Even those of us who don’t check commodity prices were probably keen to see the spike in oil prices at markets open on Monday, September 16th. While the drone attacks on the facilities of Saudi Aramco and their consequences are still present in the news, in this article we want to take a more detailed look on market positioning by means of futures and options prices on both crude oil as well as upstream companies, which are an alternative for investors to get exposure to crude oil. The second part of the article deals with a comprehensive insight into the effects of the attacks on Saudi Aramco and discusses a potential playout of the geopolitical tensions in the future.

A look at WTI crude oil

Before we go straight to the latest market moves in oil prices, we want to take a look at how oil held up before the striking events from two weeks ago. A worsening of the global economic outlook as well as geopolitical tensions caused WTI crude oil spot prices to fall continuously (note: we’ll focus on WTI crude oil in this section but similar findings hold also true for Brent crude oil) in the last quarter of the past year. With the beginning of 2019, this trend reversed but came to an abrupt stop as trade tensions between the US and China escalated in May – most remarkably here the 5% drop on May 22nd.

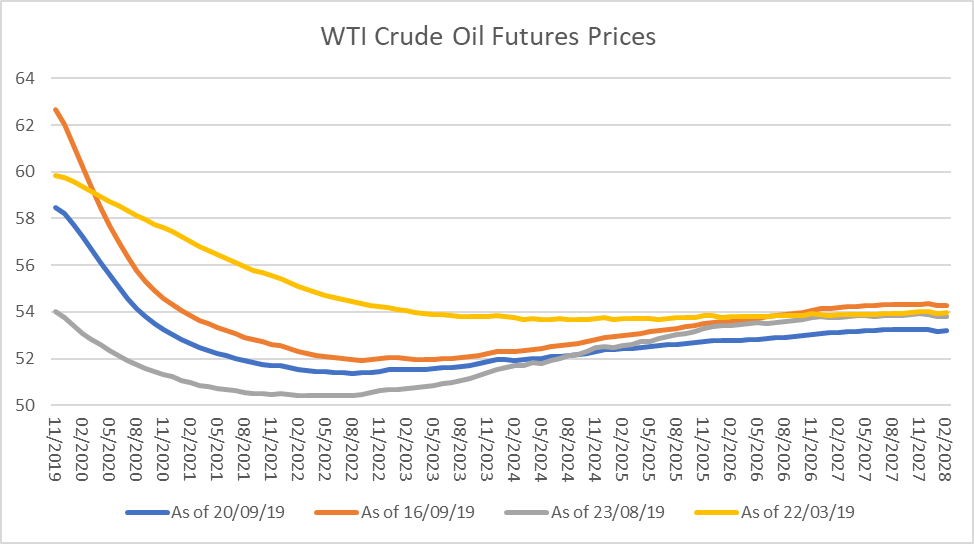

The chart below shows that market participants expected in August of this year a faster deterioration in oil prices than they did roughly 5 months earlier in March. This can be seen in the increasing backwardation in the oil futures market, which persisted already quite a while before that but manifested itself over the third quarter of this year. This clearly reflects an anticipated drop in global demand for oil, as a result of lower growth expectations for the world economy. The spike in oil prices due to the attack on Saudi Arabian oil facilities is not likely to cause an elevated level of oil prices in the medium term, given market participants’ current views. In fact, the backwardation in the futures market for WTI crude oil increased even more. Thus, supply disruptions may only persist in the near future and won’t cause a demand overhang for a longer period of time.

