Introduction and the state of the private equity industry

The geopolitical and macroeconomic environment in 2022 and 2023 led to a sharp decline in the value and volume of private equity deals. Multiple causes contributed to this collapse, with inflation headwinds being a major one. Inflation, which stood at 6.4% at the beginning of 2023 in the US, impacted PE investors’ decisions since it raised operating costs, rendering companies less appealing. Moreover, inflation caused an increase in the real interest rate, resulting in a decline in valuations. The Federal Reserve’s subsequent tightening measures and the decision to raise the federal funds interest rate to bring inflation back to its target level, represent another significant issue for Private Equity funds, since deals are typically financed with a significant amount of debt. With the Fed funds rate increasing from 0 to 5.5% between 2022 and 2023, LBOs became considerably more costly and less attractive. The higher cost of debt also implies a higher discount rate, which contributes to a decrease in valuations for companies. Lastly, there were major political disorders over the last two years. Russia’s invasion of Ukraine intensified supply chain issues, leading to energy scarcities and fueling high inflation rates. The uncertainty surrounding the geopolitical landscape further contributed to the decline in valuations and higher market volatility.

Global private equity value and volume in 2023 were at their lowest levels in the last five years. Transaction value plummeted 34.7% YoY to $474.14bn, with deal count falling by 16% in 2022 and 32% in 2023.

Source: S&P Global Market Intelligence

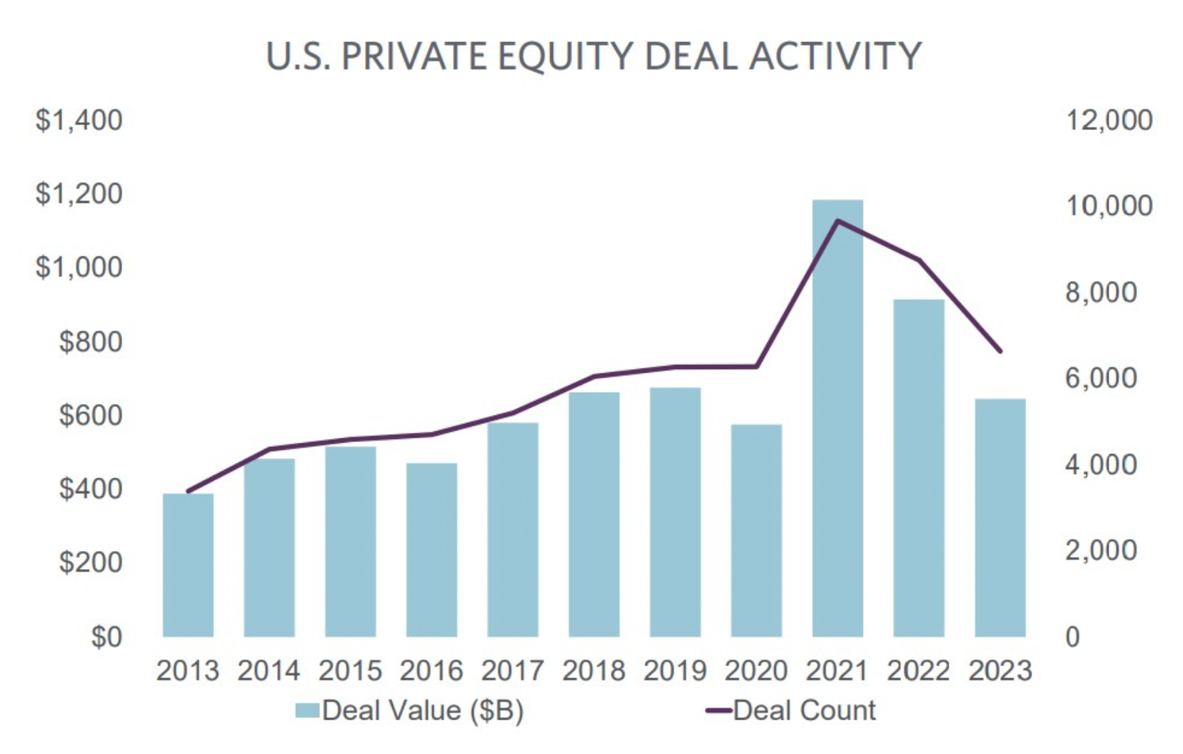

In the US market, private equity activity declined 24% in volume and 30% in value compared to 2022. Furthermore, the total value of the deals declined dramatically, with average deal size being the lowest over the last five years.

Source: Cherry Bekaert

In smaller deals, managers opted to increase equity financing, with a number of deals being financed only with equity. In the US, equity as a percentage of deal value increased to approx. 56% in 2023 from a 10-year average of cca. 46% However, for deals above 1bn, equity financing has proven to be far more challenging. The number of “megadeals” decreased by approx. 33% in 2022 and by approx. 25% in 2023. This decrease is largely because private equity’s capacity to finance major purchases was severely hampered by rising borrowing costs. Sponsors looking for funding for megadeals were therefore expected to pay greater yields and provide more protections when approaching both traditional and private credit lenders. The downturn was further exacerbated by the collapse of various previously disclosed private equity transactions. Notably, the deal disclosed in 2022 involving the sale of a $20bn life insurance portfolio by Zurich Insurance Group to Viridium, a consolidation firm in Germany owned by the UK-based private equity firm Cinven, fell apart in January 2023. In the case of this particular deal, the breakdown was primarily due to regulatory scrutiny concerning the ownership structure of Viridium.

