The purpose of the article is to provide an explanation on the economic policies of the third largest economy in the world. In particular, explanation of Abenomics’ three arrows, their effects on Japanese economy and our view on the next steps that policy makers are likely to undertake. With this regard, we focus on the most important drivers of Bank of Japan’s decisions. Finally, we suggest how to trade in the next Bank of Japan’s meeting regarding the current macroeconomic situation.

ABENOMICS

The Japanese economy has been facing two decades of inflation and deflation both. With interest rates at 0% and incredible debt levels, many economists had lost faith in the country returning to growth. Shinzo Abe, elected as Prime Minister in December 2012, declared he was willing to do everything in his power to make the “lost decades” only a shadow of the past. His remedy is called Abenomics, a policy that consists of three arrows.

The three arrows are fiscal stimulus, monetary easing and structural reforms. The first two arrows are aimed at achieving a short-term goals: boosting GDP growth and raising inflation up to 2%. The third arrow, instead, is directed to the longer-term outlook of the country: Abe seeks to improve it by increasing competition and structural reforms of the labor markets.

The three arrows

In the following paragraphs we provide a description on each of the arrows and the effects they have had on the Japanese economy.

First arrow: fiscal stimulus. The idea is to boost the aggregate demand by increasing government spending. The stimulus package is mostly focused on building bridges, tunnels, and earthquake-resistant roads. However, expanding government spending has also its drawbacks. Japanese public debt is around ¥1 quadrillion Yen ($10.5 trillion), while debt-to-GDP ratio is over 230%, which represents the highest ratio among developed countries. As a comparison, Greece has around 175% while the debt-to-GDP ratio of the US is 101%. The pile of debt, therefore, is one of the key constraint of Abenomics. It explains why the government had to vote for an increase in the sales tax, which was in sharp contrast with the expansionary objectives of policy makers. In particular, sales tax was increased by 5% to 8% in April 2014, leading to the negative growth in the second and third quarters of 2014, thus implying a technical recession in the economy.

Second arrow: monetary policy. Traditional monetary policy has been unsuccessful in boosting economic activity during the economic recession. Deflation has been persistent even with ultra-low interest rates and the zero-lower bound has prevented the Bank of Japan to cut rates further. Thus, quantitative and qualitative easing (QQE) was implemented on April 4, 2013.[1] The size of QQE was ¥60-¥70 trillion a year and the Bank of Japan governor, Haruhiko Kuroda, deemed it was sufficient to reach the inflation target of 2% in two years. Although some signs of inflation started to manifest between 2013 and 2014, depressed commodity prices and the sales tax increase eventually hampered price increases and growth, with an evident effect on Q3 2014. Consequently, the Bank of Japan decided to accelerate the purchases of government bonds up to ¥80 trillion per year on the 31st of October.

Third arrow: structural reforms. In the long run, aging population is the biggest threat for the Japanese economy. Therefore, demographic reforms are crucial to support long-term growth. Although some of the structural reforms had a positive impact on demographics issue, there are still measures that were promised but not yet implemented.

The most obvious improvement can be seen in women’s employment. The government has introduced numerous measures, ranging from efforts to expand childcare places to creating a scheme which rewards companies that provide a more welcoming workplace for women. These measures have resulted in a record high female employment of 65%, outreaching the female employment rate in the US. However, Abe and his government have done little in making immigration laws more favorable for skilled foreign workers. Considering that Japan is a traditionally locked country for foreigners and that the current government does not seem willing to change much, we believe that structural reforms are unlikely to include immigration laws. Another crucial area where Abe has shown little ambition is the labor market. Reforms in the labor market are essential to raise productivity. In particular, increased productivity combined with the exceptional Japanese technology would imply the sustained growth in the long run.

Above all, Abe has done the most in reforming the agriculture and energy sectors. Both sectors were monopolized and that prevented private-sector companies in Japan from expanding their role and reach in their own country. Agricultural co-operative reform is one of Abe’s biggest successes to date, breaking the power of a formidable vested interest. Also, Abe is on track to meet his goal of a full liberalization of Japan’s electricity market by 2016.