Source: Bloomberg. Data as of 20.09.2019

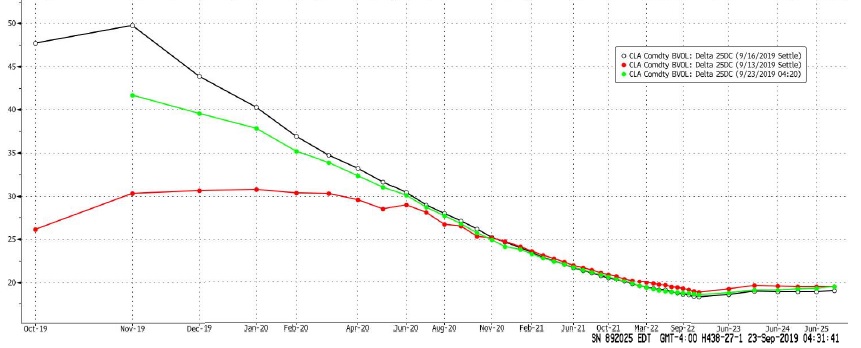

However, there is no doubt that the events from September 14th caused rising uncertainty about the course of oil prices in the next months. The graph below shows the implied volatility for Delta 25 call options on WTI crude oil for different maturity bands. The attacks on the Saudi Arabian oil facilities almost caused a doubling of the implied volatility in the options at the very forefront of the maturity band, by comparing the black line (settling prices as of Sep 13th) with the red line (settling prices as of Sep 16th). While investors were quite certain that increases (or swings) in oil prices will only persist for a few months, as the level of implied volatility for maturities past June 2020 was more or less unchanged, there was still a fairly elevated level of uncertainty in the market on September 23rd, more than one week after the attacks, despite multiple reassurances about guaranteed oil supplies given to markets.

Source: Bloomberg. Data as of 23.09.2019

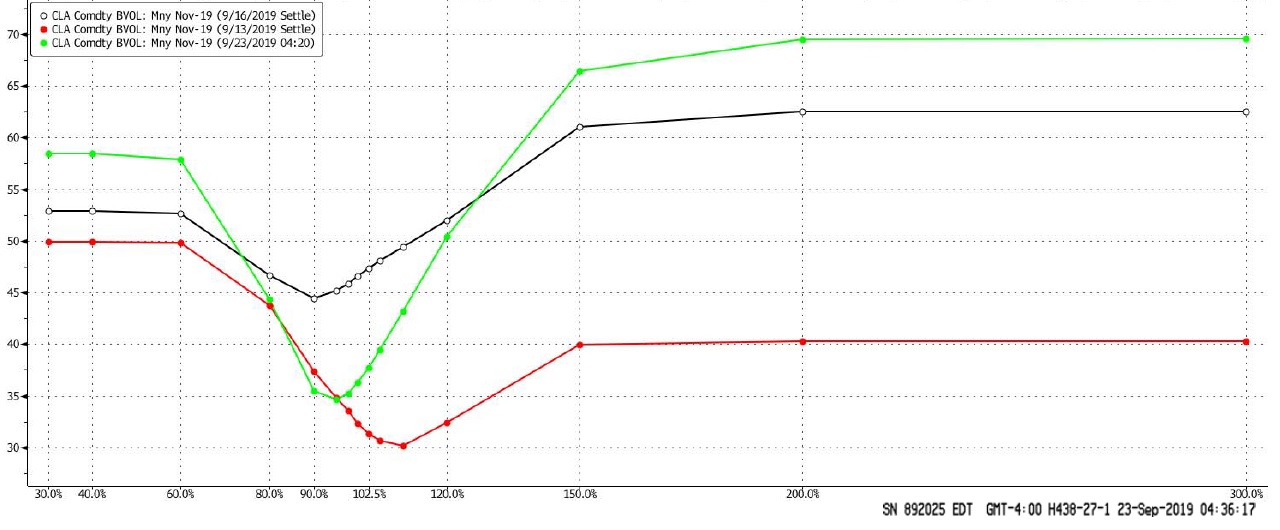

Changing perspective and looking at the skew in the implied volatility of options on WTI crude oil, the graph changed fundamentally after the attacks. While on Sep 13th (red line) the implied volatility for options with moneyness < 100%, or in other terms with a strike price below the spot price, was remarkably higher on than for options with moneyness > 100%, e.g. with a strike price above the prevailing spot price, which is a sign of a higher demand for put options to hedge investors against a deterioration in oil prices, this relationship reversed after the attacks when market opened on Sep 16th (black line). While markets on Sep 16th expected an elevated level of price volatility around the spot price, the uncertainty about smaller price movements almost normalized a week later (green line), while demand for protection of larger price movements in any direction was still elevated.

