On the 7th of February 2022 two ultra-low-cost carriers, Spirit and Frontier Airlines, announced a definitive merger valued at $2.9bn that will create the most competitive budget airline, rivaling giants like American, Delta, United and Southwest. This deal takes place in a time where airlines have to contend with higher volatility in travel demand because of new Covid variants. Furthermore, they are experiencing increases in cost based on rising wages, fuel and airport charges. These trends partially explain the merger as it is anticipated to lead to cost synergies amounting to $500m a year. Additionally, it will create an entity that can serve customers from coast to coast at budget prices, thus allowing it to compete with the established players on a more equal footing. However, the merger is going to be heavily scrutinized by antitrust regulators, as Lina Khan, chair of the Federal Trade Commission, vowed in a recent statement to rewrite merger guidelines and crack down on corporate consolidations. It is left to be seen whether the merger will be approved.

Frontier Airlines

Frontier Airlines (NASDAQ: ULCC) is an ultra-low-cost U.S. airline, headquartered in Denver, Colorado. Founded in the 1990s by Frederick W. Brown, the company has evolved into one of the top 10 airlines in the US, with a market share of 3.4%. Frontier flies more than 100 Airbus A320 to 115 destinations throughout the United States, Caribbean region, and Latin America, and is known for having a very fuel-efficient and environmentally friendly fleet. Despite the impact that the Covid-19 pandemic had on the aviation industry and rising oil prices, the carrier has managed to survive the past two years through managerial discipline and financial help – increased ancillary revenues, cutting costs, and a $150m loan from the U.S. Department Of The Treasury. With total operating revenues of $2.06bn in FY2021, sitting at 82% of FY2019 levels, and a revenue per passenger of 103$, the company is recovering faster to its pre-pandemic operations than the “Big Four”, which is also demonstrated by the recent acquisition order of 91 Airbus A321 Neo expected to be delivered between 2023 and 2029.

In April 2021, Frontier had its IPO on the NASDAQ stock exchange, preparing for a surge in bookings due to the summer holidays and looser Covid restrictions. Being priced at $19 a share, the company received net proceeds of approximately $266m, bringing its valuation up to $4bn. Even if the stock has been performing poorly, trading at around $14 a share as of February 2021, Frontier has managed to increase its liquidity. As of Q4 FY2021 it has $918m of unrestricted cash and cash equivalents, which in turn allows the merger with Spirit Airlines.

Spirit Airlines

Spirit Airlines (NYSE: SAVE) is another low-cost U.S. carrier with its headquarters and main operational base in Fort Lauderdale, Miami, Florida. Founded in the 1980s as a charter tour airline for leisure destinations like Atlantic City and Las Vegas, the company benefited from the decline and eventual bankruptcy of U.S. behemoths like Pan American, Eastern Airlines and TWA by opening new hubs in Detroit and Dallas. The shift towards a low-cost business model began in 2007 when the company discontinued its business class in favor of more economy seats, followed by it becoming the first U.S. airline to charge for carry-on bags in 2010. Since then, the airline has focused on ultra-low fares, easy online booking, and reliable services to drive its cost advantage strategy and attract budget travelers. By 2019 it had reached a market share of 5.2%.

Spirit experienced rapid growth in the aftermath of the 2008 Financial Crisis, completed an IPO in 2011 at $12 a share, and reached its peak price in November 2014, when it was titled by Morgan Stanley the “top growth airline stock for investors”. Since then, the company has been steadily losing momentum due to a steep decline in unit revenue and saw its turnover being hit hard by the pandemic. With a 53% decline in sales between FY2019 and FY2020, from $3,76bn to $1,77bn, Spirit had to take out a loan of $334m via the Coronavirus Aid, Relief and Economic Security Act, which in turn downgraded its liquidity ratios. As of 2022, the company is recovering from the pandemic, having a net operating loss in FY2021 of only $56m compared to $507m in FY2020, and is planning to acquire newer and more efficient Airbus planes, to reach a total fleet size of 216 by 2025.

