[edmc id=1406] [/edmc]

[/edmc]

US

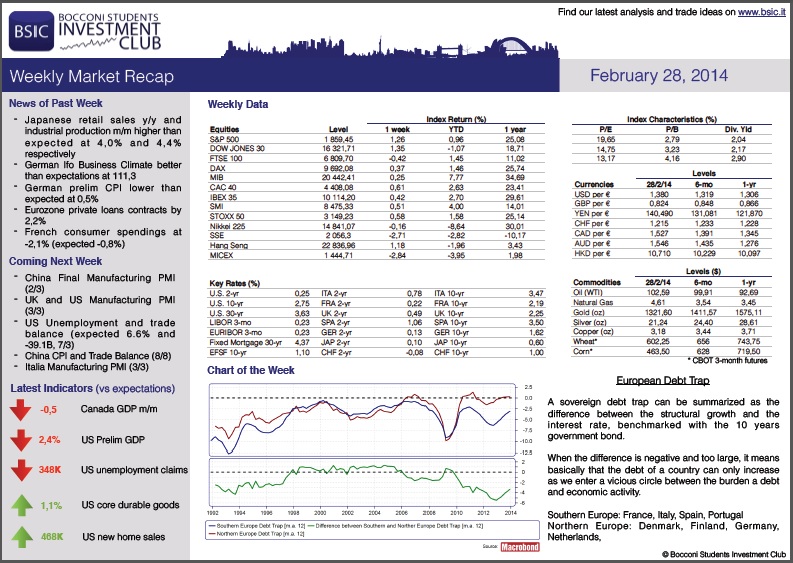

The economy grew at a slower pace than it was first estimated. Indeed, the fourth quarter GDP growth estimate was revised down to 2.4%, in contrast with the initial estimation of 3.2%. This revision was attributed to lower consumer spending growth. As this data adds to a series of negative data over the past weeks in the labour market (most importantly higher than expected unemployment claims) and retail sales, this has fueled some comments and speculation regarding the timing of the QE tapering, though the FED seems determined to go on with it, as chairwoman Janet Yellen hinted on Thursday. She acknowledged the negative data coming from different economic indicators in jobs, housing, industrial production and retail sales, while blaming this on the weather once more. Bottom line was that in order to taper there would have to be a strong change in the economic outlook, though she reiterated that rates would continue to stay at zero level, even as unemployment approached 6.5%.

The market seems to agree with Yellen’s view: S&P500 touched fresh record highs on Friday and 10 years US Treasury yields declined during the week.

Eurozone

The market mover of the week was certainly the reading of the Eurozone inflation rate that was published on Friday. It came out at a higher than expected 0.8%, ahead of the consensus of 0.7%. Moreover, the measure of Eurozone core inflation, which does not take into account the most volatile elements such as energy and food, stood higher at a full percentage point. These figures are still way below the ECB’s target of 2% in the medium term; however, they suggest that the ECB might pause to consider further developments before cutting rates again or launching more aggressive unconventional monetary policies. However, they also signal that the European economy is not at the point of entering outright deflation. The reaction from the equity markets was mixed- the German Dax Index was up 1% on the day despite ending the week just slightly positive overall; the FTSE Mib gained 0.6% on the day ending the week around 1% ahead of where it started, while the Spanish IBEX had a negative performance and the CAC 40 had lower gains at 0.27%.

On the business confidence side, we assisted to positive Eurozone aggregate data such as the Eurozone Economic Sentiment Indicator, which inched higher at 101.2 against an expectation of 100.9, showing signs of economic momentum not softening. These data add up to similarly positive readings in Germany at the start of the week that point to European growth not stalling yet.

Auctions of sovereign bonds and bills were uniformly positive across the bloc: we saw a reduction of the yields paid to investors by the states along the entire yield curve in Germany, Spain and Italy, with a sensible softening of the spread in the latter two. Markets are apparently discounting a lower relative risk of peripheral countries, while anticipating monetary conditions to remain loose in the near-to-medium term.

As regards the FX market, for the entire week the EUR/USD rate traded around 1.370, but the release of the higher than expected Eurozone inflation data caused a jump to the 1.380 level. The diminished prospects of more aggressive monetary easing contributed to the strength of the Euro here.

UK

It’s been quite a rich week for data in the United Kingdom. On Tuesday we had quite a high reading in January’s BBA Mortgage approvals, expected at 47.9k but coming in at 50k. On Wednesday the revision of QoQ and YoY GDP was expected, which came in as forecasted on a quarterly basis but short of a tenth of one percent on a yearly basis. Sterling rose with regard to a basket of currencies this week (USD, AUD,EUR). Investors in Britain are becoming more risk-adverse, which may explain why rates are likely to remain low for a long period of time. A great piece of data was the business investment in the fourth quarter that spiked up to 8,5 % YoY, proving once again the recovery’s gaining breadth.

