Conventional economic theory suggests that Central Banks (CBs) should only intervene to influence short-term interest rates and allow the market to set long-term rates. However, in modern economic history, this belief has been put into question: most notably, the US and the Euro Area have reacted to the Great Financial Crisis by employing aggressive, unconventional expansionary monetary policy, namely Quantitative Easing (QE), to reignite the economy. For some countries, though, QE has not sufficed. It has not succeeded in meaningfully improving economic output and increasing inflation and has also been very costly for CBs, having ballooned their balance sheets to unprecedented sizes.

In the past couple of years, a new convention has come about, aiming at substantially making up for QE’s shortfalls: Yield Curve Control (YCC). Unlike QE, where a CB announces a fixed, monetary amount of government bonds it intends to purchase over a given period, YCC means setting a certain yield target for at least one, longer-term interest rate. Because YCC has, to date, only been employed to keep rates low, YCC has solely involved CBs purchasing government bonds in the open market to keep yields at or below the target yields.

Economic Intuition

How is YCC supposed to be an improvement over QE?

Because exact price targets are given, assuming market participants believe in the CB’s ability and willingness to uphold the yield, there is an effective yield ceiling on the bond. This means that an investor may see less risk in investing in the bond and thereby prompts greater demand for it, sending the price higher. Similarly, it is now riskier to take a short position on the bond because the trader has to evaluate whether the CB will actually prevent the bond’s price from going lower than the minimum price. As Emanuel Goldenweiser, one of the first proponents of YCC described it: “when the public is assured that the rate will not rise, prospective investors will realise that there is nothing to gain by waiting, and a flow into Government securities of funds that have been and will become available for investment may be confidently expected.” [1]

Therefore, by simply assuring investors that the central bank will not let the price of the respective bond breach a certain yield, the price of the bond is defended. This is similar in principle to so-called qualitative tools utilised by CBs, for instance, forward guidance, where mere hints of a CB’s future actions drive reactions in the market which tend to lead towards the CB’s goals, thus forming self-fulfilling prophecies.

In QE, where investors are assured of a monetary amount of demand that will flow into the market during a certain time frame, investors do not know exactly when and at what price the CB is going to purchase the bonds. An analogy one can draw is that with YCC, investors have a put option on the bond, where the option to sell is at the minimum price as implied by the maximum yield. But it is not guaranteed that the CB is willing to “exercise” the option because it is potentially faced with having to buy up all the bonds in the float. In theory, though, this should give investors a more certain environment when YCC is deployed versus when QE is enforced.

The conclusion one can draw from this is that it is more likely that trading volumes, and consequently, volatility, become muted. As will be discussed, there is plenty of evidence that points to this; for instance, there have been many days where the 10y Japanese Government Bond (JGB) saw no trading at all in the last couple of years. The implication for the CB is that YCC is considerably cheaper than QE and perhaps even more effective at keeping rates low.

On the other hand, if rates stay stagnant below the target yields then the CB might have missed out on providing further stimulus through continuous purchases at those higher prices. Especially if the rates set by the CB seem arbitrarily high, the result may be a large opportunity cost for the CB. If the target rates are too low, then the CB will either be forced to purchase very large quantities of bonds or capitulate and potentially lose some of its credibility when it fails to keep the rate under the target and abandons the YCC policies.

It can be easily seen that success resulting from YCC rests on two key assumptions: investors’ collective belief in the CB’s word and the CB’s actual willingness to use vast resources to effectively implement YCC. In other words, whether the CB is actually willing to potentially purchase the entire float at or below the minimum price. Based on existing empirical evidence of YCC, this does not always hold and can have dire consequences for the market as well as for the CB.

Furthermore, YCC is supposed to be more effective than QE because it targets longer-term interest rates, which should prompt investors to invest in riskier securities and ventures. The CB, therefore, hopes that such greater investment into risk assets will result in greater economic output and sustainable, modest increases in price levels resulting from demand.

History

The earliest instance of YCC can be traced back to 1941. Indeed, the US government was facing upward pressure on its long-term debt because of the financing of the war effort, along with higher inflation expectations because of the war. Therefore, to stabilise the bond market and curb the cost of financing governments’ expenses, the Fed acted to control the curve, managing to anchor the front-end of the curve at 0.375% for the Treasury Bills and 2.5% for longer-dated bonds.

