Introduction: Fixed Income Markets Performance

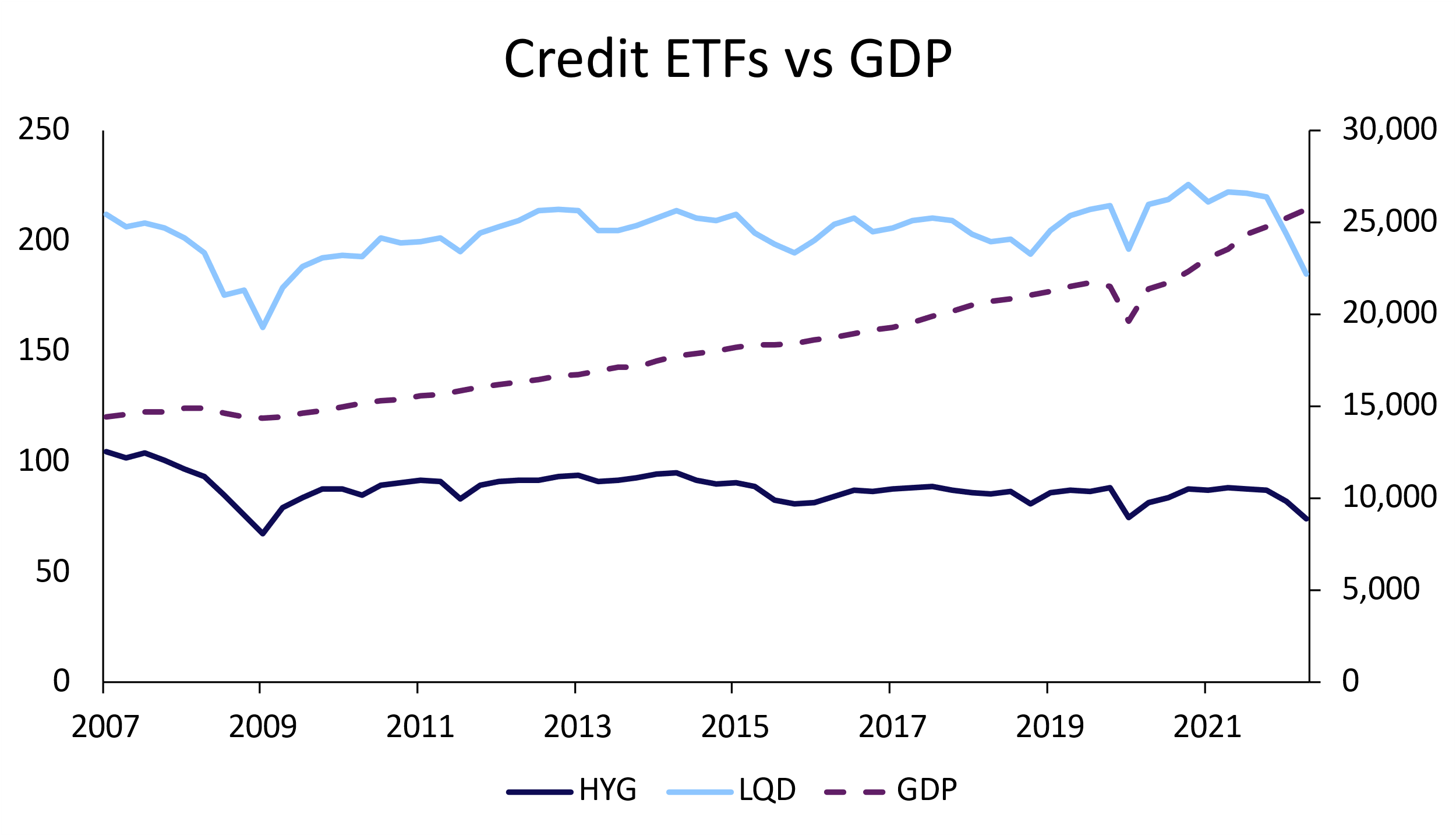

High inflation and rising interest rates have governed the credit markets in 2022. Year-to-date, high yield bonds are down approximately 16% and investment grade bonds are down approximately 23%. The 2022 macroeconomic environment has wiped away the strong recovery seen by the credit markets throughout the COVID-19 pandemic, with the investment grade market currently trading at 10-year lows.