Source: Cherry Bekaert

Why PE funds are “stuck”

This period’s slow pace of deal-making led to significant stagnation in the private equity sector. The total value of global private equity dry powder increased by 8% to an unprecedented $2.6tn in 2023 from a total of $2.4tn in December 2022. Just 25 companies hold 21% of this total, with 19 of them headquartered in the US. Apollo Global Management led all other firms, with $55.1bn in uncommitted capital available to its private equity funds. Despite holding an unprecedented amount of uninvested capital, PE funds are currently holding off on executing deals, awaiting a more stable macroeconomic environment and a decrease in interest rates. These conditions would enhance company valuations, thereby making PE investments more appealing.

Furthermore, the slowdown in dealmaking by Private Equity firms is also driven by a scarcity in exit opportunities. In fact, global exit totals decreased by 42% in 2022 and remained almost at the same level in 2023, with a total of 1,959 exits. The exit strategy that registered the most significant decline are IPOs, with Global markets recording just 72 IPOs by private equity-backed companies in 2023, the lowest number of these transactions since 2019. Both trade sales and secondary sales also recorded a sharp decline, with the former falling by 23% compared to 2021 and the latter by 27%.

The prevailing uncertain macroeconomic climate has led to numerous exit strategy setbacks, primarily attributed to declining valuations and instances where businesses have remained unsold within funds for extended periods. Veritas Capital investment in Cotiviti is a suitable example that serves as a prime illustration of this situation. Veritas Capital, a private equity firm based in New York, acquired Cotiviti, a healthcare company located in Waltham, Massachusetts, for $4.9bn in 2018. In April 2023 Veritas Capital engaged in discussions to sell a 50% stake in Cotiviti to the Carlyle Group, valuing the firm at an ambitious $15bn. However, the deal encountered significant obstacles when the Carlyle Group had to withdraw from the negotiations. The withdrawal was primarily due to difficulties in securing the necessary funds for the buyout, exacerbated by internal disruptions within its leadership structure. Since this development, the valuation of the company suffered an enormous decline, highlighting the volatile nature of market valuations and the impact of external economic factors on deal-making. The situation further evolved with rumors circulating about a potential deal with KKR, who is reportedly considering the acquisition of the shares at a reduced valuation of $11bn.

Mounting Pressure from Investors

Although we are far from the peak of portfolio companies’ sales in 2021, there is a potentially key driver in the rebound of PE activity in 2024. Indeed, while the largest private equity groups have reached record levels of investment, investors in buyout funds have started to pressure the groups to sell their portfolio companies, often held for longer than average. Since the environment for exits has been unfavorable and lower-risk investments are on the rise, investors in PE funds have increased pressure to exit in order to benefit from other opportunities, despite the cost of possibly lower valuations.

To understand the reasons behind investors’ high demand for cash returns , we recall the structure of PE funds. With a lifespan of 10 to 12 years, PE funds undergo four overlapping stages: fundraising, deal selection (investment), value-creation and deal exit, and liquidation. Limited Partners invest in the funds and serve on advisory boards, while General Partners are trusted with raising capital, selecting and investing in portfolio companies, as well as managing them until they exit the deal. LPs, who are often different types of investors, can negotiate and amend the terms of their LPA (Limited Partner Agreement) and are fundamental for General Partners beyond the life of a single fund. Indeed, GPs mostly rely on LPs that have subscribed to prior funds to raise capital for new funds, and LPs are often given the option to subscribe to a follow-on fund shortly after subscription and before returns on the existing fund are realized. Moreover, liquid LPs can certify the quality of the GP to new LPs, contributing to the investments in the funds in this manner as well.

Thus, General Partners usually exert great effort to achieve the expected high returns for current funds to retain liquid Limited Partners. Another reason why LPs have the power to influence decision-making is that the differences between LPs concerning their liquidity, as well as regulatory and tax constraints, result in differences in risk capacity and investment objectives, with a direct effect on GPs’ deal selection and investment mandate.

Several elements have contributed to investors’ urgency to exit. The first one is that buyout funds have a limited lifespan, thus capital needs to be returned to LPs at the expiration date. Usually, deals are exited before that date, but due to slow deal activity, fund managers have gathered a stockpile of assets in funds that are near their expiration date. At the current exit pace, this could have significant consequences: in the case of 2017 vintage funds, for instance, as much as 20% to 26% of the invested capital could remain locked in assets once they reach the maturity wall. In addition, buyouts are usually largely financed through term loans, with different maturities which typically range between six to seven years after the deal is closed. Consequently, the market might witness an overhang of debt maturing from transactions closed between 2016 and 2018, and with the rapid increase in interest rates and credit spreads, refinancing maturing loans might have become too costly. In some cases, corporate borrowers have already incurred costs so high in their capital structure that they resulted in breached covenants. Hence, they might not even qualify for refinancing and might need to prefer marketing their companies for sale. Another reason, perhaps more compelling for Limited Partners, is the opportunity cost of having their investments locked in funds instead of available for riskless investments or even other PE funds. Thus, they might be less concerned with lower valuations and expected returns.