Industry Analysis

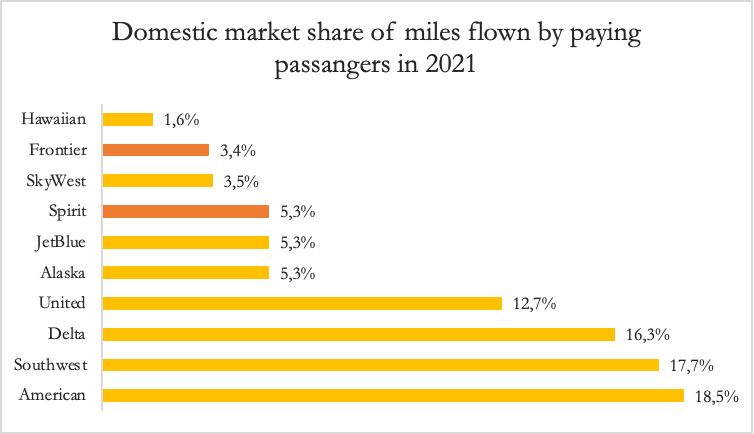

The U.S. airline market is the largest in the world, with more than 900m passengers boarding planes, and the total value estimated at $138.9bn. The market is dominated by the “Big Four” airline companies – American, Delta, Southwest and United – which together currently account for about 65% of the industry. Even if the market is concentrated into four big players, the sector still has a fairly low profitability, with an average ROIC of 5,9% between 1992-2006 (US industry average lies at 14,9%). This is due to high fixed costs and pricing wars. The other 35% of the U.S. market is dominated by Low-cost carriers (LCCs), which were a direct result of the liberalization of the airline industry in the late 1970s when companies were allowed to set their own prices for tickets – before 1978 the Civil Aeronautics Board (CAB) controlled the pricing.

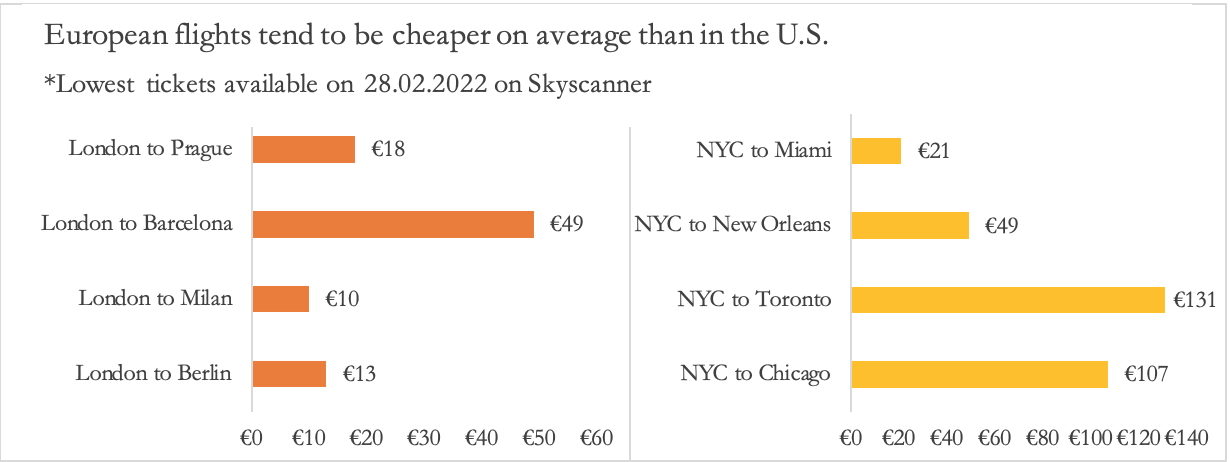

The deregulation had spectacular results, increasing the number of yearly passengers from 200m to more than 900m in 2019. Moreover, with Delta, American, and United focusing on international routes and business travelers, and given the underdeveloped passenger railway infrastructure, there is an open business segment for low-cost airline companies focused on middle and small-sized hubs. The key players in this sector are Southwest, JetBlue, Spirit, and Frontier. However, even with strong competition, the American LCCs market still has higher prices compared to the European one: According to Skyscanner a one-way ticket on Southwest costs on average $149, while Ryanair on average charges just 60$.

The price difference is generated by a lower population density in the U.S. and a stronger presence of business travelers, unwilling to sacrifice quality services for lower prices. Moreover, U.S. airline companies represent the most viable way of transportation in North America and do not have to worry about substitutes like trains and buses. On the contrary, European trains like the TGV or Eurostar offer competitive prices and are seen by passengers as a better way of transport; it is far easier to access a central train station than a peripheric airport.

Deal Structure

According to the terms of the merger agreement, Spirit will receive 1.9126 shares of Frontier and, in addition, $2.13 in cash for each Spirit share they hold. At a $25.83 per share valuation, Spirit equity holders will be compensated with a 19% premium over the firm’s stock closing price on February 4th and a 36% premium based on the 30 trading-day volume-weighted average prices of Frontier and Spirit. The deal values Spirit at a fully diluted equity value of $2.9bn and, when taking into account the net debt assumption and operating lease liabilities, the transaction is valued at $6.6 bn.

