Latest trends in Equity Capital Markets

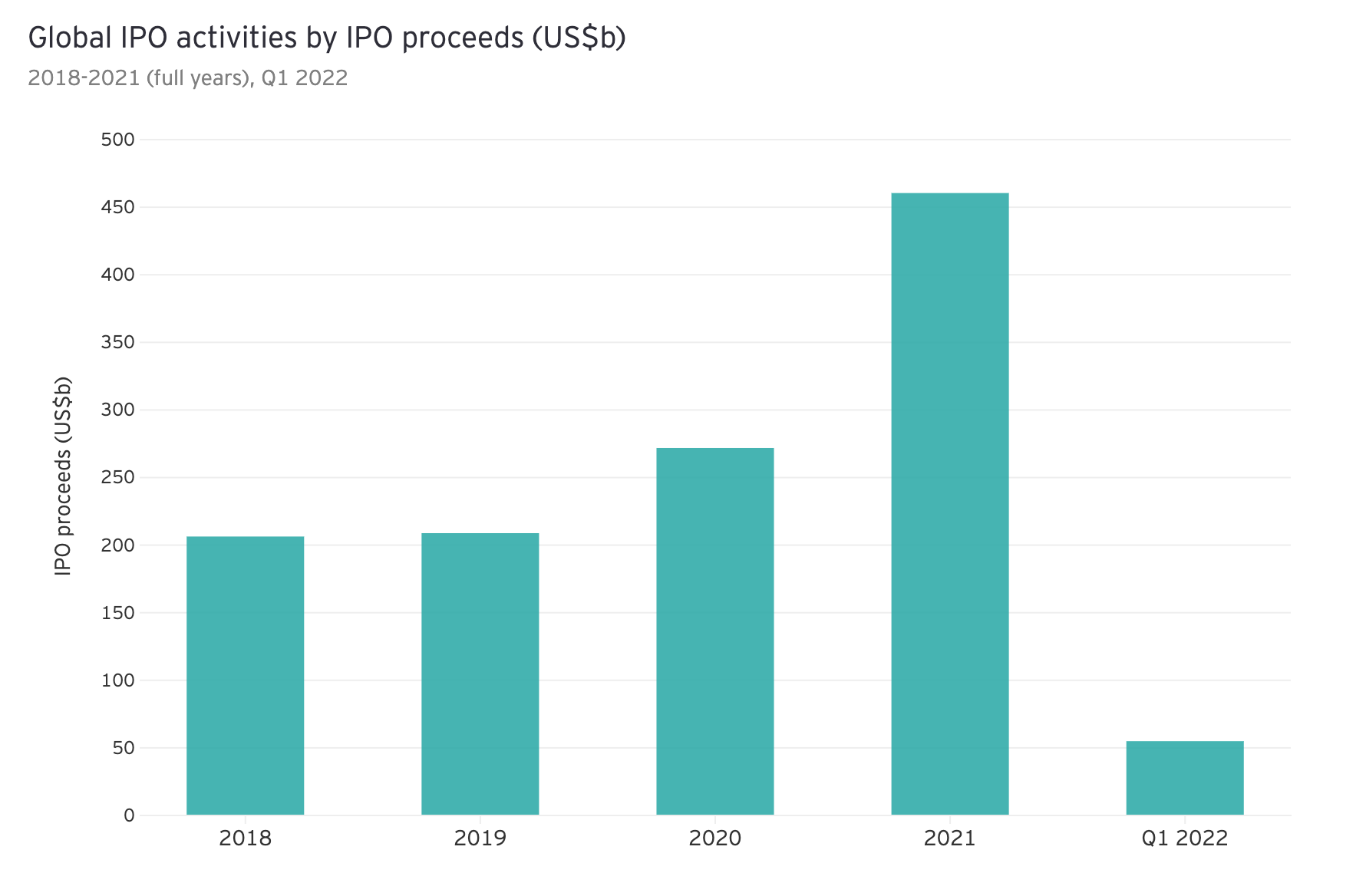

In 2021, Equity capital markets showed an outstanding recovery from 2020, with the S&P 500 closing at historic highs throughout the year. The first half of the year saw a substantial improvement in investor confidence with the passage of the American Rescue Plan Act and a record first quarter in which 390 IPOs raised $126bn, fuelled in part by a wave of special purpose acquisition company (SPAC) IPOs. This is a strong performance since it exceeded the $97bn raised in 2000 during the dot-com boom. Furthermore, In May 2021, a rise in inflation prompted the market to plummet more than 4% in three days, suggesting investor concern that remained throughout the year when inflation rose in October and November. In light of the Delta and Omicron variants of COVID-19, as well as the impact of rising costs on corporate earnings and fears that the Fed would respond to inflationary pressure by raising interest rates and accelerating its tapering program, investors have expressed concern about the economy’s recovery. An exceptionally robust earnings season, however, outweighed investor anxiety over Federal Open Market Committee (FOMC) interest rate revisions and asset purchasing plans. More than 85% of the S&P 500 companies beat their EPS estimates in the first three quarters of the year. Furthermore, an increasing number of companies are gaining access to the public markets through IPOs and SPACs, boosted by a surge in first-time retail investor engagement. All of these variables have contributed to the V-shaped recovery’s continuation, with key indices closing at all-time highs and the S&P 500 returning more than 25% for the year. Indeed, many industry experts predict that GDP growth will continue in the next quarters and that capital markets will stay resilient in the near future after the Federal Reserve carefully controls the recovery and inflation. For instance, J.P Morgan’s Chief U.S Equity Stratetegist said “ Next year, we expect S&P 500 to reach 5050 on continued robust earnings growth as labor market recovery continues, consumers remain flush with cash, supply chain issues ease, and inventory cycle accelerates off historic lows “. However, in the first quarter of 2022, we can see that the IPO market is decelerating compared to the previous year with less than 20 U.S companies that went public since the start of the year. Several factors are contributing to the IPO slowdown, including global instability caused by the war in Ukraine. Furthermore, we’ve just seen a significant drop in stock prices and valuations across numerous sectors, primarily in technology. When you combine all of these factors, you get a lot of volatility, which is kryptonite