Source: Bloomberg. Data as of 23.09.2019.

How were the upstream companies affected?

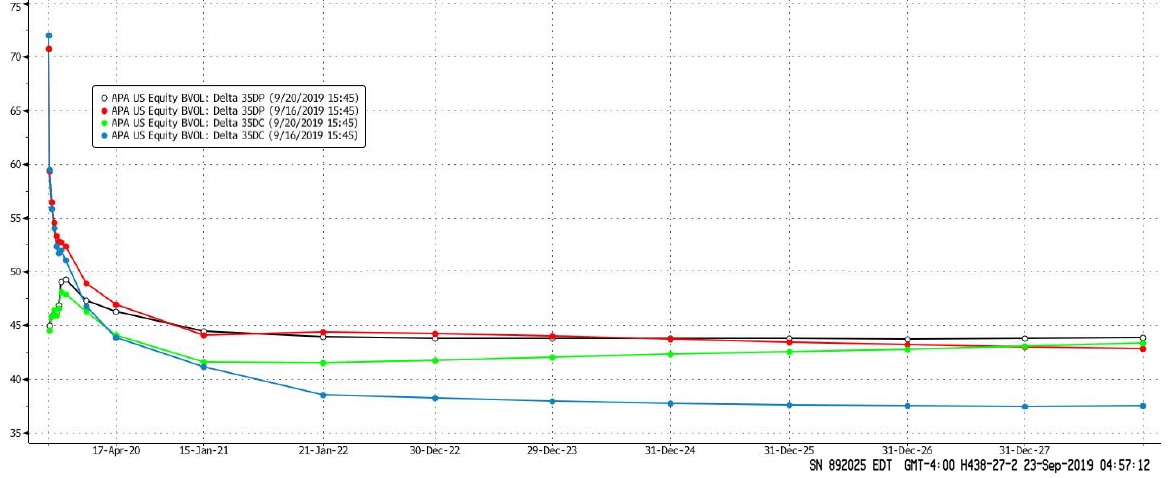

Companies that are most affected by price changes in oil are upstream companies, e.g. companies that explore, develop and produce crude oil. We will use Texas incorporated Apache Corp (APA US Equity) as an example. The company generated roughly 80% of its ca. USD 5 bn revenues from upstream activities last year (Source: Bloomberg). It, therefore, shows particular sensitivity to commodity prices. In fact, on September 16th, the company stock closed with a gain of 16.9%! Since the company has the majority of its oil exploration facilities in the US or the north sea, Apache is mostly unaffected in its production from rising tensions in the middle east. On the same day, the implied volatility of options on Apache stocks soared. The graph below shows Delta 35 put (red line) and call (blue line) options, settled on September 16th. For the shortest maturity bands, implied volatility for put options followed those of call options in lockstep, signalling that investors were cautious about large price movements in either direction. For longer-dated options, however, the demand for downside protection was larger, picturing a similar bearish view on the long-term evolution of the oil price. One week later, the noise settled and options were trading at far lower level implied volatility levels at the short end of the maturity band.

Source: Bloomberg. Data as of 23.09.2019.

Source: Bloomberg. Data as of 23.09.2019.

