic fallout from the pandemic. They are less resilient due to their smaller size and commonly operate in hard-hit industries such as tourism, hospitality, foodservices or fashion. Social distancing measures severely hit the hospitality and tourism sector while foodservices and fashion suffered from delays in delivery schedules. Furthermore, SMEs generally have fewer suppliers than larger companies. This can be beneficial, as regional supply chains are indifferent to international shocks. However, many SMEs depended on few suppliers which all faced the coronavirus impact at once. The subsequent reduction in SME production entails high costs in terms of underused capital and labour, which SMEs find even harder to cope with than corporations.

These developments left many SMEs with liquidity shortage: the need for additional funds to satisfy their short-term obligations. Indeed, research by JPMorgan shows that 50% of small businesses in the US are operating with less than 15 days in buffer cash, which makes them extraordinarily vulnerable to insolvency during the pandemic.

Also, according to data by OECD, 20% of companies would run into liquidity problems one month into confinement and 30% after two months, absent any government intervention. Among firms in sectors that are particularly affected such as the ones outlined above, an astonishing 50% will face liquidity shortage. Other studies show that without any policy change 12% of SMEs would have to declare bankruptcy by the end of the pandemic. Research by the Central Bank of Ireland furthermore indicates that even though a large amount of undrawn credit is available, 80% of it is meant for just 10% of borrowers. When extending these numbers to the rest of Europe, one can easily see that existing credit lines are not enough to address the financing needs of all companies.

Government intervention

Central banks have introduced a series of policy measures to reduce the strain on SMEs and bridge liquidity gaps. Measures by the ECB include direct lending by government institutions to SMEs as well as grants and subsidies. The most central part of its relief package, however, are loan guarantee schemes, which allow banks to provide more extensive lending to SMEs. In a loan guarantee, the central bank promises to assume the obligation of a borrowing party in case of default. Thanks to this commercial banks can afford to give credit more freely. While there are variations in the structure of these loans depending on the different countries, the framework that has to be followed remains approximately the same: they are normally short-term, priced at around 25 basis points and exhibit a maximum loss absorption of 90%.

The Small Business Administration (SBA) has also taken extensive measures to meet the demand for loans in the US. It has introduced several relief programs, most prominently the Economic Injury Disaster Loans (EIDL) and the Express Bridge Loans. Proceeds from the EIDL program are to be used as working capital or to cover short term liabilities and will be paid back over 30 years at 3.75%. If a small business requires capital while waiting for an EIDL, it is possible to receive access to an Express Bridge Loan in order to bridge the gap. These loans consist of up to $25,000.

Overview of Trade Finance

In normal times, Trade Finance helps the economy run smoothly. Trade Finance refers to the short-term financing solutions used in both domestic and international transactions of goods (although the term is more often associated with the international aspect of the business because it requires a more active presence of the banks).

A business faces various risks in such transactions including product, manufacturing, transport, and currency risk. For example, when individuals place an order on Amazon and pay in advance, they risk receiving a product below the standards promised, or not receiving the product at all. In the same way, businesses can experience these issues with their suppliers. Hence, businesses can use Trade Finance to reduce these risks. Trade Finance can offer competitive terms to suppliers and customers, and usually also involves intermediaries such as commercial or advisory banks.

Trade Finance is transaction-focused rather than borrower-focused. Thus, smaller businesses with smaller balance sheets can enter significantly bigger transactions and work with bigger businesses. Trade finance is critical to the economy as it accounts for 3% of global trade, or $3tn annually. Data emerging during the Covid-19 pandemic further confirms its importance.

As anticipated, “Trade Finance” is a group of financing solutions. Types of Trade Finance refers to the type of contract agreed. These mainly include: Trade Credit, Cash Advances, Purchase Order (PO) Finance, and Factoring.

