The focus of this article will be on the Argentinian government debt and potential upsides and downsides it faces. We will examine the attractiveness of their fixed income market by observing the current political situation in the country, the performance of neighbor countries as well as the global economic outlook.

The New Government

In November 2015, Mauricio Macri was elected as president and one of his most important goals was to implement more market-friendly policies and return the country to international capital markets. This represented the crucial point of Macri’s policy because the opportunity to issue foreign debt would allow the country to plug a gaping fiscal deficit without resorting to austerity measures or spurring inflation that is currently running at about 40%.

In April 2016, after being locked out of markets for fifteen years, the country sold $16.5bn of dollar-denominated debt, increased from a planned $15bn, as demand neared $70bn. At that time, it represented the largest sale of debt by any developing nation and one of the biggest order books ever recorded (new record set by Saudi Arabia).

From the facts mentioned above it can be observed that Mauricio Macri and the way he runs the country are highly appreciated by the investors. There are several reasons why this is the case.

Firstly, the government increased the level of transparency. For instance, the reform of the state-run statistic institute can be seen from the data on the country’s poverty levels. The most recent report has showed poverty levels were at 32%, while the previous administration’s report last year claimed 5%. In addition, the government opened its books to the IMF, after it was unceremoniously booted out of the country a decade ago.

Secondly, the market believes that country will reduce the very high level of inflation. We can observe this from the fact that most of the demand for recently issued 5, 7 and 10-year peso was from local debt funds. It is important to point out that, in terms of returns, when investing in domestic currency denominated debt, local investors care only about inflation while the foreign investors care only about the exchange rate.

Finally, investors know it is unlikely, in the near future, to see another government in Argentina that has that much market orientated policies as the one led by Macri.

Potential Risks

Although there is a positive side in investing in Argentina there is a negative side as well. The volume and liquidity of Argentinian capital markets are very low. For instance, the volume on Buenos Aires’ stock exchange was around 156,000 trades per day in August 2016, compared with around 20.2m on the Bovespa, the stock exchange in Brazil.

After the success in bringing the country back to the international financial markets, Macri needs to face structural issues such as inefficient public sector and fiscal deficit. However, since the priority in 2017 will be economic growth, the government expects to post a primary fiscal deficit of 4.2% in 2017, wider than the 3.3% it had pledged earlier in 2016.

Probably the most significant risk represents the country’s economic recovery. The economic growth is -2% in 2016 but most analysts expect economic expansion of about 3-4% next year which will be achieved by boosting debt levels to finance government spending. This is also the top priority for Macri because the midterm legislative elections are in October 2017 and the economy needs to have picked up sufficiently to ensure enough support to perform well in the elections.

Emerging Markets’ Bonds

In this section of the article we will analyze the performance of the Emerging Markets’ fixed income securities.

Source: Yahoo Finance

The chart above shows the performance of iShares JPMorgan USD Emerging Markets Bond ETF over the last year. As evident form the chart, emerging market bonds have been quite volatile in the past moths, expressing growing fears on a FED rate hike. In addition, the abrupt slump in the value of the index in November 2016 is caused by the election of Donald Trump as the new US president.

Although we agree that FED rate hike will inevitably affect performance of Argentinian sovereign debt, a few factors are still on the country’s side. Moreover, considering the new “threat’’ to the global trade represented by Trump’s policy to improve the US trade balance, we believe that Argentina is not so much exposed as some other emerging markets because the country is a net importer form the US. In 2015, American exports towards Argentina were $16.5bn while imports were $6bn, making the overall trade balance $10.5bn.

Argentinian Sovereign Debt

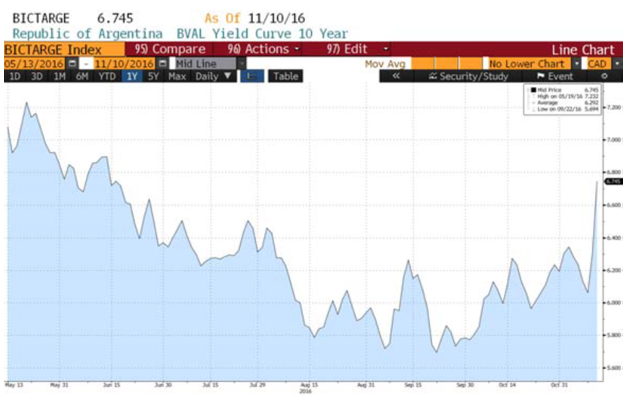

The yields on Argentine sovereign debt are attractive when compared to the rest of the region and the spread is still big which is shown in the following charts.

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

Charts above represent the trend of the yield on 10-year government bonds of Argentina, Brazil and Colombia over the las year. The yields in November are approximately 6.75%, 5.34%, 4.18%, respectively.

Given these yields, it is obvious that the country pays way more than its peers in a world where negative yields have become the norm and, also, Argentine sovereigns hold a relatively wider margin when it comes to a FED rate hike. Furthermore, in order to secure confidence in its debt the country’s macroeconomic variables must continue their normalization. That includes clear signs that show Argentina’s disinflation path (we showed above that markets are confident on this point) and a moderate GDP growth as well as proven efforts to reduce the fiscal deficit.

If Argentina follows this path, the country’s risk will continue to converge towards other Latin America benchmarks (like Brazil or Colombia). Also, in the very likely case of a gradual FED rate hike path, we should continue to see profitability in the long end of the Argentine sovereign yield curve. Thus, we have a positive outlook on Argentina for the next period but developments in the country should be closely followed. In particular, observing the situation before the elections in October 2017 which will be the first test of confidence for Macri and the team he leads.

[edmc id= 4365]Download as PDF[/edmc]

0 Comments