Introduction

The power and utilities industry refers to a category of companies that focus on providing services to satisfy basic needs. The five main businesses classified as utilities are electric power, natural gas, water supply, steam supply and sewage removal. The sector is mainly known for its stability as demand for utility services tends to remain steady, even during a recession. The utility industry accounts for approximately 3% of the S&P 500 and has a market capitalization of $1.74tn. Electric Utilities are the largest sector within the S&P 500 Utilities, accounting for 62.13% of the industry.

Although the power and utilities sector is more resilient than most, the COVID-19 pandemic led to a supply-and-demand shock for the industry, which resulted in uncertainty and operational challenges the industry is still trying to recover from. Simultaneously, utility companies are in the midst of rapid change and innovation. Whether they are responsible for electricity, water, gas, or waste utilities, they need to develop energy-efficient and intelligent solutions in their operations to keep up with the constantly increasing demand for sustainability. Over the past years, the industry has undergone measurable progress, but there are still concerns to tackle such as boosting clean energy while ensuring reliability and keeping costs down. These challenges are likely to accelerate industry consolidation and drive utilities to explore new business activities.

United States: Main players

Exelon Corporation [NASDAQ : EXC] is America’s largest power and utility company and an American Fortune 100 energy company. Headquartered in Chicago, it currently serves more than 10 million customers and generates revenues of approximately $36.35bn. Exelon was created in 2000 by the merger of PECO Energy Company and Unicom Corporation, which also owned Commonwealth Edison. The corporation has a market capitalization of about $49.5bn and consists of six transmission and distribution businesses: Atlantic City Electric (ACE), Baltimore Gas and Electric (BGE), Commonwealth Edison (ComEd), Delmarva Power & Light (DPL), PECO Energy Company (PECO), and Potomac Electric Power Company (Pepco).

Duke Energy [NYSE : DUK] is one of the nation’s largest electric power and natural gas holding companies. It is a Fortune 150 company headquartered in Charlotte, N.C. whose electric utilities serve 8.2 million customers, while the gas unit serves 1.6 million customers in the Carolinas, Florida, the Midwest, Kentucky and Tennessee. As of December 2021, the company counted an operating revenue of $25bn and its market capitalization is approximately $88bn.

NextEra Energy, Inc [NYSE : NEE] is the world’s largest power and utility company by market capitalization. The company was founded in 1984 and is headquartered in Juno Beach, Florida. NextEra Energy has a market value of approximately $160.75bn and generates revenues of about $17bn. Its principal subsidiaries are Florida Power & Light (FPL), NextEra Energy Resources (NEER), NextEra Energy Partners, Gulf Power Company, and NextEra Energy Services. FPL, its largest subsidiary, serves approximately 10 million people across Florida.

Southern Company [NYSE:SO] is an American gas and electric utility holding company with headquarters in Atlanta, Georgia. Southern Co is one of the largest utility companies in the US in terms of customer base. Through its numerous companies, Southern Co reaches almost 10 million utility customers in the six states where it operates. The company’s market capitalization is around $81bn and it registered revenues of $23.1bn in 2021.

Europe: Main Players

Enel Spa [MIB : ENEL] is a multinational manufacturer and distributor of electricity and gas utilities. It is the 73rd largest company in the world by revenue and the second-largest power company in the world by revenue after the State Grid Corporation of China. The company generated revenues of €88.3bn in 2021, experiencing an increase of 33.8% from €66bn in 2020. It was founded in 1962 as a public body by the fusion of more than a thousand energy producers and only in 1992, it became a limited company. With a market capitalization of €62.81bn, it is one of Europe’s largest utility companies by capitalization.

Iberdrola [BIT : ENEL] is a holding power and utility company engaging in the generation, distribution, trading and marketing of electricity. The company was founded in 1901 and is headquartered in Bilbao, Spain. The four main businesses the company operates through are Networks, Liberalized, Renewables, and Other Businesses that also include supply and storage of gas. Overall, Iberdrola serves approximately 34 million customers. In 2021 it generated revenues of €39bn and with a market capitalization of €64.51bn, it is the second-largest wind power producer by revenue and market capitalization.

Electricitè de France SA [Euronext : EDF] is a multinational electric utility company, largely owned by the French government and headquartered in Paris, France. It was founded in 1955 and nowadays offers services from energy generation to retail and distribution. EDF is mainly known for its focus on nuclear energy as it owns all the nuclear power plants in France, one of the most involved European countries in nuclear power, that generate 78.2% of the energy supplied by the company. Electricitè de France SA has a market capitalization of €32.32bn and in 2021 it generated €84.5bn in revenues.

