Introduction

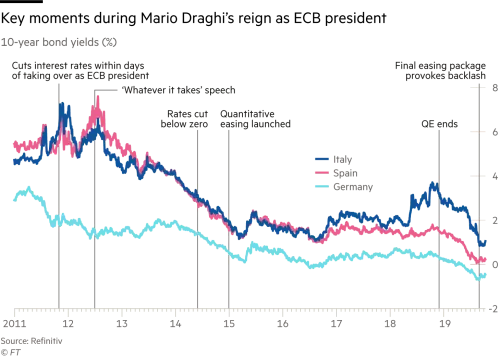

In his famous speech on July 26, 2012 at UKTI’s Global Investment Conference, Mario Draghi emphasized on the ‘irreversibility’ of the euro and ECB’s preparedness to do ‘whatever it takes’ to preserve it. The macroeconomic European atmosphere at the time was defined by uncertainty and financial troubles, especially for the southern countries of the EU like Greece, Italy, and Spain.

Since assuming office and giving that speech, Mario Draghi managed to resume confidence in the European markets and mitigated the risks of the looming sovereign debt crisis on the euro. This swift shift of investor sentiment came to define the “Draghi Effect”. In this article we explain the Draghi Effect, the market response to Draghi’s return and the challenges that he has to face as the new Italian Prime Minister.

Figure 1: Key moments during Mr. Draghi’s reign as ECB president

Source: Financial Times

First things first: Recovery Plan & Political Landscape

Nearly 2 months ago, we wrote an article titled “The Disruption Of The Highly Improbable”, describing the detrimental impact of Covid-19 pandemic on the global real economy and financial markets. Then, we demystified the dynamics of the mounting contagion of fear due to the sudden liquidity crisis that affected markets and finally reported analysts’ outlook regarding Q1 and Q2 of the fiscal year 2021. As of now, we have been experiencing a global downtrend in the number of the daily new Covid-19 cases thanks to the vaccination campaigns, masks and self-distancing measures and, hopefully, the worst is behind us.

However, that doesn’t mean it will be a smooth sailing ahead, since the violent economic shock caused by the dramatic fall in demand has still to be definitively addressed.

So far, many measures have been introduced in order to support the euro area economy.

On the one hand, the ECB has put in place a set of monetary policy measures, in particular the pandemic emergency purchase program (PEPP), which has the purpose of stimulating the banks’ lending activity by buying bonds from them in the amount of €1,850 billion.

On the other hand, the EU has launched NextGenerationEU, a temporary recovery program (also called Recovery Fund by many economists and politicians) which consists in loans and grants in the amount of €750 billion aimed at financing the investments undertaken by EU countries to reignite their economies, repair social damages and make them resilient for the next challenges.

In order to gain access to the Recovery Bonds issued by the means of the latter financial program, EU countries have to propose their Recovery Plan to the European Commission according to well-defined rules. Essentially, the Recovery Plan provides the structural reforms that will be implemented and includes as many details as possible concerning the allocation of funds by each European country.

The precedent premises are fundamental in providing the context in which the Italian governments crisis has broken out. Indeed, the management of the resources supplied by NextGenerationEU has been the crucial point triggered by Mr. Matteo Renzi, former Prime Minister and leader of Italia Viva party, to put the government of Prime Minister Mr. Giuseppe Conte on the brink.

As a matter of fact, Italian elections held in 2018 did not show an outright winner, the parliamentary majority originated was weak and fragmented, and, consequently, the country has experienced a further period of political uncertainty and shifts in power. While the previous shifts were mainly due to the scarce political affinity between the parties involved, this time the concerns are economic. Indeed, Italian economists and political experts argue that the Recovery Plan hypothesized in first instance was mainly an incomplete draft in which some key points and decisive details were missing, i.e. the link between strategy and growth, a definite implementation of the structural reforms and specific information with respect to the governance.

In addition, the fall in Italian GDP by 9% (one of the worst performance among EU countries) along with the absence of any signs of growth and the rise in unemployment make the situation even worrisome.

Hence the political crisis, the new government led by Mr. Mario Draghi and supported by a larger and heterogenous parliamentary majority.