- Trade Credit (also known as Open Account) occurs when the payment for a product is required within 30, 60, or 90 days of collection, and completely relies on trust between buyer and supplier unless the supplier is backed by an insurance policy on the buyer’s payment. As the supplier takes all the risk, this transaction occurs when there is a strong relationship between the trading partners and is popular as it sustains competitiveness between suppliers to attract the most clients. Trade credit usually does not involve any financial intermediary.

- Cash Advances require the buyer to pay the supplier upfront, which provides the latter with working capital to deliver on the order and is again usually based on trust. This method of payment is common in low-value transactions, such as placing an order with an online retailer. Cash advances provide working capital for the supplier but transfer all the risk to the buyer. This type of financing usually does not involve any financial intermediary.

- In Purchase Order Finance, when a good or service is received by the end-customer, a financier will pay the supplier and then be reimbursed by the borrowing business or directly by the end-customer. This reduces the risk of the supplier not receiving payment and the borrowing business not receiving high-quality products in time.

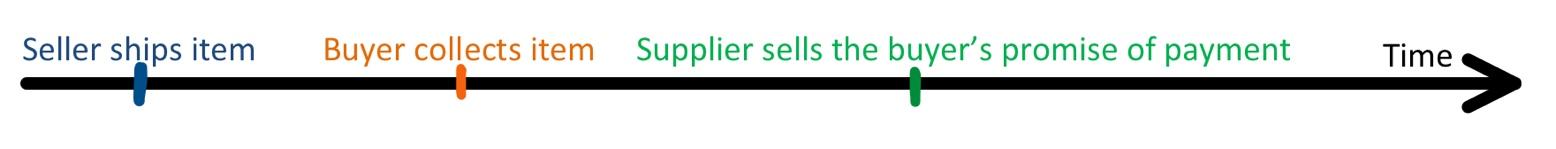

- In Factoring, (also known as Receivables Discounting), promises of payment by a buyer resulting for example from Trade Credit, such as invoices or bills of exchange, can be exchanged immediately on the market at a discounted price which would be set according to the risk of default.

Another key instrument in the trade finance arsenal is the Forfaiting. Similarly to Factoring, Forfaiting enables sellers to receive immediate cash by selling their receivables at discount. In constrast however, Forfaiting is the sale of medium to long-term receivables so it is not a short-term form of financing per se. Several other types of trade finance exist such as Stock Finance, Supply Chain Finance, and Structured Commodity Finance.

In addition to these types of trade finance, there are multiple methods of payment that define the way through which an account is credited/debited, when, and what role the financial intermediary plays. Methods of payment are even more essential to risk reduction, as data on the impact of the Covid-19 pandemic on trade has proven. In addition to Open Account and Cash Advances that we already mentioned, there are also: Letters of Credit (LCs), Bank Guarantees, and Documentary Collections (DCs).

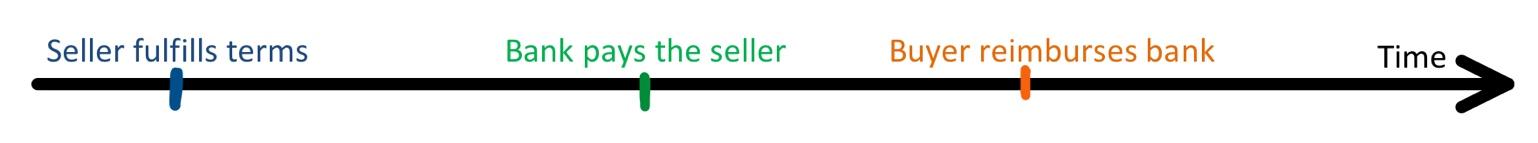

- Letters of Credit are agreements for which if the terms signed on are fulfilled by the supplier, the latter will be remunerated by an intermediary financial institution which takes responsibility on behalf of the buyer. LCs are financially and legally binding. Their effectiveness depends on the intermediary and their creditworthiness, which can potentially reduce the supplier’s risk, a process called credit enhancement. Lastly, they are widely used as they can be bespoke to the client’s needs and the nature of the transaction.

