On March 8, 2017 crude oil plummeted more than 5%, with WTI price falling through $50 a barrel for the first time since December. The sudden move was triggered by EIA reporting a massive build-up in American crude oil inventories, hitting record levels according to data going back to 1982. The remarkable growth in inventories means US shale oil drillers are increasing their production, benefiting from the higher prices oil has reached since OPEC agreed to cap production back in November. In this article we will analyse the American oil supply side and the effect of the bearish sentiment on oil futures markets. Both these issues represent a serious test for OPEC strategy.

Oil market general overview

Crude oil experienced high volatility during 2016, when Saudi Arabia led other OPEC countries to pump as much as possible, aiming at stealing market share from US shale producers. Oil dropped below $30/barrel. At the beginning of the year, fears over the sustainability of Chinese growth and a production record caused a steep fall in the oil price. On February 11, WTI touched a 13-years low at $26.05/barrel.

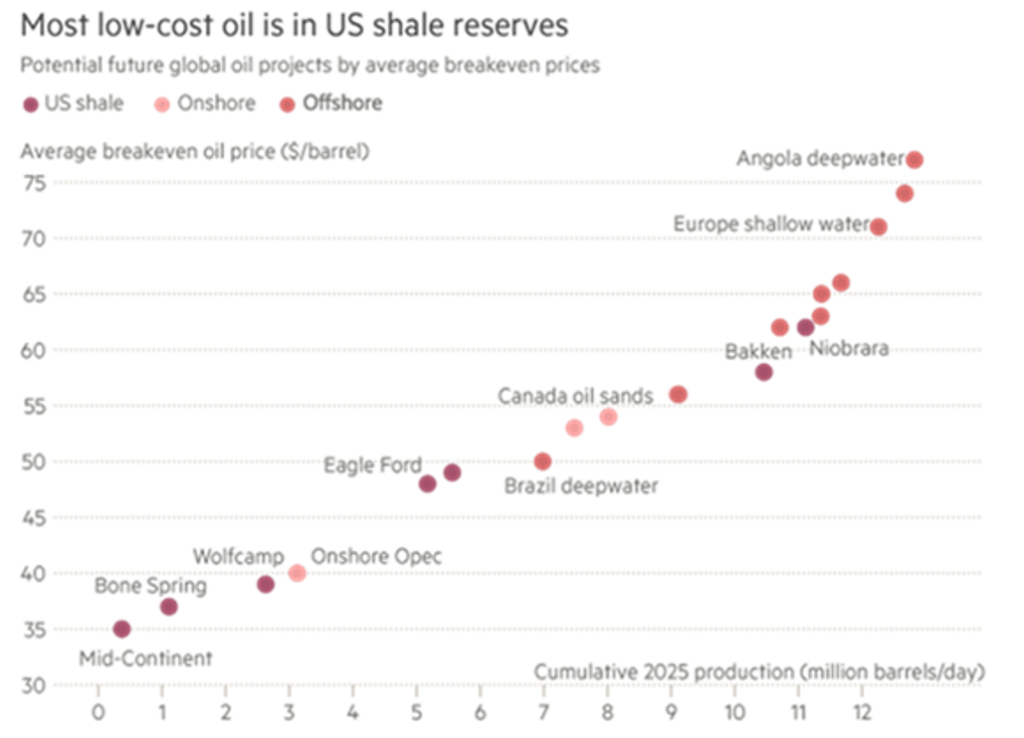

The low oil price forced many players to switch off production because producing oil at such low prices caused major losses. This move hurt especially US producers with a break-even point greater than that of OPEC countries. This issue, along with the recovery of emerging markets and the USD depreciation, caused the price of oil to slightly rebound.

In September, a first struck of an agreement between OPEC countries led to an increase in prices. After a period of uncertainty over the OPEC’s commitment to freeze production, on November[1] the first real cuts were made along with Russia and oil prices strongly rebounded. From the beginning of 2017, WTI was trading between $50 and $55.

US oil supply

The large share of US oil production consists of shale oil. Shale oil is a type of crude oil that is trapped within layers of shale rocks. Major shale oil companies produce it through the so-called fracking, shooting a mixture of mostly water and sand under high pressure against a rock formation until it fractures.

One of the pros of shale oil is its flexibility: the initial drilling only accounts for 40% of the total costs. The role of shale oil within the oil market is becoming prominent thanks to its exponential growth: from 200.000 barrels per day of production in the US of the early 2000s, it reached 4.9 mb/day in 2015 (52% of the total national production).