National Grid plc [LSE : NG] is a multinational electricity and gas utility company headquartered in London, England. Its principal activities are in the United Kingdom where it distributes electricity and natural gas and in the Northeastern United States where the company also produces and supplies electricity and gas. National Grid plc is primarily listed on the London Stock Exchange but it also has a secondary listing on the New York Stock Exchange [NYSE : NGG] in the form of its American depositary receipts. In 2021, the company generated revenues of approximately £15bn and it has a market capitalization of £42.57bn.

Valuation Primer and Industry outlook

Before we dive into the valuation, we have to understand the basic business model of Power & Utilities companies. Compared to other industries, the Power & Utilities industry is unique for its highly regulated nature. As electric utilities are normally monopolies, they are subject to careful regulation in order to protect the interests of their captive customers.

Public Utility Commissions (PUCs) in the US or their equivalent in other countries serve as a replacement for the competitive market. In exchange for granting the exclusive right to sell electricity in a given service territory, PUCs determine a utility’s total revenue requirement in what is known as a rate case. The revenue requirement represents the amount of money a utility must collect in order to cover its costs and make a reasonable profit. Individual utilities file rate cases every few years, and PUCs decide whether to approve it or not. The decisions are generally based on the cost-of-service utility model: utilities cover their expenses by passing them on to customers in rates with no mark-up or profit. But doing so does not provide the utilities with a source of cash to recover the front-loading expenses on infrastructures and pay for further capital investments. Rather, utilities have to generate money to repay the debtors and shareholders, or no investors will be willing to put capital in utilities. The simplified formula of revenue requirement is as followed:

Total Revenue Requirement = Equity Rate Base × Allowed Rate of Return + Debt repayment + Depreciation + Taxes + Operating Expenses.

Contrast to competitive businesses, where calculations of profitability are top-down, Power & Utilities companies feature a bottom-up calculation. It is worth noting that, operating expenses, taxes, and debt payments are intended to be costs pass-through, meaning that these costs are transferred to utility customers without any mark-up for profit. Additionally, depreciation is designed to return original investments back to shareholders. So, all that is left to provide profits for shareholders is the line item “Rate of Return x (Equity Rate Base).” Understanding this line is the key to understanding utility profitability. More precisely, in a regulated business, value creation results from operational and financial outperformance with respect to the targets set by the regulatory authorities. So, in most cases utility companies have to either lower the cost of debt or raise the leverage to higher than the regulator’s assumptions. Cost control can also help, but the effects are relatively minor.

Based on the business model of utilities, an interesting observation is that, theoretically, the profitability of pure utilities is not impacted by the energy prices, as all the costs are transferred to customers and no profits are earned from the sale of energy. It’s a rather low-risk and stable business. However, some utilities may have merchant energy generators as subsidiaries, getting access to another source of profits but also exposing themselves to price risks. Therefore, the current energy crisis caused by the war between Ukraine and Russia is not so relevant to utilities companies.