The markets saw extraordinary measures from the Federal Reserve this year, with aggressive interest rate hikes. The Fed Funds Target Rate has increased from 0.25% in January to 3.25% today; further interest rate hikes are priced in and the Fed’s dot plot predicts that the Fed Funds Target Rate will reach 4.25-4.50% by the end of the year. Rising rates are placing downward pressure on bond prices but not all bonds are being affected equally –investment grade bonds have been pummeled disproportionally due to their sensitivity to interest rates.

Source: Bocconi Students Investment Club

Breakdown of Corporate Bonds

Corporate bonds (or credit) are fixed income securities issued by companies and traded on the public markets. An investor who purchases a corporate bond is lending capital to the company and receiving a pre-established number of interest payments at a fixed or floating rate.

External credit rating agencies, such as Moody’s, Standard & Poor’s (S&P), and Fitch, will assess companies based on a wide array of criteria to determine the riskiness of their bonds. Bonds with a credit rating of BBB and above are considered investment grade, whereas bonds rated BB and below are considered speculative grade – also known as high yield or junk bonds. Investment grade bonds have lower yields than high yield bonds as they tend to be considered less risky. The yield is comprised of a credit spread over the yield of a US Treasury of the same maturity. The credit spread is additional yield that must be paid to an investor to compensate them for taking on additional risk that a US Treasury is not exposed to. As a result, high yield bonds have a wider credit spread than investment grade bonds due to their riskier nature.

The Current Macro Environment

Inflation has been the headline topic of 2022 across the globe, and it is the biggest challenge that the Fed is currently facing. The markets’ hopes that inflation would be declining soon were shattered by September’s CPI reading of an 8.2% increase year-on-year.

The Fed has a dual mandate – “maximum employment, stable prices, and moderate long term interest rates.” However, as inflation has reached recent historical highs, the Fed has been required to pivot and has stated in previous Federal Open Market Committee meetings that its top priority is taming inflation through tightening monetary policy, and even at the cost of hiking the US into a recession.

