Introduction

On the 25th of September Italian citizens are going to vote for their representatives in the parliament. Based on the current macroeconomic and political scenario, we analyze the effects that the elections’ results might have on the markets and propose a trade idea based on the BTP-Bund Spread Futures.

Political Situation

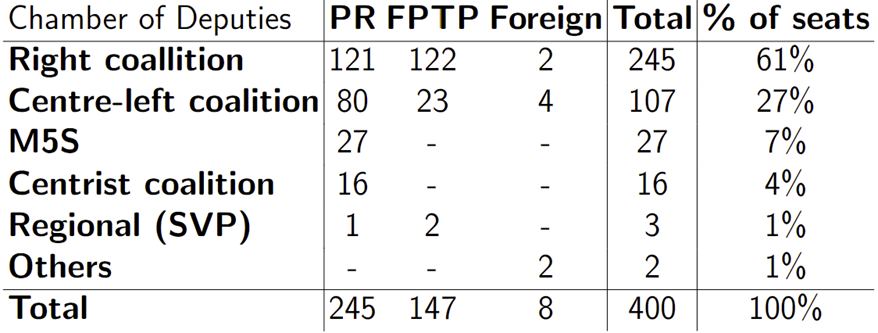

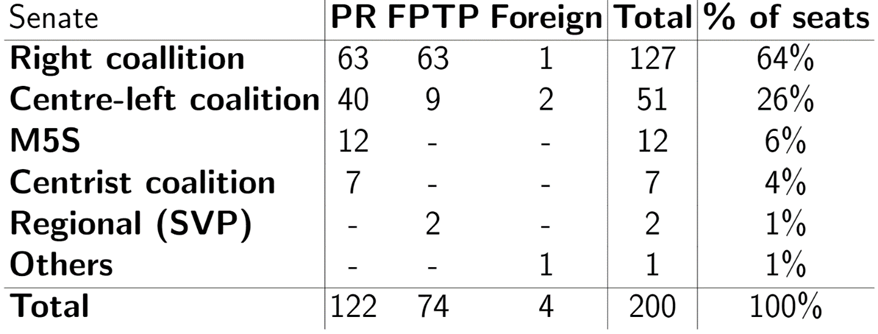

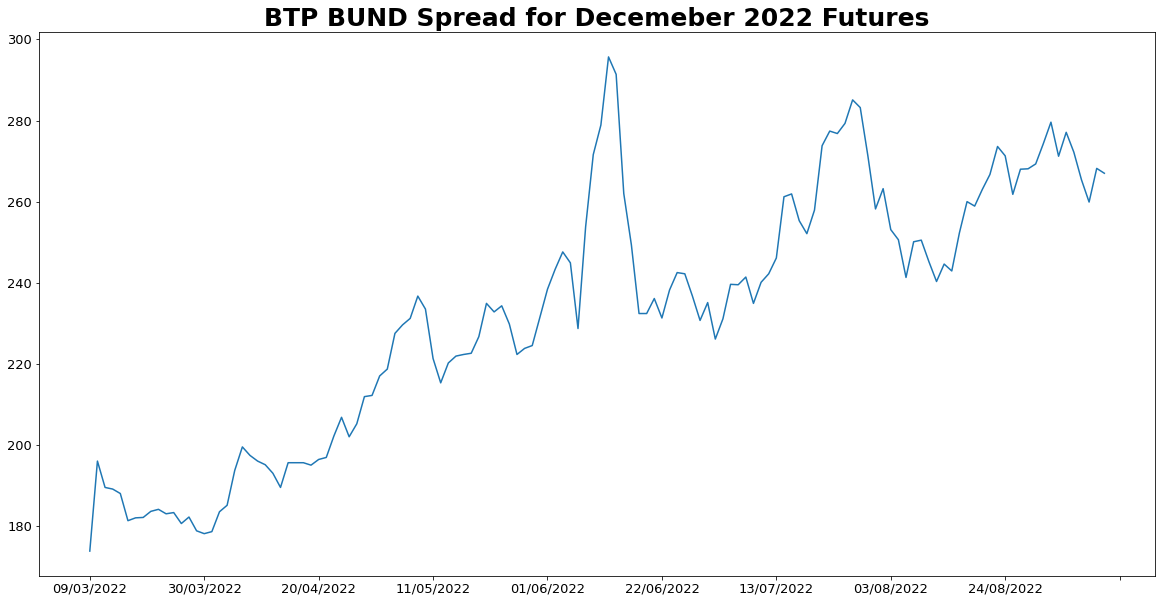

Political elections have been anticipated, from spring 2023 to the 25th of September, due to the fall of Mario Draghi’s government in July 2022, an event that shocked the markets. The BTP-Bund spread rose to 241 bps (+16%) on the day after (see Figure 2). The main political actors of the next elections are the center-right coalition (Fratelli D’Italia, Lega and Forza Italia), the center-left coalition (Democratic Party and minor far-left parties), the so-called ‘third pole’ (Azione and Italia Viva), and the Five-Star Movement. Even though there is room for uncertainty, the recent polls are clearly stating that center-right coalition is likely to win the elections and therefore secure parliamentary majority. This is due to the first-past-the-post (FPTP) mechanism that incentives to form ample coalitions (see Figure 1), with the center-left coalition suffering from the split with the third pole and the Five-Star Movement.

Figure 1. Seat allocations projections for Chamber of Deputies and Senate

Source: Istituto Cattaneo, BSIC

These elections play a key role due to the geopolitical environment in which they occur: the war in Ukraine and the tensions over Taiwan made the parties’ foreign policy agenda much more important than it was in the past, with some leaders being blamed for their unclear relationships with Putin’s regime. In 2018, the market reaction to elections was anything but moderate, with the BTP-Bund Spread hitting 300bps. Even though the eurosceptic tones of the Five-Star Movement and Lega have almost disappeared from the electoral campaign, some parties of the center-right coalition, namely, Fratelli D’Italia and Lega, have pledged to amend the Recovery and Resilience Plan (RRP). Italy has successfully achieved the first 45 milestones of the plan in the first semester of 2022, receiving a total of €46bn from the EU, while 55 new milestones are to be completed by December, possibly with the new government.

Figure 2. BTP-BUND Spread data and the Futures-implied Spread for Dec 2022 and Mar 2023