“Today, unity is not an option. Unity is a duty”

A report regarding Draghi’s return to Italy on Tuesday 2nd of February, pushed the FTSE MIB 2.64% upwards next morning, outperforming the Stoxx 600 by 0.64%. Since then, Italian equities have risen an additional 5.60% as of time of writing, following Draghi’s successful assemblement of his cabinet.

This past week, Italy’s borrowing costs have hit an all-time low, as investors showed incredible confidence and support in the BTPs rally. The yield on the 10-year Italian government bond fell 9.1 basis points on Wednesday morning to 0.560%. By Friday 12th, another new low was made with the 10-year reaching 0.427%.

An insightful metric that showed strong outperformance is the spread between the Italian and German 10-year sovereign bond yields, which narrowed 89.29 bps, a decrease of the spread by a staggering 18.9% in one single month.

Figure 2: Italy-Germany spread tightens on Draghi boost (Percentage points)

Source: Financial Times

This market response is strongly reminiscent of the 2012 market sentiment shift and has further reinforced the new meaning to the term “Draghi effect”. Morgan Stanley, released a report on Wednesday 17th, expressing its confidence in the new Italian government, forecasting a “double digit outperformance of the stock market” and a further tightening on the bond spreads. The question that naturally arises here is: Why did his return to Italy create such a risk-on and optimistic market environment? And is it warranted?

The new Prime Minister has to accomplish the challenging task of preparing the Recovery Plan to manage the Italian quota of the Recovery Fund (€209 billion). With that amount, Italy will finally be able to quit from stagnation and reach sustainable growth through focused investments in infrastructures, digitalization, de-bureaucratization, green & renewable energy. Moreover, he will also need to deal with the Italian vaccination plan. These are further elements that may be extremely relevant for the future of Italy and Europe. In fact, for the first time in its history, by the means of EU financial support and structural reforms, Italy has the opportunity of becoming more productive, inclusive and modern.

Despite the critical situation in which Mr. Draghi is about to operate in, it is worth noting that his remarkable expertise, unshakeable self-confidence and strong communication have immediately inspired investors’ trust in the Italian market. The former Chief of ECB has put strong emphasis on the European stamp of its agenda, stressing on the Euro-system irreversibility and the prospect of an increasingly integrated European Union that will arrive at a common public budget. Providing stability amid the long-lasting political turmoil, he has also been able to form a government embracing even those populist parties that had raised high criticisms over the Euro and Brussels bureaucracy in the past, threatening even remotely the integrity of the Euro system.

The dynamics of his stabilizing action look quite straightforward since Italy may presumably very soon rely on EU financial support which will bring about a double positive effect:

– In the short-term, it will ease, to some extent, the need of bond issuance by the Italian Dept. of Treasury, causing a shortage in supply, which in turn will lower the yield on Italian government bonds and ignite BTPs rally. Hence, it will allow Italy to drastically reduce their interest expense on public debt by €1.5 billion per year (assuming the current interest rates fixed)

– In the long-term, Italy may indeed benefit from structural reforms and the growing trust in the Italian system may facilitate companies to fund their projects through foreign investments, leading to a virtuous circle, and boosting its economy and in turn the overall European economy. Optimistically, it can be deemed that Italy may finally cover an even more integrated and relevant role in the European Union in the future.

However, markets are based on agents’ expectations and one should be cautious with respect to the possible risk factors on the path that may cause the Draghi Effect to vanish. It is worth noting that we are approaching two critical dates that may impact on the future of the Italian government. On May 7th, the Recovery Plan deadline, Italian government has to present the detailed project to the European Commission. On July 1st, Italy approaches the “White Semester”, the last six months of the President of Italy’s seven-year term of office and the following election of the new President, whose election may become a major concern within the parliament.

Conclusion

Mr. Draghi’s appearance on stage has been warmly welcomed by Italian citizens, European Institutions and investors. As a matter of fact, the stabilizing effect that his appointment had on the financial markets looks extremely encouraging. Potentially, it may represent the beginning of a new positive phase of rebuilding the Italian economy and bolstering the entire Eurozone system.

Though, the challenges that he has to face range from the vast parliamentary fragmentation to the “White Semester” approaching this summer. His government will need to act quickly to meet the Recovery Plan deadline as well as manage to get Covid-19 under control. Financial markets have rewarded Draghi’s return to Italy, but whether the “Draghi Effect” is fully priced-in by investors, remains to be seen.

0 Comments