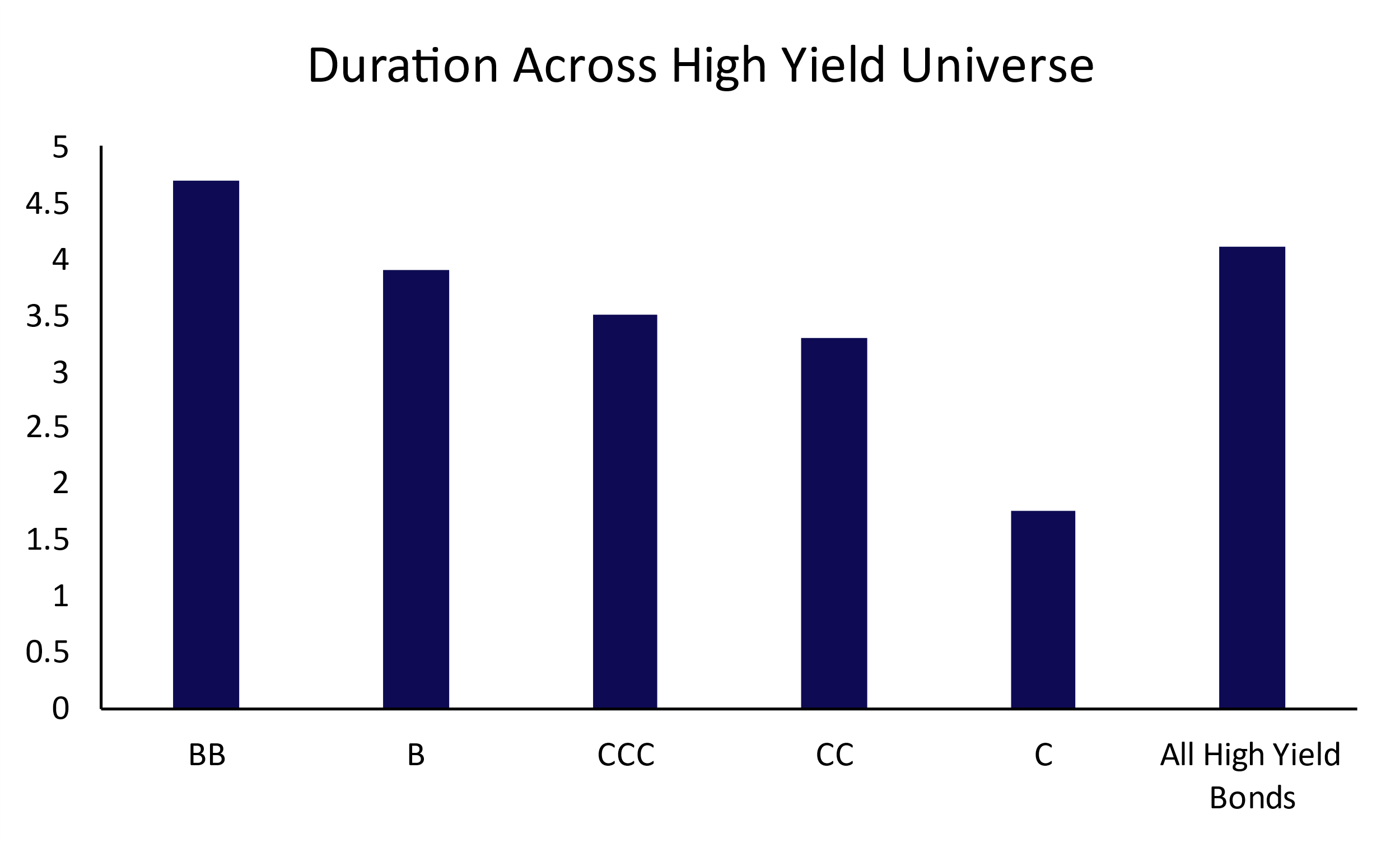

Current market conditions are dictated by inflation readings as this measure directly affects central bank activity. As a fixed income asset, credit is particularly sensitive to rate movements. However, as discussed earlier in the article, not all credit is affected equally. Investment grade bonds typically have higher duration due to their lower coupon payments and because they trade at a tighter credit spread over treasuries. As a result, prices are more susceptible to moves in interest rates.

This week’s GDP print has given some slight hope to investors, reflecting a more resilient US economy that may avoid a recession. However, in the probable scenario that a downturn occurs in the next year, high yield bonds will be affected the most. These securities generally experience a negative performance in a recession (see the figure below) as corporate earnings decline. In consequence, some companies do not manage to repay their debt and crumble under increased pressure. The most exposed firms are those with unstable capital structures operating in procyclical industries. Therefore, if the recession proves to be severe and the revenues streams deteriorate further, this will become a difficult stress test to pass.

Source: Bocconi Students Investment Club

Yet not all high yield companies are at risk even if the economy is on the brink of a recession. The ones with solid business models and stable cash flows have a high chance to continue repaying debt. In fact, the default rate of high yield bonds has been low (just under 2%) in the US market and has not shown any sign of an imminent increase. Still, one factor we should be aware of is the drop in new debt issuances that declined significantly from 2021. This situation reflects the difficulties present in the market and the potential issues the firms might encounter when trying to refinance their debt at increasingly higher rates. Lastly, we think the Fed will decelerate the rate of hiking rates in the first months of next year due to the slowing consumer activity and increased market tension, thereby creating the conditions for a recovery in high yield and other risk assets over the medium term.