FTSE100 was pretty steady and low volatile.

Japan

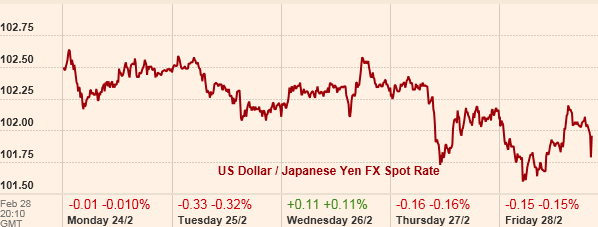

Good news for Japan this week. On Thursday, data on unemployment met expectations of 3.7% and consumer price index (+1.4%) was higher than the market consensus (around +1.3% on January, YoY). The latest figure is the main factor leading to a steady appreciation of the yen (with respect to the dollar) this week and, marking the eight month in a row with positive inflation, raises hope that the country may finally exit its stormy decades of deflation. Retail trade and industrial production data augments this view. Yen strengthening also pushed Nikkei lower in the second part of the week.

Although no big news is expected next week for Japan, we are wary ahead of important data from Europe and the US. We would short yen and bet on dollar appreciation, as we expect good data from the US.

EM

This week, market movements confirmed our view that the capital outflows from Emerging Markets (EM) are losing momentum. In particular, bad US economic data and the large fall in the RMB made emerging market more appealing.

Another negative news about US economy, a Preliminary GDP Growth of only 2.4% QoQ instead of the expectation of 2.6% was issued when some EMs Stock Exchanges such as Hong Kong, Shanghai and Jakarta were closed. This will probably help the rebound of EMs, as persisting below expectation data will increase the likelihood of a slowdown in the Fed’s Tapering.

The MSCI Emerging Markets Index climbed to 967 concluding the month, for the first time since October, with a rise of 3.2%. Next week most important catalyst will be the U.S. non farm payroll which, after two negative computation in a row, will show if the recent data are a due to bad weather conditions or to an actual slowdown. If these data were to be negatively another time, we strongly believe that a rebound in EMs will gain momentum.

China

After last week’s dovish measures, on Tuesday the PBoC drained liquidity again from the system. As a consequence, the Shanghai Composite index dropped 2%.

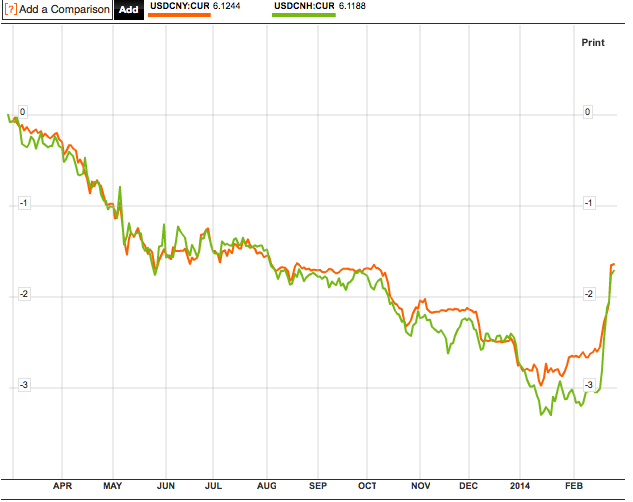

However, the key topic this week concerned the Renminbi: the Chinese currency depreciated from 6.09 to 6.12 with respect to the USD on Tuesday. The fluctuation was widely unexpected, and analysts speculated it is a move engineered by the PBoC in order to introduce and sustain a two-way volatility around its currency. In fact, each day the central bank tightly manages its currency by setting a rate against the dollar around which it is allowed to rise or fall (by a maximum of 1%). Given this system, the CNY has widely become a one-way bet for investors, who could easily speculate on its appreciation, with negligible downside risks.

Although the PBoC declines any responsibility for what happened, confirming to have left the main rate unchanged (at 6.09) on Tuesday, it is widely believed that this is an effort to manage increasing financial risks and volatility (and we agree with this view).

We are still bearish on China, as we were last week. We would also like to track the spread between the onshore exchange rate (CNY) and the offshore one (CNH, traded in Hong Kong, is allowed to move in a much wider band), which is trading at a level higher than usual.

(for further information on this topic: Forbes, J.P. Morgan)

Sources of the charts: Financial Times, Yahoo Finance, Bloomberg

[edmc id=1391]Download as pdf[/edmc]

0 Comments