for IPOs. Furthermore, the market correction in bloated valuations of companies that debuted last year has encouraged some pre-IPO companies to reevaluate their worth. For instance, Instacart recently made headlines when it cut its own valuation by almost 40% to $24bn. With the SEC considering new laws that would eliminate the benefits of special purpose acquisition company (SPAC) mergers over standard IPOs, even further uncertainty looms for private companies aiming to hit the street. SPAC mergers accounted for the majority of new listings in 2021, and the prevalence of SPAC listings increased by about 150% from the previous year. The SEC’s proposed policies would abolish “safe harbor” provisions that allow companies purchased through a SPAC to offer more forward-looking estimates than regular IPO issuers are permitted to provide. Investors would also be required to receive more detailed disclosures about potential conflicts of interest between SPAC sponsors and target companies under the new guidelines.

As mentioned, the SPAC market has significantly cooled in recent months as investors grow wary of funding companies with little revenue or inexperienced management teams. Spac bankers, who have enjoyed high fees from arranging deals, are now cutting their fees depending on the level of investor redemptions. Banks typically receive a 2% upfront fee and a 3.5% deferred fee once the merger is complete. SPAC teams whose deals face huge redemptions but do not cut fees can find themselves paying enourmous sums as a percentage of the deal value. Earlier this month, Credit Suisse agreed to reduce its fees from $14.5m to $10m on the merger between a SPAC sponsored by New York-based venture capital firm FirstMark and broadband company Starry. Others cutting their banks’ fees are I-Bankers Securities, Dawson James, Ingalls & Snyder, and Ladenburg Thalmann which are set to earn a combined $5.86m in fees, worth 3.5% of the IPO proceeds, once the merger is complete. They agreed to a pro-rata fee reduction depending on redemptions, up to a maximum 20% cut. If the deal faces maximum redemptions, the banks still make $4.7m, according to regulatory filings. Furthermore, New York-based Maxim Group is set to receive $1.84m in fees, 4% of the total IPO proceeds, once the merger closes between Agba Acquisition and TAG Holdings, a group that includes automotive and heavy equipment companies. The bank has agreed to cut its fees by 20 cents for each unit redeemed by shareholders. All banks declined to comment regarding the reasons behind the low fees, a common thought is that investment banks have been more flexible in terms of their willingness to cut back their fees if it means they can still claim they’ve been involved in a successful deal.