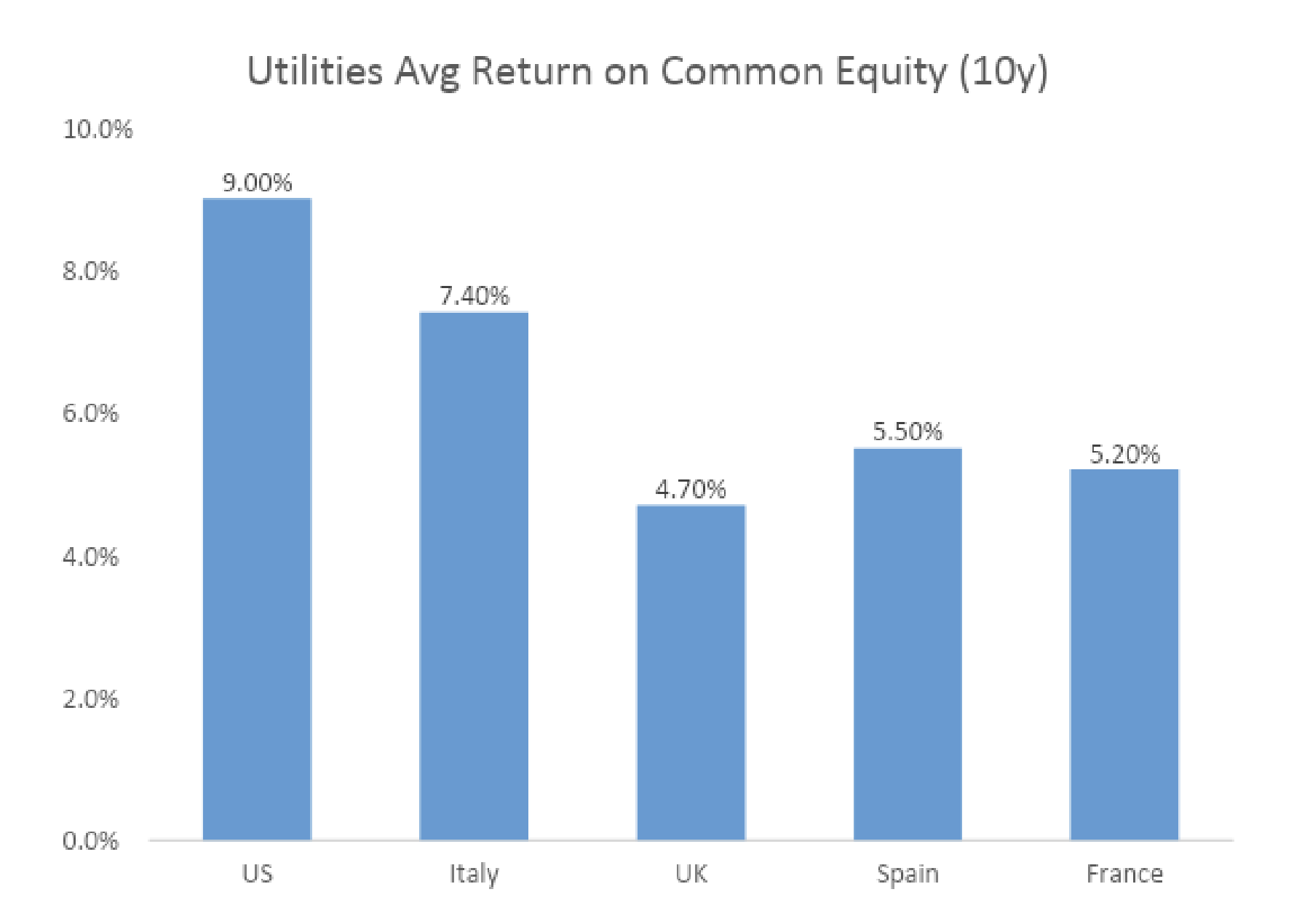

Source: Finbox

The figure above presents the average returns on common equity of utilities in five countries. Among them, US boasts the highest return rates of 9% while major EU countries mark returns rates around 5%. As regulators typically set the return rates based on comparative analysis, the average return rates in the industry will serve as the frame of reference. We can conclude that, generally speaking, running a utility in the US is more lucrative than in the EU.