For this reason, this initiative could pose a serious threat to the European agenda, and lead to time-consuming renegotiations with the European Commission. Moreover, the ECB introduced the Transmission Protection Instrument (TPI) in July 2022, an anti-fragmentation tool which requires countries to be compliant with the RRP roadmap. Even if we don’t expect the ECB to withdraw its support to Italy through the TPI, the main point to be seen is if the new government will continue in the wake of Draghi’s agenda.

We expect the next months to be characterized by high political instability for two additional reasons. Firstly, the center-left and center-right coalitions are anything but cohesive, with some parties within the same coalitions having opposite ideas on several topics, namely, sanctions against Russia, international relations and interventions to address the energy crisis. This will make it even more difficult to take strategic decisions once the government is formed. Secondly, if none of the coalitions manages to have more than 40% of the votes, the parliamentary majority is not guaranteed. This scenario would be caused by a high number of votes from the two “outsider” parties, the third pole and the Five-Star Movement, and it will likely lead to the reaffirmation of a National Government, such as the Draghi’s one.

Macroeconomic Situation

The announcement that followed the ECB’s Governing Council (GC) meeting that was held without prior notice on June 15 caused a drop in the spread of about 50 bps, as the ECB will now “use flexibility in reinvesting redemptions coming due in the PEPP portfolio”.

Besides PEPP reinvestments, the new Transmission Protection Instrument (TPI) should be engaged when there are “unexpected, chaotic market dynamics that represent a substantial danger to the transmission of monetary policy”. The future Italian government must continue to be fiscally conservative to meet its qualifying requirements. However, no specified size of spreads or rates on euro-periphery government bonds has been disclosed that would cause its activation. The timing of the ECB’s special meeting leads one to believe that this range represents the pain threshold.

A country must meet one of four requirements, including “that the trajectory of public debt is sustainable,” to be eligible for the TPI. Given that Italy’s bond spreads are mostly determined by internal politics, the country’s debt sustainability issue is likely to persist. The ECB must make sure that the increase in the average cost of borrowing for the Italian government does not result in an “unwarranted” widening of the spread, which would render its debt unsustainable.