Source: https://www.ey.com/en_gl/ipo/trends

Source: https://www.ey.com/en_gl/ipo/trends

Reasons behind SPACs underperformance

As mentioned in previous articles a Special Purpose Acquisition Company (SPAC) is a shell corporation, also known as a blank-check company, with the purpose of raising funds from public investors in order to acquire a private company, bypassing the traditional Initial Public Offering (IPO) process. SPACs, being shell companies, have no commercial operations, with their only assets being the money raised in their IPO. Once funds are raised, they will be kept in an interest-bearing trust until the sponsors, the management team of a SPAC, identify and acquire a target company. If the SPAC fails to acquire or merge with a company within a deadline of usually two years, the SPAC is liquidated and investors get their money back. Once the merger is complete, the acquired company replaces the SPAC in the stock market becoming a public firm. This allows companies to swiftly be listed on exchanges without many of the complexities and regulatory obstacles present in regular IPOs. SPACs are not new but they have rapidly risen in popularity over the last few years. This can be attributed to a pro-risk environment following the initial COVID-19 crisis, abundant market liquidity, and a large pool of investors enticed by celebrity SPAC sponsors aiming to get behind new innovative companies. SPACs boomed in both 2020 and 2021, becoming one of the hottest asset classes, with 613 SPAC IPOs filed in 2021 generating over $145bn. However, the outlook for this year is much grimmer as investors reflect on the poor performance of many SPACs from last year.

Despite large amounts of available capital and strong equity markets, SPACs have provided little returns to investors. According to data from SPAC Reasearch, out of the nearly 200 SPAC mergers completed last year stock prices fell around 40 percent up until early 2022. This follows a general trend seen amongst many SPAC companies showing a gradual decline after the acquisition of a private company. As retail investments into blank check firms have fallen since around mid-2021, SPAC stocks have significantly underperformed the overall market. The worst performing SPAC mergers have been those in the healthcare industry, falling 49% on average. Humacyte Inc. for example, a bioengineered human tissue company saw its shares drop 40.6% since its SPAC merger in February 2021. The Defiance Next Gen SPAC Derived ETF (SPAK), an index that tracks the performance of the US-listed common stock of SPACs and companies formed from SPAC mergers, is down 28% since November of last year. In comparison, the QQQ, which tracks the performance of the 100 largest non-financial companies listed on the Nasdaq exchange, is down 12% since its peak in late 2021. This underperformance can be linked to the hypersensitivity of IPOs, and hence SPACs, to market movements. Furthermore, due to the anticipated rate hikes in early 2022, there has been a large sell-off of riskier assets including SPACs.

Another reason why SPACs underperform is due to their oversupply, caused by their overwhelming rise in popularity in 2020 and 2021, resulting in a lack of target companies that meet their requirements. The outcome of this is large amounts of SPACs loaded with cash chasing the same acquisitions. This high demand for target companies has led to SPACs overpaying for these transactions, leading to low market-adjusted returns after acquisitions. Another phenomenon that has greatly affected the performance of SPACs is their ability to make firm projections. Traditional IPOs are not legally allowed to make forward-looking statements and are only allowed to report on past financial performance. However, as the target companies don’t go through an IPO, but instead merge with an already public shell company, they are able to state their projected future earnings when marketing their acquisition. This was initially seen as a great benefit of SPACs, allowing unprofitable firms like Lucid Motors to raise capital and enter the public market without even selling any cars. However, firms may exploit this by inflating future earnings reports to elicit more investments from retail investors. Once SPAC target firms enter the public market they will likely significantly underperform their initial projections. An example of this is one of the most known SPAC deals: Virgin Galactic’s merger with a SPAC backed by well-known sponsor Chamath Palihapitiya in 2019. The company missed it’s 2021 revenue forecast by 98%. The outcome for investors in similar cases is evidently not great, with post-SPAC merger companies experiencing poor performance in markets. This scam-like activity by private companies to inflate investments has attracted the attention of the U.S. Securities and Exchanges Commission (SEC), which has recently proposed sweeping reforms for SPACs.

