Introduction

On the 8th of February 2018, the shareholders of the Italian high-speed train operator Italo-NTV (Nuovo Trasporto Viaggiatori) (“The Company”) have accepted the offer of Global Infrastructure Partners (“GIP”) for the disposal of 100% of their stake, for an equity value of around €1.94bn.

As a result, the plan to list 40% of the Company on the Milan Stock Exchange was abandoned. Italo NTV has been planning to expand further in its home market and to export its business model abroad, so the deal seems to be in perfect alignment with the interests of both parties.

About Italo (NTV)

In 2006, Italian entrepreneurs Luca Cordero di Montezemolo and Diego Della Valle committed up to €1bn of capital, together with a group of co-investors, to create a start-up company to run high-speed trains in Italy, where – up to that moment – state-controlled Trenitalia S.p.A. had been the sole player. 12 years down the road, in 2017 alone, Italo NTV served nearly 13 million passengers and among its fleet there are 25 Alstom AGV (Automotrice à Grande Vitesse) trains, which are standard-gauge, high-speed, electric multiple-unit trains, among the fastest currently in use, capable of a top speed of 360 km/h.

Its board of directors features renowned names of the Italian entrepreneurial landscape, among which: Andrea Faragalli Zenobi (former executive of Alitalia and Poste Italiane), Flavio Cattaneo (former CEO of Telecom Italia), together with the previously-cited Luca Cordero di Montezemolo (former president of Ferrari, Confindustria, Alitalia and chairman of Fiat) and Diego Della Valle (managing director of Tod’s, chairman of Ferrari, board member of Maserati, BNL and LVMH), among the others.

However, Italo’s path to nowadays success has been impervious, as the company was recapitalized in 2014 after a period of intense financial distress and it managed to break-even for the first time ever only in 2016, culminating an incredibly expansionary period. The reason why it has experienced difficult times has to do with the fact that the Company has been investing massively ever since its very beginning: purchasing top notch trains, training personnel and setting up operations required a tremendous amount of capital to be deployed throughout the first years, without even being able to sell a single ticket (Italo NTV started officially in 2012). Over the last years, Italo NTV has invested in the new fleet of high-speed trains, supplied by the French company Alstom, and just last year it placed another huge order of 17 new trains, to be delivered across 2018, thus increasing the fleet to 42 trains, within mid-2019. Thanks to these new trains which registered the new wheeled rail world speed record at 574.8 km/h, in fact, the company will expand its network, increase the frequency of its services and always offer the best travel solutions to its passengers.

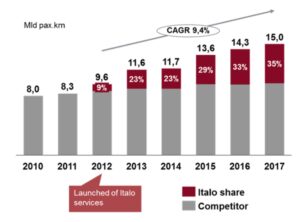

FIGURE 1: Italo’s expansion since 2012

Source: Italo

One notable mention to be made about Italo is that in June 2017, it listed its first publicly-traded bond, consisting in €500m of floating-rate senior secured notes with a 3.5% annual spread and maturity 2023. The securities received rating of B1 from Moody’s, of B+ from Standard&Poors and of BB from Fitch, thus confirming the fact that the market perceives the Company as sufficiently sound. What has been astonishing about this operation is the fact that the bonds received demand for up to 4 times the announced supply, with many large UK- and US-based asset management firms among the 140 initial subscribers: this further confirms the great turnaround carried out by Mr. Cattaneo and the positive market momentum surrounding Italo.

From a financial standpoint, in 2017 Italo NTV’s Net Income amounted to c. €34m, recording for the second consecutive year positive profits after years of losses (more than c. €200m since its foundation). In 2017, Revenues reached c. €455m (+24.8% YoY), with EBITDA Adjusted of c. €156m (+64.0% YoY). Net Debt, as of 9M2017, amounted to €478m (equal to 3.3x EBITDA). Results which are impressive in light of the fact that the company was losing money at the EBITDA level until the FY2014.

About Global Infrastructure Partners

Global Infrastructure Partners is a US-based independent infrastructure fund manager, seeking high-quality investments in infrastructure assets in the energy, transport and water/waste sectors. It currently manages around $40bn on behalf of its investors, running companies totalling $5bn in Revenues annually. On top of that, it also manages a separate credit arm called CAPS, seeking investments across the broader capital structure spectrum.

Among its current investments there are the Gatwick and City Airports in London, the Edinburgh Airport, a number of freight and port operators in the APAC region.

Their investment strategy seeks to improve the efficiency and performance of their portfolio companies throughout the holding period. In particular, they focus on personnel development and training, best practices development and implementation, sustainable development and overall better service for clients.

Industry Overview

The rail market has been defined for years as a natural monopoly. Nevertheless, the European Union (EU) is very active in proposing the restructuring of the European rail transport system opening it up to competition, in the hope that greater competition will help to create a more efficient and customer-responsive industry.