Moreover, the most important component for improving competition is on the way. In October, the US, Japan and 10 other Pacific Rim economies, reached an agreement on the Trans-Pacific Partnership (TPP). The TPP represents the biggest trade deal in the last two decades and will open markets while protecting the rights of workers and protecting the environment that enables development to be sustained.

GDP & INFLATION

With regard to the GDP growth data, it is clear that Japan had a quite stable growth until the sales tax was increased in April 2014. However, due to lower trade deficit, economy managed to achieve the positive growth in the last quarter of 2014 (1.4%) and the first quarter of 2015 (4.5%).

The most recent data shows that the annualized growth in Q2 2015 was negative (-1.2%). In particular, industrial production, a crucial input into gross domestic product, unexpectedly fell by 0.5% YoY in August and it dropped by 0.9% YoY in September. The negative data for the industrial production does not necessarily imply that the Q3 growth will be negative, but it is a very good measurement for the performance of Japanese economy.

CPI excluding fresh food, the most important inflation indicator, was -0.1% for September (YoY) which was equal to the forecast. Furthermore, last Friday (30th October) the Bank of Japan decided to leave the monetary policy unchanged, but it revised down its inflation forecast, and pushed back its expectation to the end of the next year.

However, household spending for September (YoY) was -0.4%, suggesting that generating domestically-driven demand is still a huge issue. Also, another sales tax increase from 8% to 10% is expected to occur in 2017. Therefore, due to the weak domestic demand and expected negative effects of the next sales tax hike, we believe it is likely that the Bank of Japan will be forced to expand its QQE program.

Bear in mind that the inflation rate in the period April 2014-March 2015 is higher than in other periods because of the sales tax hike (5%-8%) in April 2014. The actual rise in prices that was achieved in that period is computed by subtracting 3% from the given rate.

HOW TO TRADE JAPANESE FINANCIAL MARKETS

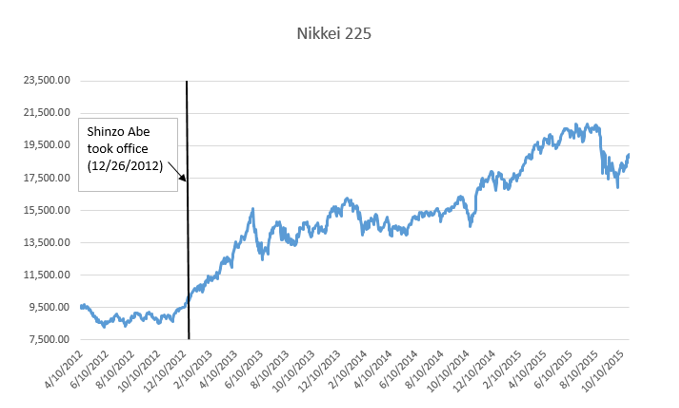

As it is shown in the chart, Abenomics has had a positive impact on the Japanese equity market. Since Abe was elected as a Prime Minister, Nikkei 225 has increased by around 90%. Rising by 57% during 2013 (the steepest since 1972) and more modest 7.1% in 2014 due to the economic slowdown.

Another factor that have positively affected Japanese equity market and especially the stock performance of export-focused businesses is the USD/YEN relation. Since 2013, the yen has weakened consistently and indeed, in June, one US Dollar was worth 125 YEN, that was the YEN weakest level since 2002.

Looking at the current environment, we believe that the expansion of the current QQE Program is likely. This would provoke further increase in Nikkei 225 and Yen depreciation against the Dollar. Therefore, we believe that markets will react in the period before the next Bank of Japan meeting and boost up both Nikkei and USD/YEN relation. Thus, long Nikkei and short Yen would provide positive returns. However, even if the QQE Program continues on the same level, both Nikkei and USD/YEN should not experience significant downward reactions and this would still be a good investment.

Another opportunity that may come up from the USD/YEN relation depends on the Fed’s meeting in December. If the Fed hikes rate, the Yen would experience further depreciation against the Dollar. Hence, shortening Yen would provide additional returns.

[1] Qualitative easing is a shift in the composition of the assets of the central bank towards less liquid and riskier assets, holding constant the size of the balance sheet (and the official policy rate and the rest of the list of usual suspects). The less liquid and more risky assets can be private securities as well as sovereign or sovereign-guaranteed instruments.

[edmc id= 3128]Download as PDF[/edmc]

0 Comments