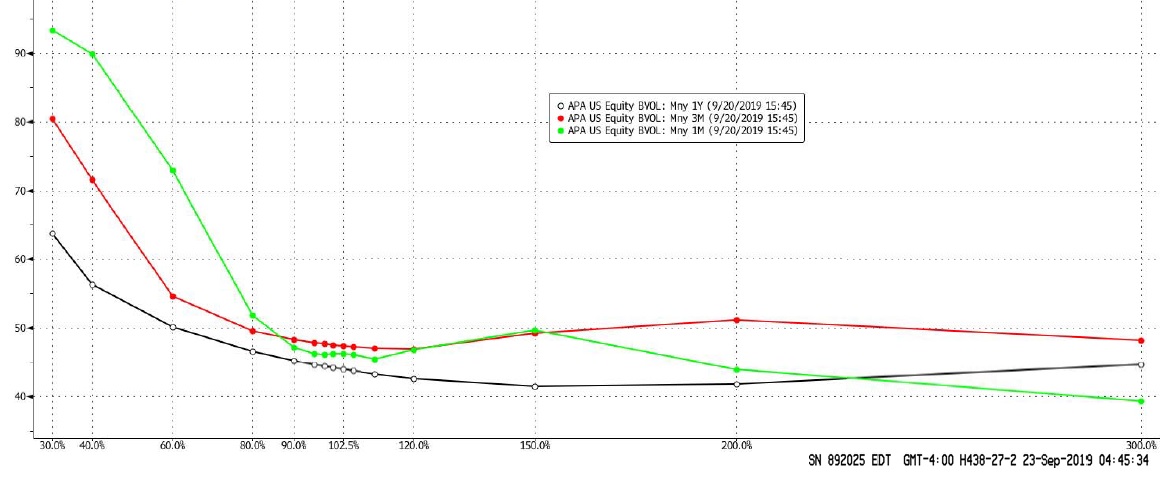

However, the implied volatility of options on Apache’s stock shows a very strong inverse skew. Investors seem to be very cautious about short term reversals in the stock price, with implied volatility decreasing with the strike price, with the only exceptions at strike prices ca. 50% above the prevailing spot price. Of course, such a relationship is mainly driven by idiosyncratic factors, the company is also engaged in upstream gas activities, but it further strengthens the rather bearish view of markets on the future evolution of oil prices.

Source: Bloomberg. Data as of 23.09.2019.

Source: Bloomberg. Data as of 23.09.2019.

Saudi Aramco’s operations

Saudi Aramco is an integrated oil and gas company, being active in upstream, midstream and downstream. It holds many records: it’s the most profitable company in the world ($111bln vs $59.53bln of Apple in 2018) and it extracts the most barrels (bps: the barrel unit of measurement is equal to 49 litres) amongst all the oil and gas industry: 13.6mi a day in 2018 on average.

Not only that but, as most of Saudi Aramco’s oil fields are domestic, the quality of crude oil is particularly high. That is, most oil extracted from Saudi Aramco is “light”. “Light” oil is defined as having a lower density which makes it easier and less costly to refine into gasoline and diesel compared to “heavy” oil which has higher density.

However, a great amount of oil extracted by Saudi Aramco in its domestic operations is “sour”.“Sour” oil is defined as having more than 0.5% sulphur contamination (oil having less than 0.5% sulphur is known as “sweet” oil). Sour oil is more expensive to refine and is considered a lower quality product. The facility which was attacked, Abqaiq, played a crucial role in the process of removing Sulphur from extracted oil as we will analyze later.

Saudi Aramco as stated before operates also in midstream, which is used entirely to transport crude oil to its downstream operations. Its refining capacity is yet to reach its oil extraction capacity: overall Saudi Aramco is capable of converting daily 4855mil bps of oil, of which 2826 domestically as of 2017.

