[edmc id=1492] [/edmc]

[/edmc]

US

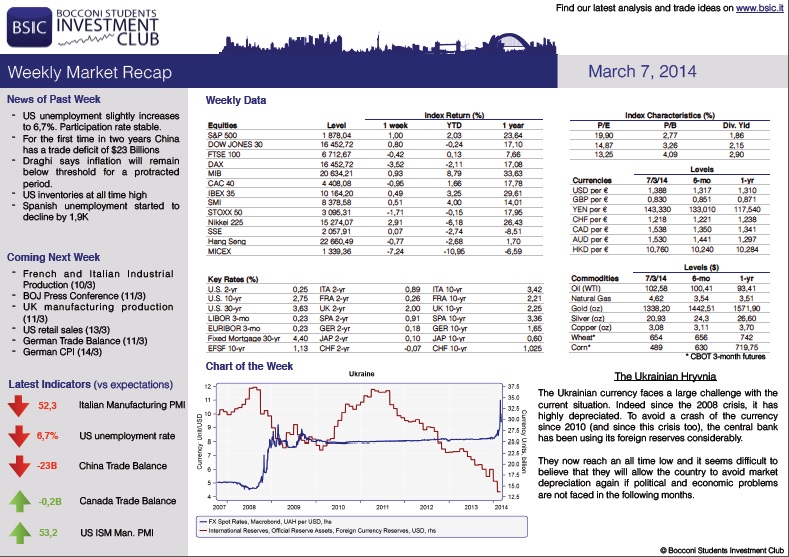

Positive data for the US economy has come out this week. Manufacturing PMI of February (53.2) showed a significant improvement with respect to January (51.3) and beat expectations of 52.0. The most interesting indicators, however, concern labour force. On February 175k new jobs were created in the US, with expectations around 150k. Given this, the rise in unemployment may seem odd (from 6.6% to 6.7%), but can be easily justified by the modest increase in the participation rate (albeit it was not enough to allow it to break the previous 63% level). (interesting article on FT )

Is, therefore, the weather the only factor to blame for the bad figures of the previous months? Data obviously support Janet Yellen’s argument. However, we still believe that this is only part of the big picture, and we would like to wait for more news in order to be sure that recovery is fully in place. There is no doubt that tapering will continue at the announced pace and, given the increase in unemployment rate, the day of a change in forward guidance looks like to be a more distant issue.

Going to the markets, the surprise came from the US Treasury yields. The 10y inched up to 2.79%, following data on US economy and news from Ukraine. This especially affected S&P500, which soared on Tuesday (as markets opened) and has stayed pretty steady after that.

Eurozone

During the week, a bunch of positive data regarding the Euro area has been published. In particular, the Eurozone Composite PMI has signalled an increase of the economic activity, moving from 52.9 to 53.3 well above the level of 50. In addition, at the beginning of the week, after the turmoil that has followed the geopolitical problems in Crimea, none of the bonds of the periphery has suffered a sell off, confirming that the pressure on countries such as Italy or Spain has definitively gone.

On Thursday, for the fourth month in a row, Mario Draghi has kept Eurozone’s main refinancing rate unchanged. According to the President, the moderate recovery is proceeding in line with the Central Bank’s expectations. Moreover, even if the level of inflation is currently at 0.8%, well below its target of “just below 2%”, Draghi said that by the fourth quarter of 2016 inflation will reach the level of 1.7%. Therefore, the present level of inflation is just temporary, and the area will experience an upward trend in the level of prices in the following years. ECB forward guidance remained unchanged: accordingly, Mr Draghi confirmed that rates will stay low for a long time and that the Central Bank is willing to act to bring them even at lower levels, if needed. According to previous comments, it seemed that the ECB board was ready to intervene in March to fight inflation. Considering all the artillery that the Central Bank possesses, markets believed the annulment of the sterilisation of the purchase of sovereign bond to be very probable. Notwithstanding this, Draghi said that the current conditions of the money markets did not justify the increase in liquidity.

In a nutshell, European monetary policy has not changed. With this situation on hand, we believe that in next meetings the policy will not be distorted, except in altered market conditions. As a consequence, the value of the Euro relative to the USD will remain at this high level in the window of 1.37-1.39, due to the high European current account surplus that sustains this high level.

