V.F. Corporation – (VFC:BYSE) – market cap as of 20th November 2020: $33.1bn

Supreme – privately owned company

Introduction

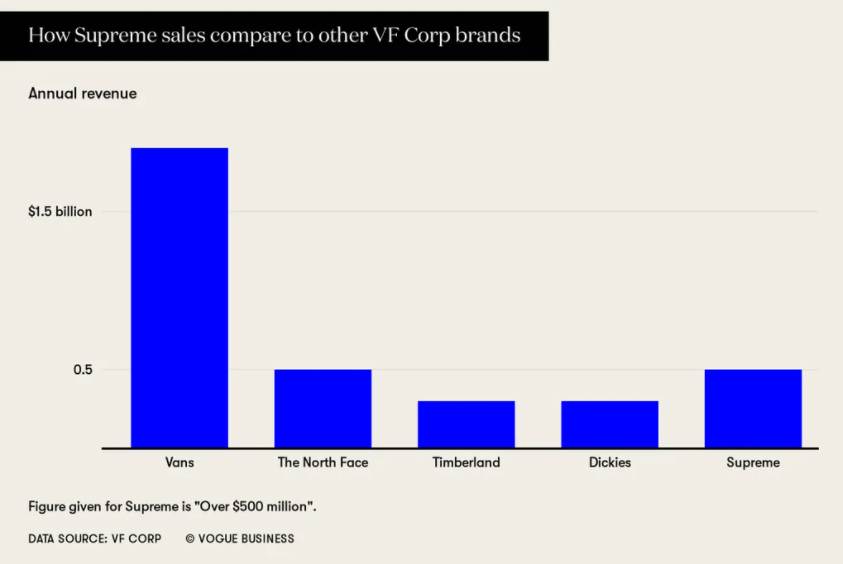

VF Corp., which owns brands including Dickies, The North Face, Vans, and Timberland, is buying Supreme, the streetwear fashion brand, directly from its founder James Jebbia and two private equity firms, Carlyle Group and Goode Partners, in a deal that values the apparel maker at $2.1bn including debt.. This acquisition follows a long-standing relationship between Supreme and VF ,which started in 1996, and it aims at accelerating VF’s consumer minded, retail-centric, hyper-digital business model transformation.

About VF

VF Corporation is an American worldwide apparel and footwear company founded in 1899 with a market cap of $33bn. It owns more than 30 brands, such as Vans, Timberland, and The North Face, organized into three categories: Outdoor, Active and Work. Each division respectively generated a global revenue of $4.9bn, $4.6bn and $800m in 2020. Supreme’s acquisition comes after a decades-long reshaping series of acquisitions, including Icebreaker, the merino clothier brand, and Altra, the running shoes brand, in 2018.

Data Source: VF Corporation

The coronavirus outbreak has forced nonessential retail stores to close across the globe; VF had to temporarily force shut its retail stores in mainland China at the beginning of the year and soon thereafter in North America, as part of its response to the impact of the Covid-19 pandemic on its business. The coronavirus crisis led to a disappointing Q4 FY 2020 ending in May. The company’s revenues declined 11% YoY (year-over-year), while its adjusted earnings per share fell 70% YoY in Q4. Like most apparel retailers, VF is essentially currently limited to e-commerce sales, as most of its stores around the world remain closed or are seeing weak footfall. It should be noted that the company generates roughly 7% of its total revenues from digital sales.

VF Corp has targeted double-digit earnings growth through to 2024 and outlined a new strategic plan that will see the apparel giant distort investments to Asia, prioritize digital, and optimize its portfolio with a focus on its biggest brands.

About Supreme

Supreme, which sells a broad range of products, including skateboarding T-shirts, hats, sweatshirts and miscellaneous items such as keychains, was founded in New York City in 1994 by British businessman James Jebbia, and is known as the brand synonymous with the term ‘hypebeast’, a controversial and popular slang for a person obsessed with fashion brand hype to the point that, regardless of their finances or whether they even like the product, will queue up for days in order to catch the latest drop.