Starting in June 2014, US oil supply remarkably declined following the oil price crash, triggered by OPEC to force into bankruptcy shale producers operating with high break-even prices. However, US oil production has recently picked up. Many drillers are decreasing the WTI price needed to reach the break-even point. Unlike the first shale oil boom, this time many shale oil producers started extracting oil when the WTI reached $40-$45, so that OPEC’s efforts to cut production and boost prices were partly substituted by shale production.

Chart 1: Most low-cost oil is in US shale reserves (source: Financial Times)

Another interesting feature of shale oil is its cost saving trend: average costs per barrel have dropped by 30-40% for US shale wells, but just 10-12% per cent for other oil projects. This is one more reason why more and more oil producers are shifting their focus from sea wells to fracking. The revamping US oil production is clearly shown by the growth in US inventories, which has recently reached record high of 528.4 million barrels, and the impressive growth of rigs. Since May 2016, US drillers have added 267 oil rigs, showing confidence of a bright future.

Chart 2: WTI – Oil rig counts (source of chart data: Thomson Reuters)

Chart 2: WTI – Oil rig counts (source of chart data: Thomson Reuters)

Contango is back

We will now analyse contango and backwardation, the price patterns in the oil futures market. Contango and backwardation provide a valuable insight for the market expected trend and OPEC closely looks at the futures term-structure to assess the effectiveness of its plans.

Contango is the situation where long-term futures prices are higher than the current spot price or, more likely, short-term futures prices (upward sloping term structure). This may be due to investors’ willingness to pay a premium to receive the asset in the future rather than paying the costs of storage and the carry costs of purchasing the asset today. On the other hand, backwardation is the situation where spot prices / short-term futures prices trade at premium relative to long-term futures prices (downward sloping term structure).

Chart 3: ICE – WTI Crude Futures Term Structure (source of chart data: Thomson Reuters)

Since OPEC had announced the landmark agreement to cut production, investors’ bullish sentiment pushed the commodity futures in backwardation. However, because of Wednesday news of US oil inventories hitting record highs and investors’ fear of a new supply glut, crude oil futures term-structure slumped again in contango.

The switch from backwardation to contango mirrors the more bearish view many investors have on oil. Contango, indeed, represents market’s sentiment for a current weak demand or excess supply, while investors expect higher demand and higher prices in the future. On the other hand, backwardation characterizes upward trends because it represents market’s sentiment for a strong current demand of the commodity. Historically, periods of weak crude oil tend to coincide with the contango structure, while backwardation characterizes the oil bullish trends.

OPEC is targeting to bring backwardation in the crude oil futures market and wipe out contango. Backwardation, in fact, makes the commodity more attractive for investors. Investors seeking to stay long in a contango market would lose money transferring their investment into the next, pricier contract. Backwardation, instead, incentivizes a buy-and-hold strategy, since long-term prices are cheaper. Therefore, backwardation together with the bullish sentiment triggered by the OPEC agreement, explains the record long positions in crude oil assumed by speculators and hedge fund, since January.

By contrast, contango incentivizes market participants to build up oil inventories. In contango, companies with large storage facilities can buy oil at the discounted spot price, store and sell it at the higher long-term futures price. Since 2014, with the huge drop in oil price and contango characterizing the futures market, the aforementioned trade generated stellar profits for suppliers, such as BP Plc and Vitol Group BV, who stockpiled oil for later sale.

From this perspective, we can understand OPEC choice to push the oil market in backwardation. Backwardation discourages companies from adding to their oil inventories and instead spur them to process excess stockpiles. This way, OPEC would be able to drain the world’s bloated fuel inventories to further control supply. At the same time, backwardation hurts US shale drillers as the down-sloping futures term-structure may dissuade them from locking in future revenue streams to fund their operations.

OPEC main issue is that since March 8, 2017 the oil market is back in contango. In fact, OPEC effort seemed to have had no negative effect on US shale producers as higher oil price more than outweigh the negative impact of backwardation. Markets are starting to price in a higher-than-expected oil supply with lower prices and contango.

Conclusion

Unlike what OPEC expected, US oil production proved very sticky, as gains in efficiency allow shale oil drillers to keep on pumping even with prices in the $40-$45/barrel range. The sudden bearish move and the contango shift in futures market, as a reaction to record oil inventories, shows that investors have just begun to figure it out. We believe there has to be another OPEC agreement or an extension of the current one in order for prices to rally again. However, considering the effort by OPEC and non-OPEC to show high compliance, it would be strange for it to fall apart now.

[1] The official OPEC deal was struck on November 30th 2016.

0 Comments