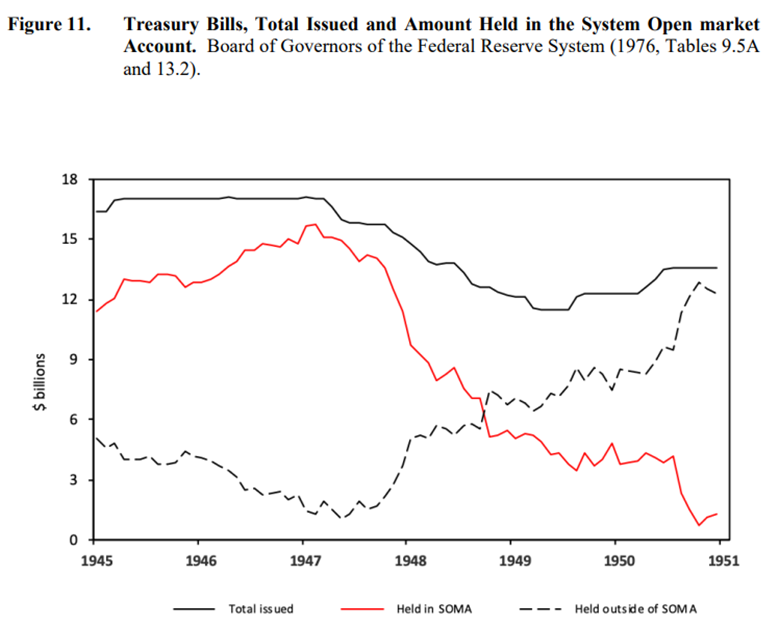

Firstly, fixing the level of Treasury yields endogenised the size of the System Open Market Account, meaning that the Fed had to buy whatever private investors did not wish to hold at the fixed rates. Seeing a similar level of risk among different maturities, private investors quickly moved most of their capital to the back end of the yield curve because of the considerably higher rates [1], forcing the System Open Market Account to absorb an increasing fraction of the outstanding T-bills, peaking at a fraction of 75% of all bills.

Source: “Managing the Treasury Yield Curve in the 1940s” – Garbade, Kenneth, February 2020

Secondly, it is important to note that after a relevant intervention in a market of this size, unwinding the caps abruptly is difficult, calling the need for large open market operations to gradually unwind the policies. After the end of the war in 1945, a measured approach was adopted, which involved terminating the 0.375% bill rate and then gradually lifting caps on yields of the front-end of the curve.

Because of this, as soon as the bill was free from the peg, its yield rose significantly, leaving very little incentive to buy longer-maturity securities, forcing the Treasury to reprice its new offerings in the following months [1].

This triggered a reversal of preference for bonds over bills, creating a substantial increase in bond yields. Very quickly officials sought to cushion the reversal by buying bonds and selling (or running off) bills, leading to a drastic decrease in the share of outstanding bills owned by the Fed, which fell to 9% in 1950.

Source: “Managing the Treasury Yield Curve in the 1940s” – Garbade, Kenneth, February 2020

Therefore, even though the YCC managed to achieve its goals during the War years, it did, however, cause a violent reaction in the bond market as well as in the overall economy as soon as the policy was dropped: this came in the form of extreme, 20% inflation level in 1947 followed by a recession that started in November 1948 lasting until October 1949.

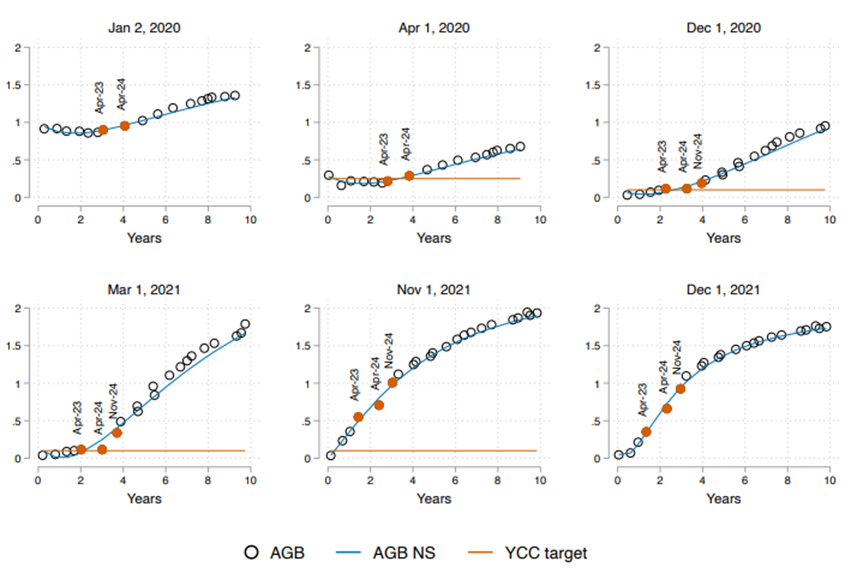

Bank of Japan

One of the most notable examples of YCC is the program that has been run by the Bank of Japan (BOJ). The BOJ’s decision of abandoning their “quantitative and qualitative easing” (QQE) for a more specific price target on the 10y Bond of 0% has proven the effectiveness of YCC, pushing other countries to follow suit or at least considering doing so.