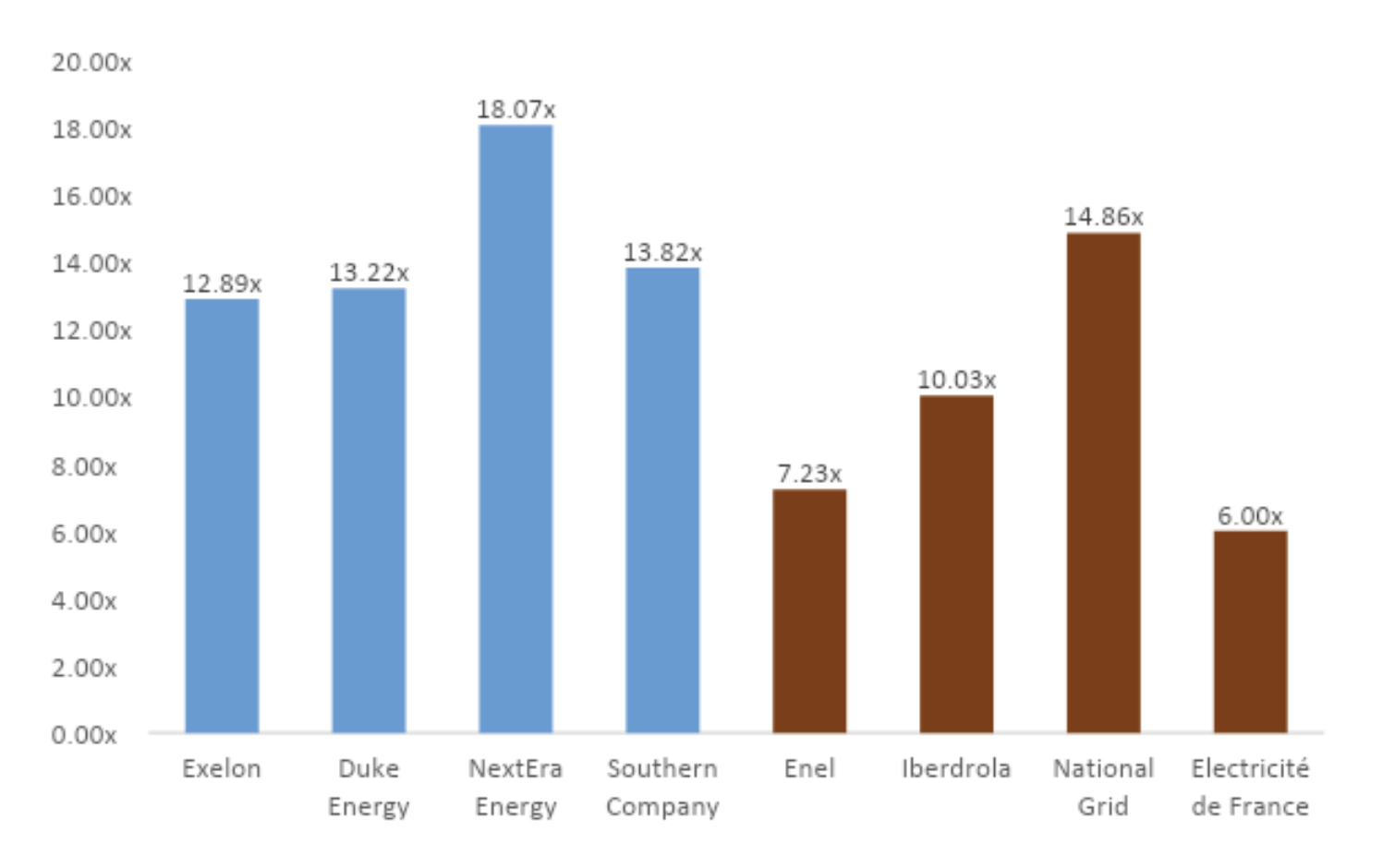

Source: Finbox

As capital structure, depreciation policies, and tax rates may differ significantly across countries, EV/EBITDA is a more appropriate multiple than P/E when comparing utilities valuations across countries. According to the chart above, utilities generally mark forward EV/EBITDA ratios around 13x to 14x, with NextEra Energy seemingly overvalued while Enel, Iberdrola and Electricité de France seemingly undervalued.

The undervaluation of Electricité de France (EDF) is an interesting case, as the reasons probably have more to do with politics rather than economics. EDF is 84% owned by the French Government, being treated as a vehicle of political will for many years. For example, EDF purchased Areva NP (another state-owned enterprise) in a government-orchestrated deal in 2015, rescuing Areva NP from bankruptcy. Despite the current energy crunch in Europe, the French government put a limit on rising energy prices in order to protect households, resulting in a possible $9bn loss for EDF. Government interference in company strategy rightfully deters investors. In contrast, National Grid is a true investor-owned company, with state owned shares only accounting for 0.14% of shares outstanding. Furthermore, as nearly 60% of its total power capacity are from nuclear plants, EDF is subject to the political controversies over nuclear power, which impose great uncertainty on the future of the company. Due to such strong political influences, EDF doesn’t feature in the low-risk profile of utilities anymore – this ultimately reflected in its low multiples.

The unconformity of multiples for NextEra, Enel and Iberdrola are more or less related to the clean energy transition in the utilities industry. As the US targets 100% carbon-free electricity by 2035 and EU by 2050, the tide of cleaner electricity is unstoppable. Considering the US for example, 56% of new generation capacity added from 2016–2020 was wind and solar, rising to 86% in the first eight months of 2021. However, the transition is not an easy task, as utilities have to invest a large sum of new capital into the upgrade of the grid towards a more flexible and modern one. Also, due to the unstable nature of wind and solar, continuous R&D expenditure on the commercialization of long-duration energy storage and green hydrogen is also inevitable. In addition, utility infrastructures are designed to function for decades, so some companies may face stranded costs of retiring fossil fuel-based generation earlier than planned. In case of valuation, future expenditures and potential loss from early decommission of assets should also be taken into account, ultimately reflected into the multiples.

In our case, NextEra was first in the sector to recognize the potential of renewable energy. As a result, it’s the undisputed leader in both onshore wind (16% US market share) and solar (11%) energy market. Wind and solar take up 80% of its total generation capacity, with natural gas and nuclear accounting for the remaining 20% – this represents a rather green utility player. In contrast, conventional fuel takes up 39% of Enel’s capacity, with coal still accounts for 8%. Iberdrola is moderately greener, with conventional fuel taking up 31% of its installed capacity, renewables 63% and nuclear 7%. Notably, Iberdrola has abandoned coal 2 years ago while Enel still seeks to phase out its coal-fired capacity by 2027, 3 years ahead of schedule. This deadline was not only brought forward, but also its existing capacity is not being utilized to its full extent, incurring further losses. All in all, the greener the power, the higher the multiples for utilities, as the future transition cost to green energy is priced in.

0 Comments