However, states are hanging around slowing down the liberalization process. Indeed, many of the current railway operators are backed by central governments which have been enjoying their privileged position for long, without the threat of new competition. In recent years, the high-speed rail market, which is also the most profitable within the railway industry, has been the one most targeted by the EU liberalization policies (especially in Italy).

The entry of Italo in the high-speed Italian rail market represented a milestone in this direction. In just a few years, an increase in competition within the railway line Rome-Milan killed the less efficient and expensive airline rivalry on the same line (i.e. Ryanair and EasyJet cancelled all their flights linking Rome to Milan). Furthermore, the presence of a competitor such Italo has taken on the public-backed behemoth Ferrovie dello Stato, which is striving to keep pace with it. As the table below shows, Italo not only has increased its market share from 9% (2012) to 35% (2017), but it has also allowed, thanks to an enhanced competition and a consequent decrease of prices and increase of quality, the overall expansion of the high-speed segment and of the railway market in general.

Then, as well as encouraging greater competition within national boundaries, EU legislation gives rail operators the ability to run services in and between other EU countries, opening up cross-border competition. By opening up cross-border competition, the EU is trying to accelerate the transformation of the whole European railway market increasing the growth opportunities within the industry and allowing the most efficient operators to widen their services.

FIGURE 2: Italian high-speed rail market

Source: Italo

Deal Structure

The €1.9bn all-cash bid offered on the 5th of February by one of the Global Infrastructure Partner funds came quite unexpectedly. The bid arrived while Italo was in the final stages to offer up to 40% of its capital in an initial public offering (IPO) to be launched by the end of the month.

Despite, the offer by General Infrastructure Partners would have insured a higher valuation than what Italo’s shareholders were expecting from the market quotation, it was initially rejected by the board of directors.

Thus, the US-based infrastructure fund raised its offer for 100% of Italo late on Wednesday, the 7th of February. The new offer of a total €1.98bn consideration excluding debt implied an equity value for Italo of €1.94bn, including then the promise to pay out €30m in already promised dividends plus another €10m to cover for the cost of dropping the planned listing. Then, GIP granted to Italo’s current shareholders the possibility of reinvesting in the group and buy up to 25% in the railway operator, as well as an option to sell any stakes in coming years.

The above-mentioned consideration paid by GIP sets Italo’s Enterprise Value to c. €2.4bn (over 15x YE2017 EBITDA).

Finally, the infrastructure fund claimed that it will not face any management change in the foreseeable future, keeping Italo Chairman Luca Cordero di Montezemolo and CEO Flavio Cattaneo in their current roles.

Deal rationale

At the end of January NTV seemed ready for the jump into the Italian public market. It had already chosen the banks (Banca IMI, Goldman Sachs, Barclays and Credit Suisse) to assist the process of floating a percentage between 35 and 40% in the MTA (Mercato Telematico Azionario). But then the Board was faced with the hard choice between being acquired by the American GIP for a sum hovering around €1.9bn and a listing process that would take (according to the estimates) 2 to 3 years to get to that valuation in the market. However, arriving just weeks before Italy’s national election, the takeover bid would have given the company’s shareholders the opportunity to cash in on an investment that took a decade to turn a profit. The uncertainty Italo could have faced if it had pursued its listing plans, the risk of delaying the flotation by a few weeks or months because of the potential volatility around the national elections and the fact that the company could hardly have got a valuation higher than €2bn (as implied in a share buy-back mandate approved last week) are all factor which have encouraged the current shareholders to ultimately accept the bid.

On the one side, some shareholders were actively trying to monetize the investment, no matter if it would have been done through the IPO or the deal with GIP, i.e. the Italian bank Intesa Sanpaolo’s CEO claimed that it is not in the bank intention to run a railway operator. On the other side, instead, shareholders such as Mr. Montezemolo and Mr. Cattaneo were reluctant to sell, believing in the opportunities of growth in the European market. They were in favour of the listing, convinced that by keeping 60% stake in the company, and therefore control, they could guide the firm effectively. But then GIP bid higher and at that point all the investors agreed that there was no alternative other than to accept the offer.

From the perspective of GIP, the acquisition is consistent with the other investments and buyouts in its track record. It has proven to be strong in the transportation sector, but until now it has operated only in commercial ports and airports. It is the first time it enters the rail market, this is probably due to the fact that there were not opportunities such as this one in Europe. Italy started the liberalization of the railroad market in 2006 and Italo was the first and only successful project of its kind. With an increasingly deregulated European market (by 2020 the entire high-speed railroad grid Italo works on will be liberalized), opportunities of growth are very interesting. GIP, with its expertise and resources, has both the knowledge and power to further expand Italo’s business model throughout the continent and make this investment become fruitful in years to come.

Advisors

Global Infrastructure Partner was advised by the Italian investment bank Mediobanca, while Rothschild acted as financial advisor to Italo-NTV.

0 Comments