Analyzing the spread dynamics, we struggle to explain why Italy’s 10-year spread over Germany has not grown too much in the aftermath of the projected replacement of a Draghi-led government of national unity with an unproven center-right coalition. Some investors could be delaying going short until it is clearer how a center-right coalition would work (or won’t). Still, due to political unpredictability and the potential for higher increases, we predict the 10-year BTP spread to increase in the upcoming months. Our six months projection is lower than the futures implied spread, because we anticipate that the next government will continue to receive financial assistance from the EC and monetary assistance from the ECB.

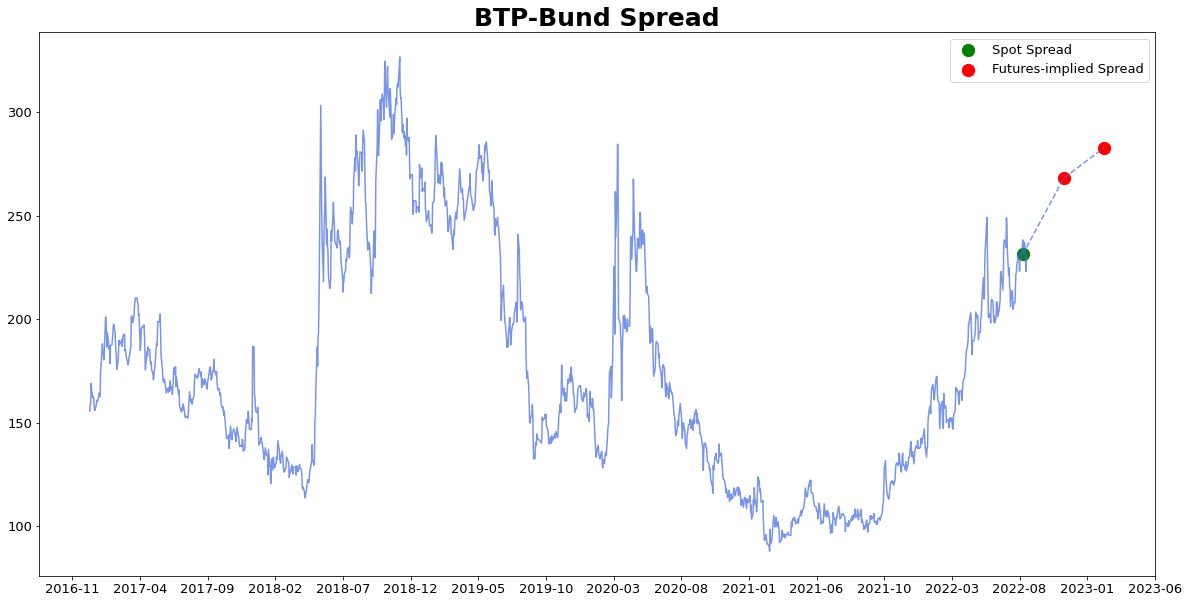

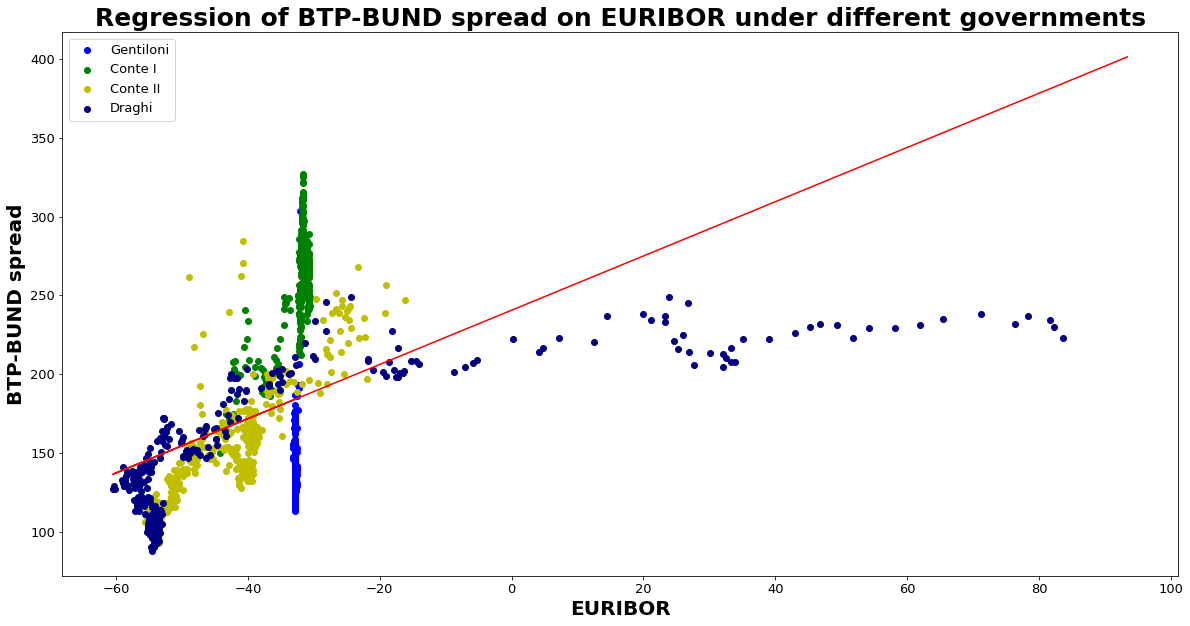

Starting from September 2017, we regress the BTP-BUND spread on EURIBOR (obtaining an R-squared of 0.28, see Figure 3) to understand how much of the spread is explained by the ECB decisions rather than Italian country risk. We can also visualize