The increasing popularity of streetwear may be attributed to the increasing presence of products traditionally associated with streetwear in high fashion brands’ collections over the past decade, thus blurring the line between streetwear and luxury fashion and paving the way for Supreme to capitalize on the gap in the market for the unification of the two. One of the keys to Supreme’s success has been its collaborations strategy: the brand has accumulated an impressive range of collaborators throughout its lifespan including some of the time’s most innovative designers, artists, photographers and musicians, all carefully selected in order to nurture the brand’s distinctive identity. Some of Supreme’s first collaborations were with VF’s brands such as Vans, Timberland, and The North Face and this explains Supreme’s deep-rooted ties with VF. This success has helped Supreme more than double its revenue over the past four years and achieve a business model with gross margins of over 60% and operating margins of over 20%.

Even though today’s economic uncertainty has the potential to lead to a decline in sales for Supreme. its business model is clever in the way that consumer demand significantly outweighs its supply; thus, the Supreme customer may not actually care about spending on Supreme during financial difficulty, as long as they feel that they are getting a unique and valuable product..

One major issue Supreme faces is counterfeit product entering the market, in fact the brand itself has never been able to be trademarked and so this has left it open to being copied and appropriated. Counterfeit Supreme products pose a great threat to its business model, particularly to its essential heir of exclusivity and high brand equity.

Industry Analysis

Worldwide, the streetwear market is one of the fastest growing sectors of the fashion industry and is estimated to be worth around $300bn. The sector makes up almost 10% of the entire global apparel and footwear industry. The global pandemic has had a disastrous impact on the fashion industry. The average market capitalization of apparel, fashion, and luxury players dropped almost 40% between the start of January and the end of March. The pandemic has presented a perfect storm for the industry highly integrated global supply chains, which, coupled with the collapse of consumer demand, has lead companies under enormous pressure as they are forced to handle crises on multiple fronts.

However, the streetwear market has seen significantly fewer losses than the rest of the fashion industry at large because of the pandemic. This is likely to be because the underlying trends behind the rise of streetwear in the past decade, such as the continual casualization of fashion, have accelerated in recent months. The pandemic has shifted consumer-shopping habits and there has been an increase in demand for more casual wardrobes as millions continue to work from home.

The streetwear market is made up of large players such as Nike and Adidas as well as many smaller labels such as Supreme in the US, Off-white in Italy and Bape in Japan. Key characteristics of streetwear businesses are their direct-to-consumer relationship, which consists of direct interactions with consumers, communication via social media and meeting consumers in-store. The main pillar of a streetwear brand’s value is its authenticity. This comes from building connections with consumers buying the products as well as creating and fostering tight-knit communities. A key tool powering streetwear’s direct to consumer relationship is the “drop” model. The drop model leverages scarcity and limited production to create high consumer demand. A booming second-hand market has emerged from the drop model as buyers who miss out on drops turn to other options. This second-hand market is critical to a streetwear brand as it serves as a barometer for the brand’s success, the higher the resale price, the more valuable the brand. In the streetwear market, it is often the case that products can only be purchased directly from the brand through its online or physical stores. Although selling products through outside retailers may create greater opportunities for consumers to buy the brand – this will likely undermine the label’s exclusivity.

Streetwear’s core consumers are GenZ or Millennials with the majority of customers aged under 25. Increasingly, we are witnessing different types of brands, including legacy luxury houses, adopt streetwear as a part of their offerings, in a bid to attract this younger consumer cohort. However, despite streetwear’s young target market and seemingly resilient front in the face of the pandemic, the potential for significant growth of the market in the future has been called into question. Streetwear brands are fighting to maintain their exclusivity in what is becoming an increasingly crowded market. Many have pointed out the opportunity for greater international expansion, especially in China, where consumer spending on streetwear reached nearly four times more than on non-streetwear apparel from 2015 to 2020. However, this may not be such a promising path for future growth as it could threaten streetwear’s brand scarcity model and so risks eroding value.