Unlocking PE Activity

Despite the lack of PE exits in 2023, fund managers have been preparing to sell their portfolio companies, waiting for the market to reach a new normal and for the economy to finally stabilize. From this perspective, 2024 might be the right time for the IPO market to make its comeback after 2023 ended with a slight increase in deal volume, despite a decrease in overall proceeds compared to the previous year. However, companies looking to go public are still facing a high degree of uncertainty. In addition to the unfavorable macroeconomic environment of 2023, 2024 brings stronger than ever antitrust scrutiny and disruptive political events such as the US presidential election.

Several factors have contributed to the slowdown of IPO activity, especially after 2021 represented a record year, with over 3,200 companies going public and over $626bn of capital raised. After the global supply and demand shocks, as well as the disrupted supply chains triggered by the pandemic, inflation levels rose both in the US and in Europe, with the latter also experiencing an energy crisis due to geopolitical conflicts, which drove prices even higher. PE portfolio companies, which suffered higher costs, were not always able to pass the cost burden onto their customers. With lower EBITDA and net income, PE portfolio assets saw pressured valuations, and managers preferred to wait instead of exiting deals with below expectation returns. As a consequence of rising inflation, interest rates rose, particularly in the US and Europe. The Federal Reserve raised interest rates from near-zero in the first half of 2022 to 5.5% in the summer of 2023, keeping them constant until the end of the year. In the Eurozone, interest rates were held at 4.5% at the end of 2023. In turn, the cost of capital increased, which combined with lower EBITDA figures led to even more downward pressure on portfolio valuations. With low-risk investment alternatives surging from the new circumstances, funds looking to sell are facing a hostile environment.

This environment was also characterized by an uncertain path to recovery harmed by GDP growth projections. The OECD forecasted US GDP growth at 1.5% for 2024 and 1.7% for 2025, while projections for the Eurozone are 0.9% and 1.5% growth for 2024 and 2025, respectively. However, with interest rates predicted to decrease in 2024, and with more stable (although slightly above target) inflation, IPOs might become a desired solution for fund-owned assets, even more than trade sales. Several companies are considering an IPO soon: Golden Goose (backed by Permira), is contemplating an IPO after initially hoping for a dual-track route; Douglas, a German cosmetics brand retail chain owned by CVC, is on track to IPO even though it might potentially attract private investors; Cinven, EQT and the Canadian Pension Plan Investment are looking for advisors to handle the IPO of hotel room booking firm Hotelbeds; Travelport, a UK-based travel retail platform owned by Siris Capital Group and Elliott Management might be looking to go public as well. However, a more cautious environment requires a more cautious attitude from both firms and funds. Sponsors also need to be careful trying to list assets that were previously on a dual-track exit, as investors might not like a company that was put up for a listing after an unsuccessful private sale process.

Although the IPO market might be looking at a possible recovery, low interest from investors and the likelihood that interest rates remain high at least for the first few months of 2024 mean that most IPOs will probably have to wait until later in the year. In the meantime, funds looking to sell their portfolio companies might look for private buyers and could have to settle for lower valuations, especially since continuation funds seem to have reached a point of saturation. This is partly due to the high exit multiples that characterized the years up to 2021, which set expectations of high bid/ask spreads. Under high interest rates, which put pressure on EBITDA and increase borrowing costs, these are no longer obtainable and might signal the beginning of a new normal, in which investors will have to accept lower returns than in recent years.

Lastly, some funds could focus on their private credit divisions to satisfy LPs with their cash payments. Indeed, while private equity investors usually anticipate returns of 20% or more (potentially infinite), private credit investors would normally expect 10% or more in average returns. In 2023, however, private credit was the driver of fund performance, with higher average returns compared to buyout funds. The choice to back private credit might be due to the advantage of predictable returns and the priority for repayment, both features that some investors prefer in times of market uncertainty, over riskier private equity investments, whose returns depend on company performance and exits. Other upsides of private credit are the shorter loan terms and the consistent periodic repayments, which enhance liquidity and simultaneously serve as a risk-mitigation mechanism, allowing steady returns to investors.

Thus, although we can expect a higher volume of deal exits in 2024, mostly due to LPs adding more pressure to PE funds, we do not expect the IPO market to recover at least for a few months which implies that we will likely see fund managers give in to lower valuations and sell soon.

1 Comment

Kateryna · 19 February 2024 at 16:35

How do private equity funds plan to navigate the challenges posed by the current macroeconomic environment, especially regarding the scarcity of exit opportunities and pressure from investors?