how this component changes under different prime ministers and how the regression’s residuals (the idiosyncratic element not impacted by the EU monetary policy) evolve (see Figure 4).

Figure 3. Regression of BTP-BUND spread on EURIBOR under different governments

Figure 3. Regression of BTP-BUND spread on EURIBOR under different governments

Figure 4. Residuals of the regression

Trade Idea

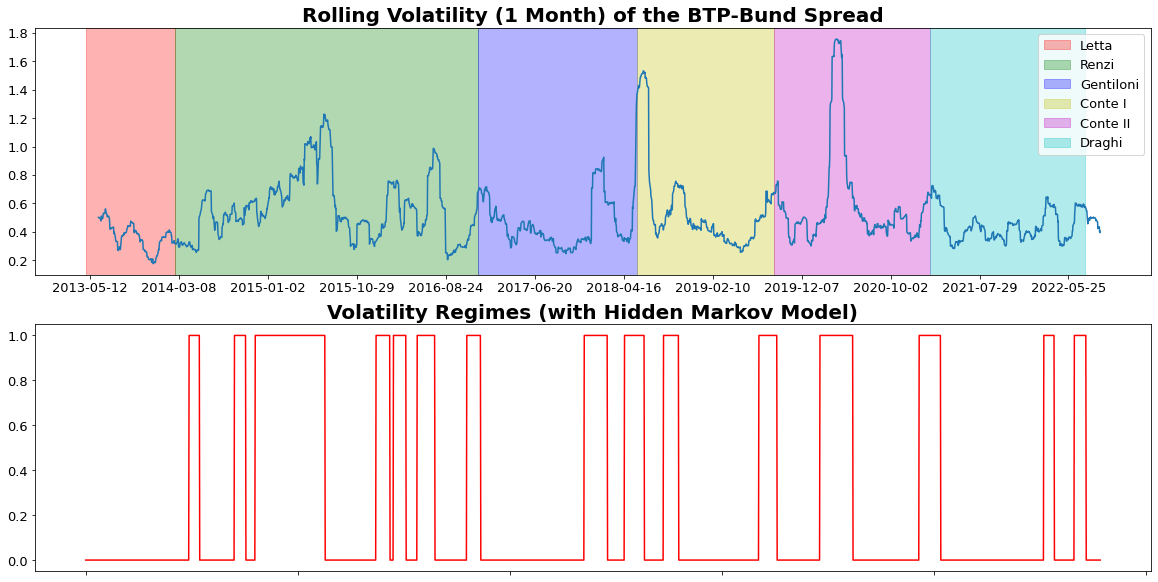

We analyzed how volatility regimes of the BTP-Bund spread have historically behaved during periods of political instability, namely, change of government and national elections, using a Hidden Markov Model (see Figure 5). By looking at the graph below it is clear that the formation of each government in the past 9 years has been preceded by a spike in volatility, and consequently by a change in regime. For this reason, we expect the BTP-Bund spread to increase its volatility over the following months, independently of the elections’ outcome, considering that the new government will likely be formed in mid-November.