- Bank guarantees are guarantees a bank gives to a seller that if the buyer defaults, the bank will pay the seller. This is different from a Letter of Credit, in which the seller receives payment from the bank as soon as he proves that he shipped the items. Whereas a Letter of Credit represents a primary liability for the bank, a bank guarantee represents a secondary liability: the bank only steps in when the buyer fails to make payment. Bank guarantees are riskier for the seller and safer for the bank.

- Documentary Collections also involve intermediaries, which, however, do not provide financial backup. With DCs, suppliers request payment by giving shipment and collection receipts to their bank, which forwards them to the buyer’s bank, which then transfers the funds to the supplier’s bank. However, these intermediaries are not accountable for checking the documents; they only control their flow. For this reason, this service is less expensive and occurs mainly when there is a good relationship between the trading partners.

Recent data revealed in a study (Demir & Javorcik, 2020) strongly suggests a relationship between the method of payment used in the trade finance of a transaction and the impact of the Covid-19 pandemic on the respective volume of trade. In fact, the volume of transactions using bank intermediation to reduce risk, such as LCs or DCs, have proven to be more resistant to downturns relatively to other methods of payment such as Open Accounts or Cash Advances. The volume of transactions made through Cash Advances and Open Accounts took a steep downturn, decreasing by 40% and 28% respectively. As for the more secure Documentary Collections and Letters of Credit, their transaction volume decreased by 12% and 23% respectively. These findings clearly show the vitality of trade finance in times of uncertainty to keep and restore trade volume to its normal levels.

When trade volumes recovered after the 2008 financial crisis, the share of transactions financed through trade finance increased. Experts from EY believe that trade finance will rebound quickly from the coronavirus crisis as well. They also expect the coronavirus will accelerate trade finance’s transition to digitalization. Indeed, we expect a good share of those who once used Open Accounts or Cash Advances to shift to either Letters of Credit or Documentary Collections. Furthermore, financial intermediaries are investing in technologies such as Optical Character Recognition, Artificial Intelligence, and Blockchain, as trade contracts that used to be made face to face now are increasingly made digitally.

Focus on Factoring

Factoring warrants a deep dive given its importance in Europe. Factoring provides a solution to potential liquidity issues caused by accounts receivables, which are delayed cash inflows from customers usually expected within 120 days. Certainly, the shortage could be solved by entering a short-term loan contract. However, doing so would worsen the company’s net financial position, making it even less attractive in the eyes of banks. Furthermore, banks’ loan internal deliberation process usually takes some time to complete. Thus, the need for some more efficient solutions, and here factoring can come into play.

As mentioned in the previous section, factoring consists of a financial transaction in which an intermediary agent called a factor, usually a bank, purchases the accounts receivables of a company. The company agrees to sell its accounts receivable at a discount in return for a quick injection of cash from the factoring company, thus avoiding any possible cash shortage caused by outflows towards its creditors. The discount rate, typically stated as a percentage of the face value of the receivables, consists of a fee the company pays to the factoring company. The fee is charged as the seller, which owns the invoices, is transferring the risk of the default to the factor, which asks for a payment to compensate for the incurred risk. More specifically, the discount rate is calculated on the implied interest rate that reflects the customer risk and some additional risk premium including the risk of the company selling its receivables.

Reverse factoring is a mechanism for supply chain financing which involves the same three players: the customer, the supplier (the company that has the receivables), and the factor. However, in reverse factoring, the customer rather than the supplier reaches out to a bank. To do that, the customer must be larger than the supplier. The bank pays the supplier the full amount of the accounts receivables minus a fee. The customer later pays the bank the original amount owed to the supplier. As a result, the supplier gets paid faster and the customer has more time to pay. Another type of contract is the factoring without recourse, a peculiar factoring contract in which the factor assumes full ownership of the seller’s receivables and all the risks associated with it.

