[edmc id=1778] [/edmc]

[/edmc]

US

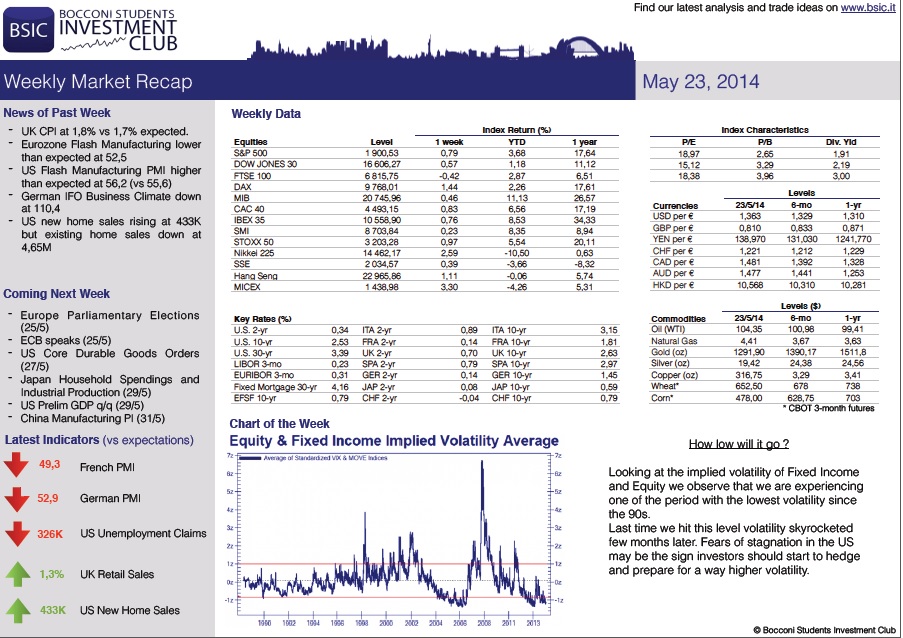

Equities closed at record highs in the week just past us; the S&P 500 in particular closed above 1,900 for the first time, gaining 1.29 percentage points from the week’s open. Such good performance, which was also echoed by the Nasdaq Composite (which retraced some of its past losses to gain more than 2 per cent), came in concurrence with mostly positive economic news.

On Wednesday the minutes from the April FOMC meeting were released, which showed that a transition to monetary policy for non-crisis times was being hinted at but without any decision being taken, if not to communicate any such action in advance. The absence of specific timing for monetary policy normalisation was enough to sustain the equity markets in the two following days, even as labour market data came out mixed. In fact, initial jobless claims were higher than expected while continuing jobless claims surprised on the low side. However, the PMI reading was also better than expected at 56.2, showing that some momentum is building up in the US economy, which is also supported by rising faster than expected new home sales.

10-year Government bond yields discounted the monetary policy normalisation possibility and ended the week trading 2 bps lower than the last at 2.54 per cent. Also, the concurrent strong stock performance did not entice investors to look for safe haven in bonds. Such rise, however, comes after a month in which 10-year rates collapsed by 15 bps -as can be seen in the chart below- so that some profit-taking was due.

The EUR/USD spot rate declined during the week from 1.37 to slightly above 1.36 as the likelihood of monetary easing in the Eurozone increases together with weak European economic data. The GBP/USD pair was more volatile and ended the week where it had started at 1.683 after having reached a peak of 1.69 on Wednesday and Thursday when inflation and GDP figures for the UK were released.

For the week ahead, the single most important economic datum for the US will be the figure for the Q1 GDP, which is currently expected at -0.2 per cent, as it will be the basis for the next discussion on monetary policy normalisation.

UK

On Tuesday Great Britain CPI (Consumer Price Index) y/y bounced back from 1.6% to 1.8%, slightly above the consensus, interrupting a long declining trend.

PPI (Producer Price Index) m/m continued a three months decline, falling by 1.1%.

