Driven by strong growth in China, the announcement of QE in the Eurozone and a solid recovery in the US, the automotive sector experienced a remarkable rally since the beginning of the year to the end of June. The SXAP (STOXX Europe 600 Automobiles & Parts Index) expanded more than 29% during the five months of 2015 (Chart 1), reflecting the risk-on environment that benefitted the sector cyclical nature.

From the beginning of June, however, three main factors had a significantly negative impact on the broader sector.

The first and probably the most important one was a decline in Chinese economic activity that also affected the automotive sector. According to the China Passengers Car Association, new car registrations dropped 2.5% in July, the lowest level since February 2014.

Secondly, the Fed indication of a potential interest rate hike in the near future increased risk aversion among market participants, reflected by soaring levels of volatility within most asset classes.

Finally, the recent emission testing scandal surrounding Volkswagen, which is accused of having deliberately mislead regulators on the emission levels of some of its Diesel vehicles, reverberated among the broader sector as further investigations into VW’s competitors are likely to follow.

Consequently, the SXAP index went severely into reverse, losing more than 32% over the following period. In our analysis, we try to highlight potential bargains, resulting from the recent sell-off, while at the same time taking into account the risks stemming from the current sector headwinds.

We compare current valuations of global carmakers against their operating profitability

In order to get a better understanding of relative valuation levels within the global automotive industry, we plotted current trading multiples against operating profitability for different OEMs. We used a 12-month forward EV/Sales multiple as a valuation metric as it takes into account differences in tax rates and financial leverage. As higher levels of profitability should make company sales more valuable, we ranked our valuation levels against 12-month forward EBIT margins. We believe that this setup is appropriate to assess relative valuations across the sector given its relatively good fit (R2 of our regression amounts to roughly 64%).

Our analysis implies that a company which is fairly priced by market participants should lie on the linear regression line, whereas a position above (below) would deem a stock overvalued (undervalued).

We acknowledge that profitability is only one driver of valuation though, and that especially earnings growth as well as risk (represented by a company cost of capital) drive the value of a firm. However, the aforementioned analysis should give us a broad indication and provide us with insights on which we base our further analysis.

Daimler seems to offer an attractive valuation compared to its peers

The outcome of our analysis (Chart 2) reveals a deviation of German auto manufacturers from their theoretical levels. Both Daimler and VW seem to trade at a massive discount to their fair value. Given the recent litigation issues that VW is facing over its alleged fraud on emission tests and the respective high uncertainty around the stock, we want to focus mainly on Daimler.

Chart 2: Regression analysis of market multiples against profitability (Source of raw data: Bloomberg)

In order to truly understand if Daimler offers an opportunity to buy, we apply a quick Sum-of-the-Parts (SOTP) valuation:

Our SOTP analysis confirms the trend from the regression analysis and implies an upside potential for the stock of c.45%, and an implied EV/Sales valuation of c.0.7x.

Daimler’s good dividend yield makes it an attractive source of constant income in a low yield environment

Furthermore, we believe that Daimler’s strong dividend yield makes the stock also a reasonable opportunity for investors looking for a constant stream of income in a still depressed yield environment (Chart 3). Its yield of 3.7% compares favourably against European investment grade corporate bonds that return 1.28% on average according to Bloomberg indices. The company’s ample cash reserves further ensure that Daimler will likely be able to maintain its current payout. On the contrary, VW’s high dividend yield will probably be impacted by the litigation costs stemming from the emission scandal.

We believe Daimler’s recent sell-off in the wake of negative economic news from China is unwarranted and expect solid Q3 results to act as catalyst to close the valuation gap

Cyclical sectors with exposure to the Chinese economy have sold off significantly over the past two months as investors fear that lower manufacturing activity and lower spending on luxury goods might negatively affect growth and profitability of companies with a strong footprint in the region.

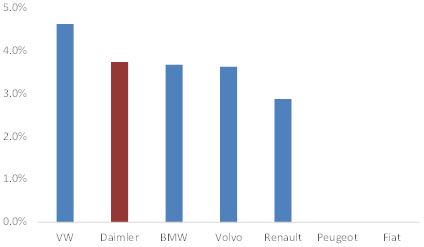

Among European carmakers, premium producers for the Chinese market such as Volkswagen (Audi), Daimler (Mercedes-Benz) and BMW have displayed the weakest performance year-to-date. From its heights at the end of June until the emergence of the emission scandal, shares of Volkswagen were down c.19%, BMW declined by c.15% and Daimler’s stocks dropped by c.13%. We believe this rather similar sell-off is unwarranted as Daimler outperformed its rivals in the Chinese market in terms of unit sales growth (Chart 4) and successfully managed to buck the negative overall trend in the market. The company’s strong results can be attributed to the introduction of new successful models (e.g. Mercedes’ new C-Class) and the improvement of its distribution network. Furthermore, Daimler’s increasing sales do not come at the expense of profit margins, as the firm generally displays lower dealership discounts than peers.

We believe that Daimler will continue to post solid results in China and outperform its German peers in the market. Strong Q3 figures would likely confirm our thesis and help narrow the valuation gap.

We prefer Daimler to other European mass-market oriented peers due to a more limited impact from investigations into emission fraud

We think that the current investigation into VW’s practices to manipulate emission tests of its Diesel engines, might possibly not be confined to Germany’s largest carmaker, but also uncover fraudulent activity at competitors. Given the magnitude of the reaction on VW’s share price following the news (VW saw c.35% of market capitalization wiped out within the first three days), this topic might be of high relevance for the entire sector. We view the impact of the scandal particularly severe for manufacturers with a high exposure to Europe (as Europe makes up c.75% of annual sales of Diesel cars) and low profit margins. As data from the International Council for Clean Transportation (ICCT) shows, current technology is certainly capable to make Diesel engines compliant with emission standards (BMW’s X5 model was generally below the required emission thresholds). However, implementing the necessary technology will expose auto manufacturers to higher production costs. Hence, we believe that premium manufacturers with higher margins have fewer incentives to save on these costs than car producers with lower profitability. Therefore, we prefer Daimler to peers with a strong footprint in Europe and a higher product range of lower priced vehicles such as Peugeot and Renault.

Risks to our thesis could include a further deterioration in Chinese car sales, a slowdown of the recovery in the US and Europe, a major acquisition and a potential involvement of Daimler in the emission scandal affecting VW.

[edmc id= 2839]Download as PDF[/edmc]

0 Comments