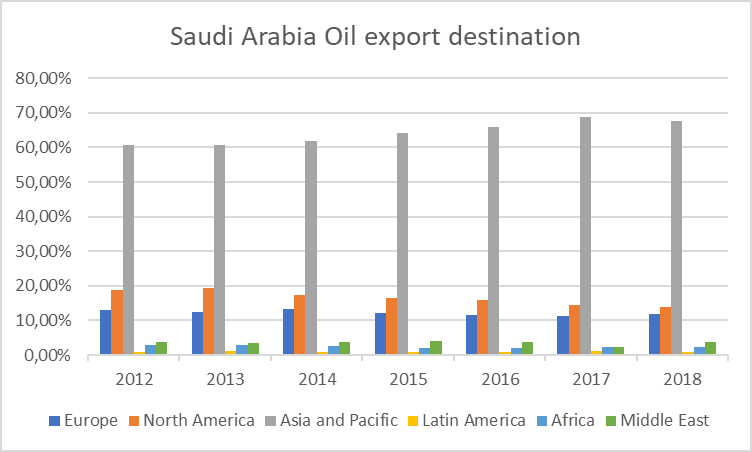

Source: OPEC

Source: OPEC

As we can see from the graph above the main customer of Saudi Aramco (that is of the domestic operations of Saudi Aramco) is Asia, which is also growing in terms of share of exports, with Europe a stable export partner, while US exports are -predictably- dwindling

The attacks

The targets of the attacks were the Abqaiq facility and the nearby Khurais oil field. The Abqaiq facility converted sour oil into sweet oil at a rate of 7mil bps daily (as well as removing any other dangerous contaminants from extracted oil). As such we should not confuse Abqaiq for what we commonly call a refinery, as it does not transform crude oil in diesel and other oil products The Khurais oil field instead is the second largest in the hands of Saudi Aramco and 1.5 mil bps are extracted daily from it.

After the attack, the Abqaiq facility can only convert 2mil bps and the Khurais oil field was shutdown. Recovery appears to have been fast however as the Khurais oil field is likely to go back in full production by the end of September according to Aramco’s executives, while the Abqaiq plant is likely to require a more prolonged period of repairs.

In addition, while it is true that the attacks significantly damaged worldwide supply of oil, its inaccurate to state that 6mil bps (approximately 5% of worldwide production) is the total amount by which worldwide supplies will diminish.

First of all, the Khurais fields will easily be back in production, making losses in that area more or less negligible. Second, with regards to Abqaiq we do not know how much of the oil transported there needed to be depurated of dangerous contaminants (which inhibits transportation) vs only sulphur, meaning that the company may settle to just sell “sourer” oil at lower prices, as indeed it appears to have done in order to honor its contractual obligations in India in the aftermath of the attack.

Finally, the company may draw from its significant inventory of oil barrels further decreasing the damage of this supply shock.

All those effects helped in calming down the markets in the aftermath of the attack and are amongst the drivers of the increased backwardation of the futures which we spoke of before

Geopolitics and speculations for the future

To get an insight into how the world’s governments and markets may react in the future, we decided to do a brief geopolitical analysis focusing on analyzing trends in the international trade of oil.