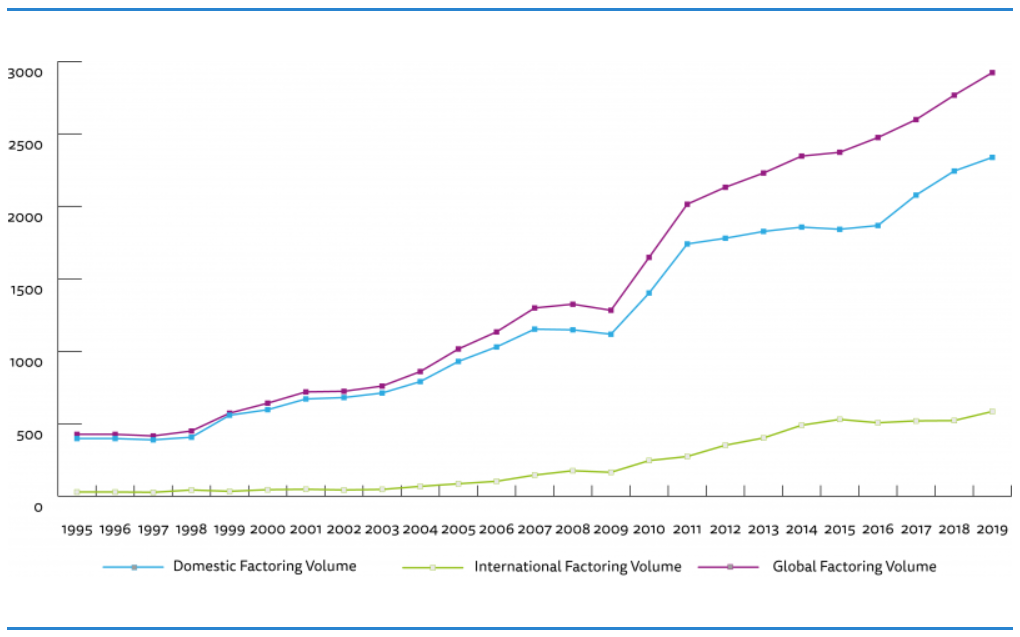

According to the Factors Chain International (FCI), the global factoring industry reached €2.9bn in 2019, resulting in a 5% increase from €2.8bn in 2018. The European area represented the largest market contributor with €2.0bn accounting for 68% of the total. The factoring industry grew in all European area countries apart from Cyprus and Turkey, which experienced high volatility in the Turkish Lira.

Evolution of Global factoring volumes

Source: Factors Chain International (FCI)

The existing academic literature suggests that an absence of or even weak access to finance can deeply inhibit Small and Medium Enterprises (SMEs) growth. In modern supply chains, characterized by high volumes of orders for exports towards global markets, obtaining cash in a shorter amount of time is fundamental for SMEs to continue to produce and supply their larger buyers. Therefore, factoring can constitute a quick and efficient solution to get immediate cash against receivables. Factoring is a popular form of finance for SMEs for several reasons. Firstly, SMEs can receive immediate cash against creditworthy receivables at a discount. Unlike a loan, factoring does not increase the company’s liabilities. Moreover, unlike other forms of working capital financing, this process does not entail loan collateralization. In addition, the factor often offers a full financial service that involves the collection, credit protection, and the book-keeping of receivables. Finally, for SMEs wanting to expand overseas, factors with extensive international experience can make international business a lot easier.

Conclusion

The coronavirus pandemic presents businesses all over the world with an unprecedented challenge. It is well known that market failures, especially when caused by financial crises, fall disproportionately on SMEs rather than on larger corporations. The results are more credit rationing, higher costs of “screening” and higher interest rates from banks for SMEs. To return to growth, businesses need to secure financial stability both for themselves and for their customers. Invoice finance, as well as other alternative financing tools, can provide them with the means to get back on their feet as quickly as possible.

0 Comments