The Defiance Next Gen SPAC Derived ETF (SPAK)

SEC crackdown on SPACs and outlook for the future

A week ago, on March 30th 2022, the SEC proposed new rules in order to strengthen investor protections in IPOs by SPACs and the ensuing acquisitions of private companies. These rules are aimed at solving two main problems: The first, outlined above, is SPAC sponsors’ ability to present unrealistic projections to entice investors; and the second is the conflict of interests between sponsors and investors. After completing a merger sponsors get around 20-25% of the money raised via the SPAC, whether the company succeeds or not. If the SPAC is unable to find a target company to merge with sponsors lose the money they spent on lawyers, advisers, employees and other costs, on top of the two years wasted and a potential ensuing negative reputation. For investors however, if a deal does not occur within the SPACs two year limit they get 100% of their investments back. In the case where a deal is done with a company that ends up being unsuccessful investors can lose a lot of money. This all creates bad incentives for sponsors. Sponsors will be very eager to make a deal within two years regardless of whether the deal makes sense. This conflict of interest can lead to sponsors being over-optimistic about target companies in order to get the shareholders approval. This in turn can lead to many post-SPAC merger underperforming companies.

Through the new rules proposed the SEC wants to restrict any sort of projections made by the acquired private companies. Furthermore, the SEC wants to introduce and enforce stricter rules to make SPACs liable for how they market themselves. SPACs will now move closer towards IPOs where if anything disclosed in the IPO prospectus is false the company can be sued. The main way in which the SEC wants to do this is by removing the “safe habour” which prevents SPACs from being sued for making false projections. The SEC now also plans to consider the SPAC merging with a private company as a public offering of securities, making the private company also liable for anything in the prospectus by treating it as a “co-registrant” of the SPAC. Moreover, investment banks which underwrite the IPOs of SPACs would also be required to underwrite the subsequent acquisition. This would also make the bank potentially liable for any misstatements in the merger prospectus.

The second set of rules aims at resolving the above-described conflict of interest and disclosing sponsor compensation. These rules would require SPACs to disclose their conflict of interest in the SPAC prospectus. This would allow investors to better understand the likely outcome of their investment. Furthermore, there will be a requirement for disclosure of potential dilution. Due to the structure of SPACs, there is often potential for significant share dilution, which through these new rules should be disclosed to investors. Investors in SPACs are given warrants in addition to common shares during the SPAC IPO. When these investors exercise these warrants after the merger they create more shares leading to dilution. SPACs will therefore now be required to disclose the quantifiable amount of potential future dilution. An additional important rule being proposed by the SEC is that the prospectus for a SPAC merger will have to include a range of valuations of the private company made by an investment bank so that investors know if the company is worth the price they are paying. This will attempt to resolve the issue of investors overpaying for SPACs due to their oversupply.

The sweeping reforms proposed by the SEC will likely have a large effect on SPACs in the future. SPACs will now be significantly more aligned with IPOs not only in terms of liability but also on projections they are allowed to make. This is good for protecting investors, however, SPAC projections have also shown to be important and useful. SPACs allow companies to go public earlier and can provide venture-like capital to new innovative companies. However, this can be very risky for investors and also allows for fraudulent behaviour by private companies and SPACs to entice investors. Investment banks now potentially being liable for errors in merger prospectuses will likely increase fees charged by banks. Furthermore, rules requiring the disclosure of conflicts of interests, dilution, and sponsor compensation will strengthen investor protection and reduce sponsors’ ability to exploit investors in order to make the most money possible. However, the reforms may be much too late for many investors who have suffered losses since the peak of SPACs last year. These reforms cover many aspects of SPACs and are designed to significantly restrict them. Many see the reforms as a means to stop the SPAC market completely. Overall, the reforms will likely reduce the number of public companies entering the public market.

0 Comments