2022 Investment Environment

In the current market conditions, we have seen investment grade bonds trading at lower prices than high yield bonds simply due to the risk-free rate increasing. However, the credit markets overall have been impacted by rising rates and bond prices are down across the universe this year, making it an attractive time for investing. Yields on corporate bonds are at recent highs while credit risk is relatively low. Strong earnings in 2022 have strengthened company balance sheets to the highest levels seen since 2008. As well, interest coverage ratios have been increasing for issuers across the high yield universe, signaling that companies are holding higher levels of cash and lower amounts of leverage.

Many corporates issued bonds at ultra-low rates during 2020 and 2021, contributing to their balance sheet strength with low-cost debt and higher levels of cash. This is especially beneficial for higher-quality issuers in the high yield space, who have longer duration bonds and benefit most from locking in low borrowing costs.

Source: ICE BofA US High Yield Constrained Index, Bocconi Students Investment Club

2023 Investment Environment Outlook

As we enter 2023, high yield bonds are an attractive investment thanks to the market technicals and company fundamentals that developed in the last year, resulting in lower dollar prices and strong corporate balance sheets. Although fundamentals may decline in a worsening macroeconomic environment, they are declining from very high levels because of favorable market conditions over the previous two years. Market technicals that are keeping high yield bonds supported include the low supply of new issuance in 2022 and the reach for yield.

With heightened recession fears, spaces to focus on within high yield will be the higher quality bonds, rated B and above. As was seen over summer 2022, decompression trades were an overarching theme in credit markets. Spread decompression refers to the situation when lower quality credit spreads widen relative to higher quality credit spreads. As price and yield are inversely related, when investors flock to safer, higher quality bonds, yields will be driven down while prices are driven higher, causing spreads to decompress and higher quality credit to outperform.

Combining the effects of investors searching for higher yield and higher quality credit in a deteriorating macroeconomic environment, we believe that high yield bonds rated B and above will be an attractive investment as they are less rate sensitive and better positioned to weather macro-headwinds.

Trade Idea: Long TDG 6 ⅜ 06/15/26

Company Description: The TransDigm Group (or TransDigm) is a leading designer and producer of engineered components that are used in nearly all commercial and military aircrafts. Offerings including engine technology, pumps, valves, cockpit components, and safety restraints. TransDigm’s strategy is built on two elements: 1) acquiring aerospace companies (using a private equity business model) to allow itself to penetrate almost every key defense and commercial aerospace program and 2) manufacturing small but critical aerospace components (protected by IP), giving it aggressive pricing power and scale advantage.

Source: Zacks Investment Research, Bocconi Students Investment Club

Thesis: The market is underappreciating TransDigm due to its elevated levels of debt (US$19.8 billion) in a rising rate environment. However, TransDigm has seen strong EBITDA and Free Cash Flow growth which will be used for debt repayments and M&A activity, further driving the company’s growth. In particular, the TDG 6 ⅜ 06/15/26 bond offers an attractive risk-reward profile with a 7.5% yield and further opportunity for price appreciation as the markets are overly pessimistic about its unsecured placement in the capital structure.