At the start of September 2016, in the attempt of achieving a stable 2% CPI inflation rate, the BOJ introduced the YCC regime, which effectively endogenizes its monetary policy through two major methods:

Competitive auction (Kai-Kiri)

Fixed-price purchase (Sashi-Neh) [2]

The first method, the competitive auction, determines the number of bonds to be purchased through the differential between the bid and the reference rates, buying specific maturity baskets. The difference between the Kai-Kiri operation under regular QE and under YCC lies in the fact that the BOJ does not keep the purchase amount for each auction stable at ¥400bn as it used to, but rather actively manages the latter depending on the position of the 10y JGB.

As for the second method, the BOJ has effectively announced its intention of accepting all offers of bonds at a fixed price whenever the yield curve shifts significantly, setting an effective yield cap at 25 bps.

This major commitment by the BOJ has had the effect of not only allowing expectations of the JGB yields to converge significantly with those of the Bank but also stabilising the yield of 10y JGB as well as those of other maturities (although data suggests that this is only the case when the 10y yield is positive). On top of this remarkable result, the CB has managed to keep under control its balance sheet’s expansion, from ¥100 trillion per year in 2016, to about ¥70 trillion in 2019.

Source: “What is Yield Curve Control?” – Bokun, Kathryn, Kliesen, Kevin L., August 10, 2020, Federal Reserve Bank of St. Louis

However, most recent developments in the macroeconomic and geopolitical landscapes, in particular, the Russia-Ukraine war and the persistent global inflation in major economies like the US and the Eurozone, as well as supply-chain issues derived from persistent lockdowns in China, have been causing issues for the Japanese strategy: the yield on the 10-year JGB pushed up against the 0.25% target yield as the entire yield curve rose along with the those of other major government bonds. This forces the BOJ, by the YCC protocol, to intervene and purchase a huge number of securities.

Thus, the BOJ remains dovish even as the Fed is set to raise its benchmark rate by 50 basis points in consecutive meetings and as the ECB is to end its asset purchases within a couple of months.

Source: Investing.com

The divergence in interest rate policy makes carry trades more attractive, prompting more investors to borrow Yen and invest in risk-free Treasurys or European Bonds (Bunds, for instance) which now yield higher returns with greater certainty for the foreseeable future. One of the results is that the Yen faces strong selling pressure, causing it to depreciate against major currencies.

Additionally, because the BOJ has bought a vast portion of the float of 10y bonds, investors sitting on cash will look elsewhere for yield including abroad, again implying Yen depreciation at a time where safe havens like the Dollar and Swiss Franc have been gaining in value.

These factors drove the Yen to 20-year lows, with USD/JPY having briefly touched 131.2 on Friday last week.

Source: Bloomberg

The main reason the BOJ seems to be content with this lies in Japan’s historically unsatisfactory inflation results: according to BOJ chair Haruhiko Kuroda, what Japan is experiencing at the moment can be defined as “cost-driven” inflation, which is not sustainable enough to meet the 2% long-term target. Additionally, in the last couple of years, the BOJ has indicated that it is looking to overshoot the 2% target, so a weaker Yen and persistent inflation abroad may help Japan import inflation, even if it causes price levels to exceed the target.

Moreover, Japan’s economy has not bounced back from the pandemic like other major economies – quarterly GDP growth was negative on several occasions throughout 2021 – and those major economies are slowing down themselves, with the US economy slowing by 1.4% Quarter-on-Quarter, signalling that further stimulus might be required on a domestic level.

In total, the policy has shown to be successful in bringing inflation figures back to positive territory from 2016 until the pandemic while simultaneously being less costly than the QE that was employed prior. It is yet to be seen what the macroeconomic effects of the rapidly depreciating Yen will be and how the YCC program will end, so it is useful to analyse another recent YCC implementation that has ended.

Our prediction is that the BOJ will remain steadfast in implementing YCC this year, though it is unlikely for the Yen to keep dropping further as speculators remain keen on purchasing the historical safe-haven asset at multi-decade lows. Furthermore, this continued stimulus and a weaker Yen will continue favoring the many Japanese exporters and conglomerates operating abroad that comprise the Nikkei 225 Index, and is why the Nikkei 225 should outperform other major stock market indices this year like the NASDAQ, and especially the STOXX 600, as the Eurozone has not even began its tightening cycle yet. This is assuming there is not a major reversal in Japan’s macroeconomic situation, where the BOJ is looking to tighten instead of continuing to expand reserves, which we think is unlikely in 2022.

Reserve Bank of Australia

Australia’s central bank, the Reserve Bank of Australia (RBA) introduced YCC at the dawn of the COVID-19 pandemic, initially setting the three-year note with a maximum yield of 0.25%, and eventually lowering this to 0.1% on November 3rd, 2020. It is important to note that, at the beginning (until November 2020), this was not in supplement to QE nor had the RBA ever employed QE before, meaning that the RBA decided to employ YCC as a direct measure to the pandemic shock along with lowering its benchmark interest rate to its minimum.