On Wednesday the Monetary Policy Committee (MPC) kept the main interest rate at a record low of 0.5%, and the Asset Purchase Facility unchanged at £375bln per annum. However, some members of the MPC showed their intention to vote for an earlier than expected rate increase. Differently form the Fed, the BoE is planning to exit its unconventional monetary stimulus by first raising interest rates, and then winding down the asset purchase programme.

Carney had previously pledged for an extended period of low interest rates. However, strong recovery, good retail sales and concerns about inflated house prices are persuading more and more people within the MPC to exit the unconventional stimulus sooner than expected.

The strong recovery, also sustained by hefty investments, has not managed to improve Public Finances, which recorded a Public Sector Net Borrowing of £9.6 bln instead of the expected £3.6 bln. This is an ongoing issue in UK and will likely be one of the most important political challenges in the future.

Source: FT

The FTSE100 did not react excessively neither to potentially good nor to bad news, such as an increase in interest rates. Despite a forward P/E of 12, which is a huge discount with respect to the S&P 18, the FTSE 100 seems not to be able to break its record and go above 7000 points.

Next week there will be little data coming out about UK. If you are looking for catalysts, you had better look somewhere else.

Eurozone

This week’s main catalyst has been politics. Voting for the European Parliament began on Thursday in Britain and the Netherlands and will continue across the EU’s 28 member states until the last Italian voters cast their ballots on Sunday evening before 10pm. The European Parliament forms one of the major institutions of the EU government and one of its main roles is to debate, amend and pass legislation proposed by the European Commission. Nevertheless whilst the parliament does have some ability to affect EU legislation, it hasn’t any power to make low itself and the response to the Euro zone crisis has only gone to highlight the central role of national governments and the European Commission in EU governance; so the parliamentary election results have to be seen as an indicator of the stability of each central government. This context is important, as the main “winners” from the election look set to be Europe’s anti-EU and protest parties. Some of the notable anti-EU/protest parties leading national polls are Syriza in Greece, the Front National in France, the Freedom Party in the Netherlands and UKIP in the UK. What would such a result mean? Quite how much influence these parties would actually be able to exert within the (already-constrained) Parliament after the election, given their fractious nature and the lack of agreement between the different protest/anti-EU parties, is up for debate. Perhaps more important could be what these elections may mean for national elections over the next few years with some maybe interpreting a Syriza win in Greece for example as a sign that they might win the next Greek election (due in 2016).

Such concerns caused some instability in the markets and, with little data coming out next week, are likely to remain the market focus next week. The FTSE Eurofirst 300, after some early losses at the beginning of the week, recovered on Thursday and Friday and concluded the week 0.5% higher.

Japan

On Wednesday, data on the trade balance was posted. A disappointing -0.8 trillion yen deficit (rather than the -0.6tn expected) made the Nikkei 225 tumble to one-month low. Furthermore, on the same day, the Bank of Japan, with its governor Haruhiko Kuroda, confirmed that there is no need for more easing now, leaving interest rate unvaried. Japanese bond yields slightly decreased overall; in particular, 30y decreased of 2 basis points. With the shadow of additional stimulus fading, the yen appreciated against the euro, closing at 138.995 (-0.12 since Monday), but, after Fed minutes, the $/¥ settled up at 101.975 (+0.47 since Monday).

The Nikkei 225 index, after hitting 14,042.17 on Wednesday, closed on Friday with a satisfactory +2.57 % since Monday, boosted by the positive performance of Chinese manufacturing data and the US factory output growth. We believe that rallying toward the maximum of April 21st 14,650 is absolutely necessary to reverse the negative trend from the beginning of the year. However, the Japanese economy is likely to slow down this quarter after last month’s increase in sales taxes. Investors are not certain how long it will take to recover internal consumption.

Sources: Financial Times

[edmc id=1780]Download as pdf[/edmc]

0 Comments