Figure 5. Rolling Volatility of the BTP-BUND Spread and its Regimes (obtained with HMM)

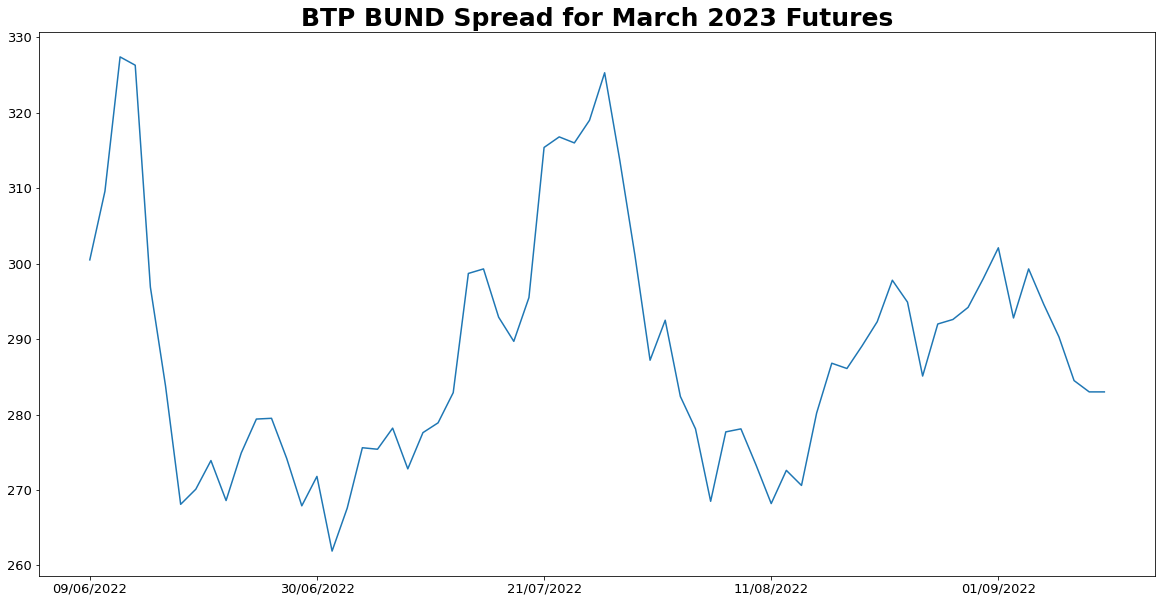

We decided not to focus on sovereign CDS because we don’t expect the formation of the next government to have a significant impact on Italy’s default risk, but rather on its sovereign bonds. Given the context of rising interest rates, it is necessary to disentangle Italy’s idiosyncratic risk from the other movements due to the ECB’s decisions, which affect all European countries. Consequently, the trade idea is based on the 10Y BTP-Bund spread futures, which are constructed by entering two opposite positions in the respective bonds’ futures. The futures are currently pricing an increase of the BTP-BUND spread of 37 bps (+16%) by December 2022, while we expect this hike to be higher, considering that after the past elections the spread rose by +170 bps (+130%), in the same period. Even though the political scenario is quite different, the macroeconomic situation is worse, as we mentioned in the previous paragraphs. On the other hand, markets price in a spread of 283 bps for March 2023, which we consider too high. In fact, we do not forecast dramatic future issues with Italy managing its debt, mainly due to the robust ECB instruments and perceived commitment to keep the spread within reasonable levels (through TPI). Given the above arguments, we propose the following trade idea:

- LONG Bund Futures Dec22, SHORT BTP Futures Dec22 (see the evolution of the spread in Figure 6)

- SHORT Bund Futures Mar23, LONG BTP Futures Mar23 (see the evolution of the spread in Figure 7)

Figure 6. BTP BUND Spread for December 2022 Futures

Figure 7. BTP BUND Spread for March 2023 Futures

1 Comment

Tom · 20 September 2022 at 1:24

I don’t know who wrote this but congrats on the amazing job!