Once the deal is closed, the new company will be 51.5% owned by Frontier’s shareholders, and Spirit will hold approximately 48.5%. The new airline’s board of directors will count 12 directors, seven of whom appointed by Frontier and five by Spirit. The Chairman of the Board will be William Franke, Frontier’s current Chairman of the Board, who will also determine the combined company’s headquarters, branding and management team.

The deal is expected to close in the second half of 2022, and is subject to the completion of regulatory review and approval by Spirit stockholders. It is projected to result in synergies of $500m a year and increment the hired labor force by 10,000 workers by 2026. Also, the merger of the two airlines would produce the fifth-largest airline in the United States.

Deal Rationale

There are several considerations to make when examining the intentions behind the merger of the two companies. Clearly, the key objective of this deal is to be able to better compete with the “Big Four” airline companies. In October 2021, Spirit owned 5.3% of the US market while Frontier accounted for 3.4%. The merger would make the combined company the fifth-largest airline in the US. Both airlines exclusively use jets from the Airbus A320 family, but Frontier is heavily concentrated in Western states while Spirit mainly serves the East coast and international routes. Only 18% of the routes overlap and therefore, the two companies will achieve substantial growth through the merger, which they would not have been able to reach if they were to act singularly. Also, low-cost airlines will be the first ones to drive post-pandemic recovery. This is because they have strategically cut costs and can now operate cash-positive routes with a lower load factor than before. This means that Frontier and Spirit have been able to return to focus on their growth plan while other big companies are still struggling with consequences from the pandemic and therefore, the merger might lead to an even larger advantage.

As stated by Spirit’s CEO and President Ted Christie, “the transaction is centered around creating an aggressive ultra-low fare competitor”. The merger would, indeed, lower operating costs, allowing the combined airline to charge even lower fares to its customers. The deal is projected to result in synergies of $500m a year through operational savings and deliver $1bn in annual consumer savings. The merger comes at an ideal time as cost pressure is the biggest threat to post-pandemic recovery in the aviation industry’s profits. Although Frontier’s CEO Barry Biffle stated “Everybody wins through this transaction”, consumer advocates are raising doubts noticing that airline mergers usually lead to fewer flights and higher fees as the concentration of the industry gives huge power to the key players. Furthermore, Frontier and Spirit have among the highest numbers of customer service complaints and therefore, with the lower fares, the merger might lead to bigger issues regarding customer service.

The unification of the two firms had already been suggested in 2013 when Frontier was up for sale. William Franke, who at the time was Spirit’s chairman, pitched Frontier’s acquisition to the directors and following their decline, he resigned from Spirit. His private equity company, Indigo Partners LLC, purchased Frontier, and he transformed it into one of the largest low-cost airlines in the US. After almost one decade, the deal he suggested is finally happening. The merger of the two companies is reasonable as they share similar values and purposes. Their commitment is towards affordable and green travel, and they have complementary fleets. Therefore, the merger would not result in a corporate culture conflict, and on the contrary, it is expected to be a smooth change.

A less important reason behind the deal which is worth mentioning is the shortage of pilots and staff in the aviation industry. After decades of low wages and intense training, US airlines are making every effort to attract talent and encourage more people to become pilots. As Frontier’s CEO Barry Biffle stated, the combined company will be “more attractive to pilots going forward” as a larger airline will be able to compete with the Big Four for pilots, who are better off in a larger and established organization.

Market Reaction

After the deal was announced, Spirit’s shares surged more than 17%, closing the day at $25.46, just below Frontier’s offer of $25.83 per share. On the other hand, Frontier’s shares experienced an increase of only 3.5%, ending the day at $12.82. Frontier and Spirit’s stock prices have been fluctuating above the announcement day’s closing prices, respectively, reaching peaks of $14.26 and $27.53 over the last week. The limited change undergone by Frontier’s stock price shows investors’ uncertainty regarding the deal’s approval. The merger announcement has raised doubts among analysts and experts regarding antitrust examinations due to President Biden Administration’s severe approach towards corporate consolidations. This uncertainty is further incremented by last year’s antitrust lawsuit filed against American Airlines Group and JetBlue Airways Corp. However, other analysts are optimistic that the merger would be approved as it will lead to a minimal overlap of route networks and will be perceived as pro-consumer.

Interestingly, other airline stock prices went up after the merger announcement, which is an unusual reaction to a threat of a potential disruptive competitor. This is another sign of investors’ skepticism about the merger’s success.

Advisors

Citigroup Global Markets Inc. is acting as financial advisor to Frontier, while Latham & Watkins is providing legal guidance. Spirit’s financial advisors are Barclays and Morgan Stanley, and Debevoise & Plimpton is serving as legal advisor.

0 Comments