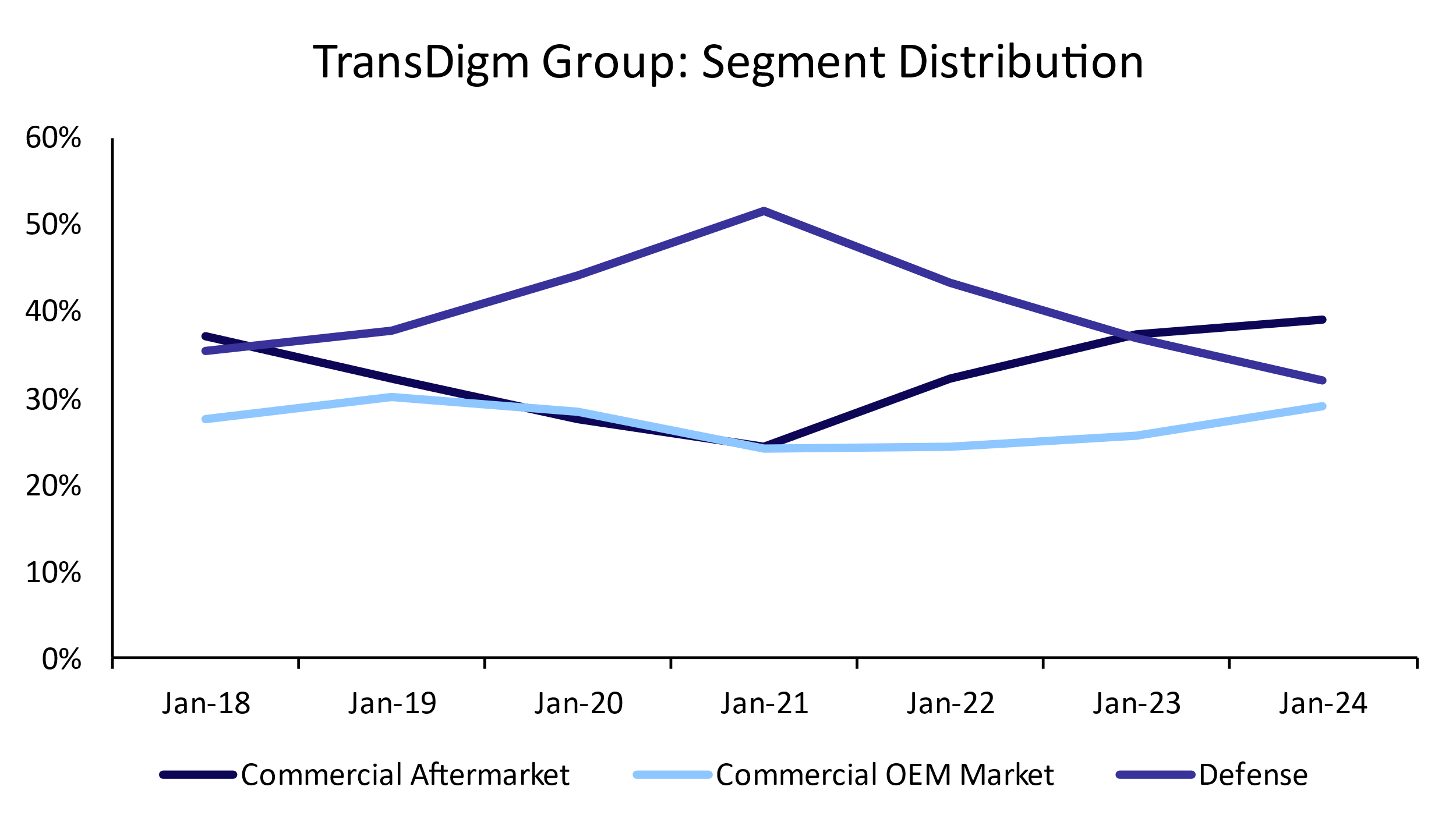

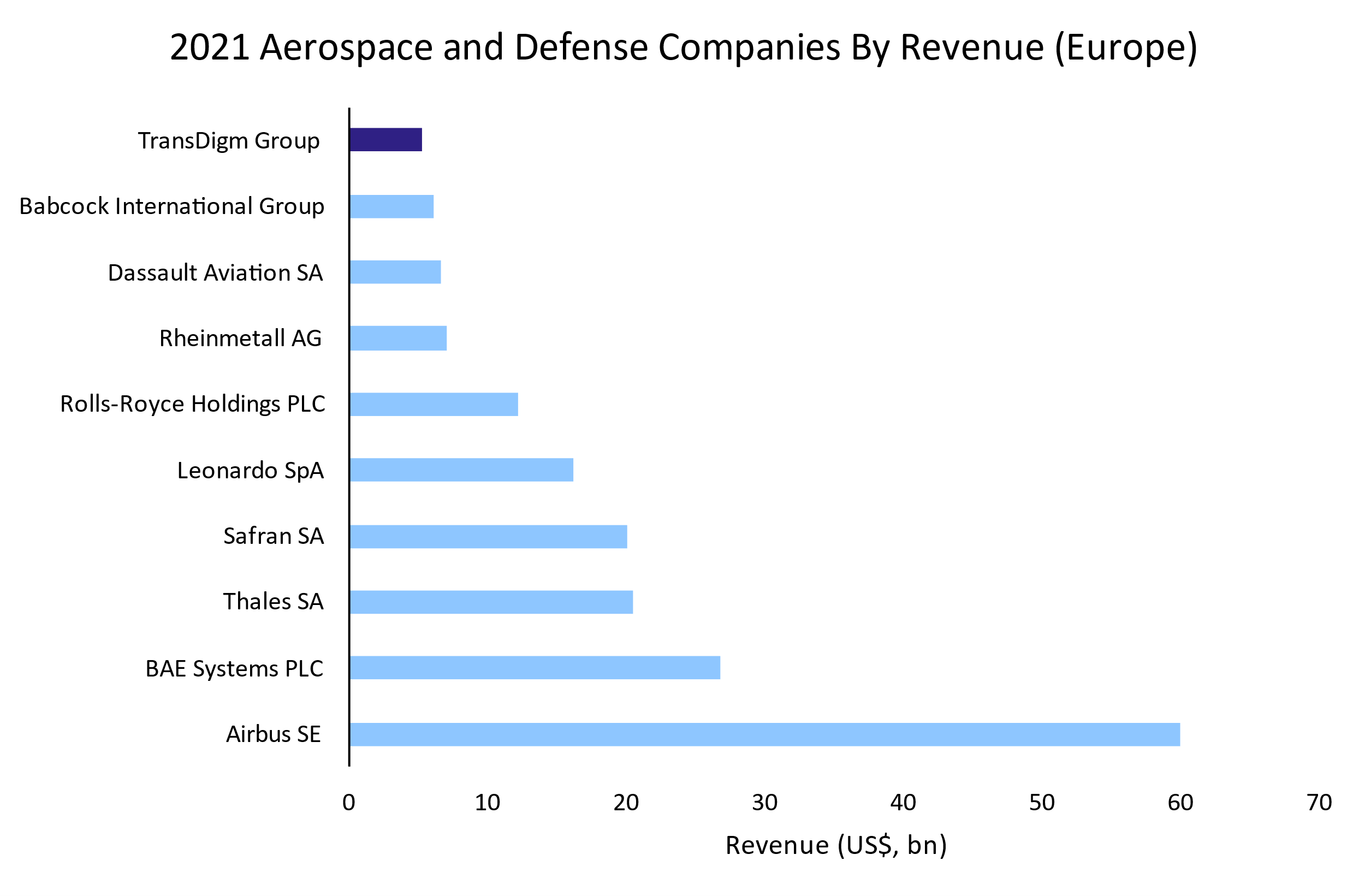

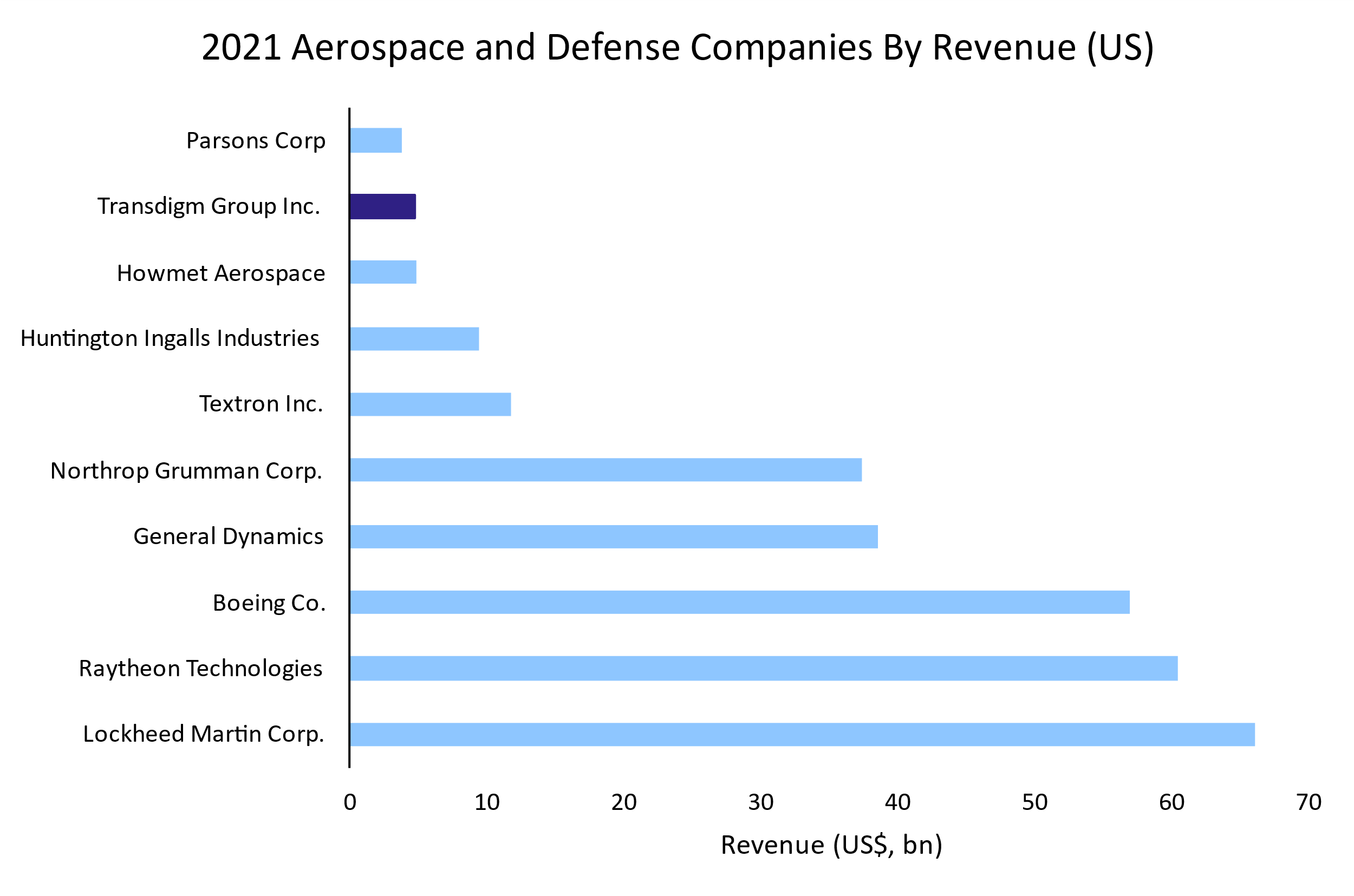

Competitor Analysis: As we can observe from the figure below, TransDigm is one of the top 10 players in the aerospace and defense industry, both in the US and Europe. Its revenue streams are diversified across three main segments: commercial aftermarket, the original equipment manufacturing (OEM) market, and defense. Throughout COVID-19, when the first two markets shrank, the latter remained a strong performer and significantly contributed to TransDigm’s bottom line. Hence, we consider this revenue stream distribution advantageous to the company, as it can contribute to earnings stabilization.

Source: Statista, Bocconi Students Investment Club

Key Financials

Source: Bloomberg, Bocconi Students Investment Club

Catalysts: 1) An increase in long-distance travel as the world reopens from COVID-19 lockdowns will drive revenue in 2022 and forward. 2) With geopolitical uncertainty surrounding the Russia-Ukraine war, countries around the world may choose to invest in defense going forward.

Risks: 1) TransDigm’s proprietary products allow it to use an aggressive pricing strategy which may be seen as price-gouging. Although the company is following all laws, this could make way for negative headlines in the news and further scrutiny. 2) With a decrease in M&A opportunities due to higher interest rates, inorganic growth may slow for the company while there being a higher chance of TransDigm issuing a special shareholder dividend.

0 Comments