Deal Structure

VF Corp will acquire Supreme from private equity firm Carlyle Group and investors including Goode Partners in a deal valued $2.1bn. VF Corp announced it would make an additional earn-out payment of up to $300m, subject to post-deal revenue growth and gross margin performance not explicitly laid out in the deal announcement. The Supreme brand will be modestly accretive to VF’s earnings per share in FY2021. In the subsequent fiscal year, Supreme will contribute at least $500m of revenue and $0.20 of adjusted EPS. The transaction will occur at less than 15x EV/EBITDA.

The $2.1bn deal, which is expected to be completed by the end of 2020, subject to regulatory approval, more than doubles Supreme’s valuation in 2017 where it has been reported Carlyle paid $500m for around a 50% stake in the fashion brand. The deal also marks VF’s largest acquisition since it bought Timberland in 2011 for $2.3bn. VF has said that it is financing the acquisition with a mix of cash and commercial paper. Supreme founder, James Jebbia, and its senior leadership team will remain with the business and continue to have creative control. Lastly, subject to certain conditions, the founder will receive a portion of the purchase price in form of VF equity over time.

Deal Rationale

The deal comes at a time when the apparel sector has been upended by the coronavirus pandemic as consumers move away from discretionary items in favor of groceries and other essential goods. Still, the Supreme brand remains a gem in the industry because of its cult following among younger millennials and Gen Z consumers. The transaction is line with VF’s strategy to optimize its portfolio and will enhance VF’s growth, profitability, and cash flow profile. Supreme is expected to offer a $1bn global opportunity over time through International and Direct-to-Consumer (DTC) expansion, core pillars of VF’s 2024 strategy.

On the one hand, Supreme will help expand VF’s digital channels, which have been one of the company’s growth engines during the pandemic. Supreme is an optimal target for VF given its “agility” to connect with customers both in brick-and-mortar locations and through its social channels. Supreme’s apparel is either sold through in-person stores or online website, which generates more than 60% of its revenue. VF plans to learn more from Supreme’s model, which relies on weekly release of new products and frequent collaborations, drumming up hype and broadening the appeal of the apparel involved. Supreme has already collaborated with VF’s three biggest brands (Vans in 1996, Timberland in 2006, and The North Face in 2007), and as such it fits very well into VF’s evolved portfolio of apparel and footwear brands. Nevertheless, Supreme will continue to work with non-VF brands as well.

On the other hand, Supreme will benefit from VF’s scale, international presence, and supply chain. VF has very deep knowledge of the consumer space where Supreme operates and it will help expand its 12-store physical retail presence internationally, to meet demand in new territories while maintaining the exclusivity drop model. On top of that, Supreme aligns well with VF’s other activity-based brands. According to James Jebbia, the company chose to stay closer to the skate culture and maintain authenticity among its young customer base, rather than sell to a luxury conglomerate. Luxury streetwear is becoming less about elite access and high-priced products and more about unique experiences. This deal will maintain Supreme’s unique culture and independence, while allowing it to grow on the same path it has been on since 1994.

Market Reaction

VF’s shares jumped as much as 17% on the day of the deal announcement in New York, the biggest intraday gain in 33 years since Oct. 20, 1987, the day after the infamous Black Monday stock market crash. The stock fell 30% this year through Friday’s close, compared with a 17% gain in the S&P Retail Select Industry Index.

On the other hand, Supreme is privately owned and not listed, so no information is available about its stock price.

Advisors

Morgan Stanley provided a fairness opinion to VF Corporation in connection with the transaction, and Davis Polk & Wardwell LLP served as its legal advisor. Latham & Watkins LLP acted as legal advisor to Supreme.

0 Comments