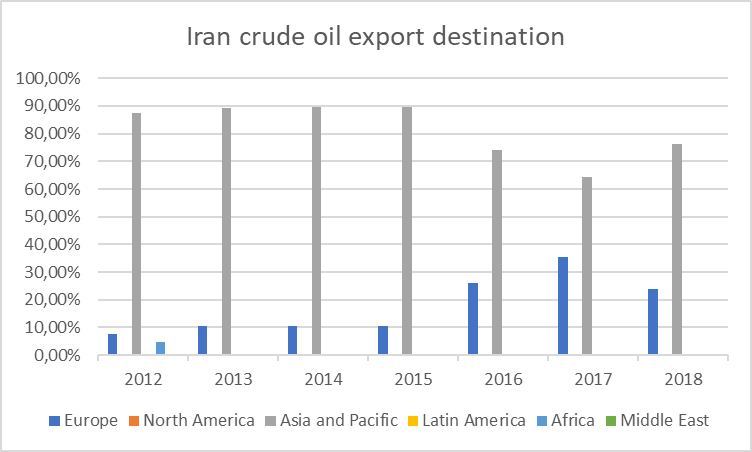

Source: OPEC

Source: OPEC

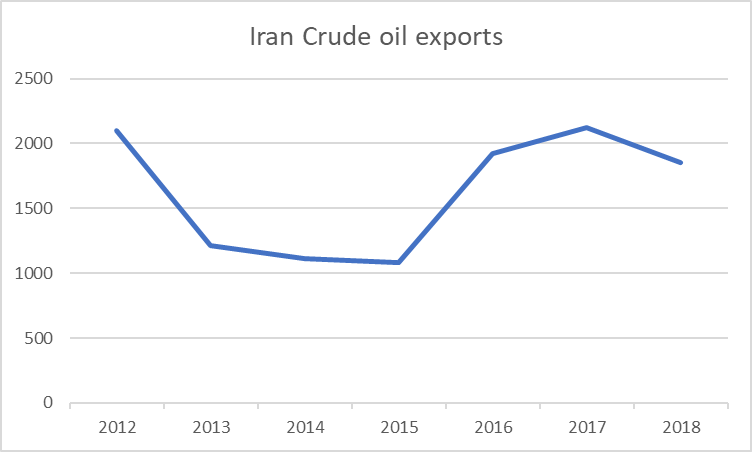

From the graph above we can notice a sudden significant increase in the share of oil exported by Iran towards Europe in 2016: in the aftermath of the Iran nuclear deal of 2015.  Source: OPEC. Data in mil bps

Source: OPEC. Data in mil bps

Those exports towards Europe have significantly contributed to the (nearly 100%!) jump in total oil exports by Iran.

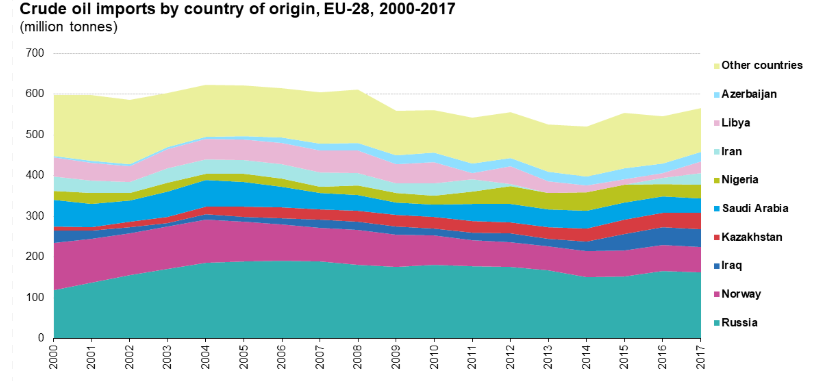

Source: Eurostat

Source: Eurostat

While Iran, as we can see from the graph above, does not contribute very significantly to European oil imports, those numbers are expected to increase in the future.

Hence, we can see that a good relationship between Iran and Europe is very convenient: Europe gets more oil, while Iran increases its exports. Indeed, despite the tensions and the various oil tanker seizures that occurred in the past few months we can see that Europe remains more or less committed to the Iran deal.

Finally, it is well known that the USA since 2018 is a net exporter of oil.

If we take into account all those factors, we believe that retaliation by the United States is likely. For the matter of our analysis its not important whether Iran is truly the culprit or not.

If the USA were to stage itself a drone attack on Iran’s fields or refineries the effects wouldn’t be dramatically felt on Europe’s oil supply since Iran’s oil is only a small part of it. The USA would not be affected too adversely.

An act of strength may give a boost in popularity if needed from the current administration ahead of elections, as well as send a message or simply damage a geopolitical adversary. This goes in line with the foreign policy ideas that have been expressed in the past by both the president and the newly appointed national security advisor, Mr Robert O’ Brien.

What may not be foreseen is that such an attack may create a permanent “geopolitical” risk premium on oil prices, as markets expect more and more disruptions to occur. As we repeatedly stated, a look at the futures curve (the backwardation) shows that the market does not believe in such a scenario and expects the “Aramco style attacks” to be a one-time event.

In conclusion, while the markets appear to have calmed down and to price in a calmer situation, we believe that it is likely that further escalations may occur in the future: only time will tell.

0 Comments