Why did they decide to do this?

For one, solely targeting this longer-term rate was supposed to provide additional stimulus to the economy, as the RBA feared that lowering the benchmark interest rate – which was already at historical lows – to zero was not enough. Also, the RBA was concerned that the pandemic will cause great distress in the housing market, a key pillar of the Antipodean economies [3]. Thus, ensuring a cheap 3-year rate would allow lenders to keep providing cheap, fixed mortgages and will help stabilise housing prices [4].

Source: “The Australian Economy and Financial Markets – Chart Pack”, April 2022, Reserve Bank of Australia

Initially, it took the RBA 11 days and A$27bn (around $21bn at the time) to get the 3y bond to the desired rate. Because of its initial success and government bond markets generally trading flat at low volumes, the RBA did not have to purchase any securities for extended periods of time. For instance, the RBA did not purchase any 3y bonds between May 6th and August 5th, 2020, when it only had to purchase A$1bn ($720m) worth of bonds.

Source: “The Australian Economy and Financial Markets – Chart Pack”, April 2022, Reserve Bank of Australia

As the pandemic progressed and global inflation started to pick up, yield curves began to elevate, eventually leading to 3y bonds breaching the 0.10% target, finally experiencing a huge spike on October 27th, 2021, after higher-than-expected inflation data. In Australia, “the large, highly liquid futures market drives the cash bond market and not the other way around” [5], meaning that although the RBA was buying up many bonds in the cash market, the futures market was unaffected and was pricing in higher yields, eventually prompting there to be much higher selling pressure in the cash market.

Source: worldgovernmentbonds.com

Because of the immense financial resources, the RBA would have had to dedicate to defend the target rate, and also considering the disparity between the target yield and the rest of the curve, it came as no surprise when the RBA declined to intervene on October 27th, and finally, on November 2nd, declared that it was abandoning the YCC.

Source: Lucca, David O., Wright, Jonathan H., “The Narrow Channel of Quantitative Easing: Evidence from YCC Down Under”, 2022, Federal Reserve Bank of New York

The entire situation led to a weakening Australian Dollar: in the week of the announcement, AUD/USD declined by 1.65% and AUD/EUR by 1.33%.

All in all, while successful at first at keeping the 3-year rate low, giving a boost to the economy including the housing market, it showed little evidence of spilling over into the rest of the curve [6]. It also worsened the RBA’s credibility because it failed to implement its policy and falsely assumed that the macroeconomic situation was not going to drastically change until 2024; it underestimated the unknown unknowns.

Finally, the RBA’s inflated balance sheet size is going to increase uncertainty when quantitative tightening (QT) will commence, as there is still little evidence on how QT will affect financial markets.

Conclusion

To conclude, although it can be said that YCC has proven to be an effective tool for expansionary monetary policy whilst not being excessively expensive for the CB, it seems as though it is not sufficient on its own to control the yield curve, meaning that it has to be supported by QE to some extent. Furthermore, it cannot be sustainable over a longer period because the rate set by the CB is unlikely to reflect market conditions, as evidenced by the case in Australia, where the YCC program was shut down two and a half years early, and CBs generally being “behind the curve”.

On the other hand, the developments of the different CBs’ balance sheets were mostly sustainable and not volatile. That holds true for all cases until market conditions forced CBs to reevaluate their measures: the end of the war for the Fed and rapidly rising global rates as a result of inflation for the BOJ and RBA. The uncertainty that comes with these novel policies makes them less effective as seen in these “implosions”.

Finally, the large volume of purchases that might be necessary to facilitate the YCC policies implies large balance sheets that have to be wound down through QT, an area that should be subject to further study.

References

[1] Garbade, Kenneth, “Managing the Treasury Yield Curve in the 1940s”, February 2020, Federal Reserve Bank of New York

[2] Hattori, Takahiro, Yoshida, Jiro, “Yield Curve Control”, January 18, 2021,

[3] Lowe, Philip, “The Housing Market and the Economy”, Sydney, March 6, 2019, Address to the AFR Business Summit, Reserve Bank of Australia

[4] Gross, Isaac, “The RBA signals the end of ultra-cheap money. Here’s what it will mean”, November 2, 2021, The Conversation

[5] Rodrigues, Sophia, “Australia’s move to end yield curve control exposes the policy’s flaws”, Sydney, November 2021, Financial Times

[6] Lucca, David O., Wright, Jonathan H., “The Narrow Channel of Quantitative Easing: Evidence from YCC Down Under”, 2022, Federal Reserve Bank of New York

[7] Bokun, Kathryn, Kliesen, Kevin L., “What is Yield Curve Control?”, August 10, 2020, Federal Reserve Bank of St. Louis

0 Comments