UK

The week opened with a tumble as financial markets discounted the political developments in Ukraine; the FTSE-100 was no exception, losing 1.49% of its value despite a positive reading of Markit Manufacturing PMI for the UK of 56.9 versus an expectation of 56.5. After Putin’s speech, quoting escalating violence in Ukraine as a “last resort”, the index bounced back on the day after above 6,800. The business confidence indicator for the Services Sector also came out higher than expected on Wednesday, but it failed to stop a retracement from the previous day’s highs. Certainly the biggest event of the week for the UK was the monetary policy decision by the BoE on Thursday; however, no volatility resulted from the Bank keeping rates at 0.5% and its asset purchases at £375b as those figures were perfectly in line with analysts’ expectations.

In fact, Britain’s economy is enjoying a good start of the year, as also the high PMI numbers attest, but price inflation is still below the BoE’s target of 2% and the unemployment rate is above the 7% threshold indicated by the Bank as a signal for reconsidering its monetary policy. As of such, the pressure is currently off the BoE to risk damaging the recovery by raising rates and the Bank has also reconsidered its forward guidance indicator from the unemployment rate to a softer measure of the spare capacity in the economy to obtain more room to manoeuver.

Volatility returned in equity markets on Friday as the Russian company Gazprom menaced to restrict access to gas to Ukraine, which would impact also European imports that pass through the latter. The prospect of a higher energy bill and possibly of heightened geopolitical tensions was enough to send the FTSE-100 down more than one per cent.

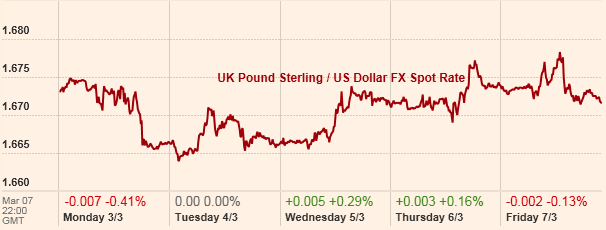

The UK 10-year gilt rate ended up higher at the end of the week from its start, closing at a rate of 2.80% from an initial level below 2.7%. Positive news from the British economy has contributed to the rise as agents consider pricing in rates hikes earlier. Instead, the pound/dollar rate kept its level between 1.670 and 1.675 despite a mild fall on Monday, as both countries face similar prospects of exit from the monetary stimulus, albeit the US is at a more advanced stage.

Japan

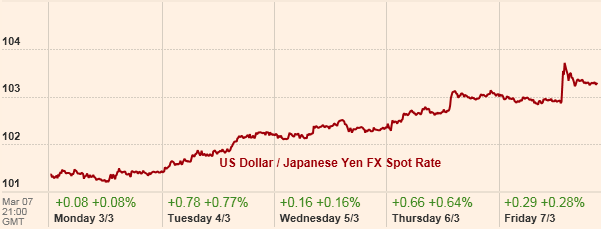

Absent any important news on economic indicators, this has been a relatively quiet week for Japan’s economy. Noteworthy though was the Yen’s depreciation this week against the US dollar, Pound and Euro as demand for safe havens fell, reflecting a temporary ease in the tensions between Russia and Ukraine. The sharp depreciation is in contrast with last week’s gains for the Yen.

Important data is expected next week such as: Final GDP QoQ, Current Account data, Monetary Policy Statement and BoJ press conference.

China

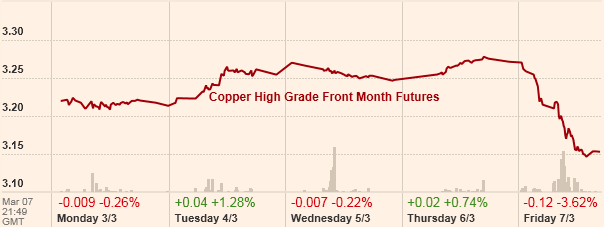

Chinese authorities have surprisingly allowed its first corporate bond default. In fact, Shanghai Chaori Solar Energy said it will not be able to repay in full the interests its 1-billion bond issuance and received no bailout from the government.

We have always been wary on the instability of the Chinese financial system due to its huge financial leverage. Is it the first signal of an unstoppable chain of defaults? It is early to argue that, but we want to keep an eye on that. For now, the only remarkable effect regards metal commodities, such as copper and silver, which tumbled more than 3%.

Sources of the charts: Financial Times, Yahoo Finance

[edmc id=1452]Download as pdf[/edmc]

0 Comments